Use a free cash receipt template to streamline your transactions in Australia. This simple tool helps you quickly record cash payments, ensuring you stay organized and compliant. Whether you are a small business owner or an individual managing personal finances, a receipt template provides clarity and keeps your records intact.

With a few key details, such as the payer’s name, payment amount, and transaction date, you can generate an accurate record every time. A well-structured template not only saves time but also reduces the risk of errors, helping you stay on top of your finances.

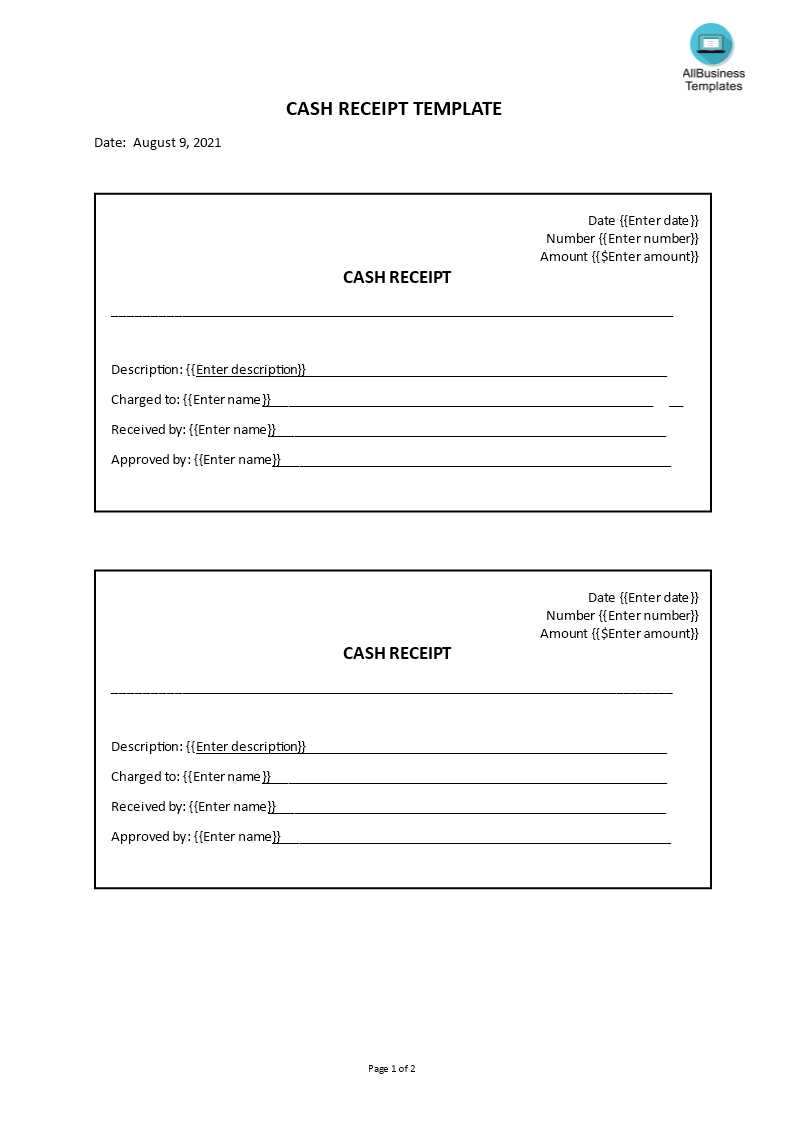

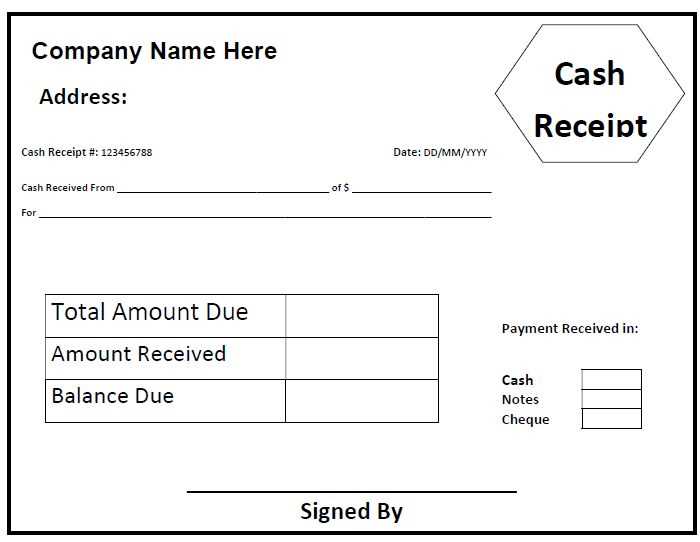

Make sure your template includes essential elements, like the payment method, a unique receipt number, and space for signatures. This ensures that both the payer and the recipient have a clear understanding of the transaction. Customizable templates allow you to adapt to different payment scenarios while maintaining professionalism.

