Download this free charitable contribution receipt template to easily track donations. This document helps provide a clear and professional acknowledgment for donors, which they can use for tax deductions. The template includes all the key details, such as the donor’s name, donation amount, and your nonprofit’s information.

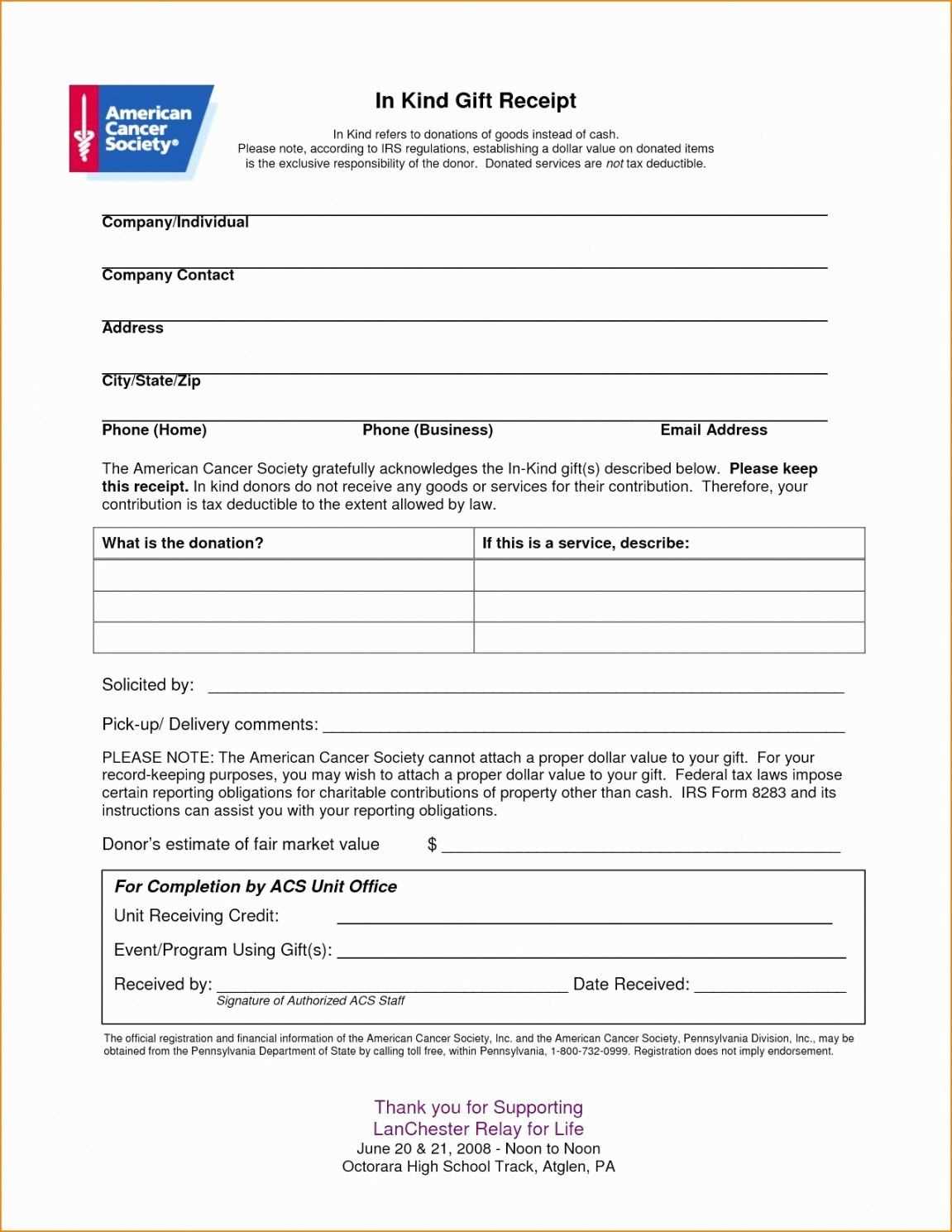

It also allows you to specify whether the donation was in cash, goods, or services. For non-cash items, include the fair market value. This way, your receipts are transparent and accurate, making the process simpler for both you and your donors.

With this template, you save time while ensuring your receipts meet all necessary requirements. Customize it to suit your organization’s needs and start using it right away to streamline your donation management process.

