Creating an oil change receipt is straightforward with a simple template. This document allows you to track all necessary details, making it easier for both customers and service providers to stay organized.

The receipt should include the service date, vehicle information, and type of oil used. Always provide the customer’s name, address, and contact details for easy follow-up. Be sure to include the total cost of the oil change and any additional services performed, like filter replacements or fluid checks.

A clean, well-organized format makes it easier to manage records for future reference. By using this template, you can ensure clarity and consistency in every transaction, reducing the risk of mistakes or confusion later on.

For simplicity, make sure the receipt can be easily customized to fit different vehicle types and service packages. Add sections to note any warranties or guarantees, as this can build trust with customers.

Here’s the revised version:

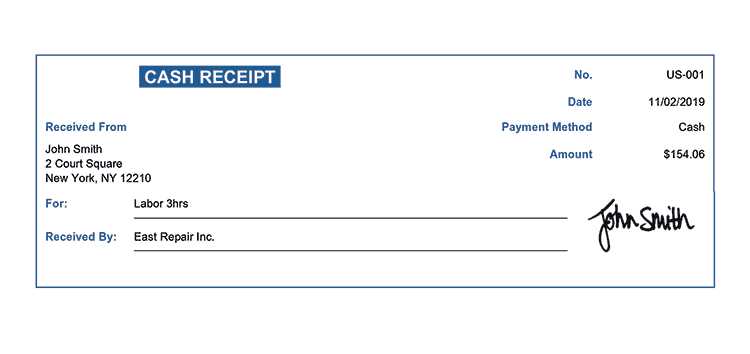

To create a free oil change receipt template, follow these steps for accuracy and simplicity. Begin by including basic details such as the service provider’s name, contact information, and service date. Then, clearly list the services provided, including oil change, filter replacement, and any other additional services. Specify the cost of each service and the total amount charged.

Key Elements to Include:

- Service Provider Name and Contact: Ensure that the service provider’s name, address, and phone number are easy to find.

- Customer Information: Include the customer’s name and contact details for reference.

