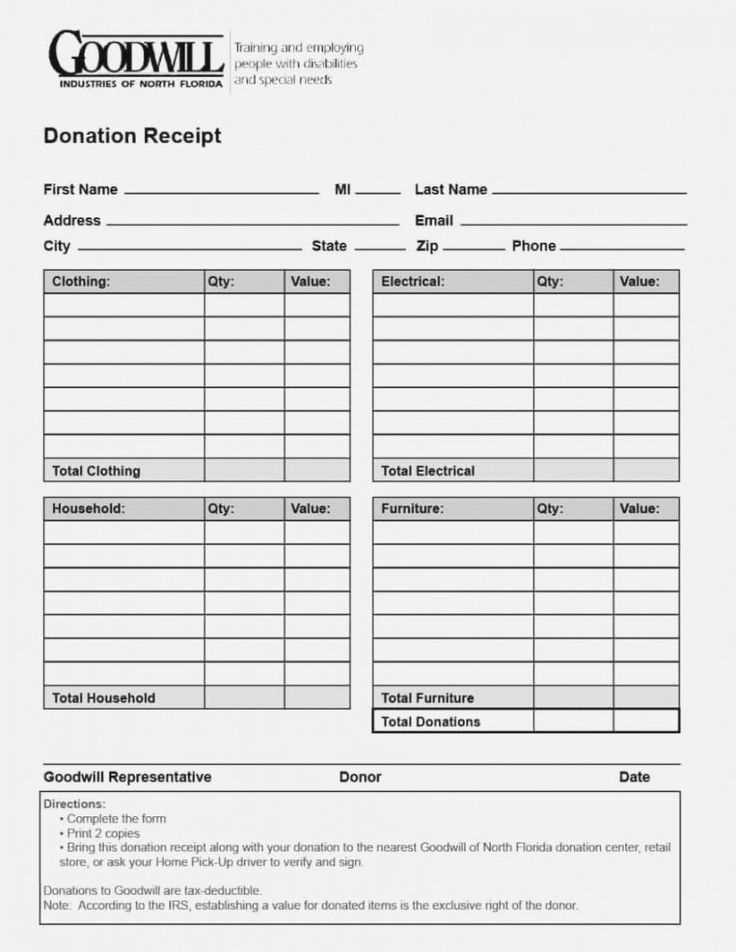

Using an itemized donation receipt template in Excel helps streamline the process of tracking charitable contributions. This template makes it easy to list donated items, their estimated values, and other relevant details. You can customize it to fit specific needs and ensure all information is accurate and professional.

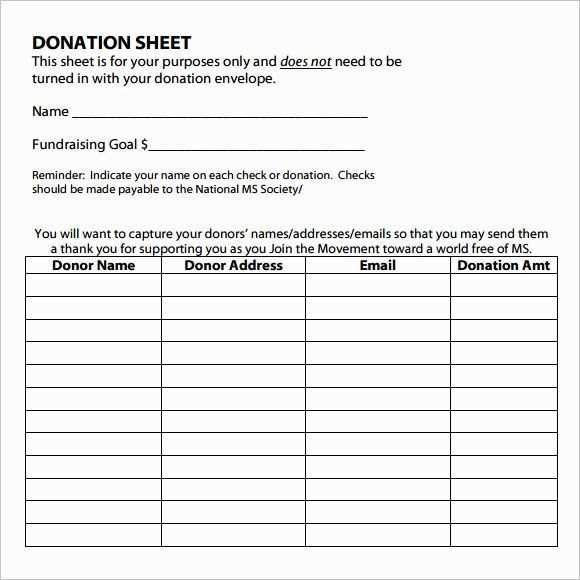

The template includes columns for the donor’s name, address, donation date, description of each item, and the estimated value. This level of detail makes the receipt both comprehensive and clear, which can be helpful for tax purposes or for personal record-keeping. It also helps ensure transparency between the organization and the donor.

Customization is simple. The layout is flexible, allowing you to add or remove fields as necessary. This ensures that the template meets the unique requirements of your organization while keeping the process efficient. Downloading and using this free Excel template can save time and provide an organized way to manage donation receipts.

