If you’re looking for a simple and clear template for cash deposit receipts, this is a perfect place to start. A free cash deposit receipt template helps you easily document transactions, providing both the depositor and recipient with a record of the deposit. It saves time and ensures accuracy without the need for complex software or additional tools.

By using a template, you streamline the process and avoid the risk of missing key details. Make sure to include fields like date, deposit amount, depositor’s name, and recipient information to keep everything transparent and organized. Customizing a template based on your needs ensures that all relevant data is captured effectively.

To make things even simpler, you can download templates from trusted sources that already include the most common fields. From there, just fill in the specific information for each transaction. This quick and practical approach keeps your finances organized while maintaining a professional and clean record of cash deposits.

Here’s the corrected version:

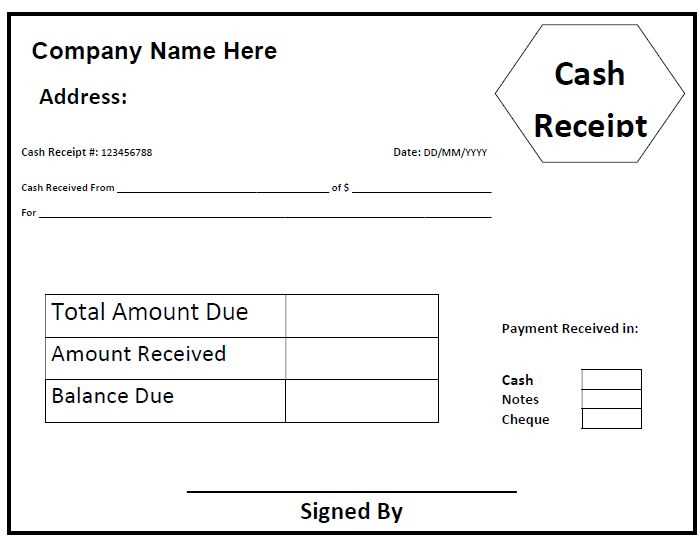

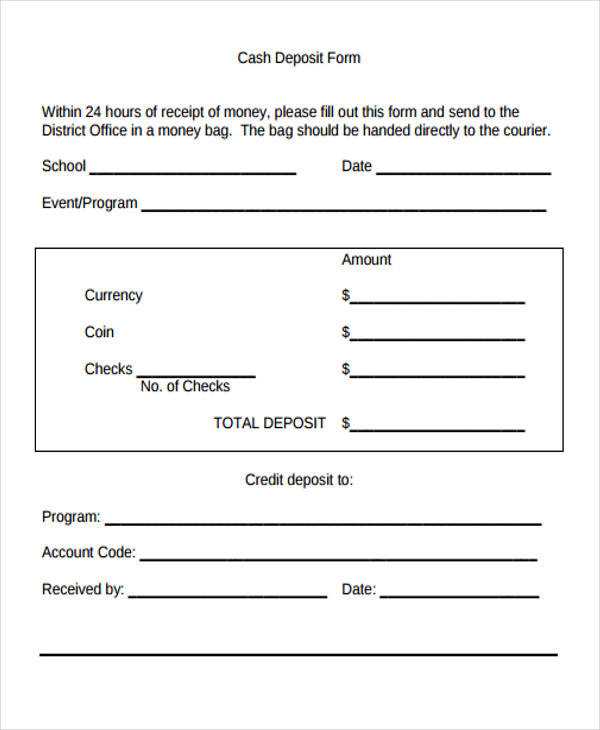

Use a straightforward template for cash deposit receipts to avoid confusion. Make sure to include clear fields for the depositor’s name, the date, the amount, and the receiving entity. Additionally, add a section for the method of payment, such as cash, check, or transfer, to give full clarity on how the deposit was made.

Key Elements to Include:

Be sure to have a space for the transaction ID, which will help in tracking the deposit. Also, include a signature line for both the depositor and the person processing the deposit, ensuring that all parties are in agreement.

Formatting Tips:

Keep the layout simple and intuitive, with easily identifiable fields. Avoid clutter by organizing the receipt in a clean, well-spaced format that makes it easy to read and understand at a glance.

- Free Cash Deposit Receipt Template

If you need to create a cash deposit receipt, it’s crucial to include specific details for clarity. The receipt should contain the date of deposit, the name of the individual or business making the deposit, the deposit amount, and the method of deposit (such as cash, check, or bank transfer). Make sure to provide a receipt number for tracking purposes.

Here is a straightforward template for a free cash deposit receipt:

- Date: [Insert date of deposit]

- Receipt Number: [Insert unique receipt number]

- Depositor Name: [Insert name of the person or business making the deposit]

- Amount Deposited: [Insert deposit amount]

- Deposit Method: [Cash, Check, Bank Transfer, etc.]

