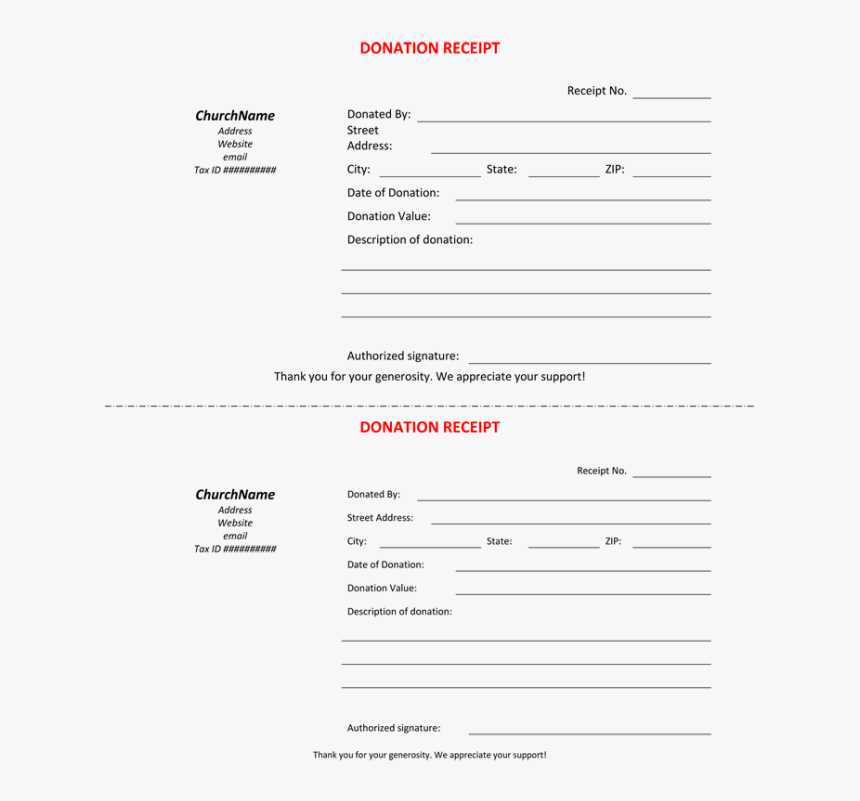

If you’re organizing a donation campaign or managing charitable contributions, having a clear and professional donation receipt is key. A well-structured template ensures that donors receive the necessary acknowledgment for their contributions, which can also help them during tax season. You can easily create one using a free donation receipt template, saving both time and effort.

