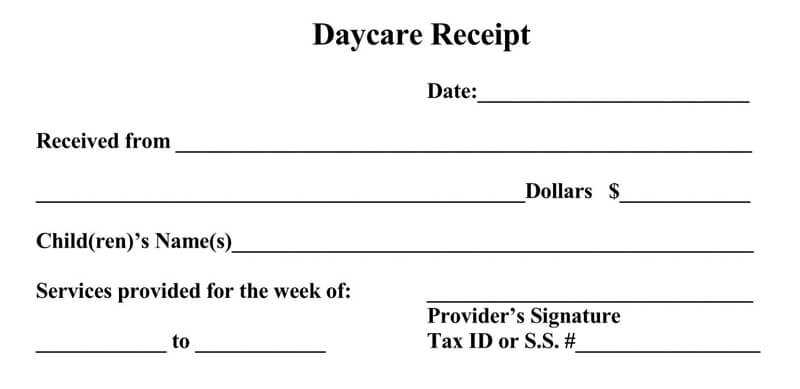

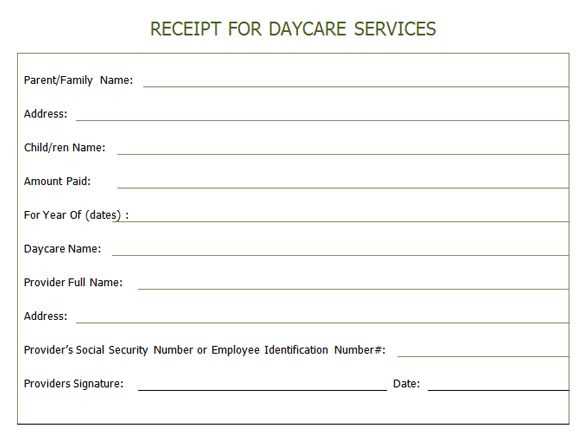

If you’re managing daycare expenses, keeping track of payments and receipts is key for tax filing. Using a free daycare tax receipt template can save time and reduce errors when you need to submit your documentation. You can easily create a receipt with the following basic details: name and address of the daycare provider, date of service, total amount paid, and a description of the services provided.

