To streamline your donation tracking, use a free charitable donation receipt template. This document serves as proof of your contribution, ensuring donors receive proper acknowledgment and tax benefits. The template includes all necessary details, like the donor’s name, donation date, value, and the charity’s details, so you don’t need to worry about missing anything crucial.

Don’t complicate things. With a ready-made receipt, you can quickly fill in the relevant information and distribute it. This process saves you time and ensures compliance with tax regulations. Use this template not only to formalize donations but also to show appreciation for the generosity of your supporters.

Having a standard format eliminates guesswork. The key sections like the donor’s contact info, item description (if applicable), and a clear statement of the donation’s value help create a transparent record. Whether for in-kind donations or cash, this template ensures clarity on both sides.

Here’s the corrected version with minimal repetition:

To create a donation receipt that is clear and professional, include the following details:

Key Information to Include

The receipt should contain the donor’s full name, address, and the date of the donation. Clearly state the amount donated, along with a brief description of the items if applicable. If the contribution is a non-monetary donation, list the donated goods and their estimated value. Always mention whether the donation is tax-deductible.

Formatting Tips

For clarity, ensure the receipt is well-organized. Use a clean, simple layout with bold headings for each section. If issuing multiple receipts, make sure each one has a unique reference number. This helps with record-keeping and avoids confusion.

Always provide your charity’s contact information at the bottom of the receipt. This makes it easier for the donor to get in touch with any follow-up questions. You can include your nonprofit’s registration number, which can boost credibility.

Once the receipt is finalized, ensure both parties have a copy. The donor may need it for tax purposes, so provide it promptly after receiving the contribution.

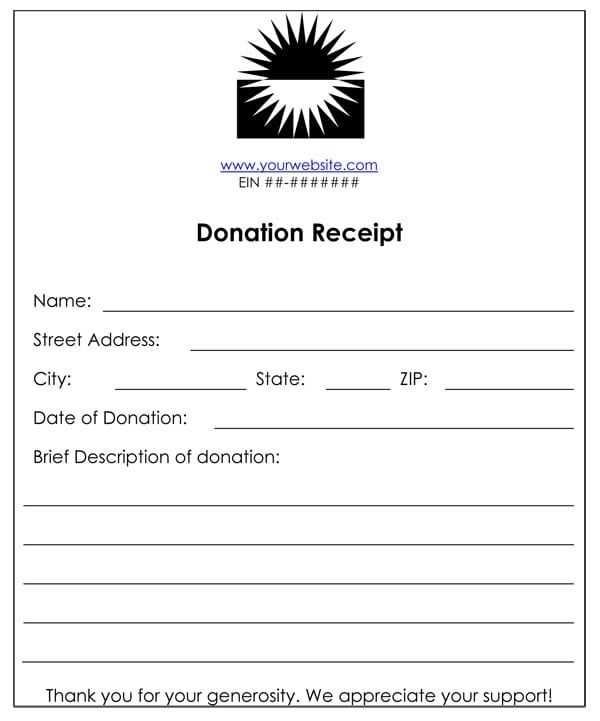

- Free Charitable Donation Receipt Template

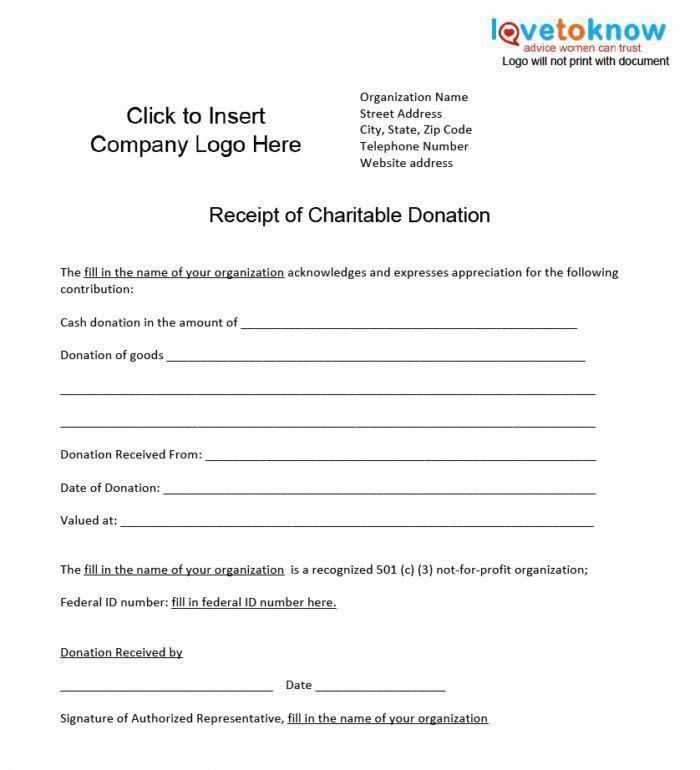

A well-designed charitable donation receipt is an important tool for both donors and charitable organizations. It serves as proof of donation, offering donors a clear record for tax deductions. Here’s a simple, free template you can use to create one for your charity or personal use:

Basic Template Components

- Donor’s Information: Full name, address, and contact details.

