Using a child care receipt template helps simplify the process of documenting payments for services rendered. Whether you’re a parent or a provider, having a clear, organized format ensures you keep track of expenses and avoid confusion. A simple receipt not only records payment details but also serves as an official document for tax purposes.

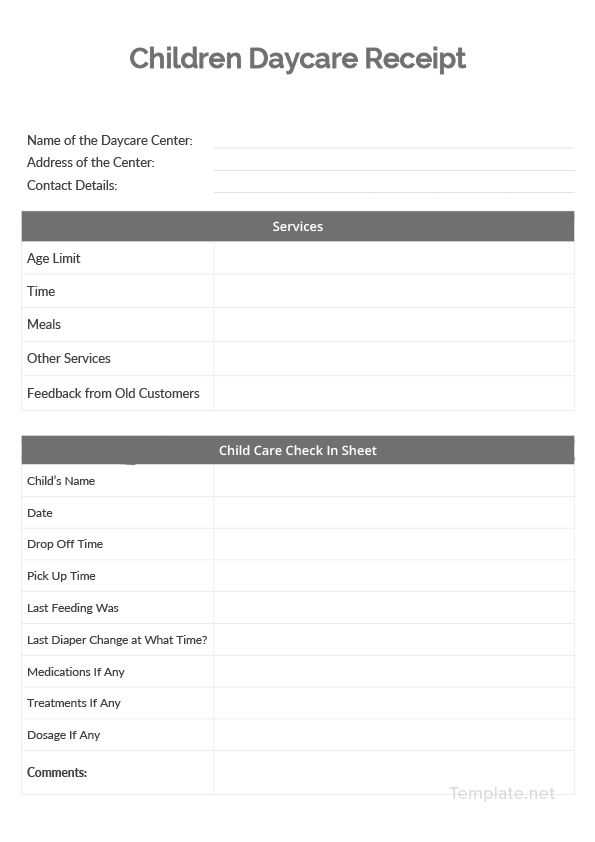

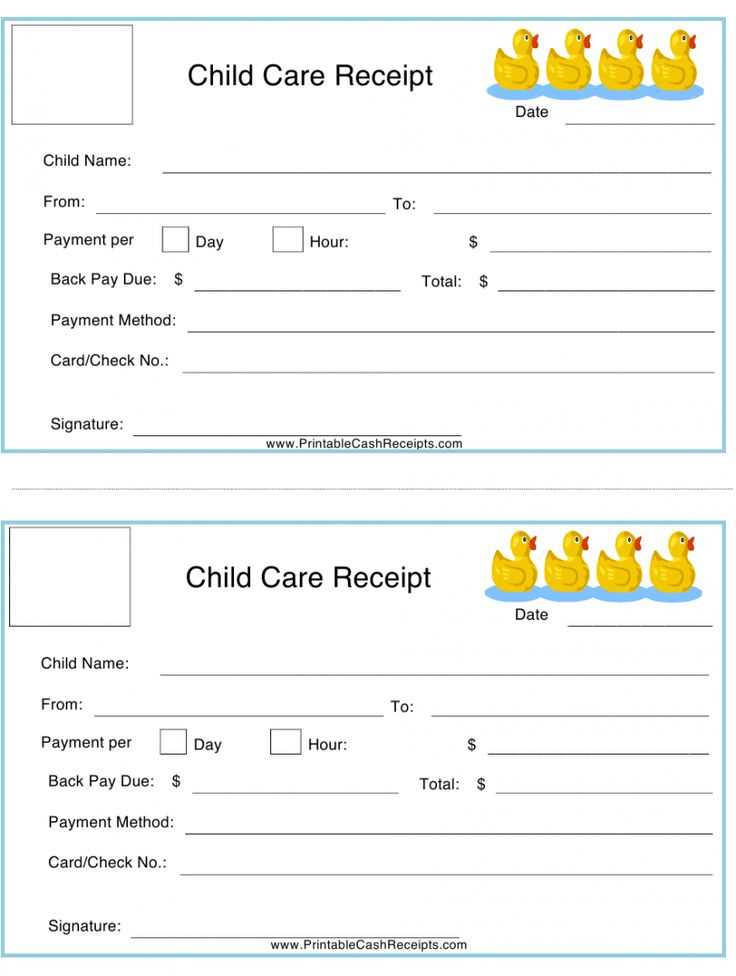

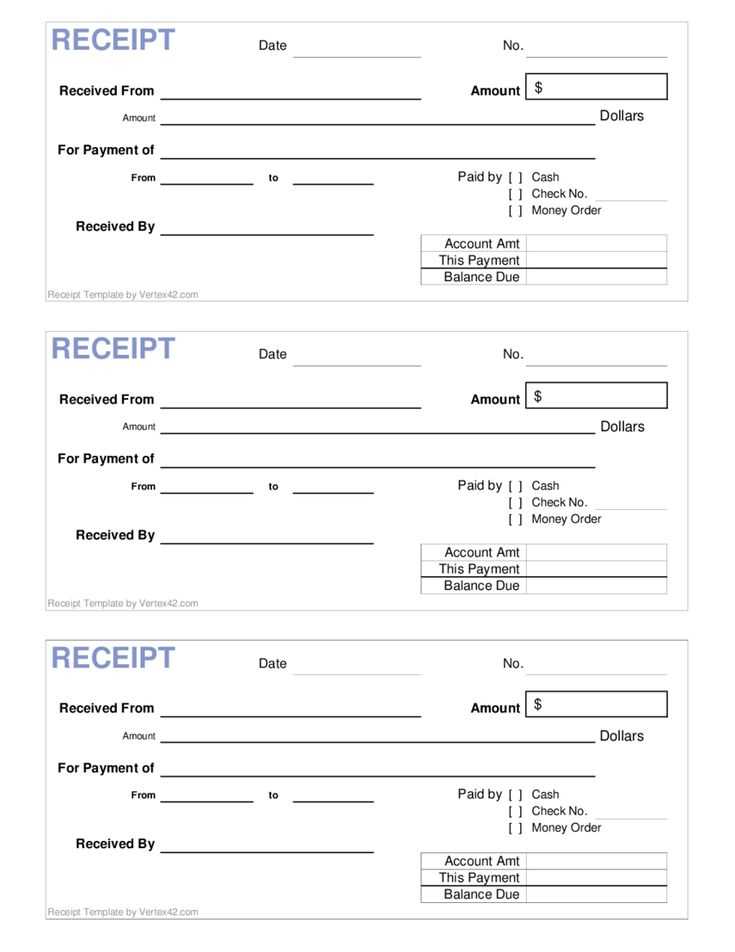

Download a free, customizable template that suits your needs. The key information to include is the name of the service provider, the date of the service, the total amount paid, and a brief description