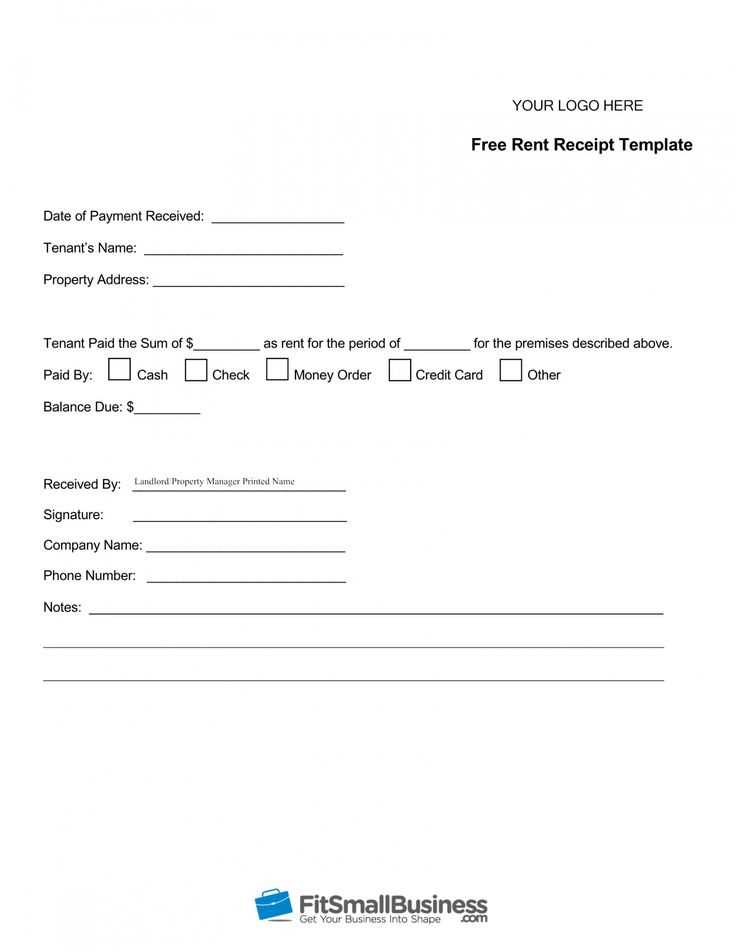

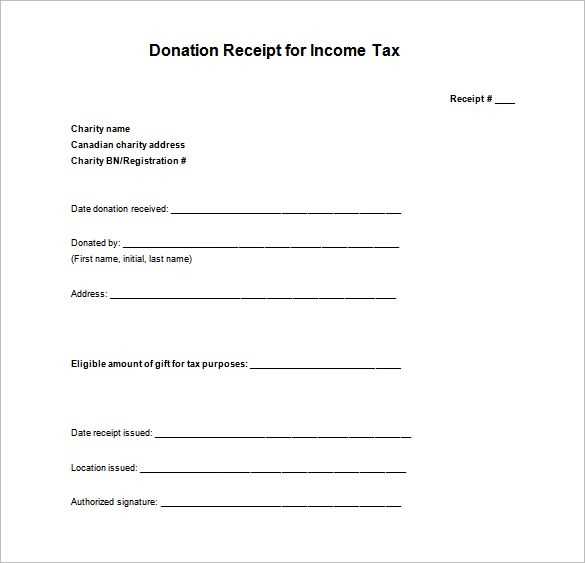

The template should include a space for the provider’s tax identification number (TIN) or employer identification number (EIN) for verification purposes. This will be important when filing your taxes, ensuring that all the payments are correctly documented and linked to the appropriate business or provider. Make sure the template includes clear sections for the parent’s name and the child’s details to avoid any confusion.

Using a template helps streamline the process and makes it easier to stay organized throughout the year. Whether you need a receipt for monthly payments or a yearly summary, having a standardized form at your disposal can speed up tax preparation and minimize errors. Keep your receipts organized by date, and make sure you have them accessible for any potential tax audits or deductions.

Here’s the revised version with word repetition reduced:

To create a professional daycare tax receipt template, start with clear and straightforward sections. Include the daycare provider’s name, address, and contact details at the top. Add the parent’s or guardian’s information, followed by the child’s name and the dates services were provided. Make sure to list the total amount paid for services, specifying if payments were made monthly or annually.

Key Sections to Include

1. Provider Information: Name, address, and contact info.

2. Client Information: Parent or guardian’s details.

3. Service Dates: List exact periods for which payment was made.

4. Payment Breakdown: Specify the total amount and any applicable taxes.

Format Tips

Ensure the receipt is clear and easy to read. Use bold text for headings and keep the font size consistent. Avoid unnecessary details that could clutter the receipt. Provide space for signatures, either digital or handwritten, to authenticate the document.

Here’s a detailed HTML plan for an informational article on “Free Daycare Tax Receipt Template” with three practical and specific headings:

To create a free daycare tax receipt template, focus on including key elements such as the daycare provider’s name, contact details, and tax identification number. Clearly state the payment amounts and date of service, ensuring accuracy for tax filing. Be sure to incorporate spaces for the child’s name, the number of days or hours attended, and a breakdown of any applicable fees.

Include Necessary Tax Information

Ensure that all receipts include the daycare provider’s tax ID or Social Security number for proper documentation. This is critical for both the provider and the parent during tax reporting. If you’re creating the template, leave a section for the parent’s name, address, and the total amount paid for the year. This allows for quick and simple tax filing.

Clear Formatting and Organized Sections

The receipt should have clear headings to make information easy to find. Divide sections for contact info, service dates, and financial breakdowns. Use simple tables or bullet points for a clean look. Adding a signature line at the bottom for the provider to verify the information can also be helpful.

