If you need to create a receipt for a transaction involving free money, a template can save you time and effort. A well-designed template will provide a clear structure for documenting the exchange, ensuring that all necessary details are included. This is especially useful for personal records or when verifying such transactions with others.

Use the following key components in your free money receipt template: Date of transaction, Amount, Payment method (cash, bank transfer, etc.), Sender’s and recipient’s names, and any additional relevant notes. Accurate information will help avoid confusion and keep the transaction transparent.

Customizable templates allow you to adjust the layout according to your needs. For example, you might want to add a reference number or specific terms related to the free money exchange. A simple design ensures that all data is easily readable and understandable.

Don’t forget to save a copy of the receipt for your records, and consider sharing one with the other party involved in the transaction for their convenience as well.

Here’s the corrected version:

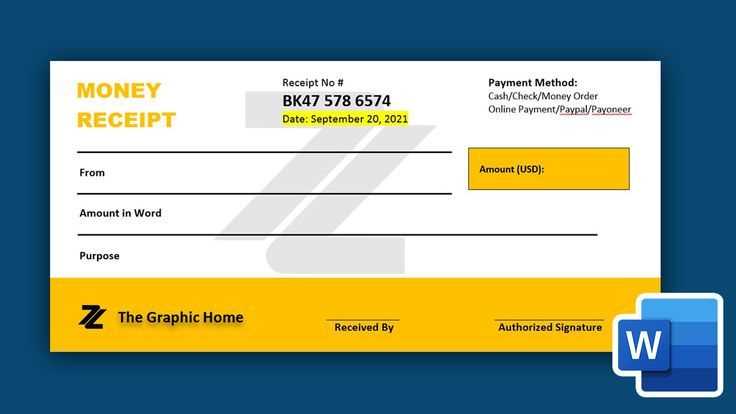

To create a clear and easy-to-use free money receipt template, ensure you include essential fields: receiver’s name, amount received, date, purpose, and payment method. A well-structured template helps avoid misunderstandings. Place these details in separate fields for clarity. Use bold headings for each section to make the template more readable. Always include a signature line at the bottom for both the receiver and the giver, confirming the transaction. You may also want to add a reference or receipt number for easy tracking.

For a user-friendly design, consider keeping the layout minimal yet organized. Avoid cluttering the template with unnecessary information. Instead, focus on the key details that both parties need for record-keeping purposes. After the template is completed, provide an option to save or print for convenience.

Free Money Receipt Template: How to Create, Personalize, and Use

To create a free money receipt, first choose a simple format that includes the essentials: the amount received, date, payer’s name, and receiver’s details. You can easily find templates online or use word processors like Microsoft Word or Google Docs to make one from scratch.

Steps to Create a Money Receipt

Start by setting up a clean layout with a header stating “Receipt” or “Money Receipt” at the top. Below, include sections for the date, payer’s name, the amount paid (in both numbers and words), and the purpose of the transaction. Add lines for signatures from both parties to validate the transaction.

Personalizing Your Receipt

To make your receipt more professional, customize the design by adding your business logo or personal information at the top. Adjust the font and formatting for clarity. You can also include a receipt number for easy tracking of multiple transactions.

Once your template is ready, save it as a file, print it, or send it digitally to the payer. Having a receipt not only confirms the transaction but also helps in maintaining accurate financial records.

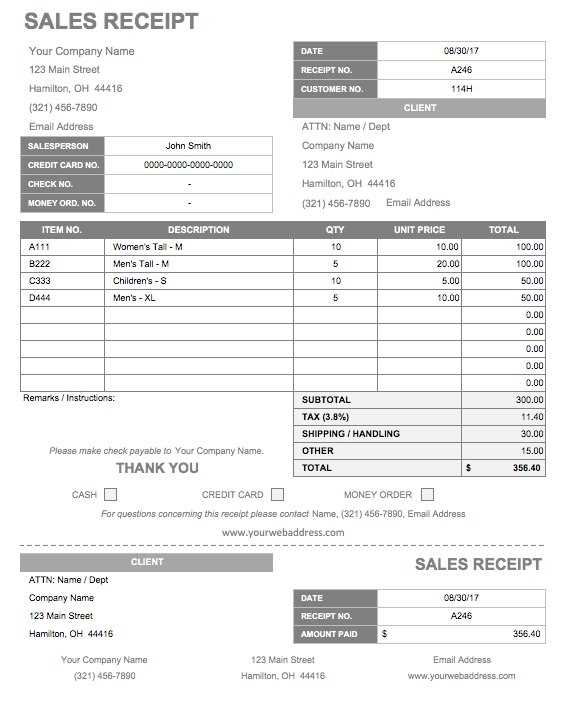

Include the date of the transaction at the top for easy reference. This helps both parties track the transaction timeline.

