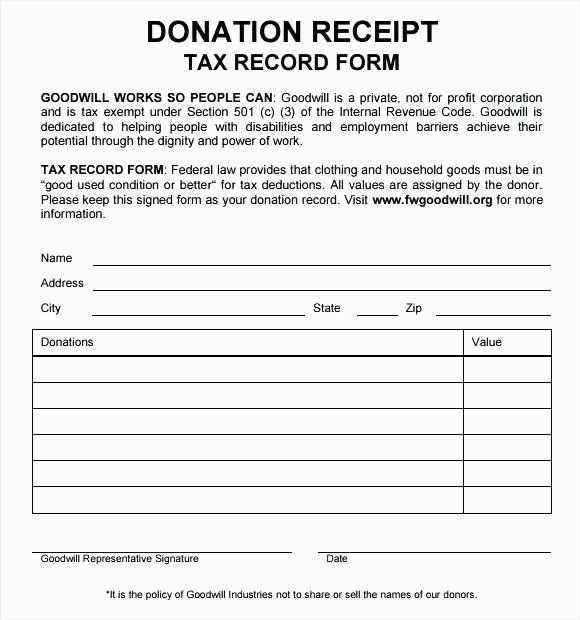

Use a free donation tax receipt template in Google Docs to easily create professional-looking receipts for charitable contributions. This template helps you streamline the process, ensuring compliance with tax regulations while providing your donors with the necessary documentation for their tax deductions.

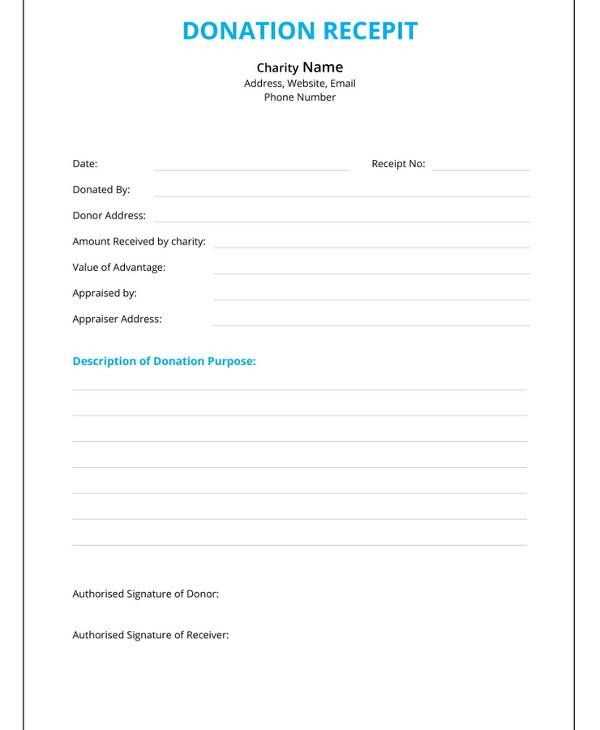

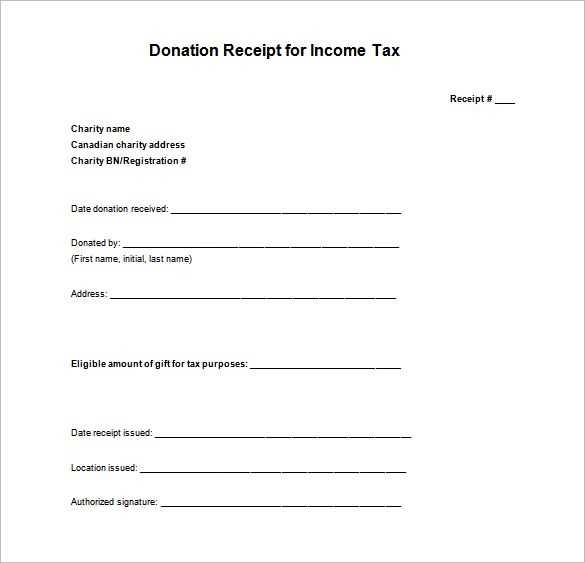

The template includes all required details, such as the donor’s name, donation date, amount, and the charity’s tax-exempt status. It’s fully customizable, allowing you to add specific information, like your organization’s logo or personalized messages. With this, you can issue receipts quickly and accurately, saving time for both you and your donors.

To get started, simply access the template through Google Docs and make any adjustments to fit your needs. This tool is especially useful for small charities or nonprofit organizations, as it eliminates the need for complicated accounting software. Adjust the text fields as necessary, and you’re ready to issue receipts with a few clicks.

Here’s a detailed article plan in HTML format for the topic “Free Donation Tax Receipt Template Google Docs”

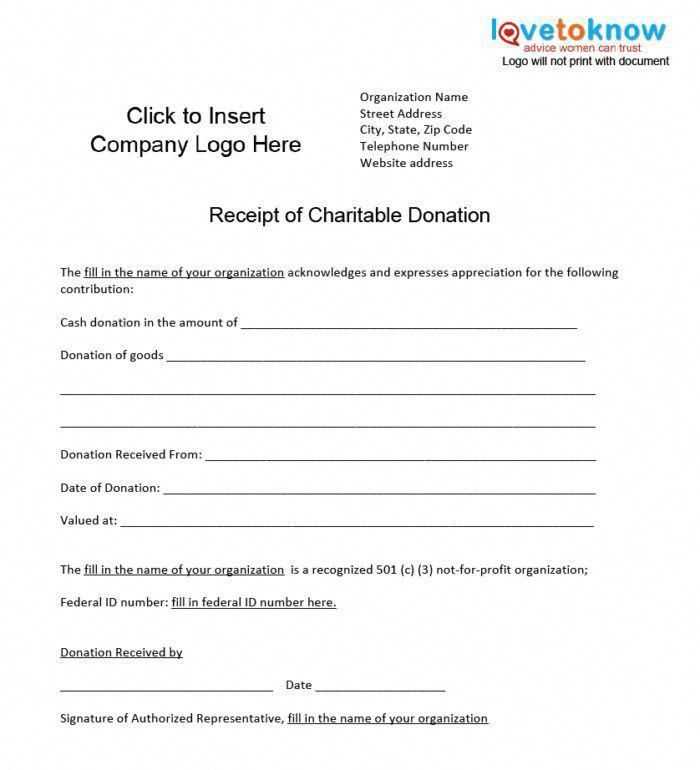

To create a free donation tax receipt template in Google Docs, follow these key steps:

