Need a quick and professional receipt? Download a ready-to-use template and customize it in minutes. Whether you’re managing business transactions, tracking expenses, or providing proof of payment, a well-structured receipt simplifies record-keeping.

Choose a template that matches your needs. Options include simple cash receipts, detailed invoices, and tax-compliant documents. Formats like PDF, Word, and Excel offer flexibility–edit, print, or share digitally without hassle.

Avoid errors by ensuring your receipt includes key details: date, amount, payment method, and recipient information. Many templates come with automated calculations, reducing manual input and improving accuracy.

Download a free template now and streamline your documentation. Clear, professional receipts help maintain financial clarity for both businesses and individuals.

Free Download Receipt Template

Choose a template that matches your needs to ensure clear and professional documentation. Consider these formats:

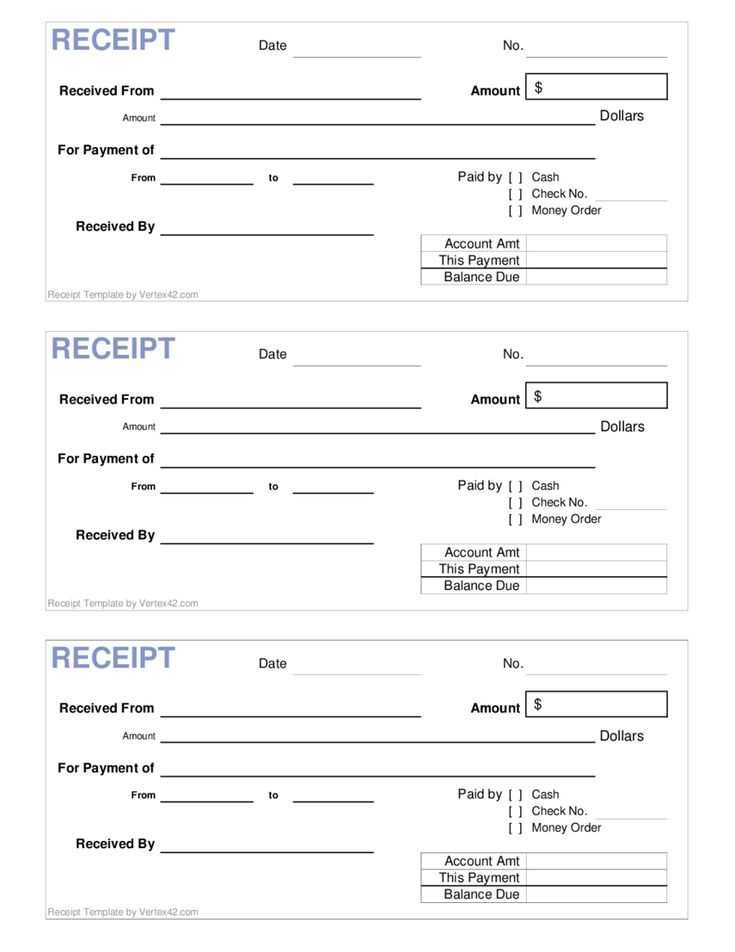

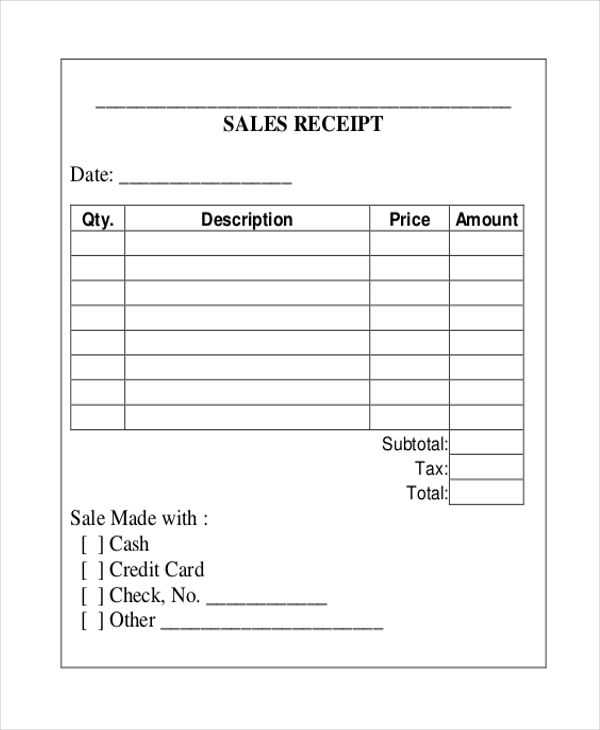

- Basic Sales Receipt: Ideal for small transactions, listing date, amount, and payment method.

- Service Receipt: Best for freelancers and contractors, detailing services rendered, rates, and total cost.