Here is a version of your text with reduced repetition of words:

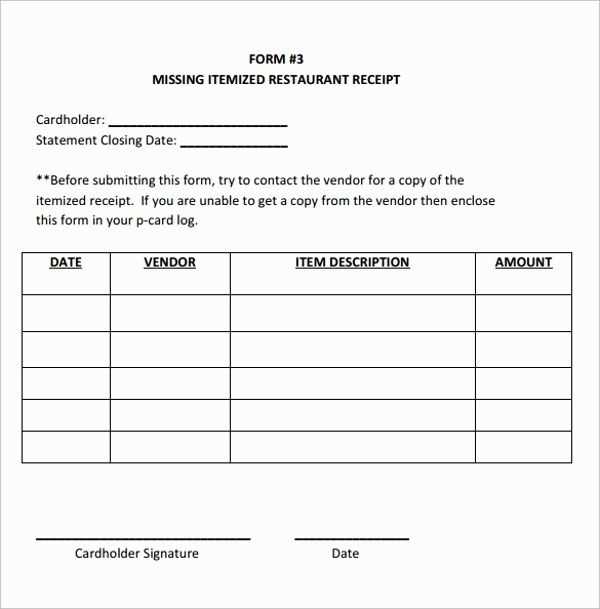

For creating a clear and concise donation receipt, use the Excel template with labeled columns: Donor Name, Date of Donation, Description of Item, and Value. Ensure that each item is listed with its corresponding fair market value. Add a column for any tax deductions that apply to the donor’s gift, which can be helpful for their tax reporting. This approach streamlines the process, allowing donors to track their contributions efficiently.

As you work with this template, maintain consistency in how each donation is described and categorized. This reduces confusion for both the donor and the recipient organization. Update the total value at the bottom of the sheet to reflect the sum of all donations. It’s also helpful to save the template with a unique file name for each donor, making it easy to reference in the future.

- Free Itemized Donation Receipt Excel Template

Use a ready-made Excel template for itemized donation receipts to ensure accuracy and save time. This template provides a structured format for tracking each donation, including donor names, addresses, amounts, and descriptions of donated items. It simplifies the process of issuing tax-deductible receipts, making it ideal for non-profit organizations and individuals handling multiple donations.

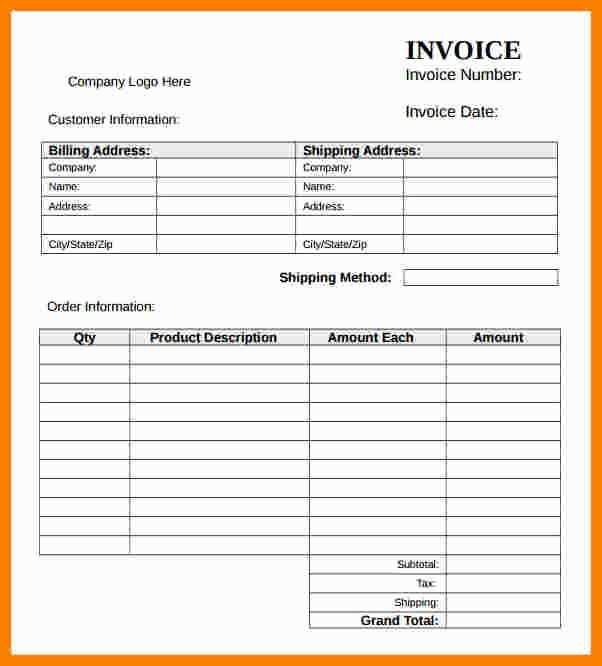

Customize the template by adding your organization’s name, address, and other required details. The itemized list section allows you to break down donations into categories, ensuring transparency and making it easier to report to authorities. In addition, pre-set fields for dates, donation types, and acknowledgment signatures help streamline the entire receipt generation process.

Save the template on your device or share it with your team to ensure consistent record-keeping. With this tool, you can maintain an organized, up-to-date log of donations, facilitating both internal tracking and tax reporting. The Excel format ensures compatibility with various operating systems, and its easy-to-use structure minimizes the need for complex software or training.

Customize your Excel sheet for donation receipts by setting up specific columns that track the necessary information. Create a clear structure by labeling columns such as Donor Name, Date, Donation Amount, Payment Method, and Purpose of Donation.

Step 1: Set Up Basic Columns

- Donor Name: A column for the donor’s full name.

- Date: Record the donation date in a standardized format (e.g., MM/DD/YYYY).

- Donation Amount: Ensure this column is formatted for currency.

- Payment Method: List options such as Cash, Credit, or Bank Transfer.

