If you need a simple and reliable way to manage cash transactions, free fillable templates for cash receipts are a great option. These templates offer an easy-to-use format for documenting payments, ensuring both accuracy and organization in your financial records.

By using these templates, you can quickly input transaction details such as the date, amount, and payer information. This eliminates the need for manual record-keeping and reduces the risk of errors in your receipts. Fillable templates are especially useful for businesses, freelancers, or anyone who regularly handles cash payments.

Several platforms provide customizable templates that cater to various needs, from small personal transactions to more complex business exchanges. Look for templates that allow you to save and print your receipts easily, streamlining your documentation process. Many of these templates are compatible with popular office software, making them convenient and accessible for users with different systems.

Here’s the corrected version:

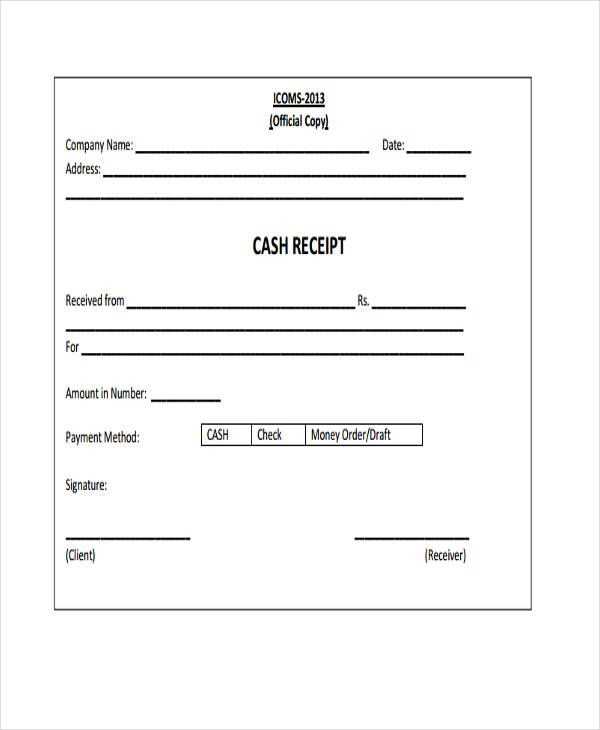

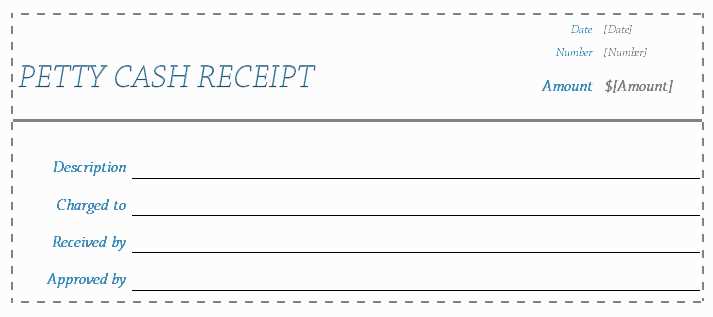

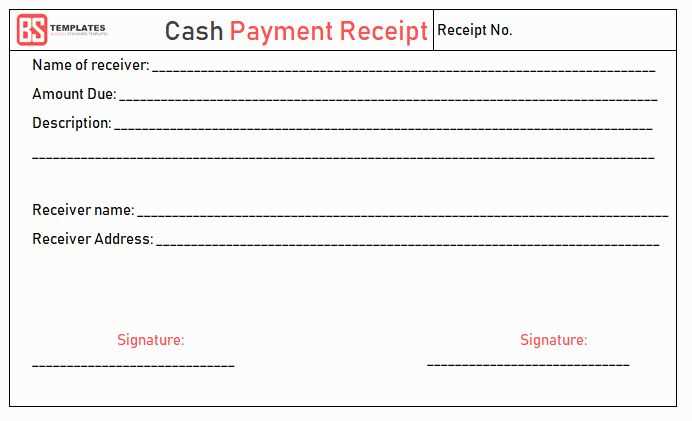

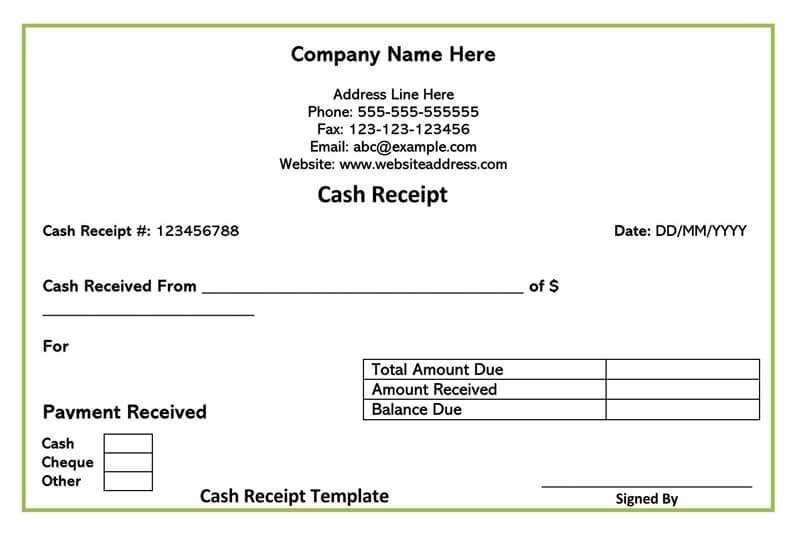

For seamless record keeping, use templates with clear fields like date, item description, payment method, and total amount. Keep the format simple and organized for quick filling. Each template should be printable, ensuring clients or recipients can get a physical copy. Adjust margins and spacing to ensure readability on both digital and printed versions.

Payment Method Details

Include a dedicated section to specify the payment method, such as cash, card, or bank transfer. This helps both parties track the transaction clearly. Make sure the design allows for easy modification of payment methods in case the template is reused for different transactions.

Item and Amount Breakdown

Provide separate lines for each item or service provided, with individual amounts listed. Include space for discounts or taxes if necessary. This ensures transparency and clarity in all receipts, allowing for easy verification of amounts.

- Free Fillable Templates for Receipts

For creating cash receipts quickly and easily, free fillable templates are a great option. Many websites offer downloadable or online templates that allow users to input specific transaction details like amount, date, and items sold. Websites like Canva, Vertex42, and Google Docs have customizable receipt templates. These platforms provide intuitive interfaces for adding relevant information without needing advanced design or software skills.

Using these templates, you can modify the format to match the style of your business or personal preferences. The templates are often available in PDF or Word formats, making them easy to print or email directly to customers. Some templates also include fields for adding tax rates or discount information, ensuring that all necessary details are captured during the transaction.

