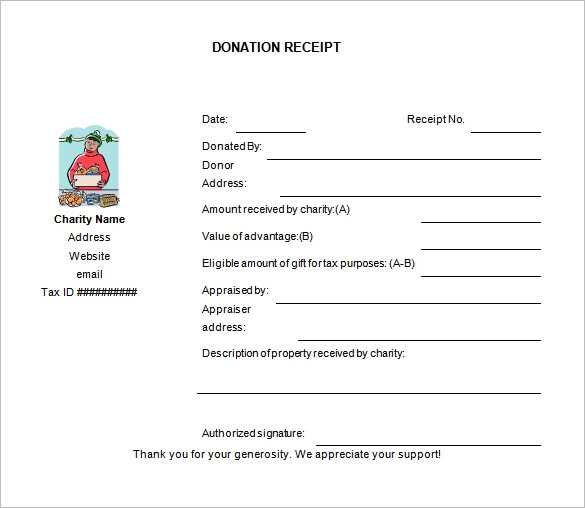

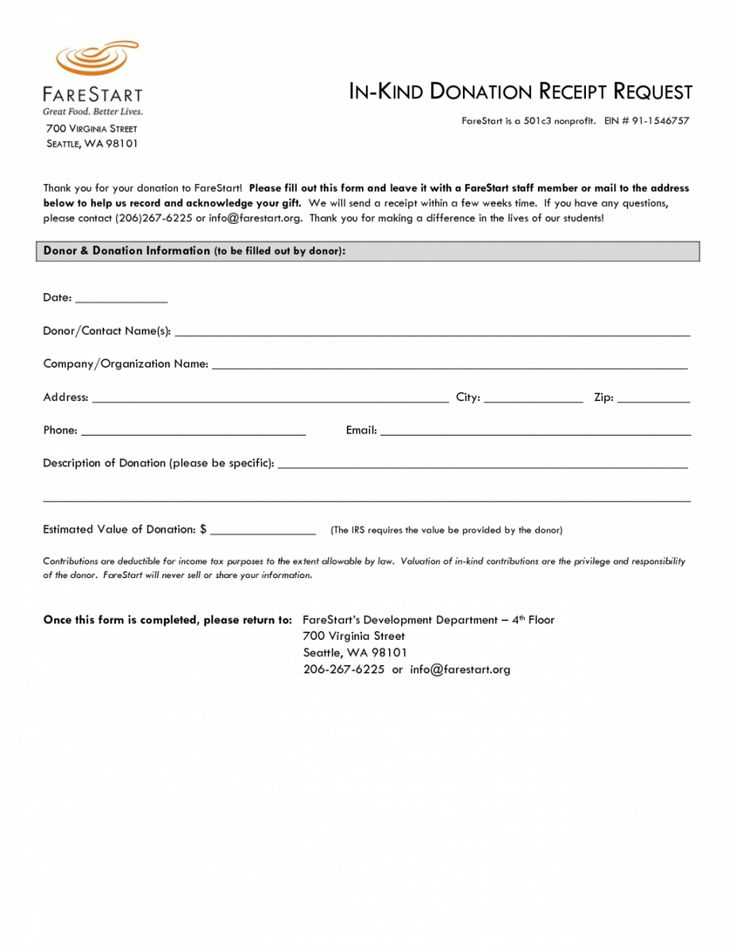

When issuing a receipt for a free gift in kind, it’s important to ensure the document accurately reflects the transaction. The template should include clear details such as the name of the donor, the description of the gift, its estimated value, and the date of receipt.

Start with the donor’s information. Include their full name, contact details, and any relevant identification or tax information. This helps to ensure the transaction is properly recorded for both parties. Be sure to describe the gift thoroughly, mentioning its condition and any special characteristics, so there is no ambiguity about what was donated.

Next, outline the estimated value of the gift. Although the gift is provided for free, it’s necessary to include an estimated market value for record-keeping purposes. This is particularly important if the recipient plans to use the receipt for tax deductions.

Finish the receipt by including the date of the transaction and the signature of the donor. This adds a level of formality to the document, ensuring both parties agree on the details of the gift exchange.

Free Gift in Kind Receipt Template

To create a receipt for a free gift in kind, ensure the document includes the donor’s and recipient’s details, a description of the item, and its estimated value. Clearly state that the gift was received without payment. Include a date of receipt and a space for both parties to sign, confirming the transaction.