of the child care provided. You can easily adjust the template to fit various payment methods, including cash, check, or electronic transfer.

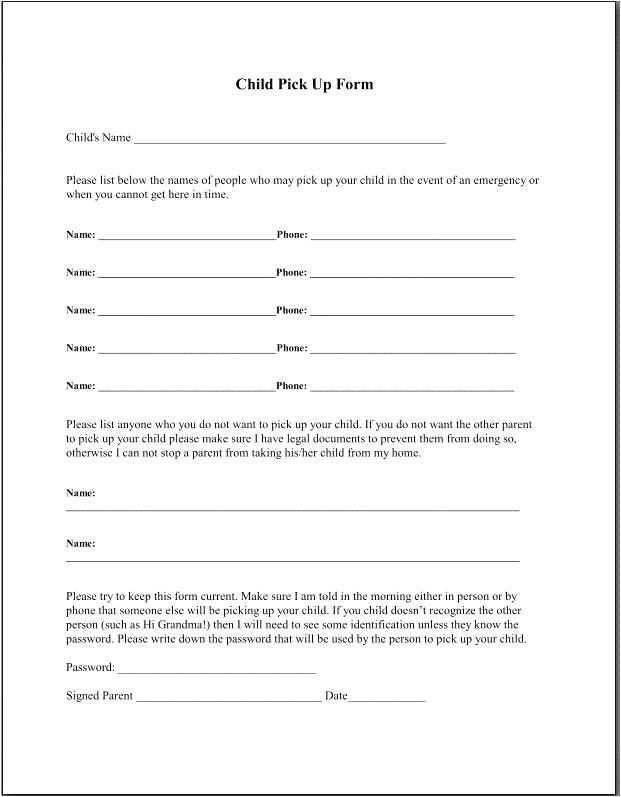

When using a template, be sure to include the child’s name, along with the caregiver’s contact information. This makes the receipt valid and ensures all necessary details are captured. For convenience, many templates offer sections for recurring services, which can be helpful for families who need regular care.

Having a consistent, professional receipt helps avoid misunderstandings and provides a straightforward way to manage payments, saving time and effort for both parties.

