If you need a donation receipt template for Word, you’re in the right place. This ready-to-use format will make creating receipts quick and easy, ensuring you have a professional document for your records.

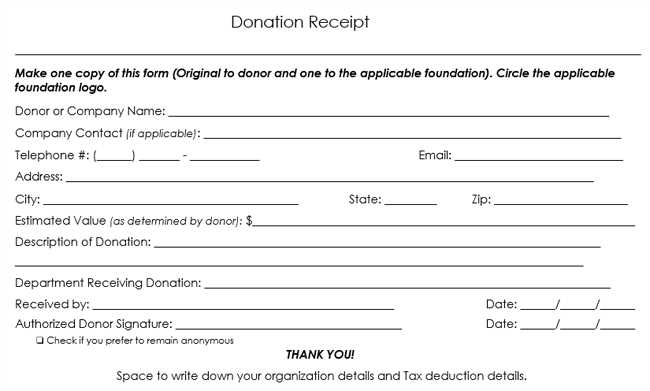

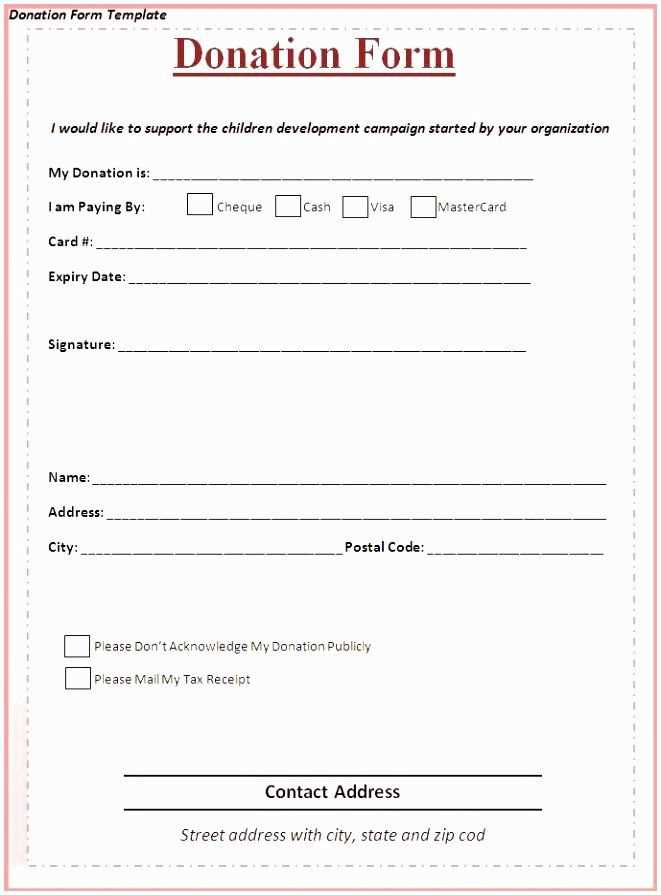

Customize the template with donor details, donation amounts, and your organization’s information. No need to worry about formatting or creating a receipt from scratch–just fill in the blanks and save your time.

These templates are compatible with Microsoft Word, so you can open, edit, and print them right away. Whether you’re managing a charity or helping out a local cause, having a clear, neat receipt is important for both the donor’s tax purposes and your own accounting.

Choose the right template for your needs, modify it as necessary, and you’re set to go. A simple yet functional document can keep everything organized and ensure you stay on top of your contributions.

Here are the corrected lines with reduced word repetition:

To streamline your donation receipt template, focus on clarity and simplicity. Avoid redundant phrases and structure each section logically to ensure it’s easy to read and understand.

Clarity in Donation Details

Clearly state the donor’s name, the amount donated, and the date. Use brief, precise wording to avoid repetition. For instance, instead of repeating “received,” simply write “Donation of [amount] received on [date].” This minimizes word overload while conveying the essential information.

Donor Acknowledgement

Include a short sentence acknowledging the donor’s contribution. Use straightforward language, such as “Thank you for your generous support,” instead of lengthy, repetitive gratitude statements.

By reducing unnecessary wording, you maintain the focus on the donation details while keeping the receipt professional and concise.

- Free Donation Receipt Template for Word

Use a simple template to track donations with ease. This ready-to-use receipt is designed for quick customization in Word, streamlining your record-keeping process. Include key details such as the donor’s name, donation amount, and date. Tailor the template to fit your organization’s requirements by adding a logo or adjusting the formatting.