Here are the corrected lines with minimized repetitions:

The key to creating a streamlined charitable contribution receipt is to focus on clarity and brevity. By eliminating redundant details, you ensure the document is professional and easy to understand.

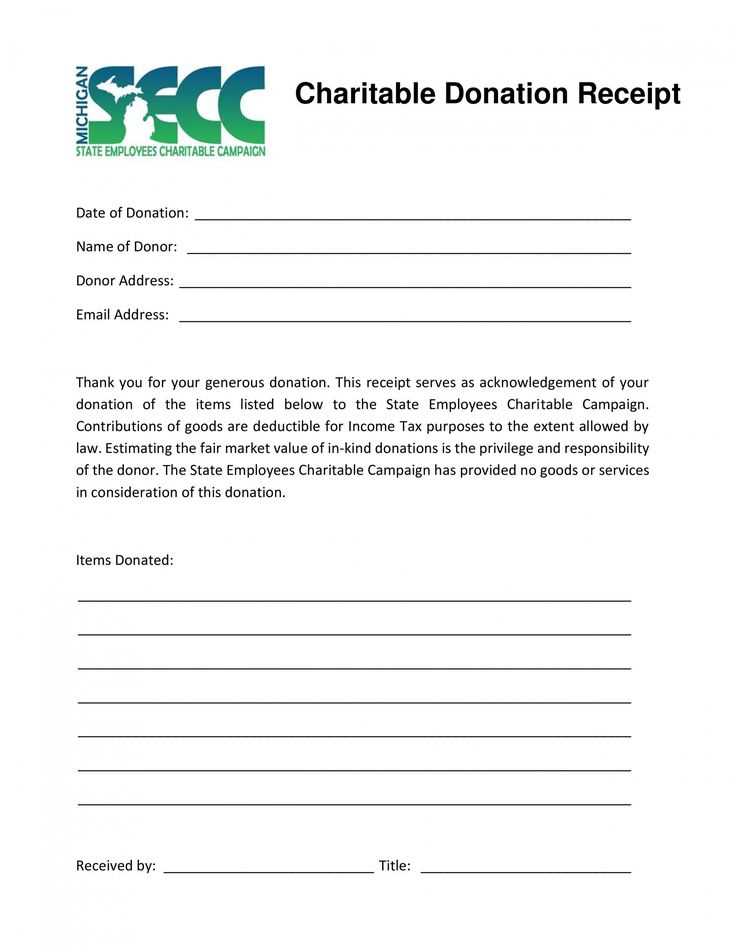

Title and Donor Information

Start with a concise title, such as “Charitable Donation Receipt,” followed by the donor’s full name and address. Avoid repeating the donor’s details in multiple sections.

Donation Description

Describe the contribution with accuracy and simplicity. Mention the type of donation, such as “clothing” or “cash,” and the approximate value if applicable. Keep this section direct, with no need for lengthy explanations.

- Free Charitable Contribution Receipt Template

To create a valid charitable contribution receipt, ensure it includes the following key elements:

1. Donor’s Name – Include the full name of the individual or organization making the donation. This helps in personalizing the receipt and ensures accuracy for tax purposes.

2. Date of Donation – Clearly state the date when the contribution was made. This is crucial for record-keeping and can affect tax deductions for the donor.

3. Description of Donated Items – Provide a brief description of the items or services donated. Be specific, especially if the donation is non-cash. For example, “10 boxes of winter clothing” or “used office furniture.”

4. Value of Donation – For non-cash donations, estimate the fair market value of the items at the time of donation. If the donation is monetary, list the exact amount.

5. Statement of No Goods or Services Received – If the donor did not receive any goods or services in exchange for the contribution, include a statement confirming this. For example, “No goods or services were provided in exchange for this donation.”