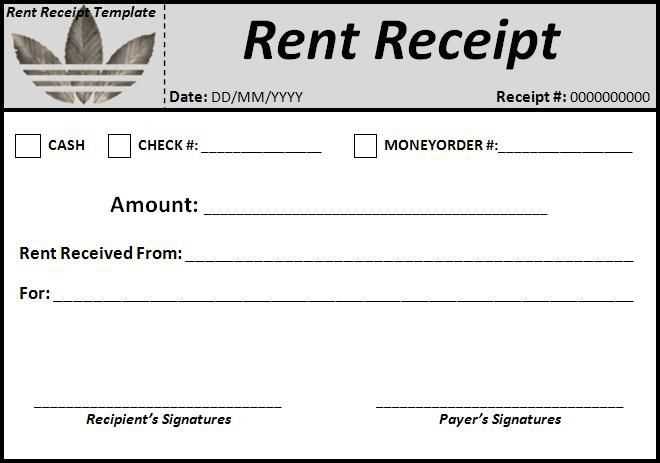

- Rent Payment Receipt: Useful for landlords, including tenant details, rental period, and confirmation of payment.

- Donation Receipt: Designed for charities, specifying donor information, amount contributed, and tax exemption details.

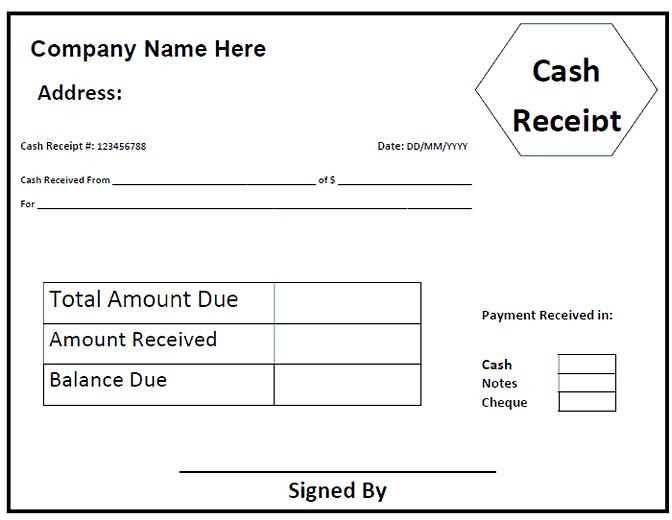

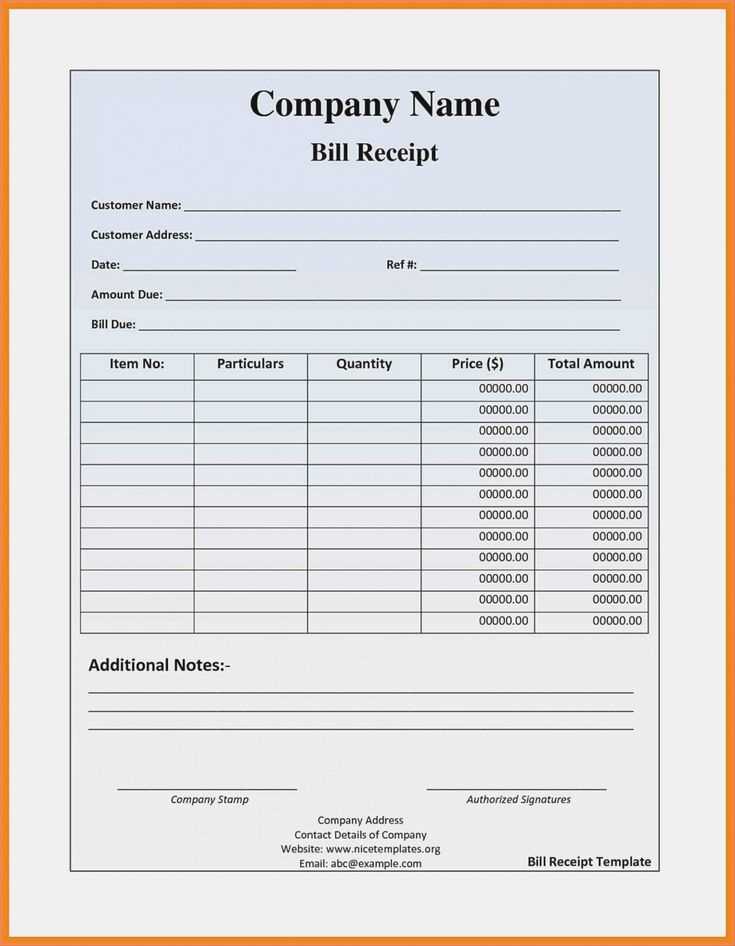

Key Features to Include

A well-structured receipt enhances clarity. Ensure these elements are present:

- Header: Business or personal name, contact details, and receipt number.