Follow these steps to create your own donation receipt:

- Insert Donor Details: Include the donor’s full name and address. This ensures accurate records for both the donor and your organization.

- Record the Donation Amount: Clearly state the amount donated, whether it’s in cash, check, or another form of contribution.

- Specify the Date: Indicate the date of the donation to avoid confusion and ensure the receipt is time-stamped.

- Include a Thank-You Note: A brief message acknowledging the contribution adds a personal touch and helps build a positive relationship.

Download the template directly from your word processor, and save time while maintaining a professional, organized approach. The ease of customization allows you to adapt the template as needed for different types of donations.

To create a customized receipt template in Word, focus on clarity and layout. Begin by opening a new blank document in Word. Set the page size according to your receipt requirements, typically 8.5 x 11 inches for standard paper or smaller sizes for compact receipts. Next, adjust the margins to allow enough space for the necessary information without crowding.

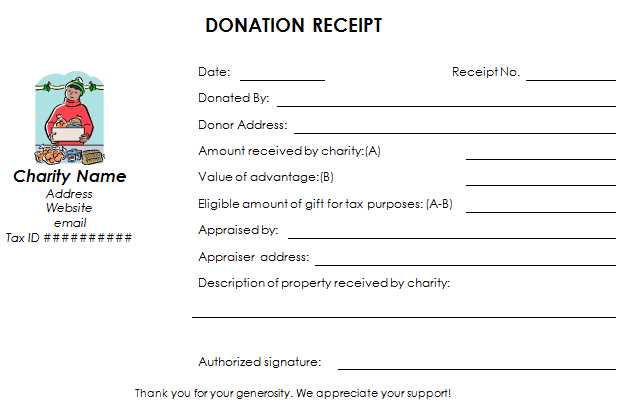

1. Add Header Information

Include your organization’s name, logo, and contact information at the top. Use a larger font for the name or logo for easy recognition. This information should be centered or aligned to one side, depending on your preferred style. Ensure the text is clear and legible by choosing an appropriate font size and weight.

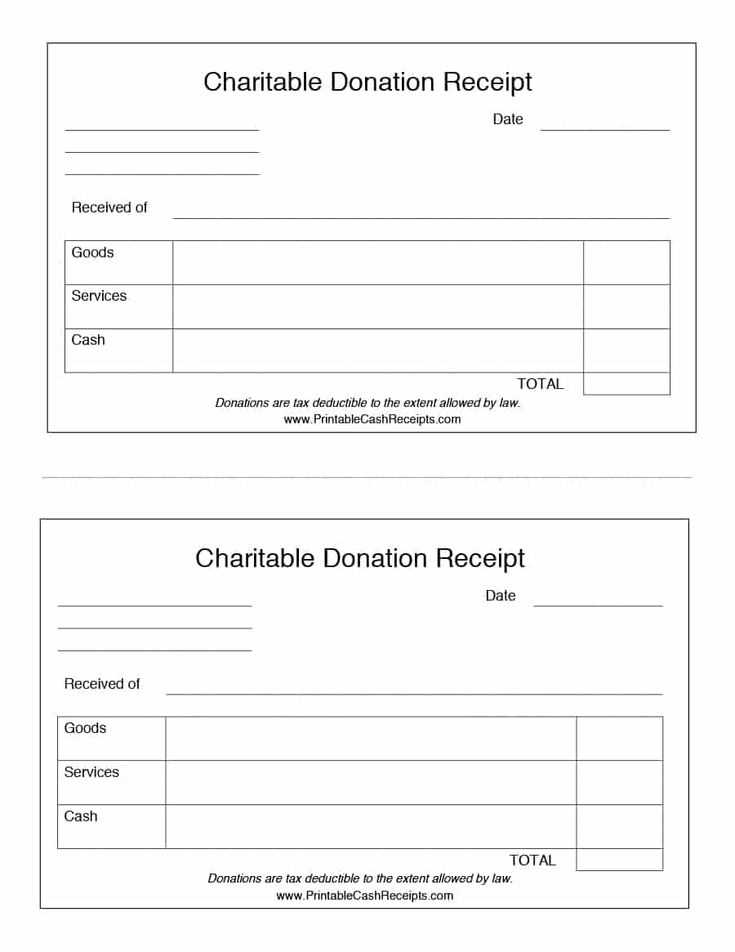

2. Include Transaction Details

Provide a section for transaction-specific details, such as the transaction date, receipt number, itemized list of goods or services, quantities, and prices. Use tables to neatly align this data for easy reading. You can add a subtotal, tax, and total amount section to clarify the financial details. Bold or highlight important figures like the total to make them stand out.

