Utilize a free daily sales and cash receipt template to streamline your sales tracking. This tool allows you to record daily transactions clearly, helping you stay organized and informed about your cash flow. By implementing a structured template, you ensure accurate record-keeping and reduce the likelihood of errors.

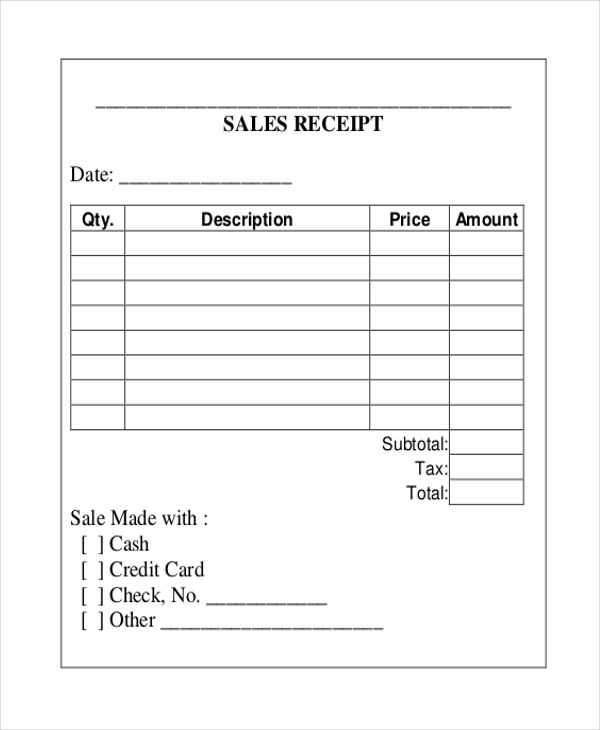

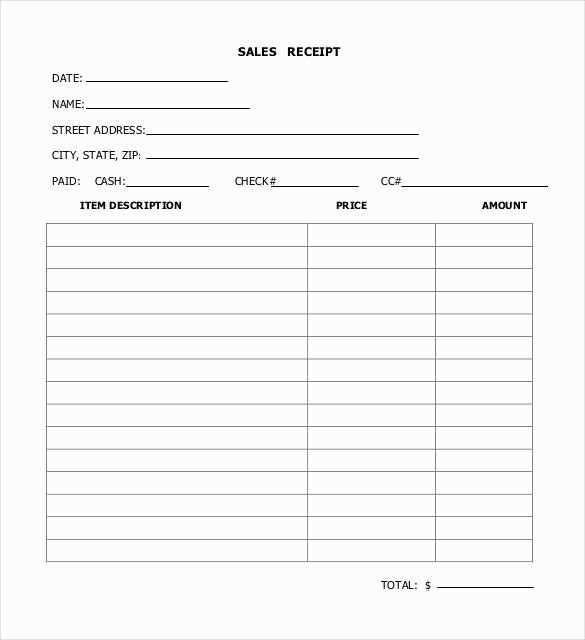

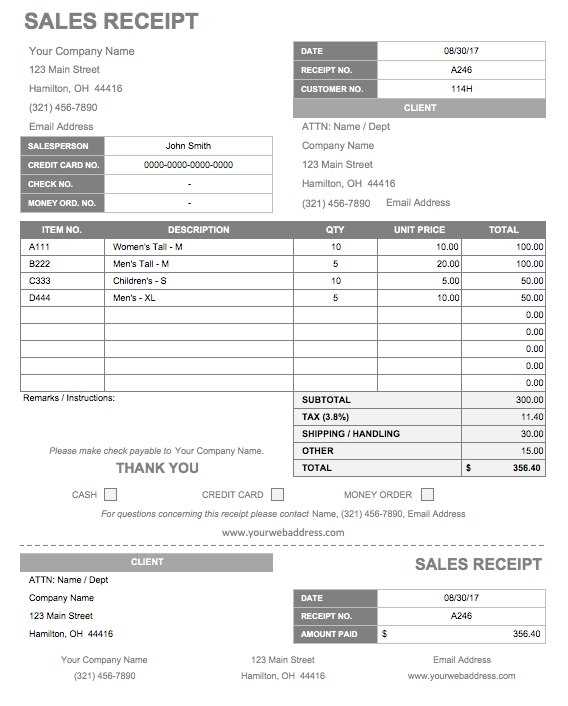

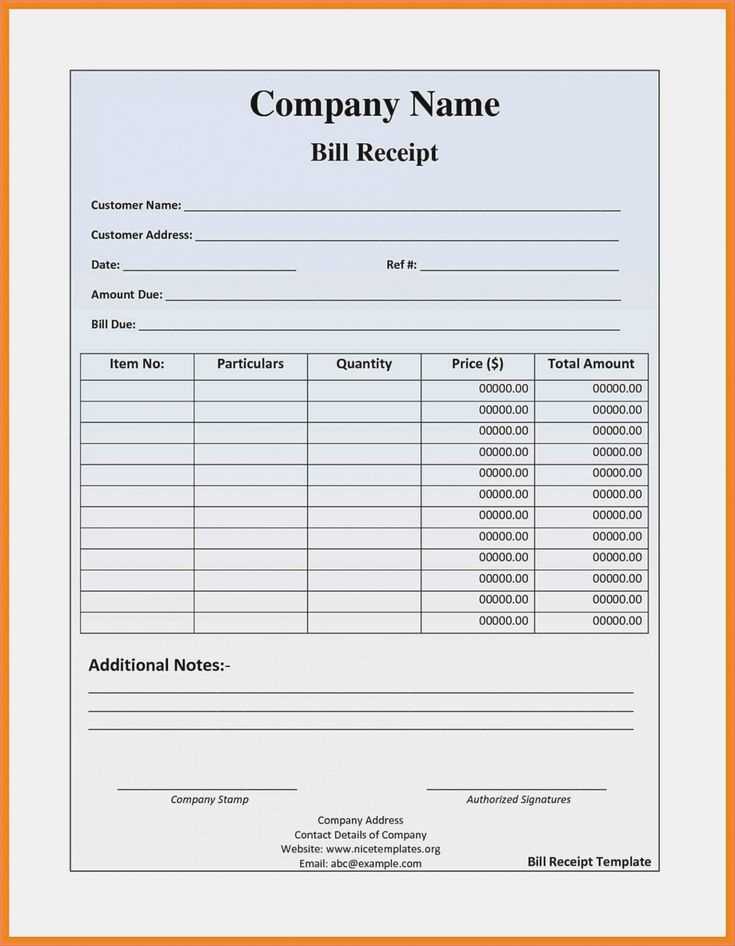

Incorporate fields for date, item description, quantity sold, unit price, and total amount. This structure not only enhances clarity but also makes it easy to review sales at a glance. You can customize the template to fit your specific business needs, adding or removing sections as necessary.

Regularly updating this template aids in financial analysis, allowing you to identify trends and make informed decisions about inventory and pricing. Make it a habit to fill out your sales receipt daily to maintain accurate records that support your business growth.

Free Daily Sales and Cash Receipt Template

Use a free daily sales and cash receipt template to simplify your record-keeping process. This template allows you to document daily sales, track cash transactions, and monitor your business’s financial performance effectively.

Start by entering the date at the top of the template. Below that, list each item sold, including the quantity, price per item, and total amount for each transaction. This detail provides clear insights into what sells best and can guide inventory decisions.

In the cash receipt section, include fields for customer name, payment method, and a unique receipt number. This organization helps maintain customer records and ensures accurate financial tracking. Make sure to provide a space for the total amount received, along with any applicable tax calculations.

At the end of each day, summarize your total sales by adding a section that captures daily totals. This summary will help you quickly assess your performance and prepare for future financial planning. Regularly updating this template can aid in identifying trends and making informed business decisions.

How to Create a Simple Sales Tracker for Your Business

Create a straightforward sales tracker by using a spreadsheet application like Excel or Google Sheets. Begin with a template that includes essential columns such as Date, Product/Service, Quantity Sold, Unit Price, and Total Revenue. This format allows for easy data entry and organization.

Next, implement formulas to automate calculations. For instance, in the Total Revenue column, multiply the Quantity Sold by the Unit Price. This ensures accuracy and saves time on manual calculations.

Incorporate a Running Total row at the bottom of your tracker to monitor cumulative sales. Use the SUM function to keep track of total revenue effortlessly. This feature helps assess business performance at a glance.

Regularly update your sales tracker with new data. Establish a routine, such as entering sales daily or weekly. This habit fosters consistency and allows you to analyze trends over time.

Consider adding additional features, such as a Sales Goal tracker. Set specific targets and compare actual sales against these goals. This can motivate your team and help identify areas for improvement.