1. Setting up the Document

Open Google Docs and create a new document. Choose a clean, professional layout. A simple template will suffice, as it allows flexibility and customization. The document should include fields for essential donor details, donation amount, and the organization’s information.

2. Key Information to Include

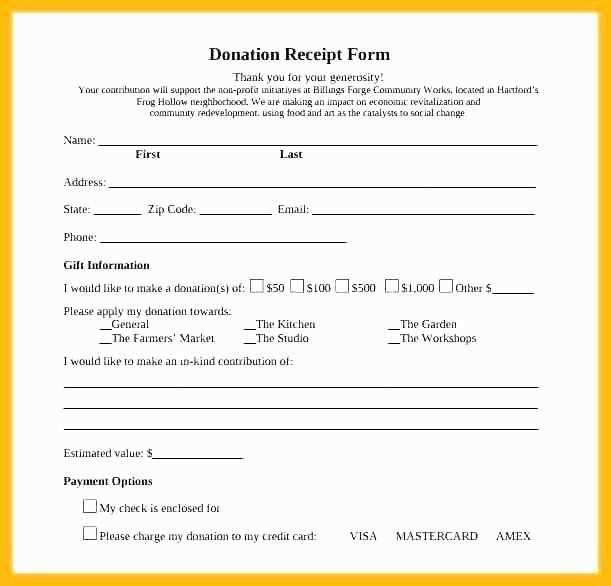

Ensure the template includes these required elements:

- Donor’s Name

- Donation Amount

- Date of Donation

- Tax-exempt status (if applicable)

- Organization’s Name and Address

- Receipt Number (for reference)

- Thank You Message or Acknowledgment

Each field should be clearly labeled and easy for both the donor and the organization to understand.

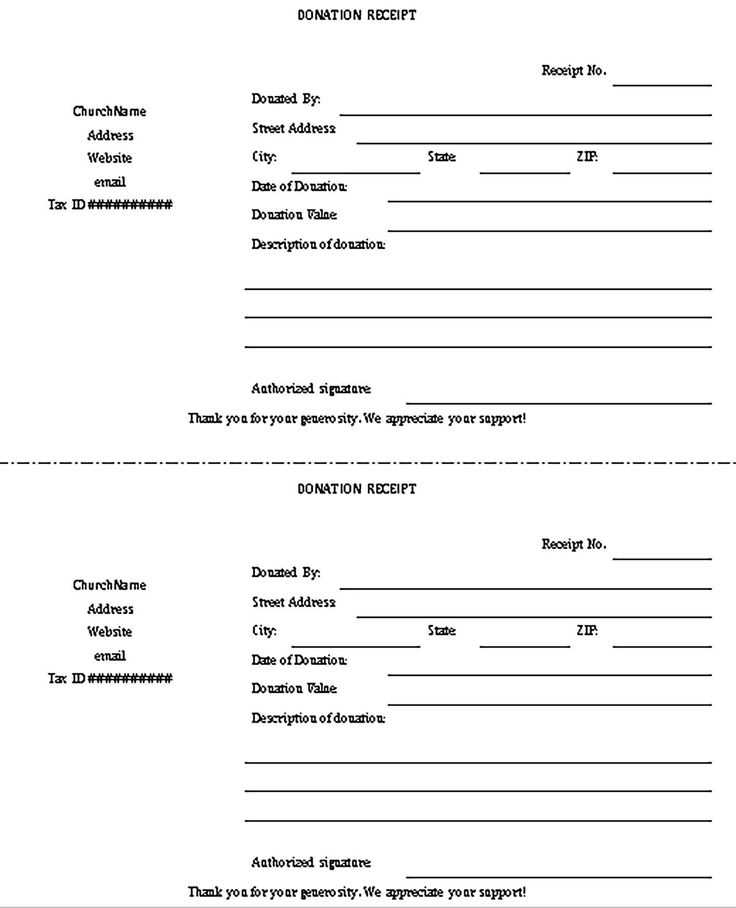

Once the template is set up, share the link to your Google Docs template or download it as a PDF for distribution. This template can be reused for multiple donations, making it an efficient way to manage receipts and ensure compliance with tax laws.

How to

Open Google Docs and create a new blank document. Click on “File” in the top left corner, then select “New” and choose “Document.” Once the document is open, type the title of your donation receipt at the top, such as “Donation Receipt.” Below the title, include the donor’s name, donation amount, date, and the nonprofit organization’s name and contact details.

To create a professional look, format the text with bold headings for each section, such as “Donor Information” and “Donation Details.” Use bold for the section titles to make them stand out. Add the necessary details such as the amount donated, the donation method, and the purpose of the donation, if applicable.

Underneath the donation information, include a statement confirming the receipt of the donation. For example, “Thank you for your generous donation to [Organization Name]. This is a tax-deductible donation.” Ensure that the statement is clear and concise.

Lastly, include a footer with your organization’s EIN (Employer Identification Number) for tax purposes. You can also add a line with a contact email or phone number for any questions or follow-ups. Make sure to save the document for easy access and printing later.