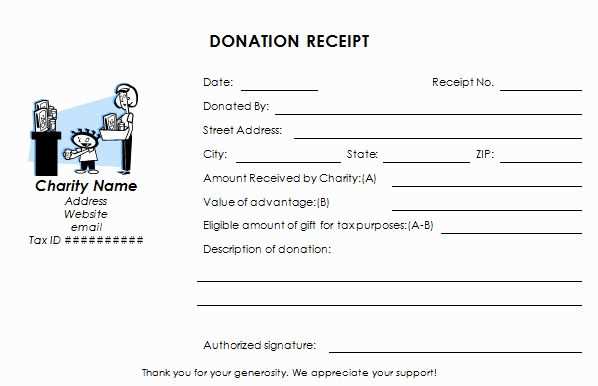

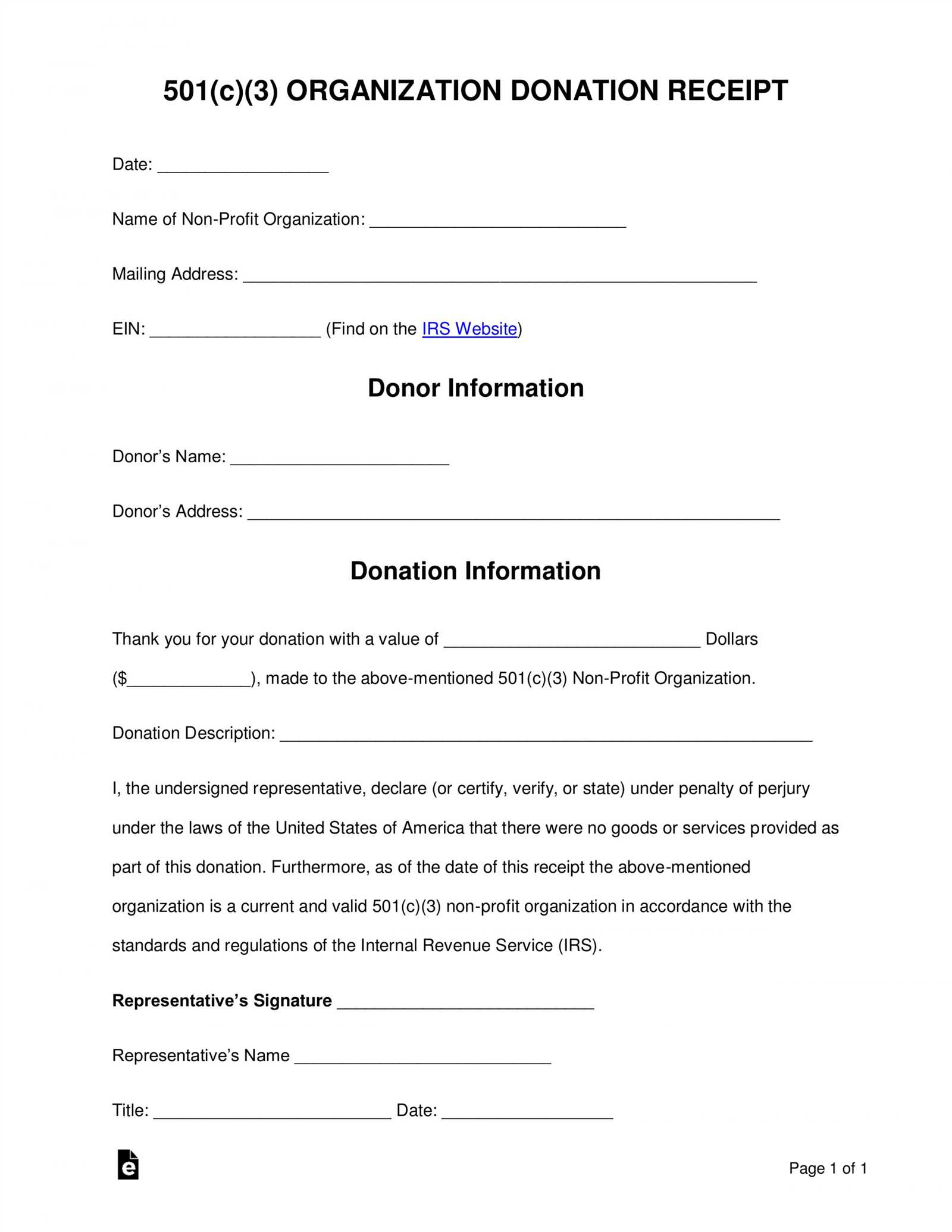

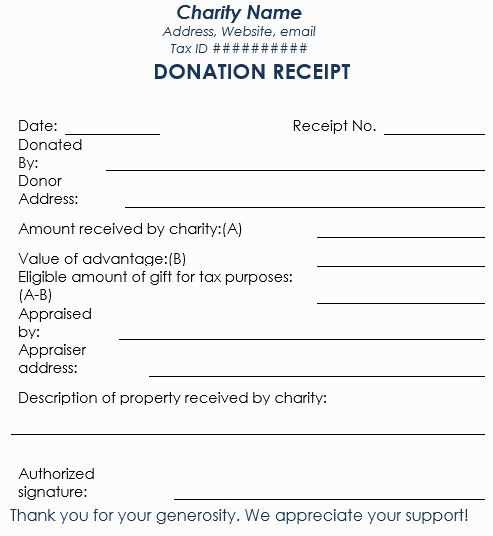

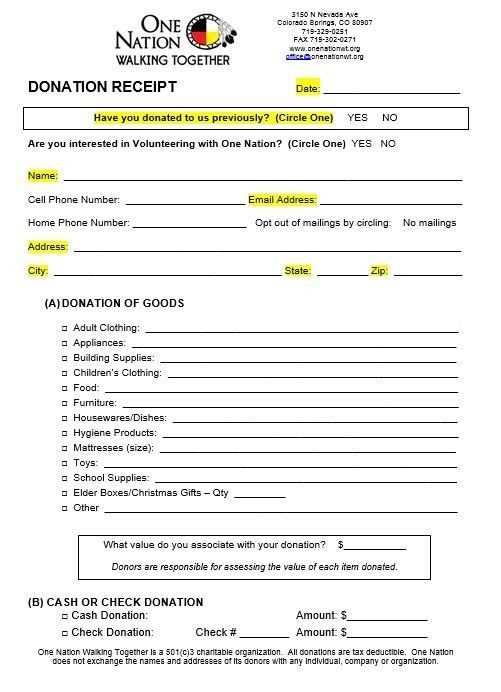

First, choose a template that includes the most critical details: the donor’s name, the amount donated, the date, and the name of your organization. Make sure to include a statement confirming whether the donation was cash or an in-kind contribution, and if it’s a non-cash donation, add an estimation of its value. Clear labeling of your tax-exempt status is another important feature for transparency.

Once you’ve selected a suitable template, customize it with your organization’s logo and contact information. The template should look clean and professional, enhancing trust with donors. Ensure that it’s easy for donors to understand what is being acknowledged, as this will make the receipt both useful and appreciated.

Here’s the corrected version:

For a straightforward donation receipt, make sure to include the donor’s name, the donation amount, and the date. This helps both parties keep clear records for tax and financial purposes.

Template Breakdown

Here’s how to structure your template:

- Donor Name: Include the full name of the person or organization making the donation.

- Donation Amount: Specify the total value of the donation. If it’s non-cash, include a description of the items donated.

- Date of Donation: Include the exact date the donation was made.

- Organization Details: Clearly state your organization’s name, address, and contact details.

- Tax-exempt Status: If applicable, mention your nonprofit’s tax-exempt number or status.

Simple and Clear Language

Always use clear and simple language to ensure that both the donor and the organization understand the information. Avoid ambiguous terms that could lead to confusion down the line.

Free Donation Receipt Template Guide

How to Create a Customizable Receipt Template

Key Information to Include in Your Donation Receipt

Choosing the Right Format for Your Receipt

Legal Requirements for Receipts in Different Regions

Best Tools for Designing a Donation Template

How to Personalize Your Receipt for Donors

