If you’re looking for a simple way to issue donation receipts online, using a free template is your best option. A donation receipt template helps streamline the process, ensuring that your donors receive accurate records for their contributions without the need for complicated software or paperwork. With this template, you can create professional receipts quickly, saving time and effort while staying organized.

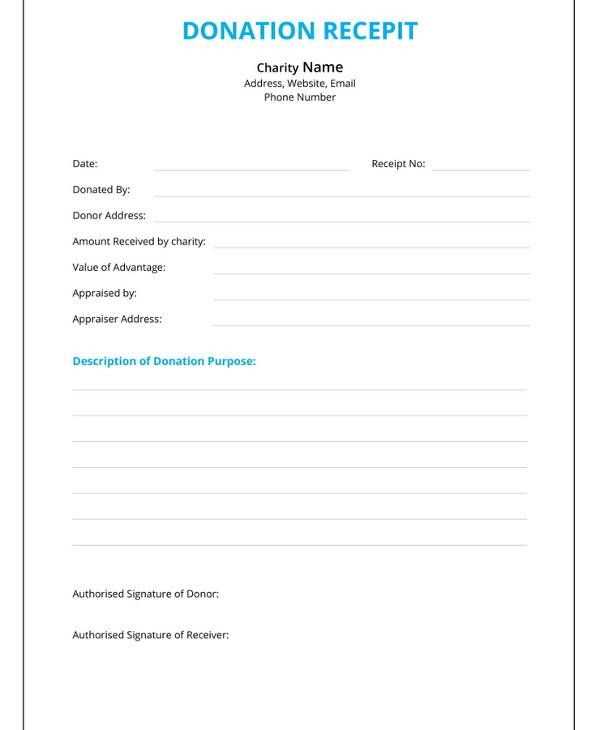

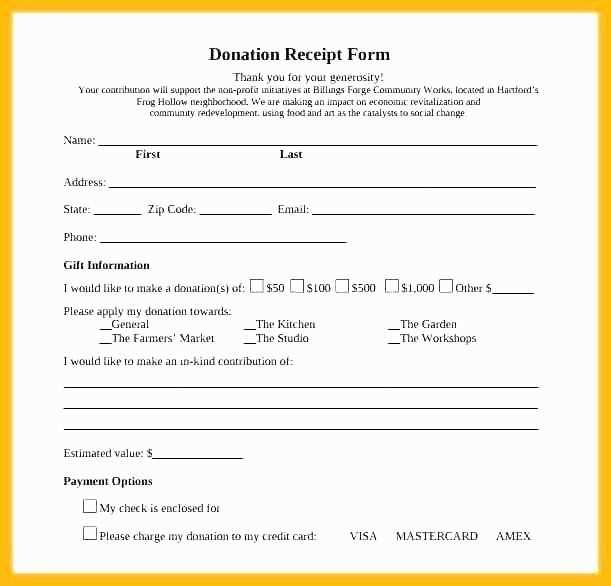

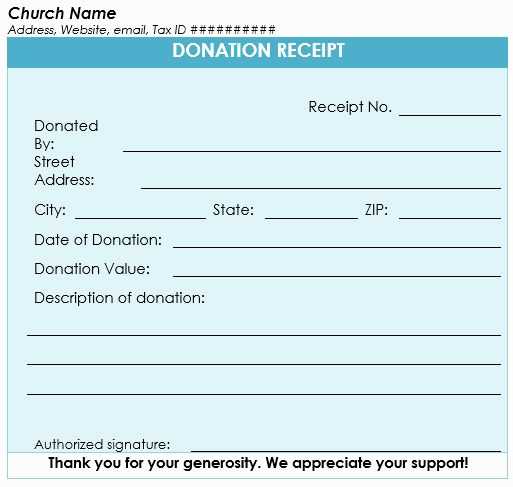

Start by customizing the template with your organization’s name, contact information, and tax-exempt status. Ensure that each receipt includes the donation amount, date, and the donor’s name, along with a brief description of the donation. This provides all the necessary details for tax purposes and helps maintain transparency with your supporters.

The beauty of a free online donation receipt template lies in its simplicity. You can easily find a format that works for your needs, and with most templates, all you need to do is fill in the required fields. This way, you can focus more on engaging with donors and less on administrative tasks.

Here’s the corrected version without repetitions:

Ensure your donation receipt template is simple, clear, and includes all necessary details. Start with the donor’s name and contact information, followed by the donation amount and date. If applicable, mention any restrictions on the use of funds. Include a statement confirming whether the donation is tax-deductible, along with your organization’s tax ID number.