List the name and contact details of the business or individual issuing the receipt. This establishes clear identification.

Detail the products or services provided with a description, quantity, and price for transparency. This makes the receipt more understandable and verifiable.

Specify the payment method, such as cash, credit card, or online transfer, to show how the transaction was completed.

Include the total amount paid, broken down by tax or discounts if applicable, so the customer can verify the final cost.

Provide a unique receipt number for tracking purposes, which helps organize and manage transactions.

If relevant, include the terms and conditions related to returns or warranties for clarity on the process following the sale.

Ensure there is space for signatures if necessary, particularly for high-value or legal transactions, confirming both parties agree to the terms.

Adjusting a free receipt template is straightforward and can save you time while ensuring it fits your specific requirements. Here are some steps to personalize the template:

- Update the Header Information: Modify the company name, logo, and contact details. Make sure the format aligns with your business branding.

- Include Unique Identifiers: Add transaction numbers, invoice numbers, or order IDs to keep track of your receipts easily.

- Modify the Date Format: Ensure the date is displayed according to your preferred format (e.g., MM/DD/YYYY or DD/MM/YYYY).

- Detail the Purchased Items: Adjust item descriptions, quantities, and prices. Use the available columns to specify product names and any applicable taxes or discounts.

- Add Payment Method: Include a section for specifying whether the payment was made by cash, credit card, or another method.

- Customize Terms and Conditions: If necessary, edit or add payment terms, return policies, or disclaimers relevant to your business.

These adjustments ensure that your receipt template looks professional and is tailored to your needs. Once the changes are made, save it in a reusable format such as PDF or Word for future use.

To create a printable receipt, choosing the right format and tools simplifies the process. Consider using PDF or Word format, as these are compatible with most printers and provide high-quality printouts.

PDFs are widely accepted for their consistency across devices and operating systems. They preserve formatting and allow for easy customization, making them ideal for professional receipts. Word documents offer flexibility in editing but may require additional setup for perfect print quality.

For quick creation and simple design, online tools like Canva or Google Docs provide templates that can be easily adjusted to suit your needs. These platforms offer pre-designed receipt templates, reducing the time spent on formatting.

When it comes to specialized receipt generation, software like QuickBooks or FreshBooks are excellent choices for small businesses. They automatically generate receipts, include itemized lists, and store records digitally.

| Tool | Best For | Format |

|---|---|---|

| Adobe Acrobat | Professional receipts | |

| Microsoft Word | Custom receipts | DOCX |

| Canva | Quick design | PDF, PNG |

| QuickBooks | Small business | |

| FreshBooks | Invoicing and receipts |

Choosing the best tool depends on your needs. For quick personal receipts, templates from Google Docs or Canva might be enough. For businesses, accounting software offers more robust features and integration with financial systems.

Use a free money receipt template to streamline the process of documenting financial transactions. A well-designed template ensures clear and concise records, preventing misunderstandings and maintaining accurate documentation for both parties.

- Choose a simple and easy-to-edit format like a Word document or Google Docs to create your receipt template.

- Include sections for the date, amount received, payer’s details, and a brief description of the transaction.

- Ensure the template has space for both your and the payer’s signatures for verification.

- Make sure to add a unique receipt number for each transaction to improve organization and track records effectively.

- Consider including a payment method field, whether it’s cash, check, or bank transfer, for additional clarity.

- Design the template in a way that allows for easy printing or digital sharing for convenience.

Once your template is set up, simply customize it for each transaction. This helps you stay organized and ensures that both parties are clear about the terms of the exchange.