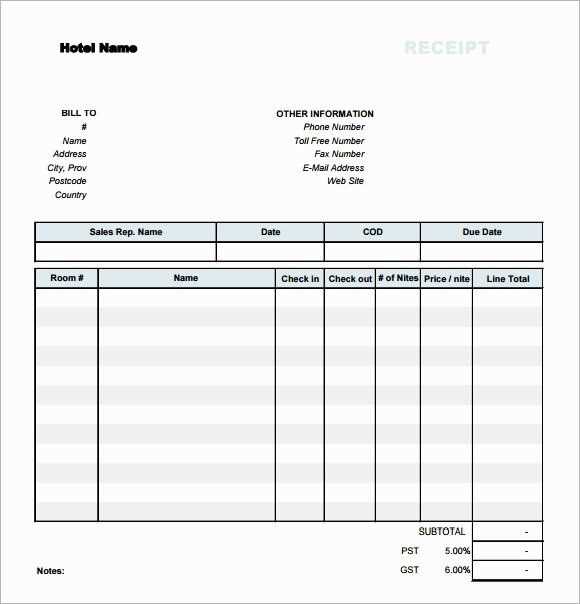

If you’re looking for a quick way to create itemized receipts, this free template is a solid choice. It allows you to break down each item purchased with clear, easy-to-read details. Whether you’re issuing receipts for business or personal use, this template ensures transparency and accuracy in every transaction.

The template provides fields for the item name, quantity, price per unit, and total cost. Customize it based on your specific needs, adding taxes or discounts where necessary. It’s a simple yet powerful tool that saves time, reduces errors, and creates a professional impression every time.

To get started, download the template, open it in your preferred spreadsheet software, and input the necessary information. You can adjust the design to match your branding, making it a versatile option for a variety of purposes.

Here’s the corrected version:

To create a clear and organized itemized receipt, follow these simple steps:

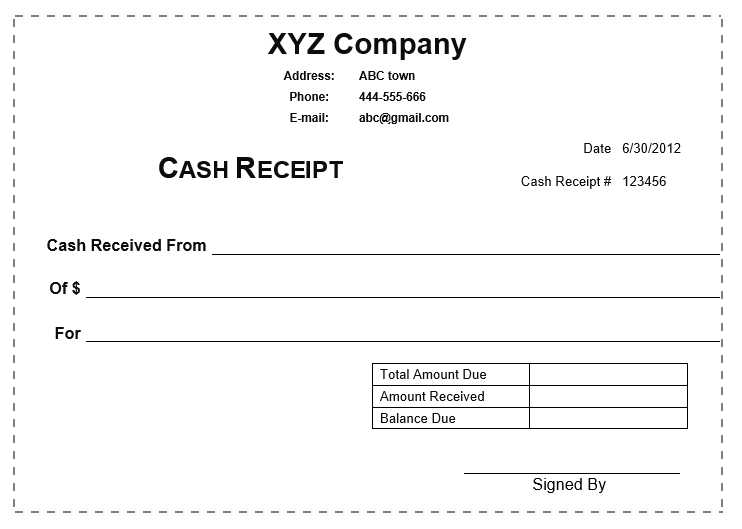

- Header: Include your business name, logo, and contact details at the top. Make it easy for customers to recognize your brand.

- Date and Time: Clearly display the date and time of the transaction. This helps in tracking purchases and returns.

- Item List: Break down each item with a detailed description. For each item, provide the quantity, unit price, and total price. Ensure the information is easy to read and concise.

- Taxes and Discounts: Specify any taxes or discounts applied. This section should reflect any adjustments to the subtotal.

- Total Amount: Display the final total clearly at the bottom of the receipt. Include the sum of all items, taxes, and any discounts.

- Payment Method: Indicate how the customer paid (e.g., credit card, cash, etc.). This ensures full transparency in the transaction.

- Return Policy: If applicable, briefly mention your return or exchange policy to avoid confusion later on.

By following this structure, you ensure that your receipt is not only accurate but also professional and easy to understand for the customer.