Here are the updated lines with minimized repetition, maintaining meaning and language:

Keep the wording concise and direct. Avoid redundancy by choosing the most precise terms. For instance, instead of repeating “receipt,” use related expressions like “payment record” or “transaction note.” This keeps the text streamlined and easier to follow.

When specifying amounts or details, combine information in a single sentence. For example, instead of saying “total amount of $100” and “amount of $100,” simply state “total of $100.” This reduces unnecessary repetition while keeping the meaning clear.

Use synonyms to introduce variety without losing clarity. Words like “payment” and “transaction” can often be swapped to prevent overusing the same term. The goal is to maintain a natural flow of language while avoiding monotony.

Lastly, structure sentences to convey information in a logical, flowing manner. Instead of breaking up related information into multiple sentences, aim to consolidate the details, which can improve readability and ensure a more coherent presentation of the content.

- Free Cash Receipt Template for Australia

If you’re looking to create a cash receipt for a transaction in Australia, a free cash receipt template can save time and ensure accuracy. The template should include essential fields such as the date, the payer’s details, amount received, payment method, and a description of the transaction. Customizing the template for your specific needs is key to keeping records organized.

A well-structured cash receipt includes the following details:

- Date: The exact date of the transaction.

- Payer Information: Full name or business name of the person or organization making the payment.

- Amount: The exact amount received, including any relevant currency symbols (AUD for Australian dollars).

- Payment Method: Indicate whether the payment was made via cash, cheque, credit card, or bank transfer.

- Transaction Description: A brief note on what the payment is for, ensuring clear identification for future reference.

- Receipt Number: Assign a unique number to each receipt for easy tracking.

- Signature: Space for both parties to sign, confirming the transaction.

By using a free template, you ensure all these elements are included and formatted correctly. You can find various options online that allow you to download and customize the template according to your business’s needs. This helps maintain transparency and keeps your financial records in order, making it easy to refer back to a transaction when necessary.

For businesses in Australia, adhering to these standards is critical for tax and record-keeping purposes. A simple, clear receipt can prevent disputes and ensure smooth business operations. Make sure to keep a copy of every receipt for your records.

Creating a cash receipt template for your business or personal use in Australia is straightforward. Ensure it includes all necessary elements for legal compliance and clarity for both the payer and recipient.

Basic Elements to Include

Start with the business name and address at the top. This helps identify who issued the receipt. Then, add the date of the transaction. Record the amount of cash received and a description of the goods or services provided. Be specific in the description to avoid confusion later. Include a unique receipt number for easy reference.

Tax Details and Legal Requirements

In Australia, if your business is GST-registered, include a statement showing the GST amount within the total, especially if applicable to the sale. It’s also good practice to add payment method details, specifying “Cash” for this template. Always retain a copy for your records, as you may need them for tax purposes or dispute resolution.

Receipts in Australia must meet specific legal criteria for both businesses and consumers. These criteria ensure transparency and support record-keeping for taxation purposes. All receipts should include the business’s name, address, and Australian Business Number (ABN). This information helps confirm the legitimacy of the transaction.

What Must Be Included on a Receipt?

Receipts must detail the date of the transaction, the total amount paid, and a description of the goods or services provided. If the sale includes GST (Goods and Services Tax), the receipt should clearly state the amount of GST included in the price. The format of the receipt, whether paper or electronic, does not change these requirements.

Record-Keeping for Tax Purposes

Businesses in Australia are required to keep receipts for a minimum of five years. This record helps ensure that businesses comply with the Australian Taxation Office (ATO) rules and support claims for deductions or refunds. Consumers can also retain receipts for their personal tax records.

In summary, businesses must provide detailed and accurate receipts that reflect the transaction and comply with the ATO guidelines. Both paper and digital receipts serve the same legal function, as long as they contain the necessary information.

Ensure that all fields are correctly filled in. Leaving any section incomplete can lead to confusion or invalid receipts. Double-check the date, amount, and service details before finalizing the document.

- Incorrect Date: Always enter the accurate transaction date. An incorrect date can create confusion and cause issues during audits or returns.

- Missing Tax Information: If your business is tax-registered, ensure you include tax rates and amounts where applicable. This detail is crucial for both the customer and your financial records.

- Wrong or Missing Contact Details: Make sure to include your business’s contact information. A receipt without clear contact information might be difficult for the customer to follow up if needed.

- Unclear Payment Method: Specify how the customer paid (e.g., cash, credit card, bank transfer). This helps in reconciling accounts and clarifying any future disputes.

- Not Including Unique Receipt Numbers: Every receipt should have a unique identifier to avoid duplicates and ensure easy tracking. This is important for your accounting and audit trails.

Review the font and layout. A cluttered or unreadable receipt can lead to misunderstandings. Use a clean, professional format that clearly distinguishes different sections of the receipt.

- Unorganized Information: Avoid cramming too much information into one section. Group related details (e.g., items purchased, tax details, totals) to make the receipt easier to read.