Free Child Care Receipt Template

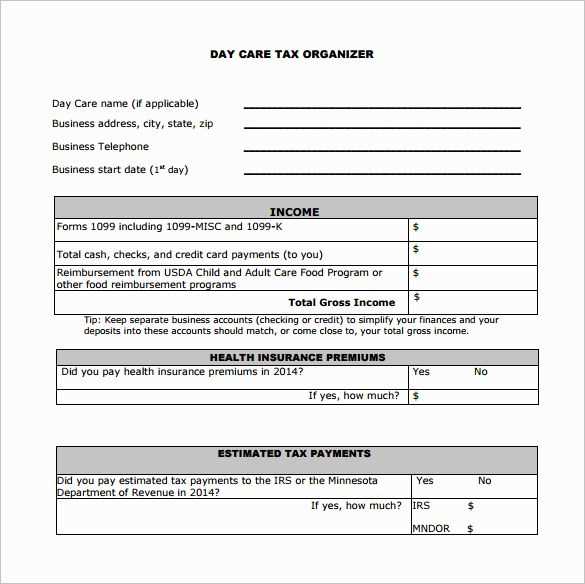

A free template for child care receipts can streamline your accounting process. Look for a simple format with fields for the provider’s name, contact details, and services provided. Include the dates of care, hourly rate, and total amount paid. Make sure the template also has a section for any applicable discounts or special offers. This will help ensure accurate documentation for both parties involved.

Key Components to Include

Ensure your receipt template includes these elements: provider information, parent or guardian details, service dates, and a breakdown of charges. A clear payment section with the total amount due or paid is necessary. It’s also a good idea to leave space for both parties to sign and date the receipt.

How to Use the Template

Once you’ve chosen a template, customize it with your details. Fill out the information after each child care session. Keep copies for your records, and provide the completed receipt to parents. This ensures transparency and makes tracking payments simpler for everyone.

How to Customize the Template for Your Needs

Modify the template to fit your specific situation by focusing on key sections. Begin with the header, where you can include your business name, contact details, and any specific instructions for parents. This will make the receipt feel personal and relevant.

Adjust Payment Information

Update the payment section to reflect your pricing structure. If you charge by the hour, include a space for the total hours worked. If you charge a flat rate, list the fixed amount. Always ensure that there is a section for applicable taxes or discounts.

- Customize the date field to include both the start and end of the care period.

- Include a breakdown of services provided if necessary, such as snack time or additional activities.

Personalize the Footer

The footer is a good place for any disclaimers or thank you notes. Customize this area with a short message or any policy reminders, like payment due dates or late fees.

- Provide clear instructions on how to reach you in case of any questions.

- Make sure your payment methods are easy to understand and clearly listed.

Common Mistakes to Avoid When Filling Out Receipts

Double-check the date and time on the receipt. Incorrect or missing information here can cause confusion and lead to disputes later on. Ensure it reflects the actual transaction date and time.

Be specific with the service description. Vague descriptions can make it hard for clients to understand what they’re being charged for, especially if they need the receipt for tax purposes or reimbursements.

Accurate amounts are a must. Always verify the totals, including taxes, before finalizing the receipt. Small mistakes, like missing decimal points or incorrect numbers, can create unnecessary complications.

Never leave out the payment method. If the transaction was made via check, credit card, or cash, include that detail. This helps prevent confusion and provides clarity if the receipt is questioned later.

Don’t forget to sign and date where required. This gives the receipt an official touch and makes it legally acceptable, particularly for services rendered over time or when a contract is involved.

Check the customer’s information. If any personal details are included, like names or addresses, make sure they are accurate and complete to avoid mistakes that could lead to privacy issues.

Best Practices for Managing Child Care Payments and Records

Keep detailed records of each transaction. For every payment made, ensure you note the amount, the date, and the payment method used. This will help you track your expenses and stay organized. Using a spreadsheet or accounting software can simplify this task.

Track Payment Frequency and Amounts

Establish a clear payment schedule with your child care provider. Regular payments should follow the same pattern to avoid confusion. Whether it’s weekly, bi-weekly, or monthly, ensure that all payments align with the terms you’ve agreed upon. Record these details immediately after making a payment.

Use Receipts for Transparency

Always request a receipt for every payment, regardless of the amount. A well-structured receipt will provide clarity on the payment details and create a transparent record. If you’re using a template for receipts, ensure it includes the provider’s information, payment date, and amount.

It’s helpful to store both digital and paper copies for easy access when needed. Maintain a separate folder for child care records to keep them organized and secure.

Staying organized with payments and records prevents misunderstandings and helps you stay on top of your financial responsibilities. This approach also simplifies tax time and ensures you have the necessary documentation for deductions or reimbursements if applicable.