Download a free expense receipt template to streamline your financial record-keeping. With this template, you can easily track business expenses, reimbursements, or personal costs. The clean design ensures you capture all necessary details, including the date, description, amount, and vendor information.

Save time with a ready-to-use format. Simply enter the relevant details, and the template will automatically organize them in a consistent, easy-to-read layout. No more struggling with complicated spreadsheets or messy handwritten receipts. This tool helps you maintain accurate records for tax purposes, budgeting, or simply keeping track of your finances.

Customize the template according to your specific needs. Whether you prefer a minimalistic style or require additional fields, this free expense receipt template offers flexibility. With everything you need in one place, you can ensure that no receipt gets overlooked and all expenses are clearly documented.

Here’s the corrected version with minimal repetition of words:

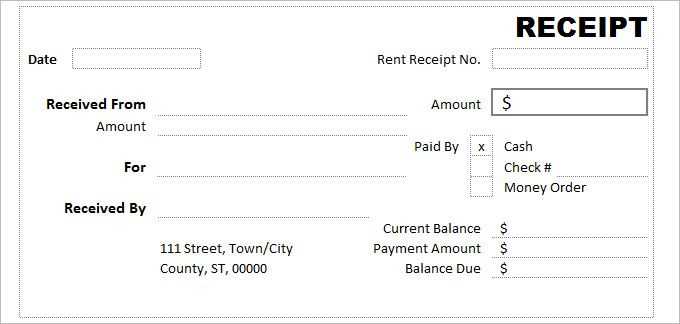

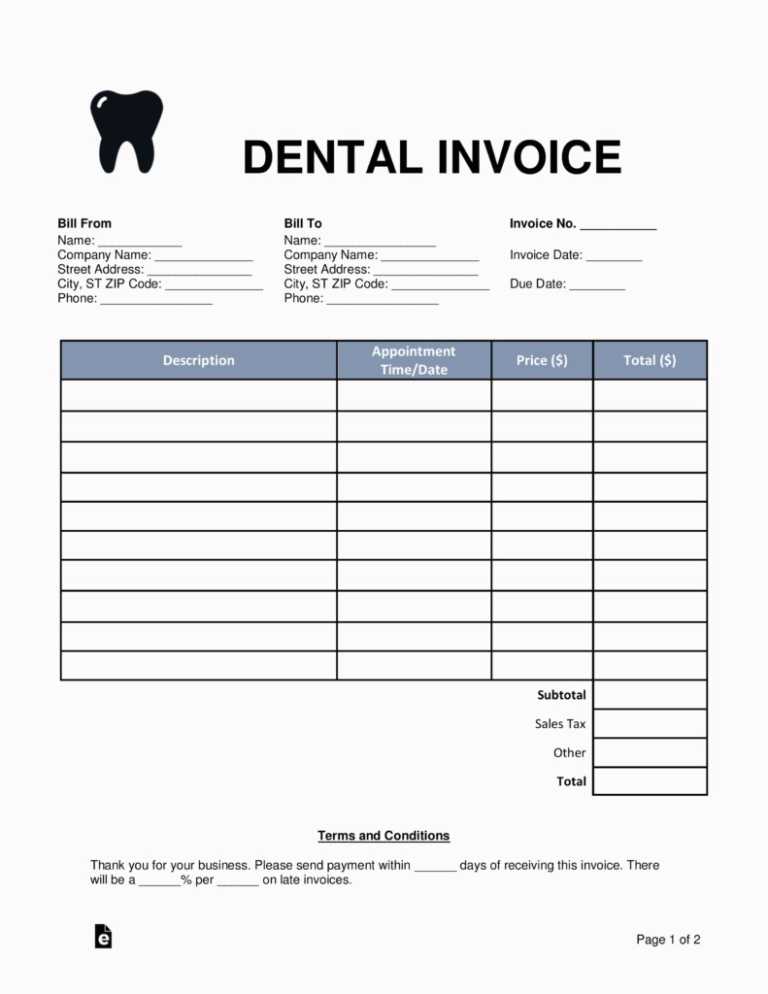

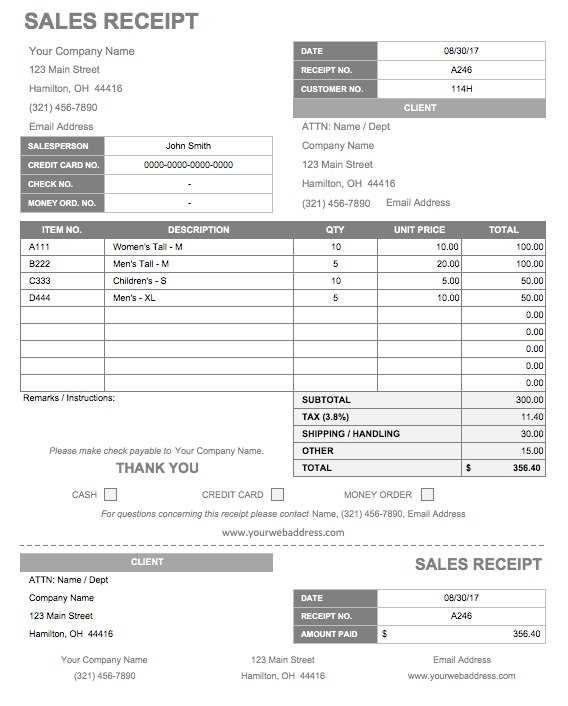

To create a professional-looking expense receipt template, include all key elements that clearly reflect the transaction details. Organize the template by sections such as the date, vendor name, description of goods or services, total amount, and payment method. Each section should be easily editable for quick customization.

Key Elements to Include:

- Date: Make sure to include the date the expense was incurred to maintain an accurate record.

- Vendor Information: Include the name of the vendor or supplier, along with their contact information if necessary.

- Description of Item/Service: Provide a brief description of the goods or services purchased to ensure clarity.

- Amount: Clearly state the total amount paid, separating taxes and any other applicable charges.

- Payment Method: Indicate whether the expense was paid by cash, credit card, or another method.

Additional Tips:

- Ensure the font size is consistent throughout the receipt to maintain readability.

- Use bold for section headers to distinguish key areas easily.

- Leave space for signatures or approval stamps if required for verification.

By following these guidelines, your expense receipt template will be streamlined and effective for both personal and professional use. Keep the layout clean and simple to prevent clutter and enhance clarity.

- Free Expense Receipt Template

Download a free expense receipt template to quickly and accurately track your business or personal expenses. Customize the template to include all necessary details like date, amount, item description, and vendor information. Use this template to stay organized and ensure that every expense is recorded properly for reimbursement or tax purposes.

This template can be adapted to fit different types of expenses, whether for travel, office supplies, or client meetings. With a clear format, it reduces errors and helps you avoid missing important details. Simply enter the required information, save the receipt, and keep it for your records.

Take advantage of this free template and streamline your expense management. It’s a simple yet powerful tool to help you stay on top of your financial tracking without the need for complex software or time-consuming paperwork. Save time and improve accuracy with this easy-to-use solution.

