If you’re looking for a simple way to document payments received by check, using a free paid by check receipt template is the best solution. This template helps you keep track of transactions quickly and accurately, ensuring all necessary details are recorded. With the right information, such as the payee’s name, check number, and payment amount, you can stay organized and maintain clear financial records. It’s an easy tool to streamline your payment tracking without the hassle of creating receipts from scratch.

When selecting a template, make sure it includes sections for the date of the transaction, the check number, and a brief description of the purpose of the payment. This way, you ensure that all aspects of the transaction are clearly documented. Including a space for signatures can add an extra layer of professionalism and security, especially for larger payments. You can find several customizable options online, many of which are free to use and can be downloaded instantly.

Using a free paid by check receipt template doesn’t only save time–it also helps maintain proper documentation for both you and your clients. Keeping accurate records is not only helpful for day-to-day accounting but also provides peace of mind in case of audits or disputes. Be sure to store these receipts securely for easy access whenever needed.

Here are the corrected lines with minimal repetition of words:

To create a check receipt template, make sure to clearly outline the details, including the check number, payer’s name, amount, and the purpose of payment. Avoid repeating information and ensure the structure is logical for easy comprehension.

For improved readability, use concise language. For instance, rather than repeating “payment received,” simply note the amount and date, followed by “thank you for your payment.” This helps in maintaining a clean and straightforward format.

Best Practices for Simplified Templates

Focus on clarity by keeping the wording minimal. State the transaction details clearly and avoid unnecessary phrases. This approach leads to quicker understanding and ensures the receipt remains professional and practical.

How to Avoid Redundancy

To avoid redundancy, limit the use of similar terms. Instead of saying “received a check for the payment of the invoice,” say “check payment for invoice.” This small change reduces repetitive wording without losing any crucial information.

- Free Paid Check Receipt Template

If you’re looking for a free paid check receipt template, you’re in the right place. This template helps you quickly and clearly acknowledge payments made by check. The receipt serves as proof of payment, which is important for both record-keeping and any potential disputes.