- Inconsistent Formatting: Consistent font sizes and spacing improve readability. Avoid using too many different fonts or excessive styling.

Lastly, ensure that your receipt template complies with Australian tax regulations. Non-compliance can lead to fines or complications with tax authorities.

For quick access to free receipt templates in Australia, you can explore several online platforms. These resources provide editable formats for businesses or individuals needing a professional receipt for transactions.

1. Template.net

Template.net offers a wide variety of customizable receipt templates for different purposes, including sales, rental, and donation receipts. You can download the templates in different formats such as Word, Excel, and PDF, making it easy to edit and print. A free account gives you access to a selection of templates, with options for more advanced designs available in the paid version.

2. Microsoft Office Templates

If you use Microsoft Office, their templates section has several free receipt options available in Word and Excel formats. The templates are user-friendly and allow for easy customization. The benefit of using Office templates is that you can easily adjust them to suit Australian requirements and business needs.

Using these free resources, you can quickly generate professional receipts without the need for advanced design software or external services.

To make your receipt template fit your small business needs, adjust it to reflect your branding and customer expectations. Add your business name, logo, and contact details at the top. This keeps your receipts professional and consistent with your overall brand identity.

Include specific details that matter most for your business. For example, if you sell products, ensure the item description, quantity, and unit price are clearly listed. For services, include the service type and the hours worked or project specifics. This provides clarity for both you and your customers.

Customize the tax section based on local requirements. For Australian small businesses, it’s important to have the correct Goods and Services Tax (GST) details. Ensure the tax rate is visible and that the total amount is broken down accordingly, including both before and after tax amounts.

Another customization option is to include a space for payment methods. This can help you keep track of how payments were made (e.g., cash, card, or online transfer). This section can help with accounting and also assist in future customer inquiries.

Consider adding a “Thank You” message or an invitation for customers to leave feedback. This adds a personal touch that can encourage repeat business and show appreciation for their purchase.

Make sure your template is easy to read. Use clear fonts, proper alignment, and sufficient space between items. If you’re offering digital receipts, ensure that your template is mobile-friendly, as many customers prefer viewing receipts on their devices.

| Section | Details to Include |

|---|---|

| Business Information | Business name, logo, address, phone number, email |

| Item/Service Details | Item/service name, quantity, unit price, total |

| Tax Breakdown | GST rate, tax amount, total after tax |

| Payment Method | Cash, card, or other methods |

| Message | Thank you note or feedback request |

By customizing your receipt template, you enhance your professionalism, stay organized, and provide a seamless experience for your customers.

Accurate record-keeping of cash receipts is necessary for smooth tax filing in Australia. Here’s how to handle cash receipts properly:

- Record Details Immediately: Every cash transaction should be recorded right away. Use a cash receipt book or accounting software to capture the transaction amount, date, payer’s details, and the reason for payment.

- Issue Receipts to Customers: Always provide a receipt to the payer, outlining the payment details. If using paper receipts, keep a copy for your records. For digital transactions, email the receipt and store it electronically.

- Store Receipts Securely: For physical receipts, use a safe, organized storage system, like a file or box. For digital receipts, store them in a secure cloud storage or accounting software with backup options.

- Maintain a Separate Cash Log: Track all cash transactions separately from other income sources. This will help ensure clarity in your financial records and reduce the risk of errors during tax time.

- Use Accounting Software: Leverage accounting software like Xero, MYOB, or QuickBooks to streamline the process. These programs allow you to record transactions instantly and store receipts electronically, making tax filing easier.

- Reconcile Regularly: Perform regular reconciliations of your cash receipts to ensure the recorded data matches your bank statements and actual transactions. This reduces discrepancies at tax time.

- Retain Receipts for the Required Period: The Australian Taxation Office (ATO) requires businesses to keep records for five years. Ensure your receipts, along with related documents, are stored for this period.

By following these steps, you can ensure that your cash receipts are well-documented and accessible for tax purposes, reducing stress during tax filing season.

To create a free cash receipt template in Australia, focus on simplicity and compliance with local regulations. The template should clearly outline transaction details, such as the date, payee, payment amount, and a description of the transaction. It should include a receipt number for easy tracking and verification purposes. Make sure the format is clean and accessible, allowing users to fill in necessary fields easily.

Key Components

Each receipt should contain these main elements: Payee name and contact detailsDate of transactionPayment method (cash, bank transfer, cheque, etc.)Transaction amount (in words and numbers)Receipt numberDescription of the goods or services receivedSignature of the issuer (optional, but recommended for formal transactions)

Customising the Template

For Australian businesses, it’s important to include your Australian Business Number (ABN) in the receipt template. This ensures the transaction is legally documented, which is especially relevant for tax and bookkeeping purposes. Consider using a simple word processor or spreadsheet software to design your template. Free online tools can help you create a professional-looking receipt without any extra cost.