Start by including the basic elements of a donation receipt: donor’s name, donation date, donation amount, and the charity’s name and tax identification number. You can also add a note on whether the donation is tax-deductible. This forms the backbone of any donation receipt.

Key Information to Include in Your Donation Receipt

Your receipt should clearly indicate the donor’s full name and address, the donation amount or description of in-kind donations, and the date of the gift. If applicable, include the charity’s contact details, tax status, and the purpose of the donation. For non-cash gifts, provide a description and estimated value. It’s essential that the receipt distinguishes between any goods or services provided to the donor, which may impact their tax deduction.

Choosing the Right Format for Your Receipt

Receipts can be printed or digital. For easy distribution, opt for a digital format like a PDF. If you’re working with physical receipts, create a template that is easily fillable and ensures clarity in every section. Digital formats allow customization with branding and easy tracking for future reference.

Consider the legal requirements in your area, which might specify what must be included in the receipt, such as whether the donor received goods or services in exchange for their gift. Some jurisdictions may also require that receipts be issued within a set period after the donation is made.

Legal Requirements for Receipts in Different Regions

Tax laws vary across regions. In some countries, such as the US, a receipt must be issued for donations over a specific amount, and for non-cash donations, an appraisal may be required. Always ensure your receipt meets the legal criteria for your region, such as including necessary tax identification numbers and notations about the value of donated items.

For designing the template, use tools like Google Docs, Canva, or Microsoft Word for quick creation. These tools allow you to customize the layout and content while maintaining a professional look. For more advanced options, try Adobe InDesign or online platforms that offer donation receipt templates.

Personalize your receipts by adding your logo, a thank-you note, or even a personal message from the charity’s team. This small touch enhances the donor experience and encourages continued support. You can also include custom fields, such as donor recognition options or campaign-specific information.