It’s helpful to review the available templates on each platform, as some may offer additional features such as automatic calculations for totals or a built-in logo placement. These features can save time and provide a professional look for your receipts. Take advantage of the free options available and streamline your receipt creation process today.

Begin by selecting a template that closely matches the specific needs of your business. Consider the types of transactions you handle and the data you need to collect. Look for a design that includes the necessary fields such as date, amount, and description of goods or services provided.

Adjust Fields and Sections

Modify the template’s fields to reflect your business operations. Add sections for relevant information such as tax rates, discounts, or payment terms. Ensure that there is a clear space for client details and invoice numbers, which can be customized to fit your invoicing system.

Incorporate Your Branding

Make the template visually represent your brand. Insert your company logo, choose a font that aligns with your brand’s identity, and adjust the color scheme to match your business colors. This ensures that your receipts are professional and recognizable to customers.

Lastly, save the customized template for future use and ensure it’s compatible with your accounting software, so you can streamline your invoicing process.

To save and print receipt templates efficiently, follow these simple steps:

1. Choose a Template

First, select the appropriate receipt template based on your needs. Many online platforms offer downloadable options in various formats, including Word, Excel, and PDF. Make sure to pick one that suits your preferences for customization.

2. Download the Template

Once you’ve selected the template, click on the download button. Ensure you save the file in a location on your computer where you can easily access it, such as the “Downloads” folder or your desktop.

3. Customize the Template

Open the downloaded file with the corresponding program (Word, Excel, etc.). Modify the fields to include your business name, address, date, and transaction details. Some templates may have pre-filled sections, which you can update with specific information.

4. Save the Customized Template

After making the necessary changes, save the file again. For easy future use, save it under a unique name or as a template that you can reuse. This will prevent you from having to redo the changes every time you need a receipt.

5. Print the Receipt

To print, ensure your printer is connected and ready. In the file menu, click on “Print” and choose your printer. Adjust the print settings if needed, such as paper size and orientation. Once you’re satisfied, click “Print” to generate a hard copy of the receipt.

| Step | Action |

|---|---|

| 1 | Select and download a receipt template |

| 2 | Customize the template with your business info |

| 3 | Save the customized version |

| 4 | Print the finalized receipt |

By following these steps, you can easily save and print receipt templates whenever needed.