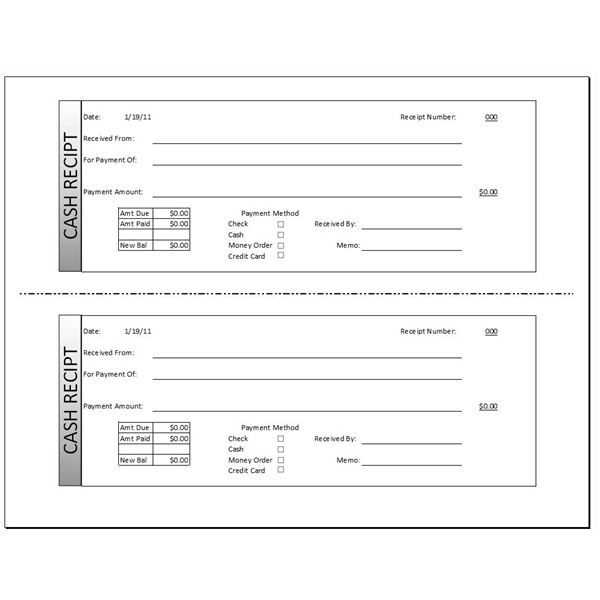

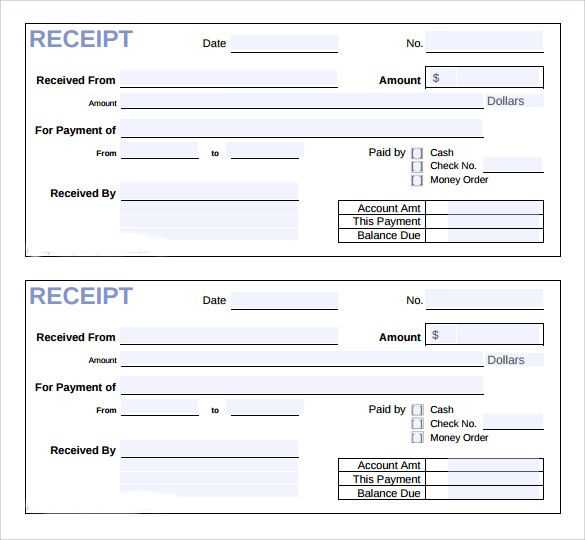

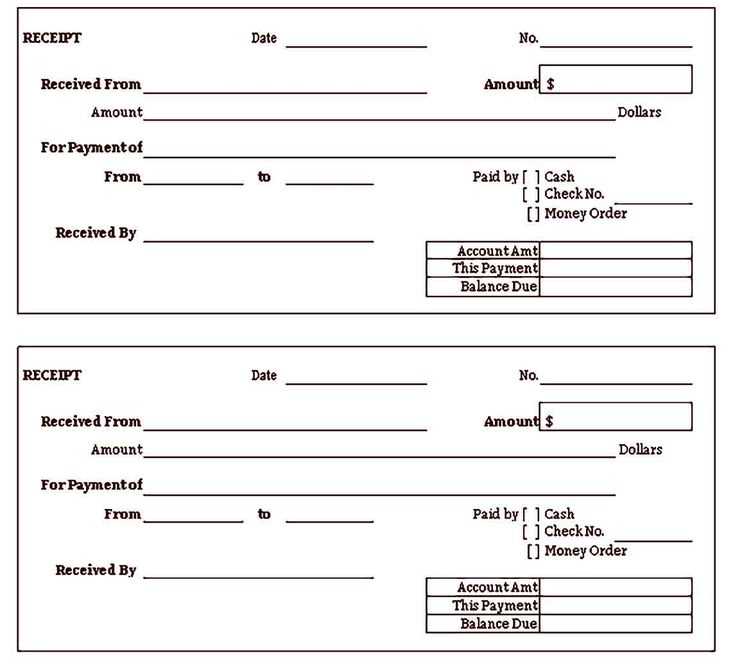

The layout of the template should include basic details like the check number, payer’s name, amount, payment date, and the name of the payee. It’s important to include the method of payment as “Paid by Check,” along with a signature line for confirmation. These elements ensure transparency and accuracy in documenting the transaction.

Customize your template to match the needs of your business or personal transactions. For example, add a section for notes or other specific terms of the transaction, such as partial payments or account numbers. This makes the receipt more versatile and adaptable to various situations.

Make sure the template is easy to print and that all required fields are clearly visible. Keeping the design simple and organized improves usability, ensuring that both parties can quickly access the necessary information when needed.

To create a custom paid check receipt template, start by choosing the software or platform you will use, such as Word, Excel, or a specialized receipt generator. The key is to design a clean, professional layout that includes all the necessary details for clarity and accuracy.

Include Required Information

Ensure the template has sections for the payer’s and recipient’s names, address, check number, payment amount, and the date the check was paid. Also, incorporate a brief description of the reason for the payment. Make sure to add space for a signature to confirm the transaction. These details provide a complete record of the transaction for both parties.

Design for Clarity

Use a simple and organized design to ensure that the information is easy to read. Break up the details into clearly labeled sections, such as “Payer Information,” “Payment Details,” and “Recipient Information.” A well-structured format reduces the chance of mistakes and simplifies the process for future reference.

If you want to add extra functionality, consider including a field for notes or comments where either party can add additional context. This can be helpful for any special terms or conditions tied to the payment.

Lastly, ensure the template is in a format that allows easy editing and printing, so both parties can keep a copy for their records.

Make sure your paid check receipt includes the payer’s full name and contact information. This ensures proper identification of both parties involved in the transaction.

Clearly state the check number, as well as the date the payment was processed. This provides a reference for both you and the payer in case any disputes arise.

Describe the purpose or nature of the payment in detail. Whether it’s for a service or product, specifying this helps to avoid confusion and ensures both parties are on the same page.

Record the exact amount paid, both in numbers and words. This removes ambiguity, especially if there’s a need for future verification of the payment amount.

Include a statement confirming that the check has been cashed or deposited. This adds clarity, assuring the payer that the payment has been processed successfully.

Provide a signature or confirmation line for the person receiving the payment. This helps legitimize the transaction and confirms receipt of funds.

Canva is a popular option for designing check receipt templates. It offers a user-friendly interface, with drag-and-drop features, making it easy to add text, logos, and customize the layout. The free version includes access to a variety of templates, fonts, and design elements, suitable for creating professional-looking receipts. It also allows for easy export in different formats like PDF and PNG.

Google Docs

Google Docs can be an excellent tool for simple check receipt designs. You can create a table structure to organize the payment information and adjust the design using various fonts and styles. Its cloud-based nature allows easy sharing and editing, making it convenient for collaborative work. You can download the document as a PDF or print directly from the platform.

Microsoft Word

Microsoft Word is another great choice for building check receipt templates. It offers flexibility in terms of design, with options to add tables, adjust fonts, and format the layout to suit your needs. It also supports saving documents in PDF format for easy distribution. Word is widely accessible, and templates can be found online to streamline the process of creating check receipts.