- Donation Details: Date of donation, amount donated (monetary or description of goods), and method of payment (cash, check, credit, etc.).

- Charity’s Information: Name, address, and contact info of the charity.

- Tax Information: A statement confirming the charity’s tax-exempt status and IRS details if applicable.

- Thank You Note: A short, friendly message of gratitude for the donation.

Template Example

Charitable Donation Receipt

Donor’s Name: [Donor’s Full Name]

Donor’s Address: [Street Address, City, State, ZIP]

Donation Date: [MM/DD/YYYY]

Donation Amount: [Amount or Description of Items Donated]

Payment Method: [Cash, Credit Card, Check Number, etc.]

Charity Name: [Charity Name]

Charity Address: [Street Address, City, State, ZIP]

Charity’s Tax-ID: [EIN Number]

Thank You: Thank you for your generous donation to [Charity Name]. Your support helps us continue our mission.

Signature: [Authorized Signature, Title]

By including these details, you ensure that both the donor and the charity are clear on the specifics of the donation, aiding in smooth tax filing and financial record-keeping.

To create a free charitable donation receipt, start by including basic donor and donation information. This ensures both the donor and organization can track the contribution accurately.

1. Gather the Necessary Details

Make sure to include:

- Donor’s full name and contact information

- Date of the donation

- Amount donated, or a description of the items if it’s a non-monetary donation

- Organization’s name, address, and tax identification number (TIN)

2. Create the Template Structure

Your receipt template should have clear headings such as “Receipt of Donation” or “Charitable Contribution Receipt.” Then, list the donor’s information and donation details, followed by the organization’s information. Include a statement indicating that the organization is a registered charity.

Example: “This is to acknowledge the receipt of your donation of $XXX, which will be used for [specific cause or purpose]. We are a registered 501(c)(3) charity, and no goods or services were exchanged in return for this donation.”

To make the process quicker, you can use free online templates or simple word processors to design your receipt. Just ensure all the necessary information is included, and the document is clear and professional.

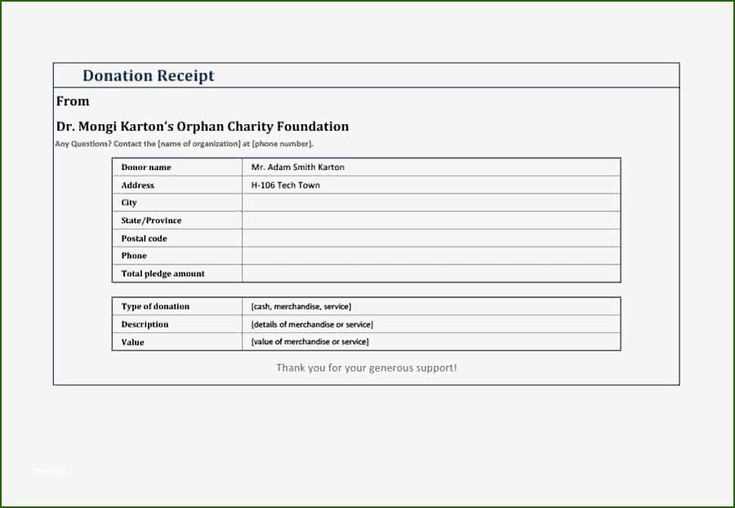

A donation receipt should provide all necessary details to make it clear for both the donor and the charity. At the very least, the receipt must include the following:

1. Donor Details

Include the full name of the donor or their organization. If applicable, add the donor’s address or contact details. This helps in identifying the donor and matching the receipt to the correct tax records.

2. Charity Information

Clearly state the charity’s name, address, and a statement confirming its tax-exempt status. Include the charity’s tax identification number (EIN), as this is necessary for tax reporting purposes.

3. Donation Date and Amount

Note the exact date the donation was received. For cash donations, state the amount. For non-cash donations, provide a description of the item(s) donated, including their estimated fair market value if possible.

4. Description of Goods or Services

If any goods or services were provided in exchange for the donation, mention their fair market value. This ensures transparency and helps donors determine the deductible amount.

