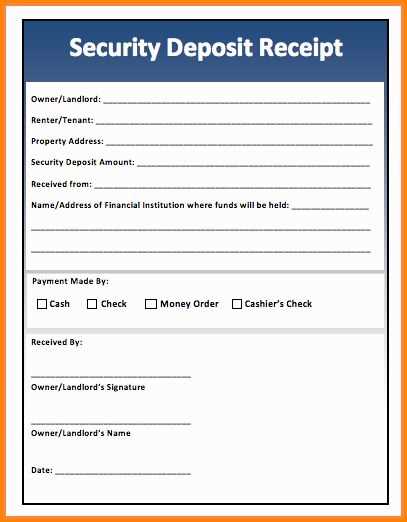

When managing deposits, a clear and simple receipt is a must. A well-designed receipt not only serves as proof of transaction but also keeps both parties informed about the transaction details. Below is a guide to creating an easy-to-use deposit receipt template that can be customized to suit your needs.

Key Elements of a Deposit Receipt

A deposit receipt should clearly include the following information:

- Date of Deposit: The date when the deposit is made.

- Depositor’s Information: Full name and contact details of the person making the deposit.

- Recipient’s Information: Name of the business or person receiving the deposit.

- Amount Deposited: The total amount being deposited, including any relevant currency or denomination.

- Deposit Method: Whether the deposit was made in cash, check, or via a bank transfer.

- Description of Purpose: A brief note describing what the deposit is for (e.g., rent, services rendered).

- Receipt Number: A unique identifier for record-keeping purposes.

How to Create a Simple Deposit Receipt Template

Creating a deposit receipt template is simple and can be done using word processing software or a spreadsheet. Here’s a breakdown of the process:

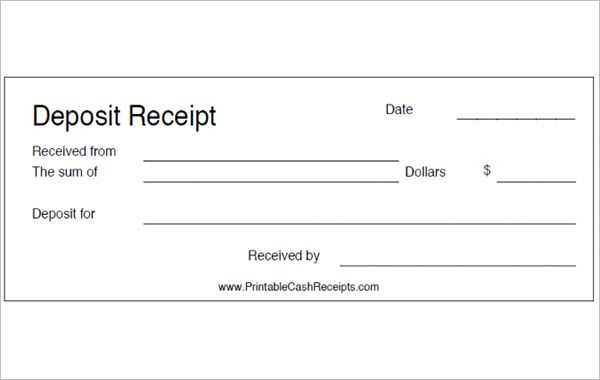

- Header: Include a title such as “Deposit Receipt” at the top, along with the name of your business or organization.

- Transaction Details: Below the header, include fields for the depositor’s name, amount deposited, deposit method, and purpose of the deposit. Keep the layout clean and structured.

- Unique Numbering: Assign each receipt a unique number for easy reference. This can be automatically generated in spreadsheet software or manually entered if using a word processor.

- Signatures: Provide space for both the depositor and recipient to sign, confirming the transaction.