List the following information in the template:

- Donor’s full name and address

- Recipient’s full name and address

- Description of the gift item, including quantity and condition

- Estimated value of the gift

- Date of receipt

- Signature lines for both donor and recipient

By including these details, the document serves as proof of the transaction and ensures transparency for both parties involved. Always retain a copy for your records.

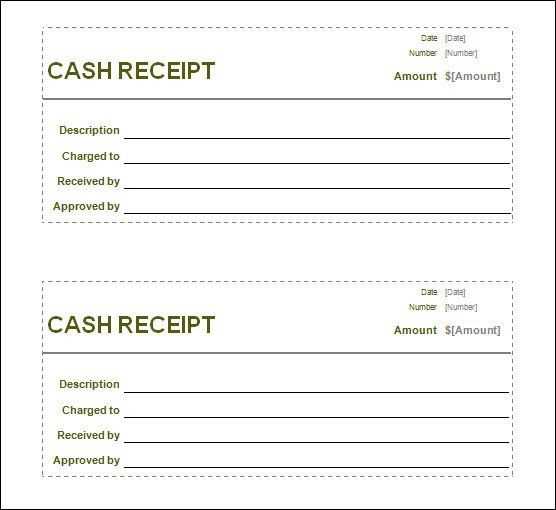

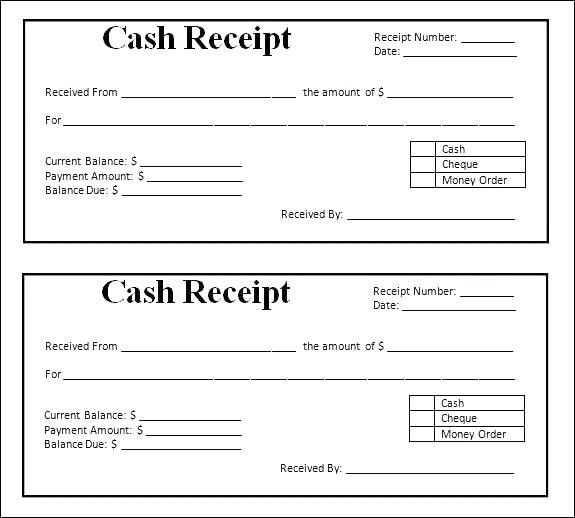

Designing a Clear and Simple Template

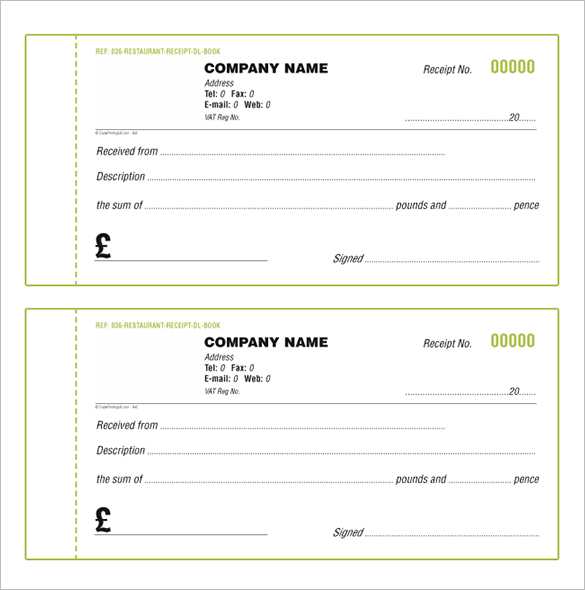

Keep the layout straightforward. Use a clean, uncluttered design with ample white space to ensure each section stands out. Start with a clear title at the top, followed by the donor and recipient details in separate fields for easy identification.