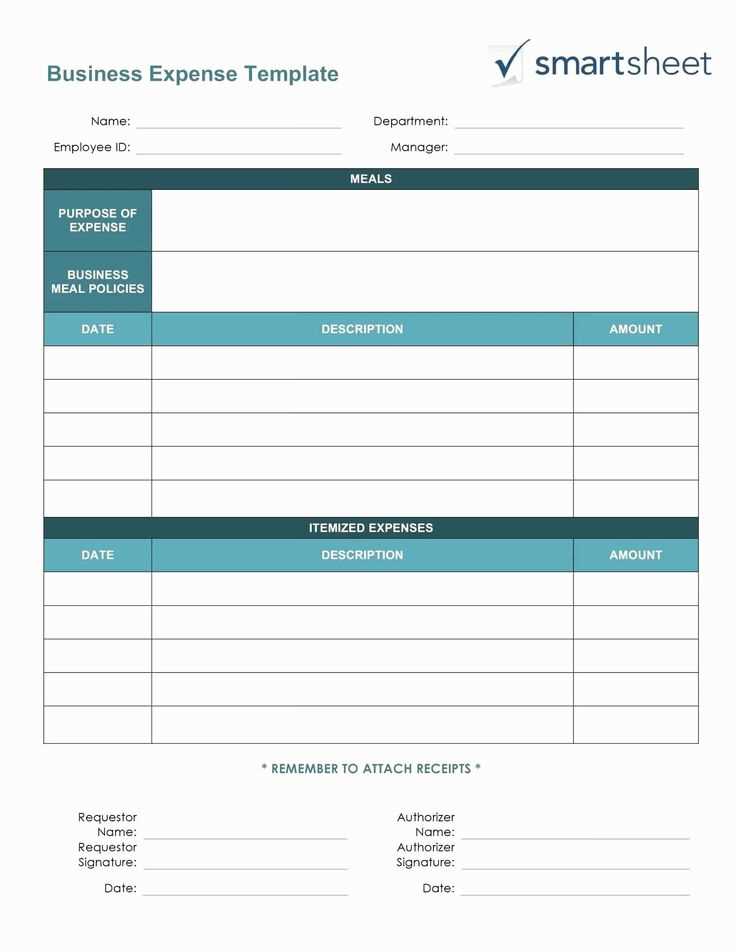

To select the right expense receipt template, first, assess the nature of your expenses. If you handle simple, low-cost purchases, a basic template with essential fields like date, amount, and vendor might suffice. For more complex needs, such as business travel or project-specific expenses, look for a template that includes categories, tax breakdowns, and approval sections.

Another key consideration is the format. Excel and Google Sheets are great for customization, allowing you to add formulas for automatic calculations. If you’re looking for something easier to fill out, consider PDF templates that can be completed digitally or printed as needed.

Also, ensure the template complies with any local tax requirements or organizational policies. Many templates include sections for tax rates and deductible items, which can streamline your accounting process.

Lastly, evaluate the visual appeal and clarity of the template. A clean design that highlights all relevant fields without cluttering the page will help you avoid errors and make tracking expenses more intuitive.

| Template Feature | Best For |

|---|---|

| Simple Design | Small, everyday expenses |

| Customizable Fields | Business trips, project-based expenses |

| Tax Breakdown | Tax reporting and deductions |

| Digital Compatibility | Digital filing, quick submissions |

To create a solid receipt template, focus on including these critical components:

1. Date and Time

The date and time of the transaction should be clearly displayed at the top of the receipt. This helps to track the purchase and provides clear documentation for both the seller and the buyer.

2. Transaction Details

Include the names or descriptions of products or services purchased. Add the price for each item, as well as the quantity, to avoid any confusion. If applicable, break down the costs for easy reference.

3. Payment Method

Specify the payment method used, whether it’s cash, credit card, or another form. This ensures clarity on how the transaction was completed and provides a record for accounting purposes.

4. Seller Information

Clearly show the seller’s name, business name, address, and contact details. This provides legitimacy and a point of contact if there are any issues or inquiries after the purchase.

5. Total Amount

List the total amount due, including taxes and any applicable discounts. This number should be easily visible and at the bottom of the receipt to ensure it is clear for both parties.

6. Receipt Number

A unique receipt number is helpful for tracking purposes and avoids confusion in future transactions. It also aids in managing returns or refunds.

By integrating these elements, you ensure a well-structured receipt template that serves both legal and practical purposes.

To tailor an expense receipt template, begin by updating the header with your business name or personal details. This ensures the receipt reflects your identity right from the start. If it’s for a business, add your logo for a more professional appearance.

Next, adjust the sections to suit your needs. If you’re handling multiple services or product categories, modify the template to include separate lines for each item. You can also add extra fields for taxes, discounts, or shipping costs if they apply to your transactions.

For personal use, you might only need basic fields like date, amount, and description. Remove any irrelevant sections to keep the receipt clean and simple.