Lastly, review your sales tracker periodically. Analyze patterns in your sales data to make informed decisions. Adjust your strategies based on the insights you gather to drive growth.

Best Practices for Recording Cash Receipts in Daily Reports

Implement a structured approach to logging cash receipts. Create a designated section in your daily sales report specifically for cash transactions. This ensures easy reference and minimizes the risk of overlooking any receipts.

- Record the date and time of each transaction immediately. Timely entries help maintain accuracy and reliability in your reports.

- Include detailed descriptions of each transaction. Specify the items sold, quantities, and amounts received to provide clear context for future reference.

- Use a consistent format for entering data. Uniformity helps streamline the reporting process and reduces errors during reconciliation.

Establish a verification process. After recording cash receipts, conduct a quick review to ensure all entries match the cash drawer totals. This practice helps catch discrepancies early.

- Set aside time at the end of each day to reconcile cash receipts against sales. Cross-checking these figures aids in identifying potential issues.

- Utilize tools like spreadsheets or accounting software. These tools can automate calculations and provide templates for consistent data entry.

Maintain a backup of your records. Regularly save digital copies of your reports and receipts to prevent loss of information. This practice enhances your ability to track cash flow and resolve disputes.

Train staff on the importance of accurate cash recording. Ensuring everyone understands the procedures promotes consistency and accountability within your team.

Regularly review and update your cash receipt recording practices. Stay informed about new tools and methods that can enhance your reporting efficiency and accuracy.

Customizing Your Template for Different Business Needs

Tailor your sales and cash receipt template to reflect your unique business identity. Begin by incorporating your logo and brand colors. This personal touch not only enhances your brand visibility but also fosters a professional appearance.

Next, adjust the layout to prioritize the information most relevant to your business. For retail, emphasize product details, prices, and sales tax calculations. For services, highlight hours of service, labor costs, and additional fees. This customization streamlines communication with your clients.

Consider adding fields for customer information. Collecting data such as names and contact details can improve customer engagement and enable follow-up communication. This approach is especially beneficial for businesses relying on repeat customers.

Integrate payment options that suit your operations. Include sections for cash, credit card, and mobile payment transactions. This flexibility caters to diverse customer preferences, enhancing the purchasing experience.

Review your template periodically to ensure it continues to meet your evolving business needs. Gather feedback from your team and customers to identify areas for improvement. Adjustments based on practical insights can significantly enhance the template’s usability.