3. Customize Footer for Additional Information

At the bottom, include space for a thank-you message, return policy, or other relevant information. This section should not overpower the main content but still be visible for recipients. If applicable, add payment method details or a signature line for validation.

Once the basic structure is set, save the template for future use. Customize fonts, colors, and any additional fields to match your branding or business style. Make sure the template is clean, professional, and simple for easy readability.

Ensure the donor’s name and contact details are included, as well as the organization’s official name and address. This provides clarity and confirms the transaction for both parties.

Specify the donation date and the amount given. If the contribution is non-monetary, provide a detailed description of the donated item or service.

State the nature of the donation, whether it’s a one-time gift or a recurring contribution. For monetary donations, note whether the donor received any goods or services in exchange. This ensures compliance with tax regulations.

For tax purposes, a statement clarifying that no goods or services were received in return for the donation is necessary if applicable.

Include the donation method, such as check, cash, or online transaction, for transparent record-keeping.

Provide a clear statement about the tax-exempt status of your organization, citing relevant registration details, which adds legitimacy and reassures donors about their contribution’s purpose.

Finally, express gratitude for the contribution and offer further contact details should the donor require additional documentation for tax filing or other purposes.

Organize donation receipts by creating a structured system for easy access and distribution. Assign unique identifiers or numbers to each receipt for efficient tracking. Group receipts based on donation dates, donor names, or categories to streamline retrieval when needed.

Distribute receipts promptly after processing donations. Use email for faster delivery, ensuring the receipt reaches the donor without delay. Keep a copy of each receipt in both physical and digital formats for backup.

Maintain an up-to-date record of all distributed receipts in a centralized database or spreadsheet. This will help with reporting and ensure donors can be verified if needed.

For large donations, consider sending receipts with personalized messages or thank-you notes to enhance donor engagement and maintain transparency.

| Receipt Number | Donor Name | Amount Donated | Date of Donation | Distribution Method |

|---|---|---|---|---|

| 001 | John Doe | $500 | 02/12/2025 | |

| 002 | Jane Smith | $300 | 02/12/2025 | Physical |

| 003 | Mark Johnson | $150 | 02/12/2025 |

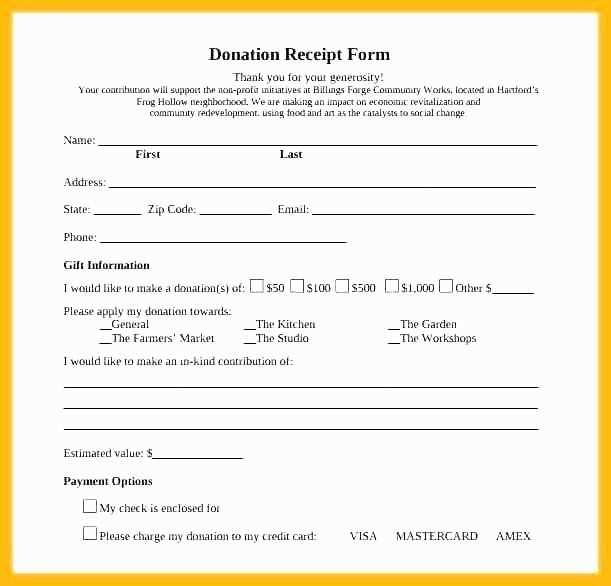

To create a donation receipt template in Word, begin by organizing the necessary sections: the donor’s information, the donation amount, and the purpose of the donation. You can use tables for clarity and alignment. Include placeholders for the donor’s name, address, email, and the donation amount. Clearly state the date and any additional notes about the donation. Ensure the purpose of the donation is specified to avoid any ambiguity.

Keep it simple: Avoid unnecessary sections. Focus on the core elements: donor details, donation amount, date, and purpose. Providing a clear breakdown makes the receipt easy to understand and ensures it meets the necessary requirements for both the donor and the organization.

Customize the template: Adjust the font, spacing, and alignment to match the organization’s branding. Include a footer with your organization’s contact information and any tax-related disclaimers if applicable. This will add a professional touch without overwhelming the template with unnecessary text.

Provide a clear donation amount: Always specify whether the donation is monetary or an in-kind contribution. If it’s a monetary donation, state the exact amount given. If it’s in-kind, describe the donated items and provide an estimated value. This detail helps in case of tax deductions.