5. Acknowledgment of No Goods or Services Provided

If the donation was purely a gift with no goods or services exchanged, include a statement to confirm this. This is crucial for donors to claim a full tax deduction.

6. Charitable Purpose

Include a brief description of the charity’s mission or purpose. This not only reinforces the nature of the donation but can also assist with tax records.

7. Signature or Authorized Representative

Include the signature of an authorized person from the charity, such as a director or executive. This adds validity to the receipt and confirms it was issued by the charity.

Tailor your receipt template to meet the specific needs of different charities by adjusting details like their legal status, donation guidelines, and tax-exempt status. For example, include the charity’s full legal name and tax ID number for nonprofit organizations. This ensures transparency and accuracy for both the donor and the charity.

For religious organizations, you may want to note if donations are considered tithes or charitable contributions under tax laws. For educational charities, highlight the specific purpose of the donation, such as scholarships or general funding. This distinction can be helpful for donors when claiming tax deductions.

In the case of international charities, specify the country of registration and include any international tax considerations that apply. This is especially important if the charity operates across borders and donors need to account for foreign donations on their tax returns.

Also, if the donation is restricted to a specific project or cause, clearly mention this on the receipt. This helps donors understand how their contributions are being used, fostering trust and ongoing support.

For large donations, consider providing additional documentation, such as a separate acknowledgment letter or a breakdown of the donation’s intended purpose. This provides more detailed information for both the donor’s records and the charity’s accounting.

Finally, ensure your template includes a clear and easy-to-read donation amount, along with any relevant currency details. Adjust the format to suit the preferences of the charity, whether they require a simple list or a more formal breakdown of the gift.

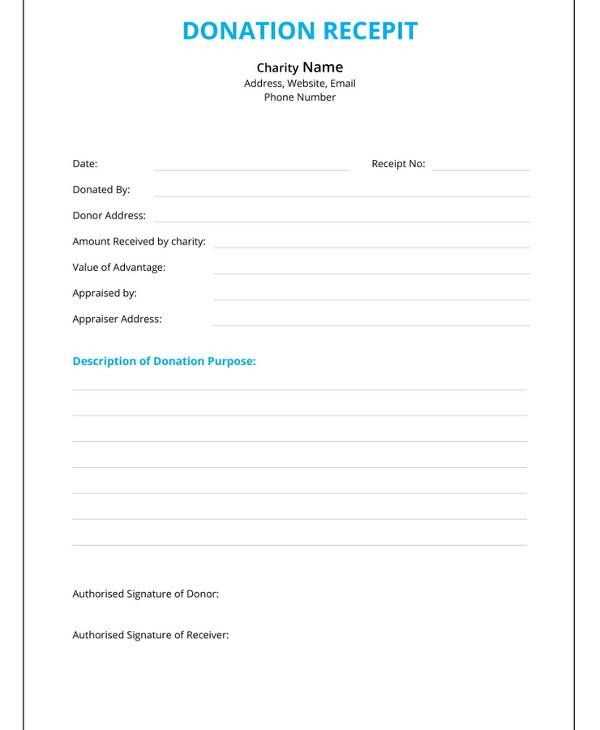

Charitable organizations must follow specific legal requirements when issuing donation receipts to ensure compliance with tax laws and donor recordkeeping. The IRS outlines clear guidelines for what a receipt should include to be valid for tax deduction purposes.

- Donor Information: Include the full name of the donor. If the donation is made by a corporation, include the business name.

- Organization Details: The receipt must list the full legal name of the charitable organization, its address, and the EIN (Employer Identification Number) or tax ID.

- Date of Donation: Record the exact date the donation was made. If the donation was made by check, the date the check was processed should be used.

- Donation Amount or Description: For cash donations, specify the exact amount. For non-cash contributions, provide a detailed description of the items donated. Avoid assigning a value to non-cash donations; this is the donor’s responsibility.

- Statement of No Goods or Services Received: If the donor did not receive goods or services in exchange for their donation, include a statement confirming this. If something was received, describe it and provide an estimate of its fair market value.

- Certification of Non-Profit Status: The organization should state that it is a qualified 501(c)(3) tax-exempt organization, allowing donors to claim tax deductions for their contributions.

Issuing receipts with all required information ensures both compliance and transparency. These records protect both the donor and the organization in case of audits or tax filings.

Search for free donation receipt templates on trusted websites like DonationTrack and Charity Dynamics, which provide customizable templates for non-profit organizations. Both platforms offer user-friendly tools to create donation receipts in just a few minutes.

1. Google Docs Templates

If you prefer a simple, editable option, check out Google Docs. They have a selection of free donation receipt templates that can be easily customized. Simply search “donation receipt template” within Google Docs’ template gallery, and you can get started immediately without needing extra software.

