If you need a straightforward way to track cash transactions, using a free cash receipt book template can make the process easier. This template offers a simple structure, allowing you to record each cash receipt with accuracy and clarity. It’s ideal for small businesses, freelancers, or anyone handling cash payments regularly.

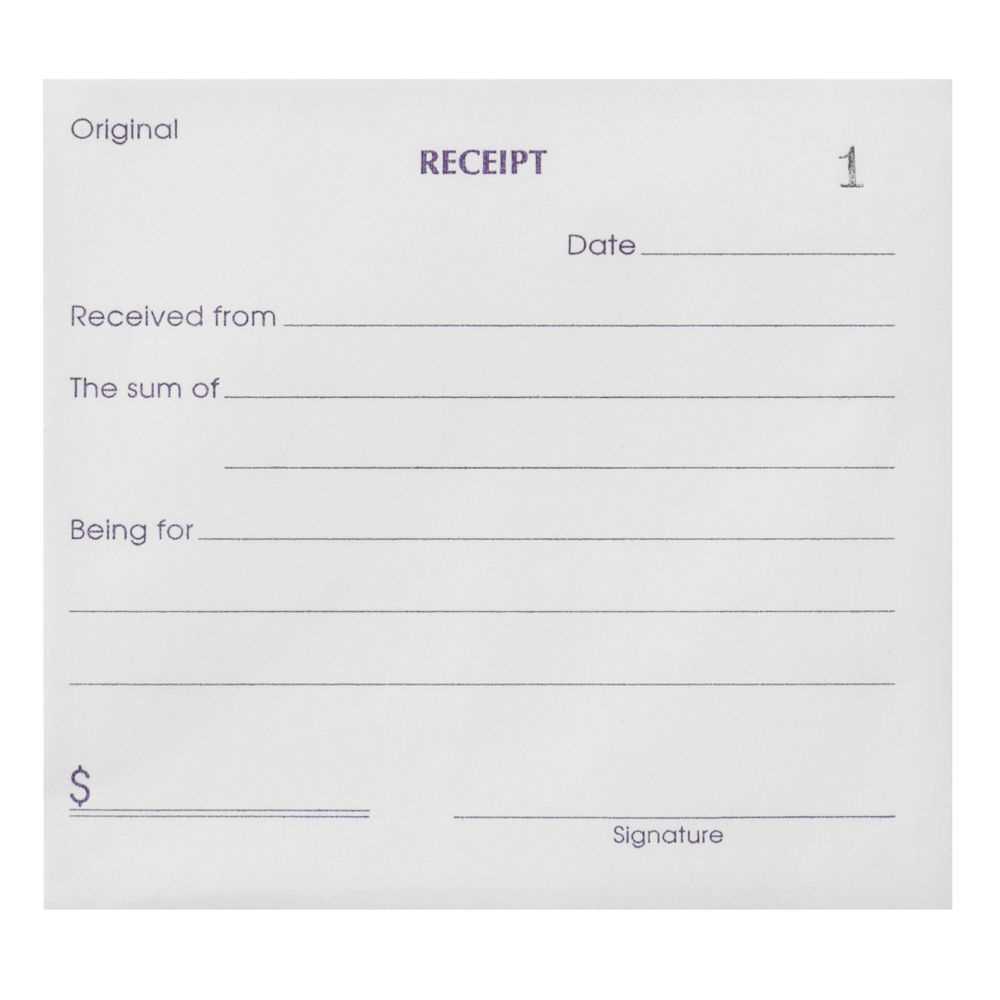

Start by filling in essential details like the date, amount received, and the payer’s name. You can also add any specific notes regarding the payment, such as the purpose of the transaction or invoice reference. This ensures that every entry is organized and easy to reference later.

Many free templates are customizable, so you can tailor them to fit your needs. Whether you’re using it for personal record-keeping or business transactions, having a clear format makes it easier to maintain accurate financial records without the hassle of manually tracking each entry.