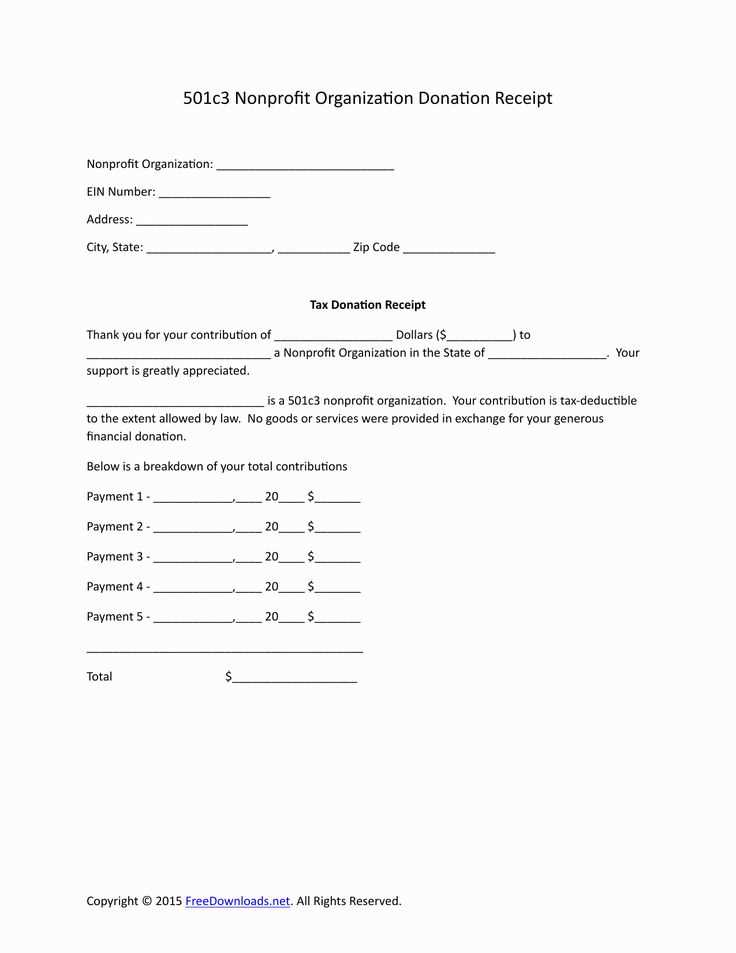

6. Charity’s Information – Include the full name of the charitable organization, along with its address, phone number, and tax-exempt status (such as the 501(c)(3) status in the U.S.). This information verifies the legitimacy of the donation.

7. Signature – Have an authorized representative of the charity sign the receipt. This provides official verification that the donation was received and documented properly.

By following this structure, you ensure that your charitable contribution receipt is complete, accurate, and ready for both the donor’s records and tax purposes.

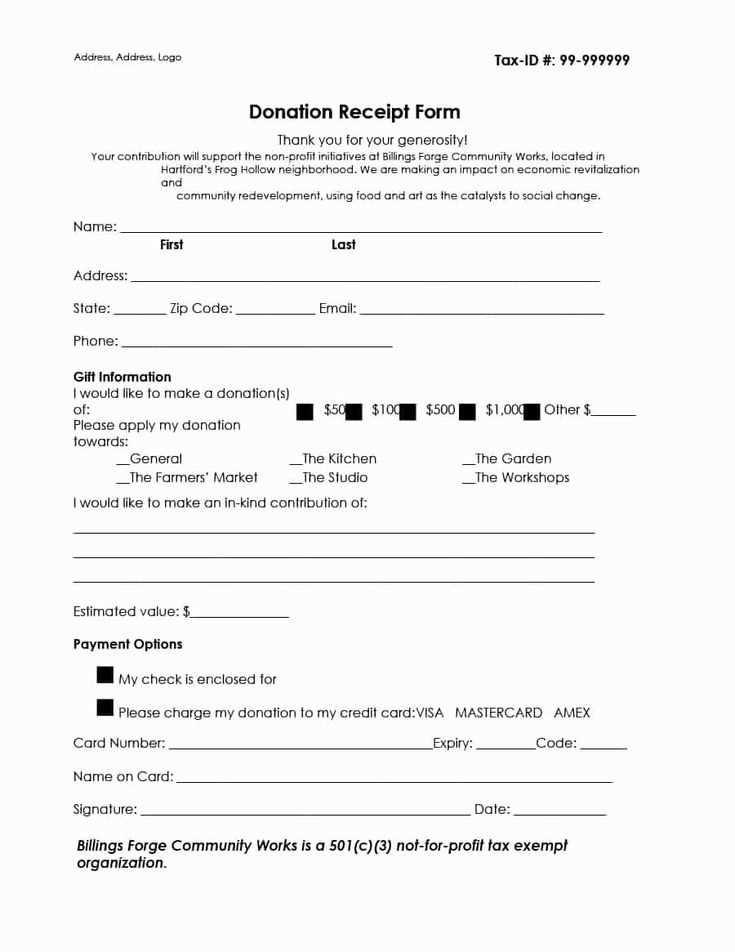

To create a simple donation receipt, include key details such as the donor’s name, the organization’s name, the donation amount, and the date of the donation. Start by providing your organization’s full legal name and contact details at the top of the receipt. Below that, add the donor’s name and address.