- Purpose of Donation: Include the specific cause or event the donation is for.

Step 2: Add Calculations

- Add a “Total Donation” column if you want to calculate cumulative donations over time.

- Use Excel formulas like SUM to quickly add up total contributions from a specific donor or across all donations.

Step 3: Personalize Your Receipt Layout

- Create a header with your organization’s name, logo, and contact details at the top of the sheet.

- Design the receipt layout by formatting cells to look visually appealing and easy to read.

- Consider including a thank-you note or message at the bottom of the receipt to personalize it for the donor.

Step 4: Automate Data Entry

- Use drop-down lists for the Payment Method column to make data entry quicker and more consistent.

- Consider using Excel’s “Data Validation” feature to ensure accurate and uniform entries across the sheet.

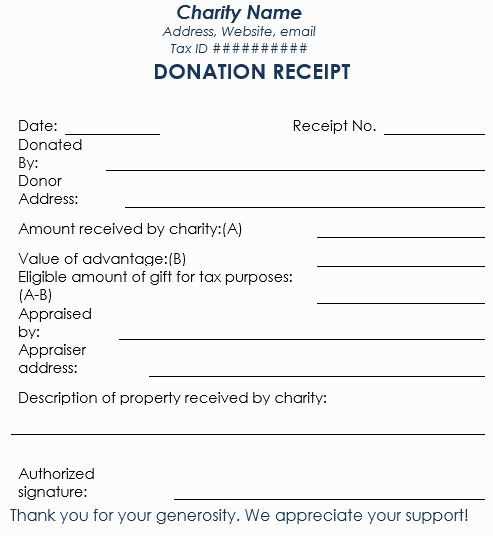

Ensure your donation receipt contains all the necessary details to make it clear and organized for both the donor and your organization. Below are the must-have features:

1. Donor Information

Include the donor’s name and contact information, such as address and email. This ensures clarity in identifying the giver for tax records and future correspondence.

2. Donation Date and Amount

Clearly state the date the donation was received and the exact amount donated. This detail helps both parties track the transaction for tax purposes and auditing.

3. Donation Type

Specify if the donation was cash, check, or non-cash (e.g., goods or services). Non-cash donations require a brief description of the item(s) donated and their estimated value.

4. Tax-Exempt Status

If your organization is tax-exempt, include the official tax-exempt number or EIN. This allows the donor to claim tax deductions on their donation.

5. Thank You Statement

A short thank you note is important to acknowledge the generosity of the donor and maintain a positive relationship.

6. Disclaimer Statement

If the donor received any goods or services in return for the donation, include a statement detailing the fair market value of those items. This ensures transparency for tax purposes.

| Item | Description |

|---|---|

| Donor Information | Name, address, email |

| Donation Date | Specific date donation was received |

| Amount | Exact dollar amount donated |

| Donation Type | Cash, check, or non-cash items |

| Tax-Exempt Number | Official tax-exempt number (EIN) |

| Thank You Statement | Personal acknowledgment for donation |

| Disclaimer | Fair market value for any goods/services received |

Share donation receipts electronically using secure email or a cloud-based platform. This method ensures the receipt reaches the donor quickly and remains easily accessible. Always include all relevant details in the subject line, such as the donation amount and the recipient organization, to make searching and identifying the document easier for the donor.

Archiving Donation Receipts

Store donation receipts in a structured, organized manner. Use a cloud service with folder systems categorized by donation year or donor type. This setup ensures quick retrieval if needed later. Make sure to back up all receipts in multiple locations, such as an external drive or secondary cloud service, for added security.

Maintaining Privacy and Compliance

Ensure that donor information is protected at all times. Redact sensitive personal information from public or shared documents. Regularly review compliance guidelines to make sure your practices align with tax reporting requirements, ensuring both donors and organizations stay within legal boundaries.

Minimizing Word Repetition in Your Donation Receipt

To create a concise and clear donation receipt template, avoid overusing the same terms. By replacing redundant phrases with synonyms or restructured sentences, you maintain clarity and readability. For example, instead of repeatedly using “donated item,” alternate with “contributed goods” or “charitable contribution.” Similarly, rather than saying “thank you for your generosity” multiple times, consider varying it with expressions like “we appreciate your support” or “your kindness is greatly valued.” This not only keeps the text fresh but also ensures that the message remains impactful without unnecessary repetition.