Here’s the revised plan, with repetitions removed:

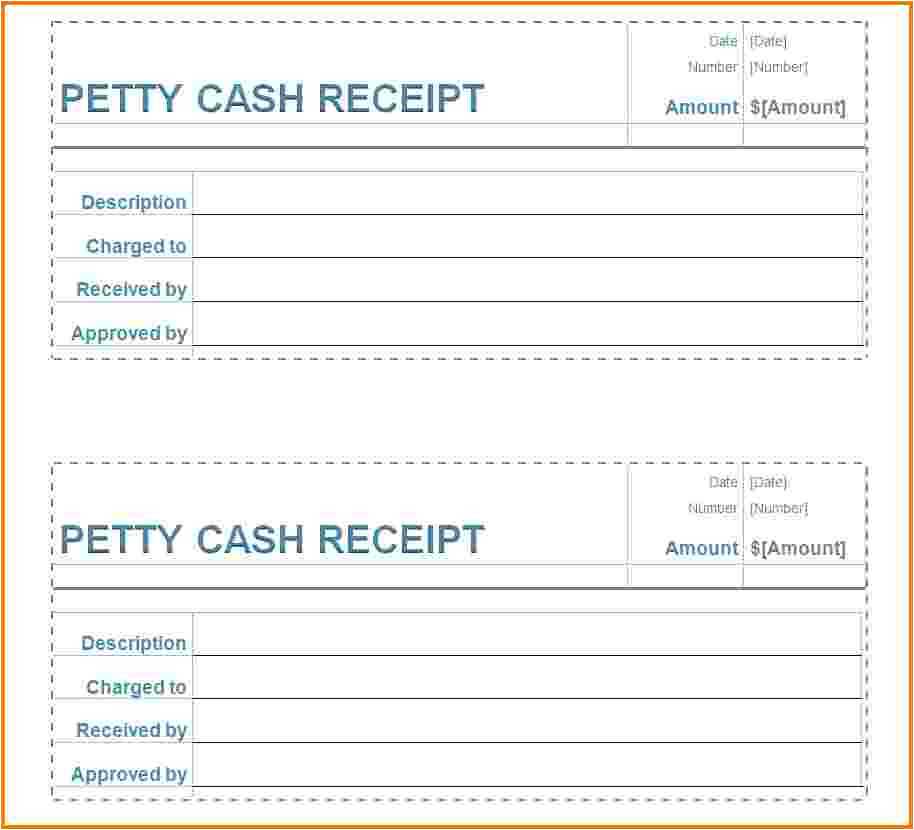

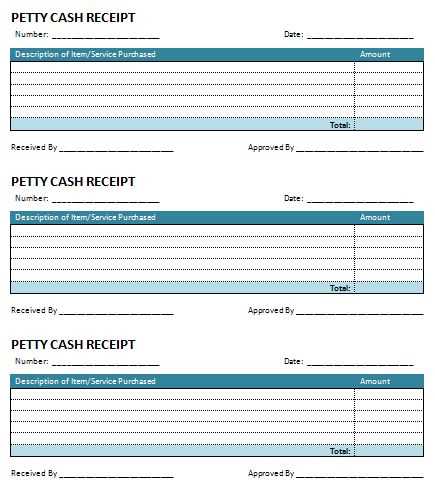

Focus on clarity and structure in your receipt book. Make sure to include the date, receipt number, payer name, amount received, and purpose of the payment in a clear layout. Place each section in a consistent order to avoid confusion.

Use grid lines or boxes to separate different fields. This helps in quick identification and ensures that all entries are readable. Use a simple, legible font for the text, and avoid overly decorative styles that may distract from the important information.

Design the template to accommodate both printed and handwritten entries. The template should allow flexibility for different payment types while maintaining uniformity in each receipt.

Include space for a signature line at the bottom of each receipt for verification purposes. This adds a level of authenticity and ensures both the payer and recipient can confirm the transaction.

Finally, save the template in multiple formats such as PDF and Excel. This ensures easy distribution and editing when necessary.

Here’s a detailed plan for the informational article on the topic “Free Cash Receipt Book Template” with three practical and focused headings:

Begin by exploring the different formats available for cash receipt books. Offer a variety of free, downloadable templates that can be customized based on specific needs. Highlight templates that are easy to edit in both PDF and Word formats, allowing users to adapt them without advanced technical skills. Provide clear guidance on how these templates can help maintain accurate records for small businesses or personal transactions.

Next, dive into the practical features of a good receipt book. Discuss what details should be included, such as the date, transaction amount, payee information, and the method of payment. Provide recommendations on how to structure each entry for clarity and easy reference. Point out common mistakes to avoid when filling out receipts to ensure consistency and accuracy.