- Signature: [Insert space for depositor’s signature]

This template is simple and allows customization depending on your needs. Adjust it as necessary to match the details of your specific transaction.

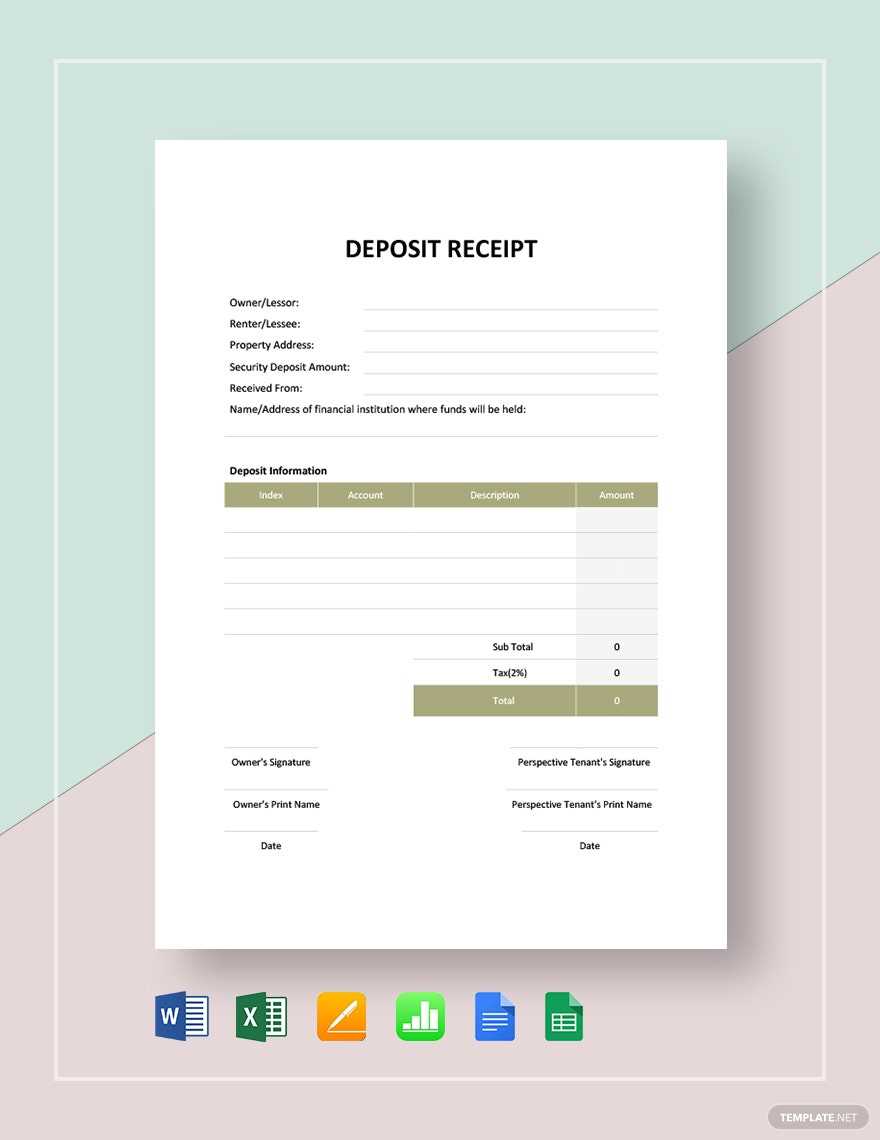

To create a custom deposit receipt template, focus on including key details: the date, deposit amount, payer information, and recipient details. Choose a clean layout that highlights the most important information first.

Step 1: Set Up the Basic Structure

Begin by defining the sections of the receipt. Include a header with your business name or logo, followed by the receipt number and date. Leave space for the payer’s name and contact information. A table format works well for organizing the details of the deposit.

Step 2: Add Clear Payment Details

In the next section, include the deposit amount, method of payment (cash, check, bank transfer, etc.), and any relevant transaction numbers or references. Make sure the amount is clearly visible, and add a field for notes or descriptions, if needed.

Ensure the template allows for easy adjustments in case additional details need to be included later. Save your design as a reusable template to simplify future deposits.

Include the date of the deposit. It provides a clear record of when the transaction took place, ensuring transparency and accuracy.

Depositor Information

Always list the name and contact details of the person or entity making the deposit. This avoids confusion and links the deposit to the correct party.

Deposit Amount and Method

Clearly specify the total amount deposited, along with the method of deposit (e.g., cash, check, bank transfer). This helps track and reconcile funds with ease.

Transaction Reference Number helps in identifying and tracking the deposit in case of future inquiries or issues.