To ensure accuracy and clarity, follow these steps when filling out a paid check receipt template:

- Enter the Date: Write the exact date when the payment was made. This helps both parties reference the transaction accurately.

- Include the Check Number: Specify the check number issued for the payment. This ensures that the check can be traced back to the original source.

- Write the Payer’s Information: Clearly list the name and address of the person or entity that issued the check. This identifies the payer and adds verification to the transaction.

- Describe the Purpose of Payment: Provide a brief description or reference for the payment. It could be for goods, services, rent, or another specific reason.

- State the Amount Paid: Write the exact amount paid in both words and numbers. This eliminates any confusion and ensures the payment is recorded correctly.

- Verify Payment Method: Indicate that the payment was made by check. You may want to include the bank or financial institution that issued the check for extra clarity.

- Include the Payee’s Information: Clearly include the name and address of the recipient (the payee). This ensures the correct party is receiving credit for the transaction.

- Sign the Receipt: Add the payee’s signature at the bottom. This is an acknowledgment of receipt and confirms the payment was accepted.

- Optional: Add a Receipt Number: For easy tracking, consider adding a unique receipt number. This helps organize records and serves as a reference for both the payer and payee.

By following these simple steps, you create a clear and well-documented paid check receipt. This prevents misunderstandings and provides a reliable record of the transaction for both parties.

Using a paid check receipt template streamlines the process of documenting transactions, reducing the effort needed to create receipts manually. By filling in the required details in a ready-made format, you eliminate the need to start from scratch each time a payment is made. This not only saves you time but also ensures that the receipt is accurate and consistent every time.

Quick Completion

With a template, you can generate a receipt in seconds. The key fields, such as date, amount, payee, and check number, are already defined. All you need to do is input the relevant information, significantly reducing the time spent on creating custom receipts from scratch.

Prevents Mistakes

A template provides a structured format, minimizing the risk of forgetting critical details. The consistency of having the same structure for every receipt also ensures that no information is overlooked, helping to prevent mistakes and ensuring clarity for both parties involved in the transaction.

- Saves time by eliminating repetitive tasks.

- Reduces errors through predefined fields and clear structure.

- Improves productivity by streamlining receipt creation.

If you need a reliable check receipt template, several websites offer high-quality options that are free to download and use. One solid resource is Template.net, where you can find a variety of receipt templates for checks. Their templates are user-friendly and can be customized to fit your specific needs. Another great option is Canva, which offers free templates that can be easily personalized online before printing. You can adjust text, colors, and logos to match your style.

For a more straightforward approach, Microsoft Office Templates provides free check receipt templates that are compatible with Word and Excel. These templates are easy to use and can be modified according to your preferences. Google Docs also has a selection of free check receipt templates in their template gallery, which can be accessed directly from your Google Drive.

Lastly, websites like TemplateLab and JotForm offer downloadable templates for check receipts that are both free and simple to edit. These templates are typically available in multiple formats like PDF, Word, and Excel, allowing flexibility in how you want to use them.

Creating a Clear “Paid by Check” Receipt Template

To create an effective “Paid by Check” receipt template, focus on clarity and simplicity. Follow these key steps to ensure your template is both functional and professional.

Start by including the basic elements that any receipt should have: the name of your business, contact information, and the date of the transaction. These will help the recipient easily identify the transaction and your business.

Ensure that the receipt specifies the payment method as “Paid by Check.” Include the check number, the bank name, and the check amount. This information confirms that the payment was made using a check, which is important for both parties.

Include a section for the description of the goods or services provided. This helps clarify what was paid for and avoids any confusion down the line.

Finally, leave space for both the issuer’s and recipient’s signatures to validate the receipt. It’s a small but important detail that adds authenticity to the transaction.

| Field | Details |

|---|---|

| Business Name | Include your company name, address, and contact info. |

| Date | Specify the date of the transaction. |

| Payment Method | Clearly state “Paid by Check.” |

| Check Number | Include the number of the check used for the payment. |

| Bank Name | Include the name of the bank the check was drawn from. |

| Amount Paid | Write the total amount paid, as shown on the check. |

| Description of Goods/Services | Provide a brief description of what was purchased or paid for. |

| Signatures | Include spaces for both the issuer and recipient to sign. |

This template structure will make your receipts clear and organized, ensuring that both parties are fully informed about the transaction.