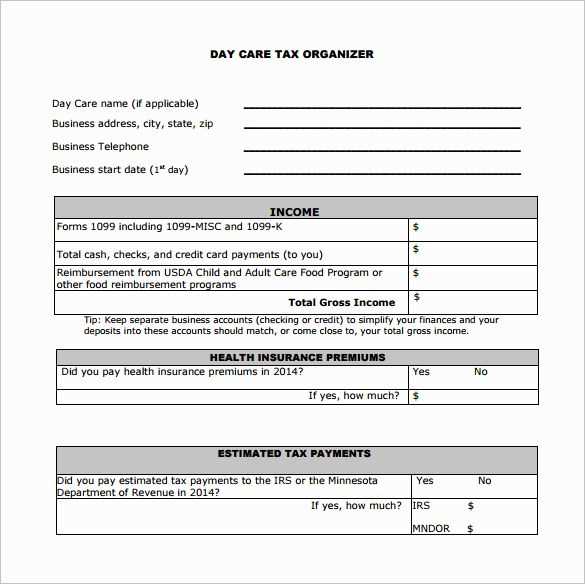

If you’re looking for a straightforward way to provide a receipt for your after-school program, consider using a customizable template. This document will help you meet tax requirements and maintain clear financial records. A well-organized receipt will include necessary details such as the program name, participant information, dates, and payment amounts. Providing this documentation can ensure parents or guardians can claim any eligible tax benefits related to the service.

The template should feature clear fields for the child’s name, program session dates, and total payment made. This format ensures that the receipt is both professional and useful for tax filing purposes. Include the payment method, whether it was by check, credit card, or cash, along with a unique receipt number for reference. This makes it easier to track any financial details if needed later.

By offering a template that can be customized with minimal effort, you make it simple for families to keep accurate records. Parents will appreciate receiving receipts that are formatted correctly and contain all the required information for tax purposes. This small step not only ensures compliance but also strengthens the trust between the after-school program and the families it serves.

Here are the corrected lines where duplicate words have been removed, but the meaning remains intact:

When preparing a receipt for a free after-school program, ensure all necessary information is included. The recipient’s name, the program’s dates, and the total value of services provided are key elements. Avoid unnecessary details that might complicate the document.

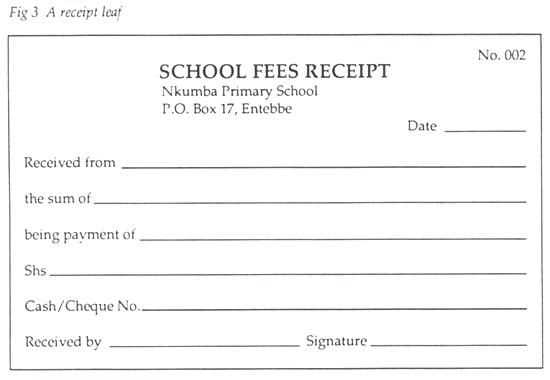

Example of a simplified receipt:

Receipt for After-School Program

Date of Service: January 1 – December 31, 2024

Program Name: After-School Care Program

Total Value: $300.00

Recipient: John Doe

Services Provided: Free after-school care for 50 sessions

Signature: ____________________

- Free After School Program Receipt for Tax Purposes Template

Create a receipt with the following components for easy use during tax filing:

Program and Payment Information

Include the name of the after-school program, its address, and contact details. Specify the total amount paid and the payment period, such as monthly or for a specific session. If any discounts or financial aid were applied, mention those as well. Ensure the receipt is clear about what the payment is for.

Participant and Tax Identification Details

Provide the full name of the student, as well as the parent or guardian’s name. Include the program’s tax identification number (TIN) to confirm its eligibility for tax deductions. Adding the date the payment was made and a reference number can help track the payment for future use.

Finish the receipt with a signature from the program coordinator and the date it was issued. This will make the receipt valid for tax purposes and provide proof of the payment made to the program.

Include the program’s name, address, and contact information at the top of the receipt. Clearly state the receipt number, date of payment, and the recipient’s name. Specify the child’s name, program details, and the dates for which the payment is applicable, such as the month or week of attendance.

Itemize the charges for the after-school program, listing each service separately, such as tuition, activity fees, or any additional costs. If taxes apply, indicate the amount and percentage clearly. Deduct any discounts or financial aid provided, if applicable. Conclude with a statement confirming that this receipt is valid for tax purposes.