- Transaction Details: Date, description of goods or services, and total amount.

- Payment Information: Method used and confirmation status.

- Signatures (if needed): Useful for agreements requiring proof of acknowledgment.

Where to Download

Many platforms provide ready-to-use templates in different formats:

- PDF: Print-friendly and secure, but less customizable.

- Word or Google Docs: Easily editable for specific needs.

- Excel or Google Sheets: Ideal for automated calculations.

Ensure the template aligns with legal and financial record-keeping standards to avoid future issues.

Choosing the Right Format for Your Needs

Pick a format that aligns with how you issue and store receipts. If you send them digitally, a PDF ensures consistency across devices. Need an editable option? A Word document allows quick adjustments without requiring design software.

Standardized or Customizable?

For businesses handling frequent transactions, a structured template in Excel automates calculations and reduces errors. If flexibility matters, a Google Docs file makes edits easy from any location while keeping collaboration simple.

Printing and Archiving

Physical copies demand a print-friendly layout with clear sections for details. A high-resolution PDF prevents formatting issues when printed, while a plain-text document ensures accessibility across various systems.

Customizing Receipt Templates for Your Business

Adjust fields to match your needs. Remove unnecessary details and add relevant sections like tax identification, discounts, or payment terms. Ensure clarity by using a readable font and well-structured layout.

Adding a Professional Touch

Incorporate your logo and brand colors for consistency. A customized header with your business name and contact details enhances credibility. Use clear item descriptions and price breakdowns to avoid misunderstandings.

Optimizing for Digital and Print

Ensure compatibility across formats. Save receipts as PDFs for easy sharing and printing. For digital transactions, include clickable links for returns or support. A responsive layout ensures readability on different devices.

Understanding Legal and Tax Compliance

Ensure every receipt template includes legally required details such as the seller’s name, date of transaction, total amount, and applicable taxes. Missing key elements can lead to disputes or regulatory penalties.

Tax Reporting Requirements

Different jurisdictions impose specific rules on receipts for tax purposes. Businesses should verify whether their receipts need to include tax identification numbers, VAT breakdowns, or specific wording to qualify as valid records. Automated templates help maintain consistency and prevent errors.

Retention and Audit Considerations

Authorities often require businesses to store receipts for several years for audit purposes. Digital backups with timestamps enhance security and simplify retrieval during inspections. Always confirm the mandatory retention period in your region to avoid fines or compliance issues.

Ensuring Clarity and Accuracy in Entries

Use a consistent format for dates, amounts, and descriptions. Align all entries with the same structure to prevent misinterpretation and errors.

Record each transaction immediately to avoid missing details. Delayed entries often lead to discrepancies and require corrections.

Verify all figures before finalizing a receipt. Double-check calculations, tax rates, and totals to maintain accuracy.

Use clear and specific descriptions for each item or service. Avoid vague terms that may cause confusion.

Ensure legibility by using a readable font or handwriting. Illegible text complicates record-keeping and audits.

Cross-check with payment records to confirm that every entry matches the corresponding transaction.

Regularly review stored templates to keep them aligned with current financial requirements.

Integrating Digital Receipts with Accounting Tools

Automate receipt processing by linking digital records with accounting software. Many platforms support direct imports, eliminating manual entry and reducing errors. Look for integrations with cloud-based services to sync transactions in real time.

Choosing Compatible Software

- Ensure the receipt format aligns with the accounting tool’s supported file types.

- Check if the software offers automatic categorization of expenses.

- Opt for platforms that provide optical character recognition (OCR) for seamless data extraction.

Optimizing Workflow

- Enable automatic imports from email or cloud storage.

- Set up rules for expense categorization to streamline reconciliation.

- Regularly review and verify imported data to maintain accuracy.

Use mobile apps to capture receipts on the go, ensuring every expense is logged instantly. Automated syncing with accounting tools improves financial tracking, simplifies audits, and keeps records well-organized.

Common Mistakes to Avoid When Using Templates

Don’t assume all templates are a one-size-fits-all solution. Tailor the template to your specific needs. Failing to make adjustments can lead to a mismatch between the template’s design and your requirements.

Neglecting Customization

Many users overlook the importance of customizing a template. Default settings often include generic information that doesn’t fit your situation. Take the time to edit text, add branding, and adjust layout elements to better reflect your business or personal style.

Overloading with Content

Using templates can be tempting, but adding too much content to a pre-designed structure can overcrowd the design. Avoid stuffing the template with excessive text or images. Stick to the most important points and ensure the layout remains clean and readable.

| Mistake | Recommendation |

|---|---|

| Neglecting Customization | Modify template text and design to suit your needs. |

| Overloading with Content | Keep content concise and relevant to avoid clutter. |