Details to Include

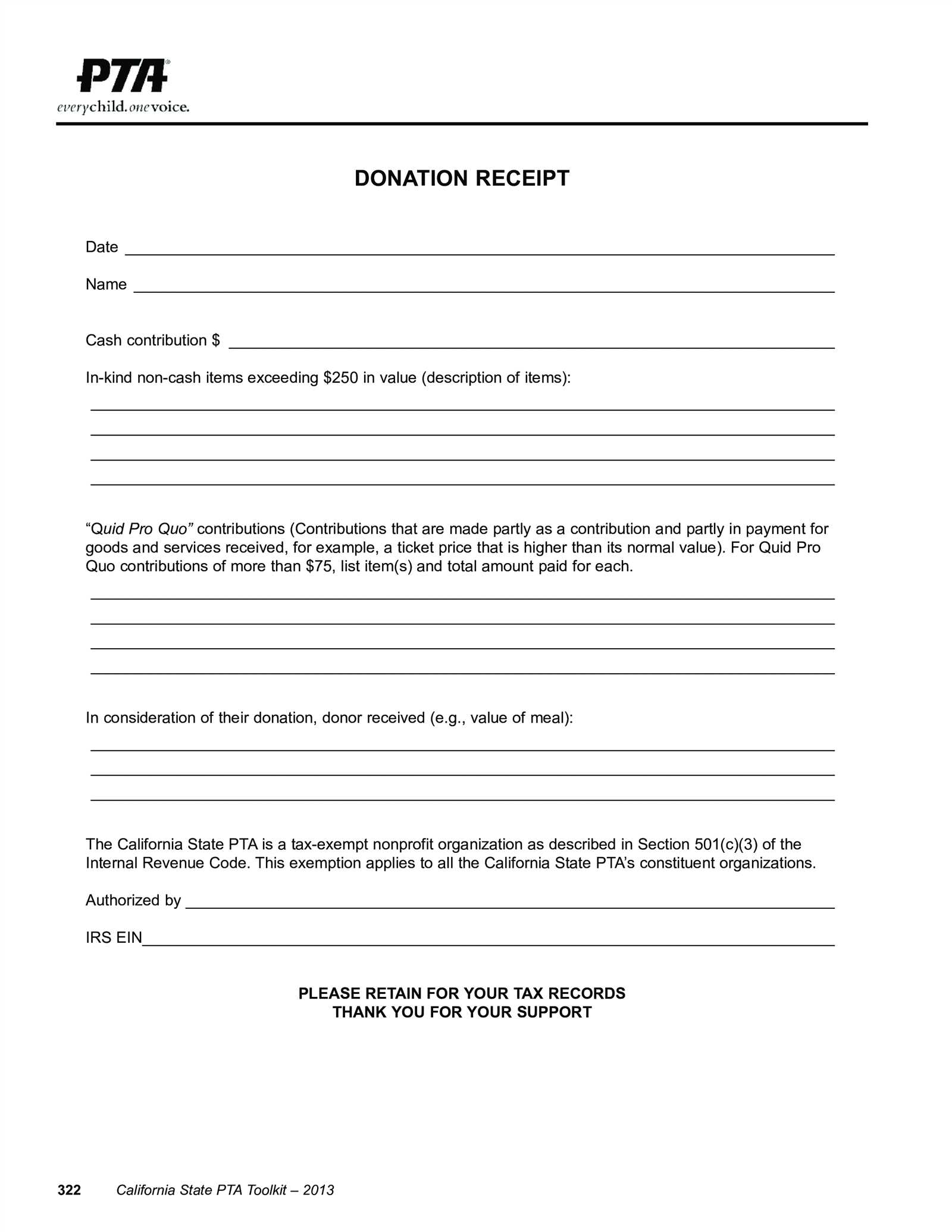

Be sure to list the donation type–whether it’s monetary or in-kind–along with a brief description of the donation. If you’ve received non-cash items, include their fair market value. It’s helpful to add a reference number or receipt ID for easy tracking in your database.

Formatting Tips

Keep the design clean and professional. Use legible fonts, and make the donation details easy to find. A clear section for the donor’s information, followed by the donation specifics, will help prevent confusion. Make the receipt downloadable or printable for donor convenience.

- Free Online Donation Receipt Template

Using a donation receipt template can save time and simplify the process of acknowledging charitable contributions. A free online donation receipt template should include key details that ensure both the donor and the organization comply with tax and legal requirements.

Key Elements to Include

- Donor Information: Name, address, and contact details of the donor. This is important for record-keeping and tax reporting.

- Organization Details: The name, address, and contact info of your charity or nonprofit organization.

- Donation Amount: Clearly state the total amount donated. If it’s a non-cash donation, include a description and estimated value.