Ensure that the document includes a section for the program’s tax identification number (TIN) or employer identification number (EIN). Organize the information logically and use a clear, readable font for easy reference. Save and offer the template in a printable format, such as a PDF, for convenient distribution to parents or guardians.

Include the name of the after-school program and the provider’s contact details at the top of the receipt. This ensures the recipient can easily verify the program’s identity. Clearly state the total amount paid for the program and the period it covers, such as the dates of attendance. Add the child’s name and the names of any other participating children, if applicable.

Details of Payment

List the method of payment used (credit card, check, or cash). For credit or debit payments, include the last four digits of the card number for verification. Make sure to include any discounts or financial assistance applied to the total amount.

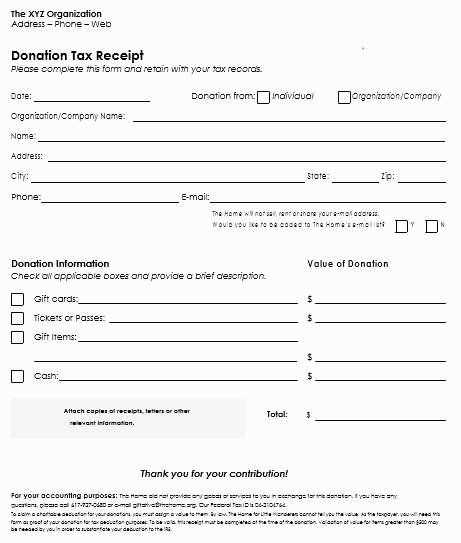

Tax Information

If the program qualifies for tax deductions, mention the tax ID or Employer Identification Number (EIN) of the organization. Include a statement confirming that the payment is for an after-school program and any relevant information that may help the taxpayer claim a deduction.

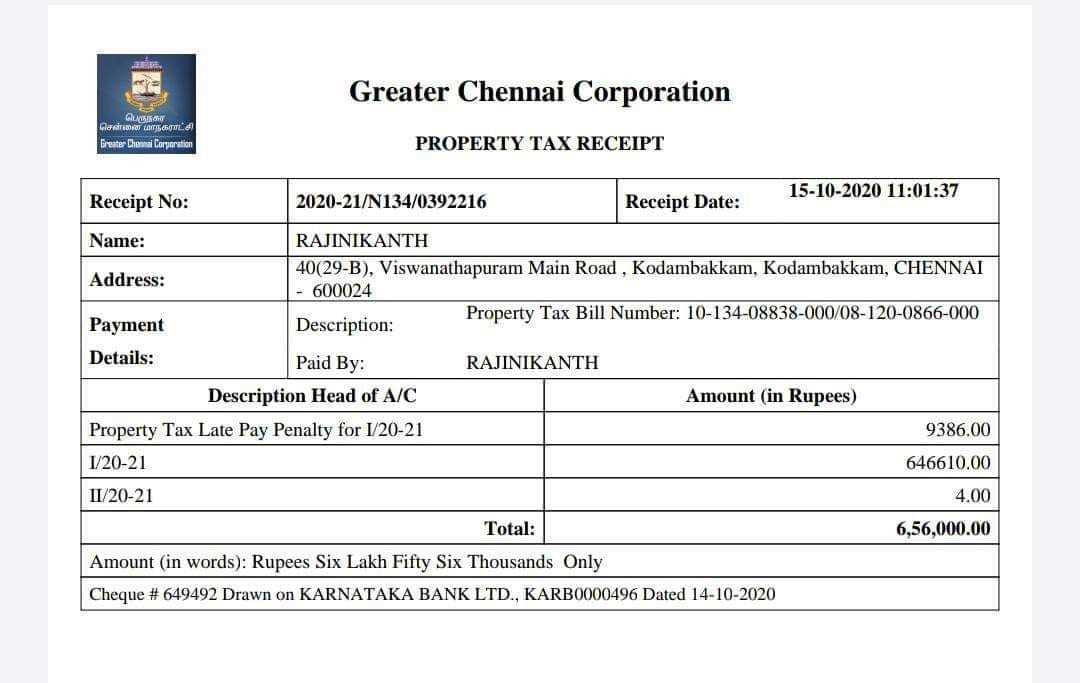

Accurate documentation of dates and hours is fundamental for tax purposes when dealing with receipts for after-school programs. It ensures that the records comply with IRS requirements and can be used to substantiate tax deductions. Here’s how to manage these details effectively:

- Track Program Start and End Dates: Clearly record the start and end dates of each session. This helps distinguish between services provided in the current year and those from the previous one.