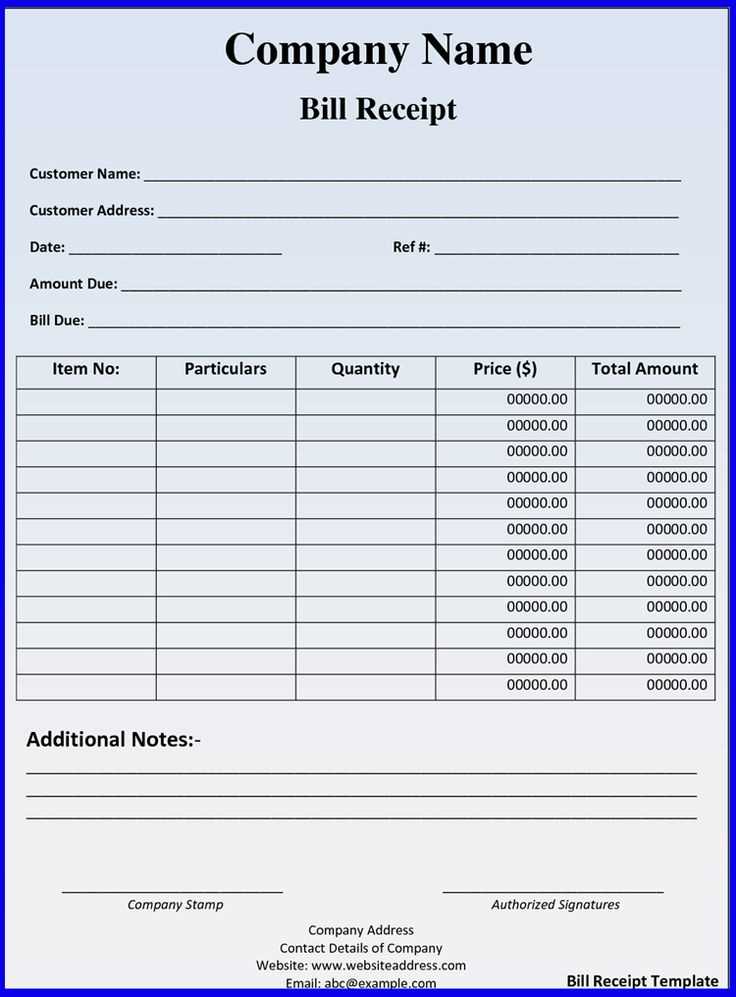

Organize the template into logical sections. List the donated items in a simple table format with clear columns for item description, quantity, and value. Ensure that each section is well-spaced to avoid crowding the information.

Use standard fonts that are easy to read. Stick to one or two font styles and ensure the text is large enough to be legible without strain. Avoid heavy or decorative fonts that can distract from the message.

Provide clear instructions for filling in the template. Include a brief description for each field to guide the user on what information is needed. Keep the language simple and direct to avoid confusion.

Incorporate a signature section at the bottom for both the donor and recipient. This section should include clear labels and enough space to write the necessary information. A date field should also be included to ensure the receipt is time-stamped.

Key Information to Include in the Receipt

Ensure that the receipt clearly displays the following key details for transparency and accurate record-keeping:

- Recipient’s Information: Include the full name of the person or organization receiving the gift, along with their contact details if necessary.

- Donor’s Details: Clearly state the name and contact information of the person or entity providing the gift.

- Description of the Gift: Provide a clear and precise description of the item given, including any relevant serial numbers or identifying marks to avoid confusion.

- Date of Donation: Clearly state the exact date the gift was given to ensure proper documentation for both parties.

- Estimated Value of the Gift: Include the estimated monetary value of the gift, if applicable, to establish a fair record of the exchange.

Additional Details to Consider

- Purpose of the Gift: If relevant, briefly mention the intended use or purpose of the gift to avoid any ambiguity.

- Signature of Donor and Recipient: Include spaces for both the donor and recipient to sign and confirm the transaction.

- Special Conditions or Notes: If any specific conditions apply to the gift, such as restrictions on use or warranties, note them clearly.

Legal and Tax Considerations for Gifts

Before accepting or offering gifts, ensure compliance with local laws and tax regulations. Both donors and recipients should be aware of any potential tax liabilities related to the transaction. Gift recipients may be required to report the value of received items on their tax returns. Depending on the jurisdiction, a gift may be taxable if it exceeds a specific threshold set by local authorities.

Gifts given by businesses, particularly if they exceed a set value, may also require reporting. Some governments impose a gift tax on the giver, particularly if the value is substantial. Be aware that certain types of gifts, such as cash or real estate, might have different tax implications than physical items. Consult with a tax advisor to determine whether a gift falls under taxable categories and to avoid surprises during tax filing.

If you’re making a charitable donation or providing a gift in-kind, check if the gift qualifies for a tax deduction. Charitable gifts often require proper documentation, such as a receipt that lists the donated item’s value and purpose. Ensure these receipts meet legal requirements to qualify for deductions. Keep records of all gifts for reporting purposes and future reference.