Specify the donation amount clearly. If the contribution was monetary, list the exact amount given. For non-cash donations, describe the items donated along with their estimated value, if applicable. Mention whether the donation was a cash gift or an in-kind donation.

Include a statement confirming that no goods or services were provided in exchange for the donation, unless applicable. If goods or services were provided, outline them with their value, and indicate the deductible portion of the donation.

Finish with a thank-you note expressing appreciation for the donor’s support. Make sure the receipt is signed by an authorized person from your organization and provide any required tax-related information, such as your nonprofit’s EIN (Employer Identification Number).

Include the following details in your contribution receipt to ensure it meets all requirements:

- Donor’s Name: Clearly state the full name of the donor as it appears on official records.

- Organization’s Name: Mention the full legal name of your charitable organization.

- Contribution Date: Specify the exact date the donation was received.

- Donation Amount: Indicate the dollar amount of the monetary donation or the fair market value of any non-monetary contribution.

- Nature of Donation: Clarify whether the donation was in cash, property, goods, or services.

- Statement of Goods or Services: If any goods or services were provided in exchange for the donation, describe them and state their value.

- Tax-Exempt Status: Include a statement confirming your organization’s 501(c)(3) status to assure the donor of their tax-deductible status.

- Receipt Number: Add a unique number for tracking purposes, especially for larger organizations handling numerous contributions.

Ensure all information is clear and precise to avoid confusion or complications for both the donor and your organization.

Begin by including the organization’s name, address, and contact information at the top of the receipt. Make sure this section is clear and easy to read, as it helps identify the charity quickly.

Follow with a detailed breakdown of the donation: specify the type of donation (monetary, goods, or services), the amount or value, and the date of the donation. If the gift is a non-cash donation, ensure the fair market value is included. For monetary donations, list the exact amount given.

Next, include a statement acknowledging that no goods or services were provided in exchange for the donation, or if there were, describe them and their value. This statement helps ensure the donor receives the correct tax deduction.

Ensure that the receipt includes the charity’s tax-exempt status number, which verifies that the organization is eligible to receive tax-deductible donations. This number is a key part of the receipt and should be clearly visible.

Conclude the receipt with a thank you note for the donor’s generosity. This adds a personal touch while remaining professional.

| Item | Details |

|---|---|

| Organization Name | [Charity Name] |

| Organization Address | [Full Address] |

| Donation Date | [Date] |

| Donation Type | [Monetary/Item/Service] |

| Donation Value | [Amount/Value] |

| Tax-Exempt Status Number | [Tax Number] |

| Receipt Statement | No goods or services provided in exchange for this donation. |

| Thank You | Thank you for your generous donation! |

How to Properly Structure a Charitable Contribution Receipt

When drafting a charitable contribution receipt, clarity is key. Focus on presenting the details of the donation without overusing the term “receipt.” Ensure that the purpose and information are easily understood.

Key Information to Include

- Organization Name and Address: Clearly list the name of the charitable organization along with its physical address. This is essential for record-keeping.

- Donor Information: Include the name and contact details of the donor. This ensures the correct attribution of the gift.

- Date of Donation: State the exact date the donation was made to confirm the transaction’s timing.

- Description of Donation: Provide a brief but accurate description of what was donated, especially for non-cash items.

- Donation Value: If the gift is monetary, specify the amount. If it’s an in-kind contribution, mention the estimated value.

- Statement of No Goods or Services Provided: If the donation was purely charitable, include a statement that no goods or services were given in return.

Keeping It Simple

By minimizing the repetition of “receipt,” you ensure that your document remains concise. Instead of repeating it multiple times, focus on the donation details and use terms like “acknowledgment” or “confirmation” to refer to the documentation. This maintains a professional tone without redundancy.