- Document Hours Attended: Specify the exact hours each participant attended. This is especially important for programs where rates differ based on time spent.

- Avoid Rounding: Do not round hours up or down. Report the exact time to avoid discrepancies or issues during audits.

- Separate Session Hours: For programs offering various activities, list each activity’s duration separately to maintain clarity and accuracy.

Tips for Organizing Hours and Dates

- Use a Log or Time Sheet: Maintain a log or time sheet for each participant. This can be done digitally or in paper form but should be updated regularly to avoid errors.

- Cross-Check Dates: Before issuing a receipt, cross-check the dates with your calendar or scheduling system to ensure they are correct.

Clearly track payment methods for accurate tax reporting. Record whether payments are made by check, cash, credit card, or bank transfer. Each method should be associated with specific receipts or transaction records. Ensure you include the date, payment amount, and any related fees for clarity.

For cash payments, maintain detailed logs, including the payer’s name and transaction amount. Use receipts or invoices to substantiate these records. If payments are made through electronic means, keep digital statements or screenshots showing the transaction details, including confirmation numbers.

For checks, always retain a copy of the cleared check or the bank statement showing the withdrawal. For credit or debit card payments, ensure that the payment processor provides a report or invoice that outlines transaction amounts and dates.

These records should be organized by date and easily accessible. Proper documentation of payment methods ensures smooth tax filing and minimizes the risk of discrepancies in your financial records.

For accurate record-keeping, ensure that any discounts or special offers are clearly itemized in the receipt. This helps both the business and the customer track the value of the discount applied. Start by listing the original price, followed by the discount amount or percentage. Make sure to subtract the discount from the total, showing the adjusted price.

Display the Discount Type

Specify the type of discount provided, such as a percentage off, a fixed amount, or a special promotion (e.g., “Back-to-School Discount”). This transparency makes it clear how the final price was calculated.

Include Discount Terms and Conditions

If the discount is part of a limited-time offer, include the validity dates on the receipt. This can help prevent confusion and serve as a reminder for the customer to claim similar offers in the future.

For tax purposes, ensure that the receipt reflects the price after the discount, as this is the amount used for tax calculations. Providing a clear breakdown of discounts ensures that both the customer and the business remain compliant with tax regulations.

Keep receipts organized by category, such as transportation, supplies, and meals. This will save you time when you need to reference them later for tax purposes.

1. Create a Filing System

Designate separate folders or binders for each category of receipts. Label each folder clearly for easy access. Use dividers to further break down categories like business vs. personal expenses or by month.

2. Utilize Digital Tools

Scan and store receipts digitally for added convenience. Use apps that automatically categorize and store receipts, such as Expensify or Shoeboxed. Digital records make it easier to find and share receipts when necessary.

3. Regularly Update Your Records

Set aside time weekly or monthly to update your receipt records. This keeps your documentation current and prevents a backlog at tax time.

4. Store Receipts Securely

For physical receipts, use a fireproof and waterproof safe to store them. For digital receipts, ensure files are backed up in cloud storage or an external hard drive to prevent data loss.

5. Retain for the Recommended Period

Keep all tax-related receipts for at least 3 years, or longer if your tax return is under audit. Review your records periodically to discard outdated receipts that are no longer relevant.

6. Use a Spreadsheet or Tax Software

Track your expenses in a spreadsheet or tax software like QuickBooks, which can help categorize and summarize your expenses, simplifying the tax filing process.

7. Keep Copies of Important Documents

For significant purchases or business expenses, store both the original and a copy of the receipt. This ensures you have a backup in case of loss or damage.

| Receipt Type | Retention Period |

|---|---|

| Business Expenses | 3 to 7 years |

| Personal Expenses | 1 year |

| Donations | 3 to 7 years |

| Major Purchases | Indefinitely (for warranty purposes) |

To create a receipt for a free after school program, make sure to include the following details:

- Program Name: Clearly mention the name of the after school program.

- Child’s Name: Include the name of the child participating in the program.

- Dates of Service: Specify the dates when the program was provided, including start and end dates.

- Total Value of Program: If the program is free, indicate that the value is $0. However, if there is a specific value, list it.

- Program Description: Briefly describe the nature of the program (e.g., tutoring, recreational activities, etc.).

- Provider’s Contact Information: Include the name, address, and contact information of the program provider.

- Tax Identification Number (TIN): Include the TIN or Employer Identification Number (EIN) of the provider if applicable for tax purposes.

This format ensures that the receipt includes all necessary details for tax reporting and can be easily understood by both the parents and tax authorities.