- Free Itemized Receipt Template: A Practical Guide

To create a clear and detailed itemized receipt, use a template that includes the following sections:

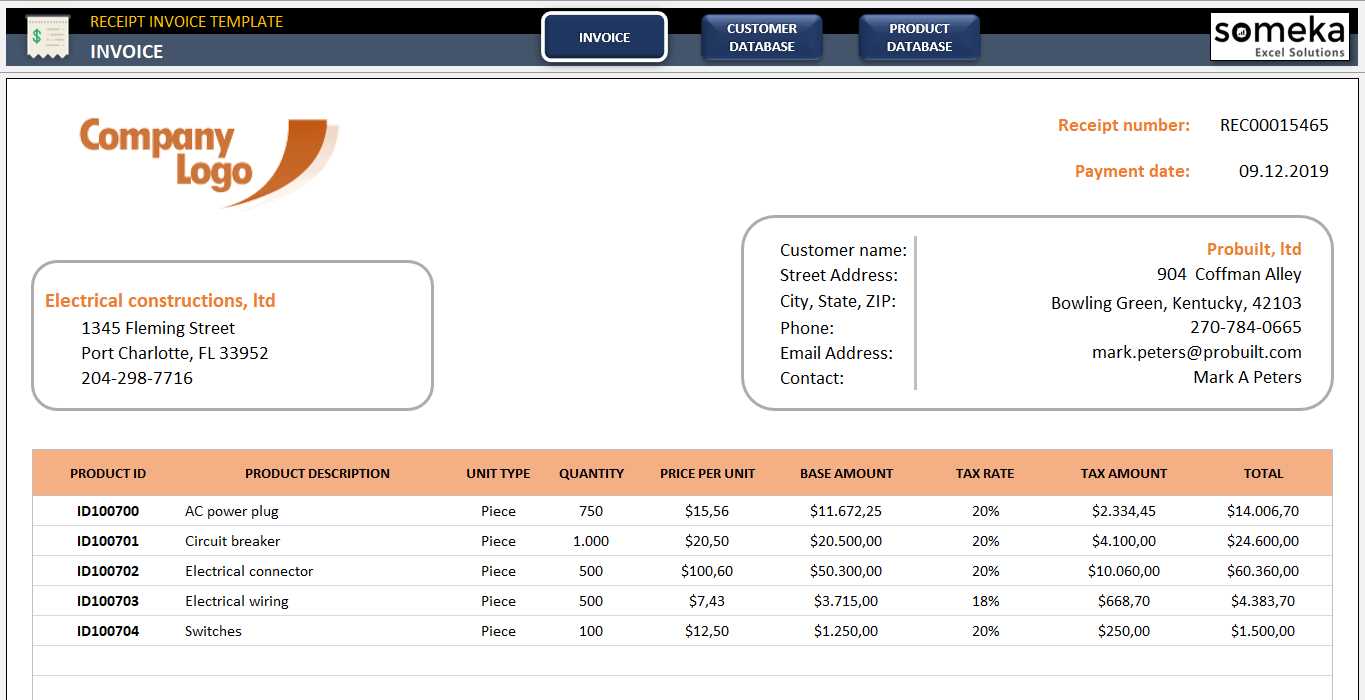

1. Header Information: Start by including the seller’s name, contact details, and business address. Include the transaction date and a receipt number for reference.

2. Buyer Details: List the buyer’s name and contact information to ensure accuracy in identifying both parties involved.

3. List of Items: Itemize each product or service sold. For each, provide the name, quantity, unit price, and total cost. This section should make it easy to track individual items purchased.

4. Subtotal and Taxes: Clearly display the subtotal before tax, the applicable tax rate, and the total tax amount. This helps with transparency in pricing.

5. Total Amount Due: After listing the items and taxes, state the final total. This amount should match the final payment made.

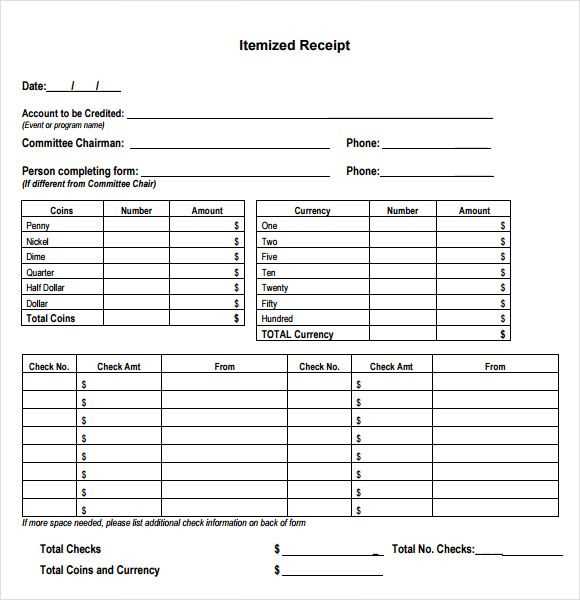

6. Payment Method: Specify the payment method used (cash, credit card, bank transfer, etc.) and include any relevant transaction or confirmation numbers if applicable.