- Free Daycare Tax Receipt Template: A Practical Guide

Using a daycare tax receipt template can save you time and ensure you have the right details for tax deductions. To create one that works for you, follow these straightforward steps:

- Include the daycare provider’s full contact information: The name, address, and contact details (phone number and email) of the daycare center should be listed clearly.

- Specify the dates of service: Include the exact start and end dates for which the services were provided. It’s important for record-keeping to avoid ambiguity about the covered period.

- Provide the child’s full name: The receipt should specify the child’s full name to link the payment to the correct beneficiary.

- List the total amount paid: Include a breakdown of all fees paid, whether it’s a weekly, monthly, or one-time payment. Specify the exact total amount for the year.

- Provide the daycare tax ID number: The daycare provider’s tax identification number should be included for tax purposes.

- State the nature of services provided: Mention the type of daycare services offered, such as full-time care, part-time, after-school programs, etc.

Once your template includes these basic details, it will be ready for use when you file taxes. Ensure that both you and the provider retain a copy for your records in case of any questions or audits later on.

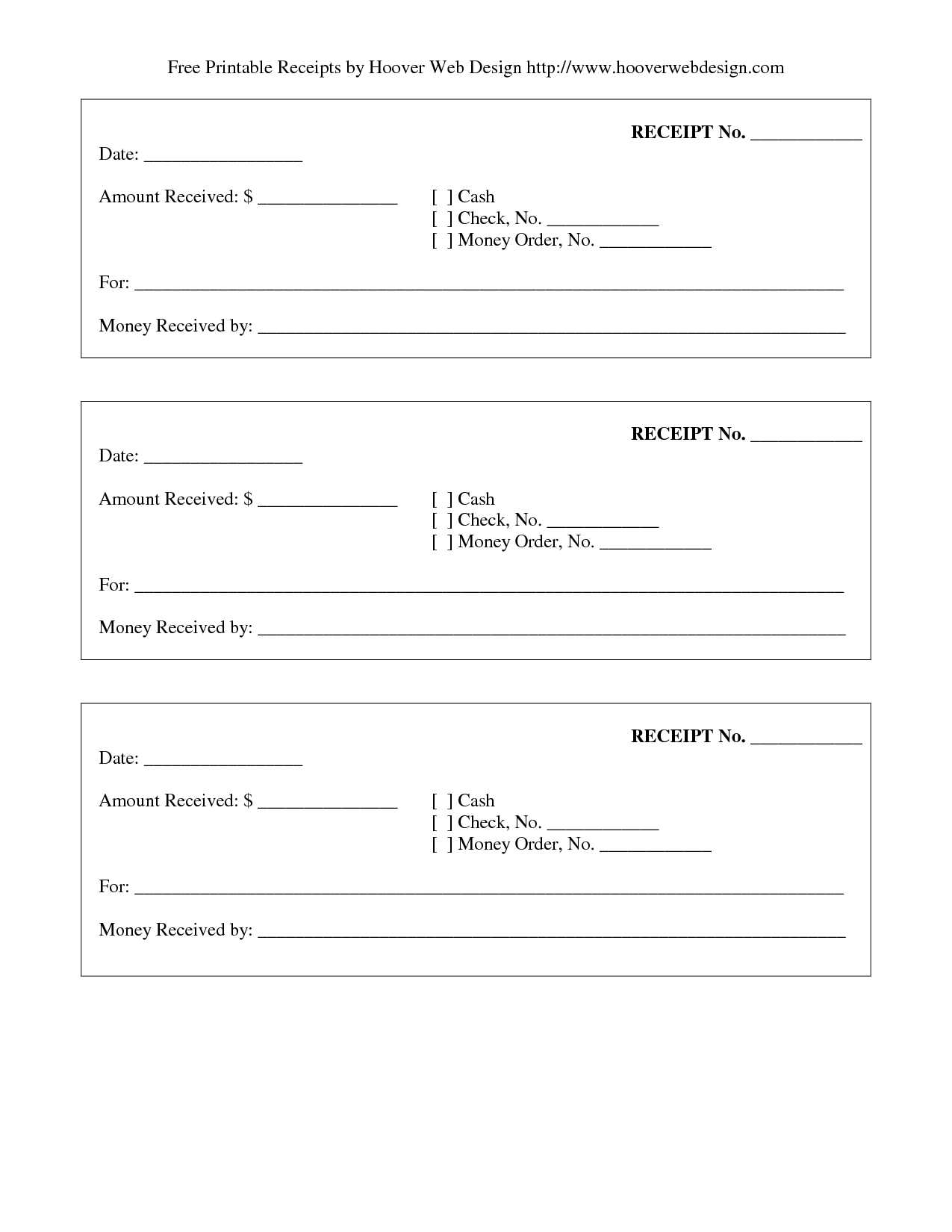

To get started, find a reliable website that offers free daycare tax receipt templates. Ensure it allows for easy editing, whether directly in a web browser or through download options like Word or PDF. Look for templates that meet your local tax requirements and include fields for necessary details such as daycare provider name, service dates, and payment amounts.

Step 1: Download the Template

Once you’ve selected the template, click the download link to save it to your device. Make sure it’s in a format that’s compatible with the software you plan to use for customization, such as .docx, .pdf, or .xlsx.

Step 2: Customize the Template

Open the downloaded file and begin personalizing it. Fill in the daycare provider’s information, your child’s name, service dates, and the total payment amount. Adjust any fields that may be pre-filled with placeholders. Add or remove sections depending on your specific needs.

Include the daycare provider’s full name and business address, along with their tax identification number (TIN). This ensures the receipt is properly attributed for tax purposes. The child’s name and the period of care are also crucial details. Specify the dates of service, clearly stating the start and end dates for each billing period.