To smoothly integrate free receipt templates with accounting software, choose a template compatible with your software’s format (e.g., CSV, Excel, or PDF). Most accounting tools allow importing files directly into the system, simplifying data entry and tracking. Here are the steps to ensure a seamless integration:

1. Choose a Template Compatible with Your Accounting Software

- Select a receipt template with fields that align with the data your accounting software requires.

- Ensure the template supports formats like CSV or Excel, as these are commonly accepted by most software.

- Check that the template includes essential details such as dates, amounts, payer details, and payment methods.

2. Customize the Template for Your Needs

- Modify the template’s layout to match your accounting system’s input format. This may include adjusting columns or adding custom fields.

- Fill in the necessary data fields consistently to ensure easy importation into the software.

Once customized, save the file in the format your software accepts, and import it for automatic data processing. This reduces the need for manual entry, saving time and minimizing errors. With proper integration, you can ensure that your records are accurately reflected in your accounting system.

Double-check the date and time of the transaction. Failing to update this information can lead to confusion when reconciling records. Always ensure the date reflects the actual transaction day, not the day of entry.

Accurately record the payment method. If the method differs from what is listed on the template, it can cause discrepancies in accounting records. Always match the payment type with the correct option.

Include a clear description of the items or services purchased. Leaving this field blank or using vague terms makes it difficult to track transactions or clarify details later.

Avoid skipping the payer’s full details. Omitting crucial information like the payer’s name or contact number can result in lost follow-up opportunities or disputes regarding the transaction.

Ensure the amounts are correctly entered, particularly the total sum. Simple errors like misplacing a decimal point can have significant financial consequences, so double-check every figure.

Be mindful of taxes and discounts. If a receipt template requires tax calculation, always verify the rates applied to ensure the totals are correct. Similarly, any applicable discounts should be properly noted to avoid misunderstandings.

Before using any receipt templates, ensure they meet the legal standards applicable in your jurisdiction. Always verify that the template includes the required elements, such as the seller’s name, address, contact information, transaction details, and tax information. Omitting these could lead to compliance issues, especially in tax-related matters.

Accuracy of Information

Falsifying any part of a receipt can result in legal consequences, including fines or legal action. Ensure all fields on the template reflect actual data, and do not manipulate any transaction details for deceptive purposes. Receipts must reflect accurate sales information to avoid any legal disputes with consumers or tax authorities.

Tax Compliance

In many regions, receipts must clearly state whether tax has been applied, along with the applicable tax rate. Templates should be modified to include fields for sales tax, VAT, or other relevant taxes. Failure to do so can result in penalties for both businesses and consumers.

Consult a legal expert or accountant to ensure your receipt templates comply with local tax laws and accounting practices. Using a non-compliant template could jeopardize your ability to file taxes correctly, leading to potential audits.

Start by organizing receipts with clear, easy-to-use templates. Save each receipt in a consistent format, whether it’s a PDF or Excel file, and name them appropriately for quick reference. Choose templates that allow you to add important details like date, amount, vendor, and payment method.

To share receipts, upload them to cloud storage services like Google Drive or Dropbox. This enables real-time access for both you and others involved in the transaction. Make sure to set permissions so the right people can view or edit the receipts. Using collaborative tools such as Google Sheets or Microsoft Excel can also help you track and update receipts as needed.

Tracking receipts becomes easier when you categorize them. Organize receipts by date or vendor for a clear overview. Set reminders to check and update records regularly, especially for recurring expenses. Consider using automated software tools that integrate templates to streamline tracking and minimize errors.

When sharing receipts, always include necessary context such as project name or account number. This helps avoid confusion and ensures that everyone involved has the correct information.

Use a simple and intuitive template for cash receipts that allows quick customization. A clean format helps in tracking transactions with ease.

- Ensure space for all transaction details, such as date, amount, payer’s name, and reason for payment.

- Include a section for notes, which can be useful for adding additional details about the transaction.

- Consider adding an area for signatures or initials, confirming the receipt of funds.

Many free templates are available for download online. Choose one that best fits your needs, such as those that provide columns for itemized charges or that allow for bulk entries.

- Look for templates that can be filled out digitally to save time on each transaction.

- If you prefer paper, templates with pre-filled fields can be printed and used for multiple receipts.

Adjust templates to match your business’s specific requirements. The more streamlined the receipt format, the quicker the transaction process will be.