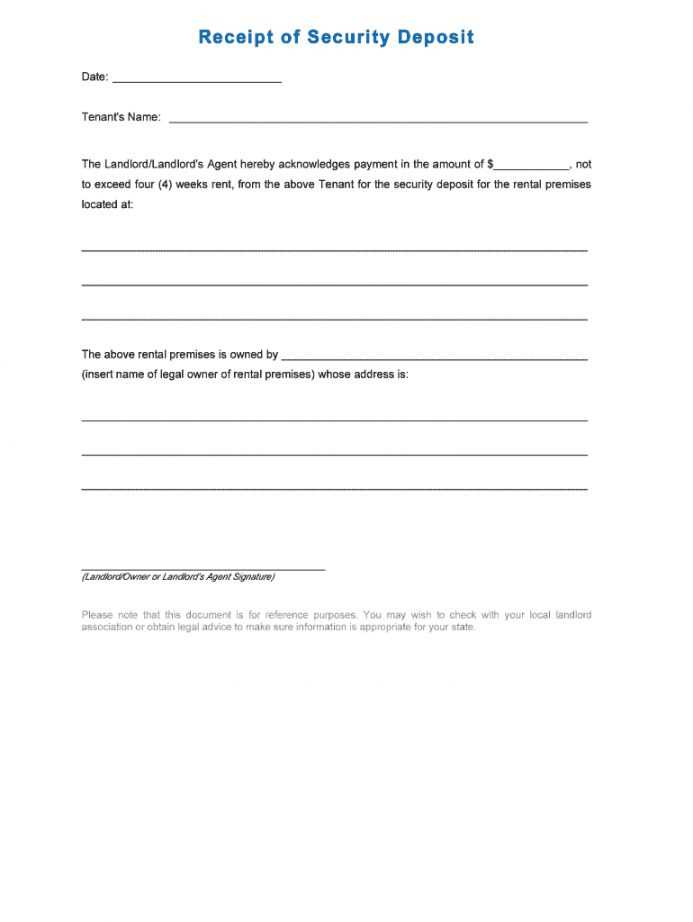

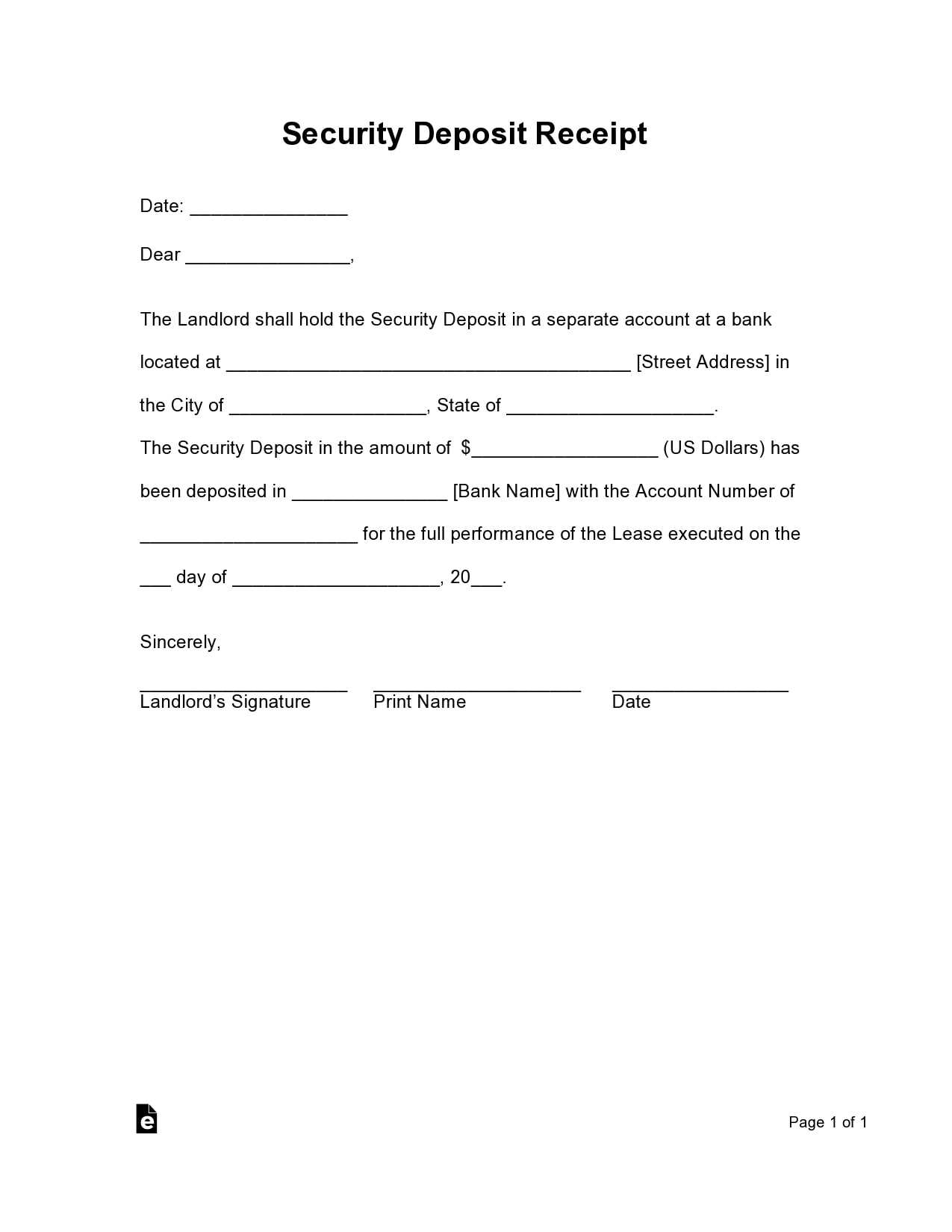

Example Deposit Receipt Template

Below is a simple deposit receipt template you can use:

| Receipt Number | [Insert Receipt Number] |

|---|---|

| Date | [Insert Date] |

| Depositor’s Name | [Insert Name] |

| Amount Deposited | [Insert Amount] |

| Deposit Method | [Insert Method] |

| Purpose | [Insert Purpose] |

| Recipient’s Name | [Insert Recipient Name] |

Signature of Depositor: ___________________

Signature of Recipient: ___________________

By including all the necessary details in your deposit receipt template, you can streamline your record-keeping and ensure transparency in every transaction.

Free Deposit Receipt Template: A Practical Guide

Choosing the Right Format for Your Receipt

How to Customize a Deposit Template for Your Business

Key Elements to Include in a Receipt Template

How to Use a Template for Tracking Payments

Benefits of Using Free Receipt Templates

Where to Find High-Quality Deposit Templates

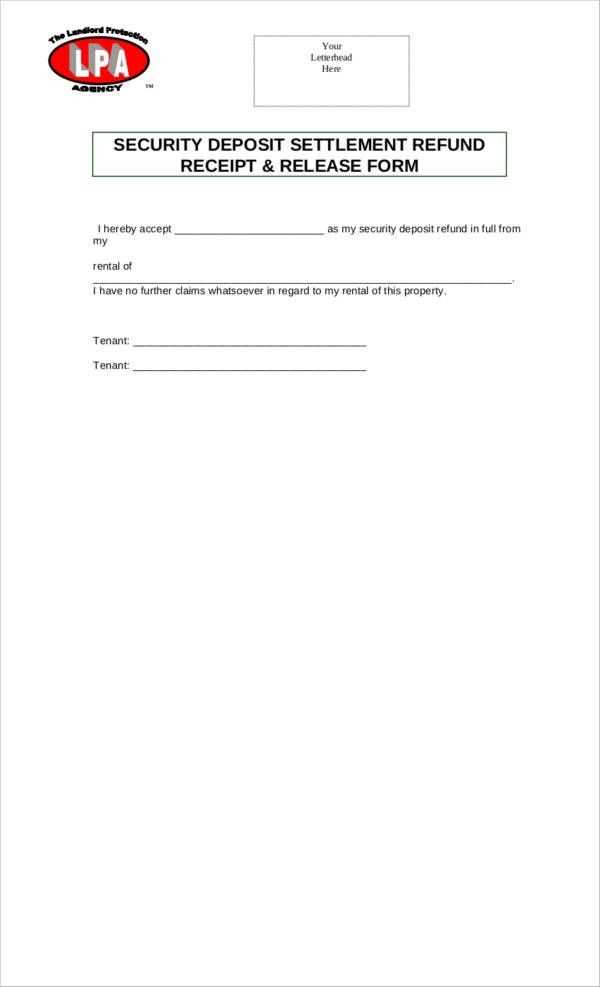

Choose a template that aligns with your business needs and the type of deposit you’re recording. Common formats include simple printable versions or more advanced digital templates that integrate with accounting software. Select one that offers easy customization options, ensuring it fits your branding and specific transaction details.

How to Customize a Deposit Template for Your Business

Customization is key to making the template work for your specific requirements. Include your company name, logo, and contact details at the top. Customize fields such as deposit amount, payment method, and purpose of the deposit. Ensure the template reflects the unique way your business processes payments.

Key Elements to Include in a Receipt Template

A comprehensive deposit receipt template should contain the following details: date of transaction, payer’s information, amount deposited, payment method, a brief description of the deposit, and any transaction reference number. Ensure the template allows for clear and accurate entry of these details.

Use the template to keep track of payments by recording every transaction. This helps with organizing financial records, making tax reporting easier, and maintaining clear documentation of deposits for both you and your clients.

Free receipt templates save you time and money. You won’t need to create one from scratch, and most are easily editable. This also allows for consistency in how you handle deposits across different transactions.

Many websites offer high-quality deposit templates for free. Look for ones that offer easy customization and compatibility with other tools, such as accounting software, to streamline your financial process.