Next, outline the total amount paid for daycare services during the period covered. If there are any additional charges, such as late fees or extra services, list them separately. Additionally, note whether payments were made by check, credit card, or another method to provide clarity in case of any discrepancies.

It’s helpful to mention the provider’s licensing status, confirming whether they are registered or licensed by relevant authorities. This adds credibility and assures clients that the provider complies with local regulations. Lastly, ensure that the receipt includes a clear, signed statement from the daycare provider, acknowledging the payment.

Double-check the dates. A frequent error is entering the wrong date, which can cause issues during tax filing. Ensure the receipt shows the exact date of service to match your records.

Incorrect Amounts

Accuracy is key when entering the amounts. Ensure that both the total amount paid and the amount eligible for tax deductions are correctly listed. Mistakes here can delay processing and lead to incorrect tax refunds.

Missing or Incorrect Information

Verify that all required fields, such as the provider’s name, business address, and tax ID, are filled out properly. Incomplete or inaccurate details can lead to the rejection of your receipt by tax authorities.

| Common Mistake | Consequences | How to Avoid |

|---|---|---|

| Wrong Date | Delays or rejections of claims | Double-check the date on every receipt |

| Incorrect Amounts | Incorrect tax deductions | Review totals and eligible deductions |

| Missing Details | Rejection of receipt | Ensure all fields are filled correctly |

Enhancing the Tax Receipt Template

Streamline your tax receipt template by removing unnecessary repetitions of terms like “daycare” and “receipt” where the context already makes their meaning clear. This not only simplifies the text but also ensures clarity without redundancy. For instance, after initially mentioning the type of service or the purpose of the document, it is clear enough to simply refer to the relevant details without repeating these terms in every section.

Practical Example

If the document is already identified as a daycare tax receipt, you don’t need to constantly repeat “daycare” or “receipt” throughout. Instead, focus on the specifics of the charges, the dates, and the child’s name, which provides all the necessary information without the extra wording.

Improved Clarity

By making these adjustments, the receipt not only looks more professional but is also easier to read and process. This helps reduce any potential confusion for both the recipient and the tax authorities. The key is keeping the wording precise while eliminating unnecessary repetition.