Lastly, give advice on how to use the receipt book for tracking and accounting purposes. Emphasize the importance of regularly updating the records and organizing receipts for future reference. Offer tips for creating a filing system that keeps receipts accessible and easy to locate when needed. Include best practices for managing physical and digital copies to avoid confusion and errors.

- Customizing Your Cash Receipt Book Template

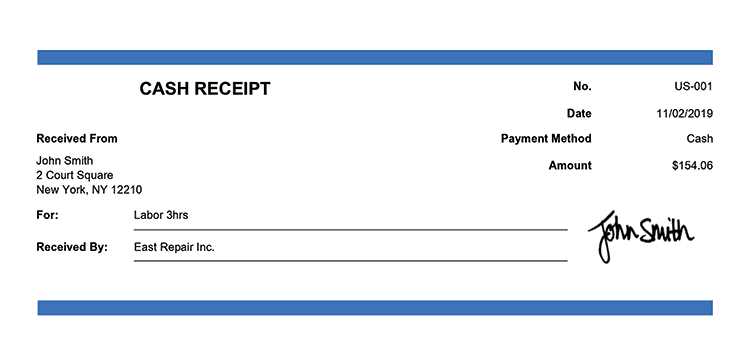

Adjust the template’s fields to reflect your business needs. Include essential details like the recipient’s name, transaction date, payment method, and amount. You can also add a section for a description of the goods or services provided, helping clarify the transaction for both parties.

Modify the Layout for Easy Use

Ensure the layout is clean and organized. Group related sections together, like payment method and total amount, for quick reference. A logical flow will make the receipt easy to fill out and read. Consider leaving space for signatures, making it formal for both parties.

Add Custom Branding

Incorporate your business logo and contact information at the top of the receipt. This will help maintain consistency in your documentation and make it easy for customers to reach out if needed. Choose a font style and size that match your company’s branding guidelines.

Finally, save the customized template in a format that’s easy to duplicate and distribute. Whether printed or digital, having a uniform receipt book will simplify record-keeping and improve the professionalism of your business transactions.

Ensure that your receipt template includes clear, readable fields for the transaction date and time. These details confirm when the exchange took place, which helps for both tracking and resolving disputes.

Buyer and Seller Information

Include spaces for both buyer and seller contact details. This provides clarity on who was involved in the transaction, allowing easy reference for future communications or returns.

Transaction Breakdown

A line-by-line breakdown of the items or services sold should be visible. This section allows the buyer to see exactly what was purchased, its quantity, and the price, ensuring transparency.

Ensure that your receipt clearly lists the total amount paid, including any applicable taxes or discounts. This prevents confusion and allows both parties to verify the payment amount easily.

Start by organizing your receipt book into sections based on transaction types or customer categories. This will make it easier to find records and track patterns. Use clear, legible handwriting or stamp each receipt to maintain professionalism and avoid confusion later.

Maintain a Consistent Format

Always use the same format for every receipt. Include the date, transaction amount, purpose of the transaction, and the recipient’s name. This helps create uniformity and makes it simple to cross-reference data when needed.

Keep Records Organized

Store your receipt book in a secure, easily accessible place. After completing a transaction, immediately record the details. Don’t wait until later; this minimizes the risk of forgetting information.

- Use a specific spot for each transaction entry.

- Make a habit of checking your receipt book for completeness before closing it each day.

- Don’t mix different types of transactions in one book to avoid confusion.

Review your entries regularly to spot any inconsistencies or errors, and make sure all receipts are accounted for. When you’re ready to archive older receipts, organize them by date or category for easy reference.

For those managing cash receipts, creating a streamlined template is crucial. A simple, clear structure helps track transactions accurately and maintain accountability. Start by organizing the receipt entries into basic sections, such as date, amount, payer’s name, and purpose of the transaction. This ensures a smooth and quick process each time a receipt is issued.

Key Sections for Your Template

Each section should be easily distinguishable. Key areas include:

| Section | Description |

|---|---|

| Date | Record the exact date of the transaction to avoid confusion. |

| Amount | Clearly state the amount of money received, ensuring it matches the payment. |

| Payer’s Name | Include the full name of the person or business making the payment. |

| Purpose | Detail the reason for the payment to provide clarity for both parties. |

Additional Tips for Creating Your Template

Make your template easy to adapt for various situations. Use consistent formatting, and consider adding a unique receipt number to each entry for better organization. This will make it simpler to track past transactions. A clean, uncluttered design ensures each element stands out without distraction.