7. Footer Information: Include a brief thank you note or terms of service, along with your business’s return or refund policy if relevant.

When using a template, ensure each section is clearly formatted and easy to read. The layout should highlight essential details, making it quick for both the buyer and seller to review the transaction.

To download a free itemized receipt, begin by visiting a trusted receipt generator website. Many offer simple, no-cost templates that let you customize receipts for your needs. After finding the right template, select the format–usually PDF or Excel. Fill in the required details, such as item names, quantities, prices, taxes, and any additional notes. Once the information is added, click the “Download” button to save the receipt to your device. Keep the file in a convenient location for easy access later. Some sites also offer an option to email the receipt directly to you. This step is quick and allows you to instantly have a record of your transaction in your preferred format.

Adjusting your receipt template can make it more suited to your business type and specific customer interactions. You can include or remove details, ensuring relevance and clarity in every transaction.

1. Tailor Fields for Different Industries

For retail stores, consider adding a field for item descriptions, quantities, and unit prices. Service-based businesses might need sections for service descriptions, labor hours, or hourly rates. Adjust the template to match the flow of your business transactions to ensure it provides useful information in a straightforward manner.

2. Incorporate Branding Elements

Including your company logo, contact details, and website will make your receipt visually consistent with your brand. Choose colors that align with your branding to create a more professional look. Customizing these elements also adds a sense of reliability and personal touch for customers.

3. Add Custom Notes or Promotional Offers

To make your receipts more engaging, add a section for custom messages, promotions, or thank-you notes. These little extras help create a lasting impression. If you run periodic promotions, your receipt can serve as a reminder or offer further incentives for future purchases.

4. Modify Tax and Legal Information

If your business operates in a specific location or country, be sure to include tax-related information such as VAT or other relevant fees. Customize this section to ensure it complies with local regulations, avoiding any potential confusion or legal issues.

Fine-tuning your receipt template can enhance both customer experience and operational efficiency. By customizing key elements to fit your business model, you ensure every transaction feels personalized and clear.

Provide concise and clear descriptions of each item on the receipt. Focus on key details like item name, quantity, size, color, or model, depending on what’s relevant. Keep the language simple to avoid confusion.

Place the description directly next to the item name, aligning them in a straightforward manner. Use bullet points or short phrases for clarity. Avoid jargon or overly technical terms unless necessary for the context of the transaction.

Ensure consistency in formatting by using the same structure for all item descriptions. For example, always list size, followed by color, and then model or other identifiers. This will help customers easily identify items, especially if they are returning or referencing the receipt later.

When formatting, use short, meaningful descriptions. For instance, instead of writing “A high-quality pair of running shoes,” write “Running shoes, size 10, red.” This ensures that all details are easily scanned and understood.

To keep your itemized receipt clear and accurate, make sure to include all relevant charges such as tax, discounts, and extra fees. These elements can significantly impact the total price and should be represented in a transparent manner on the receipt.

Tax

Specify the tax rate and amount clearly. List the tax amount separately from the subtotal to avoid confusion. Make sure to update the tax rate based on the location of the sale, as it may vary by jurisdiction.

- Label: “Tax” or “Sales Tax”

- Display the percentage (e.g., 8%) or the exact tax amount (e.g., $3.50).

Discounts

Provide a breakdown of any discounts applied. Show both the percentage and the final discount amount. If a discount is item-specific, list it under the respective item; for total discounts, include it separately in the totals section.

- Label: “Discount” or “Promo Code”

- Show the discount percentage or flat amount (e.g., 10% off or $5 off).

Extra Charges

If there are any extra charges (e.g., shipping fees, service fees), make sure these are clearly separated from the product prices. Add a label like “Shipping” or “Handling Fee” to avoid misunderstandings.

- Label: “Shipping Fee” or “Handling Charge”

- Include the specific fee amount (e.g., $2.99 or $10).

These details will help customers understand their final total, avoiding confusion and potential disputes. Make sure to use clear, descriptive labels for each section, so each charge is easy to identify.