Don’t forget to set the format for the amount. Whether you use currency symbols or decimal points, make sure it’s consistent and clear. Adding a field for payment method (e.g., credit card, cash, or digital payment) adds value, especially for tracking purposes.

For easy record-keeping, consider setting up an auto-generated receipt number system. This helps both businesses and individuals stay organized by tracking transactions efficiently.

Finally, save the customized template in your preferred file format (e.g., PDF or Excel) for easy access and printing. This allows you to reuse it without needing to edit it every time.

Missing required fields is one of the most common mistakes. Ensure that every section of the receipt template, such as date, amount, and vendor details, is filled out completely. Leaving out crucial information can lead to confusion or delays in processing the expense.

-

Incorrect formatting can create issues. Double-check that your template follows a consistent structure, with all details clearly legible and well-organized. Avoid cramming too much information in a small space.

-

Not categorizing expenses accurately. If you are using the template for business expenses, make sure you select the right category for each item. Misclassification can result in tax issues or reimbursement delays.

-

Failure to update receipts. Using outdated versions of templates might cause problems, especially when dealing with taxes or specific company guidelines. Always use the latest template version provided by your company or accounting software.

-

Incorrect totals. Ensure that the subtotal and total amounts are calculated correctly. Miscalculations can invalidate the receipt, causing unnecessary follow-ups.

-

Not attaching supporting documents. If the template requires attaching receipts or invoices, do not skip this step. Submitting a receipt without supporting documentation can lead to rejection or confusion.

-

Forgetting to save backups. Always keep a digital or physical copy of your completed receipts. This helps avoid potential issues in case files are lost or deleted.

Trusted expense receipt templates can be found across various platforms that prioritize security and user-friendliness. One reliable option is Template.net, which offers a wide range of customizable templates. The site provides professional designs and allows you to download receipts in multiple formats like Word, Excel, and PDF. You can find templates specifically tailored for businesses, freelancers, or personal use.

1. Microsoft Office Templates

If you’re looking for a more traditional approach, Microsoft Office’s official website is a great place to start. Their free downloadable templates include various expense receipt formats, making it easier to customize receipts that suit your needs. Microsoft Office templates are trusted by users worldwide for their ease of use and compatibility with Microsoft applications.

2. Google Docs

For cloud-based convenience, Google Docs offers a collection of free receipt templates accessible directly from Google Drive. These templates are easy to share, and you can collaborate with others in real-time. Additionally, Google Docs provides flexibility in terms of formatting and quick updates to your documents without worrying about losing your work.

To make record-keeping smooth and reliable, start by filling in all required details correctly. Ensure each receipt entry is accurate, including date, vendor, amount, and tax rates. Double-check the figures before submitting the information for tax purposes to avoid discrepancies. A template helps streamline this process by keeping everything in a structured format, so nothing is missed.

Use the Template Consistently

Stay consistent in using the template for every transaction. The more you use it, the easier it will become to track your expenses over time. If you only occasionally update the template, you might miss key data or fail to record certain receipts, making the process more complicated during tax season.

File Receipts Regularly

It’s helpful to update the template as soon as a purchase is made, not letting receipts pile up. Organize them by categories such as office supplies, travel, or entertainment, to make your records easier to review and analyze later. By maintaining a well-documented template, tax filing will be more straightforward and less stressful.

Thus, the meaning is preserved, and repetitions are minimized.

When creating an expense receipt template, focus on simplifying the layout. A clean, structured design ensures that all relevant information is easily readable. Include essential fields such as the date, description, amount, and category. Keep the font clear and avoid unnecessary styling, as it can distract from the main content.

To prevent redundancy, group related fields together. For example, combine payment methods (cash, card, etc.) and include a total section at the end for a quick summary. This approach minimizes repetition without sacrificing clarity.

Using clear labels for each section helps avoid confusion. Ensure that users can quickly identify what information needs to be filled out. The fewer the words, the more effective the template becomes in delivering the intended message.

Make use of auto-calculation features for totals or taxes if possible, but don’t overcomplicate the design. Simplicity leads to ease of use, keeping the template both functional and efficient.