2. Microsoft Office Templates

Microsoft Word offers donation receipt templates through their template gallery as well. Visit the Microsoft Office website and download a template that suits your needs. These templates come with customizable fields for donor details and donation information, allowing you to quickly generate professional receipts.

For more flexibility, some online platforms like Smartsheet and Template.net offer free, easy-to-edit templates in various formats, including Excel and PDF, which can be customized to suit your specific needs.

Send receipts as soon as possible after receiving a donation. This shows appreciation and keeps records organized. If you’re using physical receipts, ensure they are printed clearly and signed by an authorized individual. For electronic receipts, email them directly to the donor in a PDF format with a clear subject line, such as “Donation Receipt for [Date].” Always include the donor’s name, donation amount, and the charity’s details for reference.

Consider Timeliness and Accuracy

Be prompt in issuing receipts. Donors appreciate quick acknowledgment of their contributions, which helps them keep their own records. Ensure all details are correct, including the donation date and amount. Double-check for typos or inaccuracies that could cause confusion or legal issues.

Choose the Right Delivery Method

For large donors or corporate sponsors, consider delivering receipts via registered mail or another reliable method to ensure they receive them. For regular donors, an automated email system can save time and keep things streamlined. Both methods should have clear instructions in case the donor needs to get in touch for any reason.

Be Transparent by including a statement on the receipt specifying that no goods or services were exchanged for the donation, as required by tax laws in many regions.

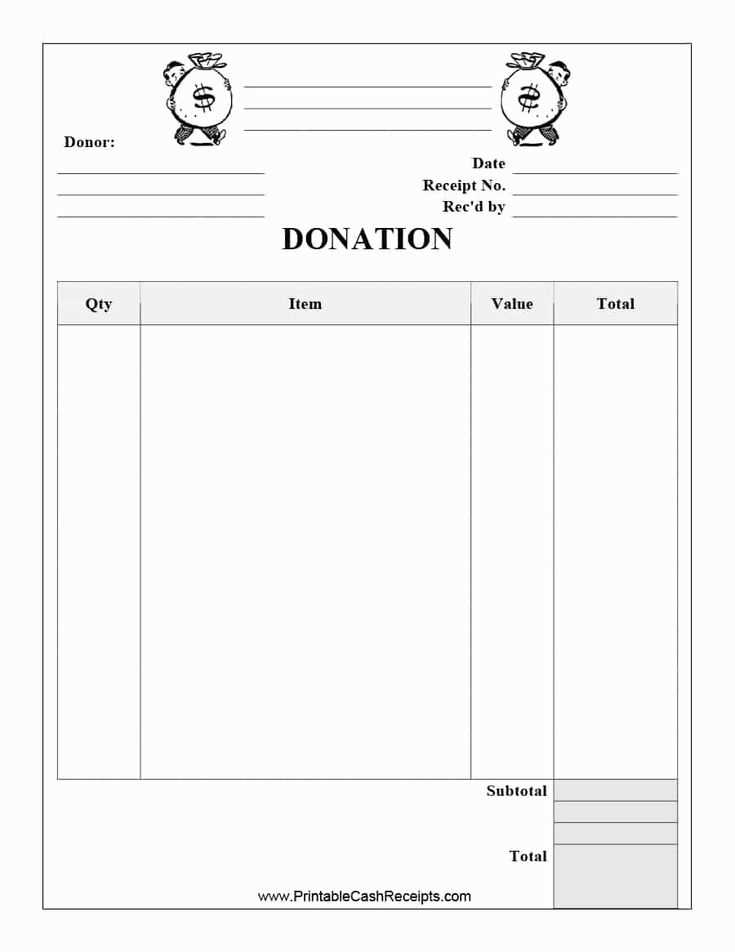

Free Charitable Donation Receipt Template

Use clear and concise wording in your donation receipts to avoid confusion. Ensure all relevant information is included, such as the donor’s name, donation amount, and the date. Make sure to state that the donation is tax-deductible if applicable, and include the organization’s contact details for future reference.

A simple structure helps maintain clarity. Here’s a recommended layout for a donation receipt:

| Donor’s Name | Donation Amount | Date of Donation | Tax-Deductible Status | Organization’s Contact Information |

|---|---|---|---|---|

| [Donor’s Name] | [Amount Donated] | [Date] | Tax-deductible (if applicable) | [Organization’s Contact Info] |

Keep the language simple and focus on the details that will help the donor with their tax filings. Avoid unnecessary information that may clutter the receipt. Make sure to maintain a formal but friendly tone in the document.