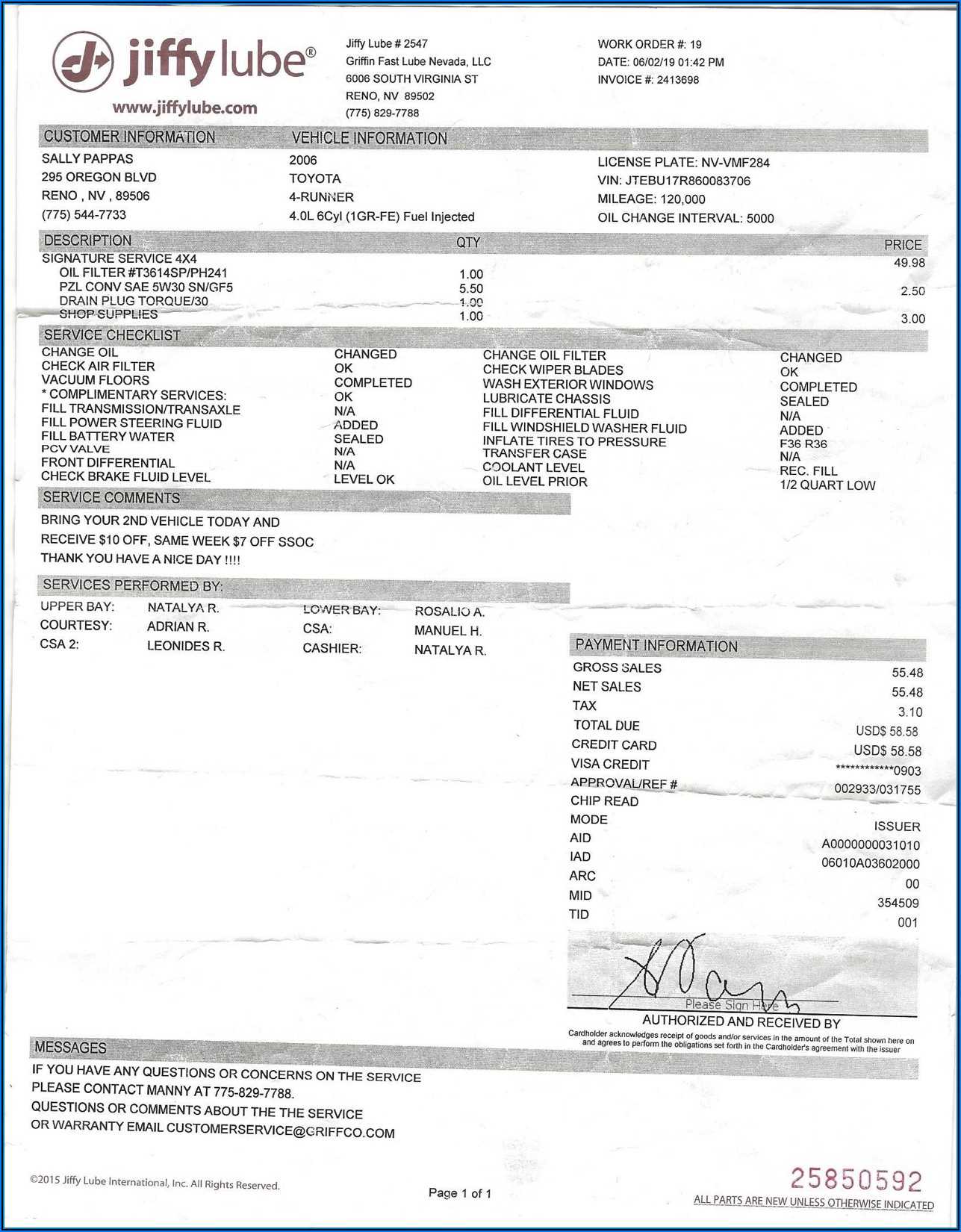

- Service Details: List all services provided, including oil brand, type, and quantity used. Mention any additional parts or services, such as filters or fluid top-ups.

- Total Cost: Clearly outline the total cost, with individual service prices listed separately.

- Invoice Number: Assign a unique invoice number for easy tracking.

Additional Tips:

- Formatting: Keep the layout clean and organized, using clear headings and bullet points to improve readability.

- Receipt Template: Consider offering the template in a downloadable format like Word or PDF for easy access.

Free Oil Change Receipt Template

How to Create a Simple Receipt for Oil Changes

Creating a receipt for an oil change can be done quickly by including specific details. Start with the service provider’s name, address, and contact information at the top. Follow this with the customer’s name and the vehicle information, such as make, model, and year. Add the date of service and a breakdown of the oil change, including the type of oil used, the number of quarts, labor charges, and any additional services provided. Finish with the total cost and payment method.

Key Elements to Include in Your Oil Change Receipt

Make sure the receipt contains the following:

- Service provider details (name, contact info)

- Customer information (name, vehicle details)

- Date of service

- Detailed description of the oil change (oil type, quantity)

- Labor charges and additional services

- Total cost and payment method

This ensures the receipt is both professional and legally acceptable.

Free Templates for Receipts: Where to Find Oil Change Versions

Many online platforms offer free templates for oil change receipts. Websites like Microsoft Office Templates, Google Docs, and other specialized platforms provide easily customizable formats. Choose a simple design with clearly labeled sections for ease of use and quick editing.

Customizing Your Receipt for Different Vehicles

Modify the receipt template based on the vehicle. For example, include the vehicle’s VIN number for more detailed records, or adjust the pricing if there are different oil types or vehicle sizes. Some templates allow for additional fields, such as tire checks or fluid top-ups, which can be customized for different services.

Legal Considerations When Issuing Oil Change Receipts

Keep in mind that receipts are not only proof of payment but may also be used for warranty purposes or tax documentation. Ensure all the information is accurate and legible. Check local regulations to confirm if any specific details are required by law, such as a business license number or tax ID number.

Best Practices for Storing Receipts for Future Reference

Store your receipts digitally or in a physical file for easy access. Digital receipts can be saved on cloud storage or in organized folders, while paper receipts should be filed by date or service type. Keeping records for a set number of years is recommended for tax or warranty purposes.