Deposited Item Description should be included if relevant, particularly for businesses accepting goods, to clarify what is being deposited along with the payment.

Make sure the receipt is signed by both parties, or provide a digital signature option, ensuring accountability and confirmation of the transaction.

Start with a clear title, such as “Cash Deposit Receipt” or “Deposit Receipt” at the top of the document. This ensures immediate recognition of the purpose.

Details to Include

- Receipt Number: Assign a unique number to each receipt for tracking purposes.

- Date of Deposit: Clearly state the date when the deposit was made.

- Depositor Information: Include the name or business name of the person making the deposit.

- Amount Deposited: Clearly indicate the total amount, breaking it down into smaller units if necessary (e.g., coins and bills).

- Payment Method: Specify if the deposit was made in cash, check, or another form of payment.

- Bank Information: If relevant, include the bank’s name or account number where the deposit was made.

Formatting Tips

- Readable Font: Choose a legible font, such as Arial or Times New Roman, with a size of 10-12 points.

- Clear Layout: Use bullet points or a simple table to organize the information. This makes the receipt easy to read.

- Consistent Alignment: Align all text properly for a neat and professional appearance.

- Space for Signatures: Include space for both the depositor and the receiving party to sign the receipt if needed.

Ensure that your receipt template is clear and easy to read. Avoid using small fonts or cluttered layouts that make it hard for recipients to quickly find key information. A busy design can confuse customers and create frustration.

Don’t forget to include all necessary details, such as the date of the transaction, the amount paid, and the payment method. Omitting any of these elements can lead to misunderstandings or difficulty in tracking financial records.

Another mistake is using inconsistent formatting. Stick to a uniform style for fonts, headings, and spacing. This helps with readability and makes the receipt look more professional.

Be cautious with the use of colors. While a pop of color can make a receipt visually appealing, using too many bright colors or heavy shading can detract from the information. Choose a color scheme that aligns with your brand and enhances readability.

Finally, double-check for spelling errors or inaccurate details before finalizing the template. Even minor mistakes can harm the credibility of your business and create confusion for your customers.

Check out these websites for free deposit receipt templates:

- Template.net – Offers a variety of templates that can be easily downloaded in multiple formats like Word and PDF.

- JotForm – Provides customizable deposit receipt templates with an option to download them after filling out details.

- Canva – Features visually appealing receipt templates, ready to be personalized and downloaded for free.

- Microsoft Office Templates – A solid collection of receipt templates available for free, downloadable through Microsoft Word.

- 123FormBuilder – Free receipt templates, which can be customized online and downloaded after use.

Explore these platforms to find the format that best fits your needs, whether it’s for personal or business use.

A deposit receipt template simplifies the process of documenting transactions between businesses and clients. Start by customizing the template with your business name, contact details, and transaction specifics. Ensure the template includes fields for the deposit amount, payment method, and the date of the transaction.

Customize the Template for Specific Transactions

Modify the template based on the type of transaction. For example, include an invoice number or reference code when the deposit is part of a larger payment. This helps in tracking multiple deposits and ensures proper documentation for accounting purposes.

Make Use of Digital Versions for Easy Distribution

Save the completed deposit receipts as PDF files. This allows for easy sharing with clients via email, ensuring a professional and organized record. Additionally, storing them digitally makes retrieval and tracking more efficient when needed for future reference.

| Template Field | Details |

|---|---|

| Business Name | Your company’s name and contact information |

| Deposit Amount | Exact sum of money received |

| Payment Method | Cash, check, credit card, etc. |

| Date | Exact date of the transaction |

| Reference Number | Transaction or invoice number (optional) |

Using a deposit receipt template ensures accuracy and consistency in your business transactions. This streamlined process helps in managing client relations, tracking finances, and staying organized.

To create a free cash deposit receipt template, focus on the key components that provide clarity for both the depositor and the recipient. A well-structured template ensures that all necessary information is included without confusion.

Key Elements of a Cash Deposit Receipt

The template should feature the following sections:

- Receipt Number: A unique identifier for each transaction.

- Date: The date when the deposit is made.

- Depositor’s Name: Full name or business name of the person or company making the deposit.

- Amount Deposited: The exact amount of cash being deposited, written in both numerical and word form.

- Account Information: The account number or description of where the funds are being deposited.

- Purpose: A brief note about why the deposit is being made, if necessary.

- Signature: Space for the depositor’s and receiver’s signatures, confirming the transaction.

Formatting Tips

Use a clean and professional layout, ensuring the template is easy to read. Avoid clutter and ensure each section is clearly labeled. You may choose to add a footer for your company logo or contact information, but keep it minimal.

By keeping the structure straightforward, the receipt will serve its purpose without unnecessary details.