- Date of Donation: The exact date the donation was received should be included on the receipt.

- Purpose of the Donation: If applicable, include a brief description of how the donation will be used. This helps clarify the donor’s intent.

- Tax-Exempt Status: Include a statement confirming your nonprofit’s tax-exempt status, such as “501(c)(3) organization” in the U.S.

Where to Find Free Templates

- Search for reputable nonprofit organizations or donation software platforms offering free receipt templates for download.

- Check online tools like Google Docs, Microsoft Word, or specialized nonprofit management tools that often provide free customizable templates.

- Explore online platforms such as Canva, which offers easy-to-use, customizable templates specifically for donation receipts.

Once you find a suitable template, make sure to personalize it with your organization’s information. A clear and professional receipt reassures donors that their contribution is being properly recorded and documented.

To create a donation receipt template for nonprofits, include the donor’s name, the organization’s name, and the amount donated. Make sure to specify whether the donation was in cash, check, or another form. The date of the donation must be clearly visible, as well as a unique receipt number for record-keeping.

Include Tax-Exempt Status Information

If your nonprofit is tax-exempt, mention your organization’s tax ID number and the fact that the donor may be eligible for a deduction. This helps donors understand the potential tax benefits of their contribution and provides transparency.

Note Any Non-Cash Donations

For non-cash donations, include a description of the item(s) and, if possible, the estimated value of the donation. Be sure to state that the nonprofit does not assign a value to the donation–this allows the donor to claim a fair market value deduction.

Make sure the receipt template is easy to read and contains all necessary details. This will help you maintain good records and ensure that your donors can claim any eligible tax deductions smoothly.

To find customizable templates for free donation receipts, check out these reliable resources:

- Google Docs Templates: Google Docs offers simple, editable templates for donation receipts. You can customize these for your organization’s needs. Search the template gallery or use pre-designed options available through Google Drive.

- Canva: Canva provides free donation receipt templates that are easy to modify with your logo, donation details, and personal touch. Choose a template and adjust fonts, colors, and layout as needed.

- Microsoft Office Templates: Microsoft Word and Excel have free downloadable donation receipt templates. These are well-suited for users who prefer traditional office software for customization. They come in both letter and statement formats.

- Template.net: Template.net offers several donation receipt templates that are free to use. You can customize the content, but you might need to create a free account to access certain features.

- DonorBox: DonorBox’s platform offers customizable donation receipt templates. After signing up, you can generate and send receipts directly to donors. They also allow you to include tax-deductible details if needed.

- Zoho Forms: Zoho Forms includes pre-built templates for donation receipts that you can tailor to your specific needs. This is ideal for users who also need a way to manage donations and track contributions.

- JotForm: JotForm offers free customizable donation receipt templates. You can easily integrate the template with your form to generate receipts instantly when a donation is made.

For a donation receipt to be valid, it must include specific details to comply with legal standards. This helps donors claim tax deductions and ensures your organization meets reporting obligations. Here are the key points to include:

Required Information

Each receipt must clearly state:

- Donor’s Name: The person or organization making the donation.

- Amount Donated: The exact donation amount or the fair market value of any non-cash donation.

- Organization’s Name: Your nonprofit’s official name.

- Tax-Exempt Status: A statement confirming the organization is recognized as tax-exempt by the IRS or equivalent body.

- Date of Donation: The exact date the donation was made.

- Gift Description: A brief description of any goods or services provided in exchange for the donation (if applicable).

IRS Guidelines for Non-Cash Donations

If a donor gives non-cash items, such as clothing, equipment, or other goods, your receipt should include a description of the items and their estimated fair market value. If the value exceeds $500, the donor must complete IRS Form 8283 for further reporting. Always ensure the description is accurate to prevent future issues with tax filings.

Failing to include these elements or inaccuracies in your receipts can lead to penalties for both the donor and your organization. Keep records of all donations and receipts for at least 3 years in case of an audit.

How to Create a Donation Receipt Using a Free Online Template

Using a free online template for donation receipts simplifies the process. Choose a template that aligns with your organization’s branding and easily customize it with donation details.

The key components of a donation receipt include:

| Component | Description |

|---|---|

| Donor Information | Name, address, and contact details of the donor. |

| Donation Details | Date of donation, amount, and type (monetary or goods). |

| Organization Details | Name, address, and tax identification number of the charity. |

| Receipt Number | A unique identifier for each donation receipt. |

| Statement of No Goods/Services Provided | Confirm no goods or services were exchanged for the donation (if applicable). |

Be sure to include a clear thank you message at the end of the receipt to show appreciation for the donor’s support. A good practice is to offer a reminder of how the donation will be used, if possible.