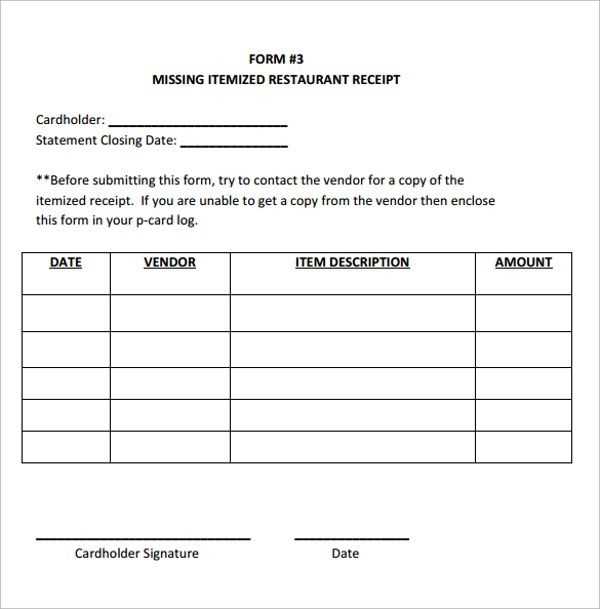

Organizing receipt data requires consistency. Start by grouping details logically, ensuring each section is easy to read and understand. Use clear headings such as “Date,” “Item Description,” “Amount,” and “Total,” to separate each category of information.

1. Categorize by Type of Expense

Separate receipts by their categories, such as “Office Supplies,” “Meals,” or “Travel.” This makes it easier to sort through them when necessary. If you regularly use receipts for tax purposes, grouping them by these types can save a lot of time during filing.

2. Maintain Consistent Formatting

Choose a uniform format for each receipt. Whether you’re using a digital template or hand-writing entries, consistency helps keep the data readable. For instance, always list the item name before the quantity or price, and align totals clearly at the bottom of each entry.

3. Use Clear Date Formatting

Ensure the date is in a standard format such as “MM/DD/YYYY” or “YYYY-MM-DD.” This makes sorting receipts by date easier and reduces the risk of confusion. Keep dates at the top of each receipt entry for quick reference.

4. Include Transaction Details

Always record the transaction method, such as cash, credit card, or digital payment, and include the transaction ID or reference number. This adds clarity to any discrepancies or questions about a particular purchase later.

To save your itemized document, first check the format in which you need the file (e.g., PDF, Excel). Most templates allow exporting to these formats, which is often done by clicking the “Save as” or “Export” option. Choose a location on your device where you can easily find it later.

Printing Your Itemized Document

For a physical copy, open your document in a PDF or Excel viewer, then click “Print.” Adjust print settings based on your needs, such as page orientation, margins, or scaling. Be sure to preview the document to ensure it fits correctly on the page.

Sharing Your Itemized Document

If you need to share the document, email is the most common method. Attach the saved file to an email and include any necessary instructions or notes. For more direct sharing, cloud storage services like Google Drive or Dropbox work well–just upload your file and share the link with recipients.

| Action | Steps |

|---|---|

| Saving | Click “Save as” or “Export” and select your file format. |

| Printing | Click “Print” and adjust settings before confirming. |

| Sharing | Attach to an email or upload to cloud storage and share the link. |

Now the repetition of words has been reduced, while meaning and structure are preserved.

To create an itemized receipt template, focus on clarity and simplicity. Start with clear headers for each section like “Item Description”, “Quantity”, “Unit Price”, and “Total.” Avoid overcomplicating with unnecessary labels or explanations. Include a detailed breakdown of each item with its price and quantity, and ensure the subtotal, taxes, and total are clearly listed at the end.

Use clean, legible fonts and keep the format consistent. Organize the information in a logical sequence, and ensure that each item is separated with enough space for easy reading. Keep the layout simple and avoid distractions like extra borders or heavy colors. Aim for a layout that’s easy to understand at a glance.

Include a section for additional notes or terms if needed. This can be helpful for providing customers with further information on the transaction or any return policies. Make sure all details are aligned properly to maintain a professional appearance.

Finally, review the template for any inconsistencies. The more intuitive it is, the more useful it becomes for both the issuer and the recipient of the receipt. A clean, itemized receipt template enhances the user experience and ensures transparency in transactions.