If you’re looking to simplify your payroll process, a free payroll check and receipt template is an excellent tool to have. It can save time, reduce errors, and help ensure that all payroll transactions are clear and documented. Downloading a ready-made template will help streamline your payroll system and provide employees with a professional pay stub.

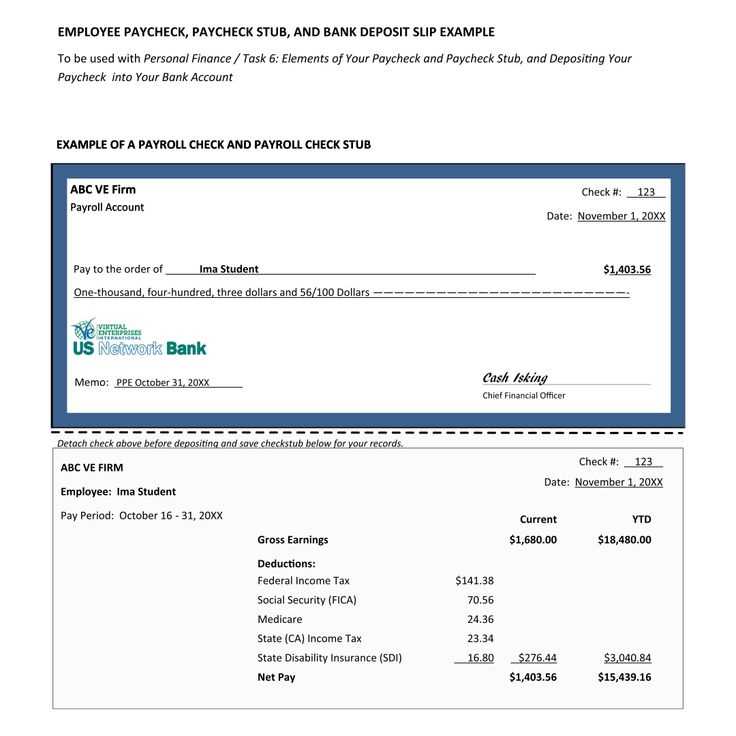

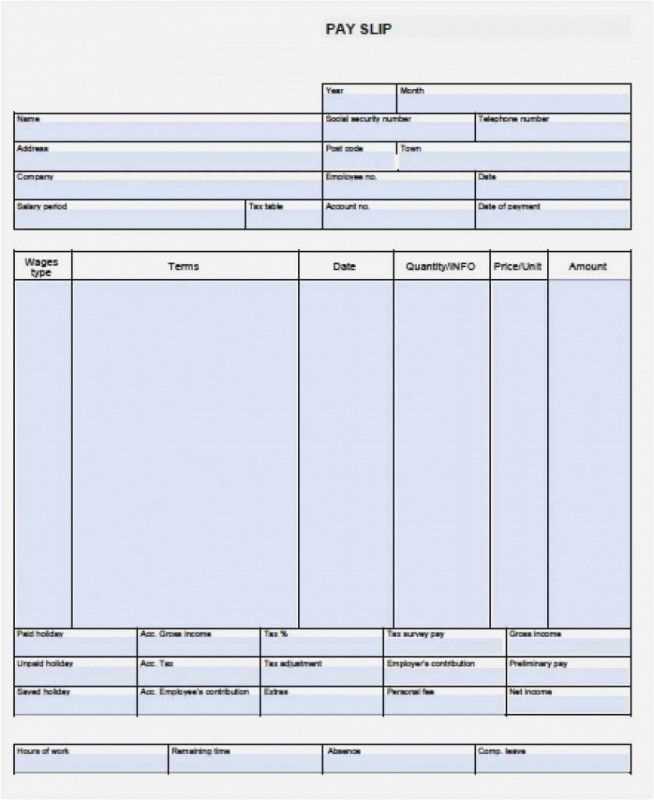

The template typically includes fields for essential details such as employee name, hours worked, pay rate, deductions, and net pay. By customizing these sections according to your needs, you can ensure that all payroll records are accurate and easy to track.

Incorporating such templates into your workflow will keep you organized and compliant with any local payroll requirements. Using a template also helps eliminate the need for manual calculations, reducing the risk of mistakes. This straightforward approach to managing payroll can benefit both small businesses and freelancers.

Here is the revised version:

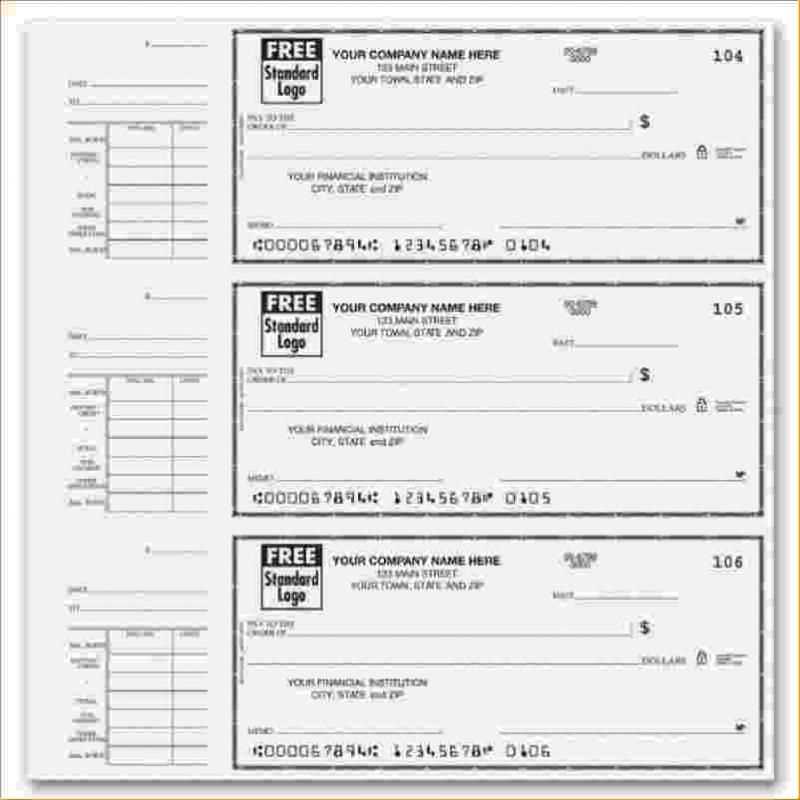

For a clean and accurate payroll check template, ensure you include all necessary elements. Start with the employer’s name, address, and contact details, followed by the employee’s name and designation. Specify the payment period, gross pay, deductions, and net pay. Use clear, legible fonts and structured spacing to separate each section for easy reading. Include a space for any additional notes or benefits. Always make sure the template is customizable for different payroll needs. Double-check formulas to ensure accurate calculations before using the template in practice.

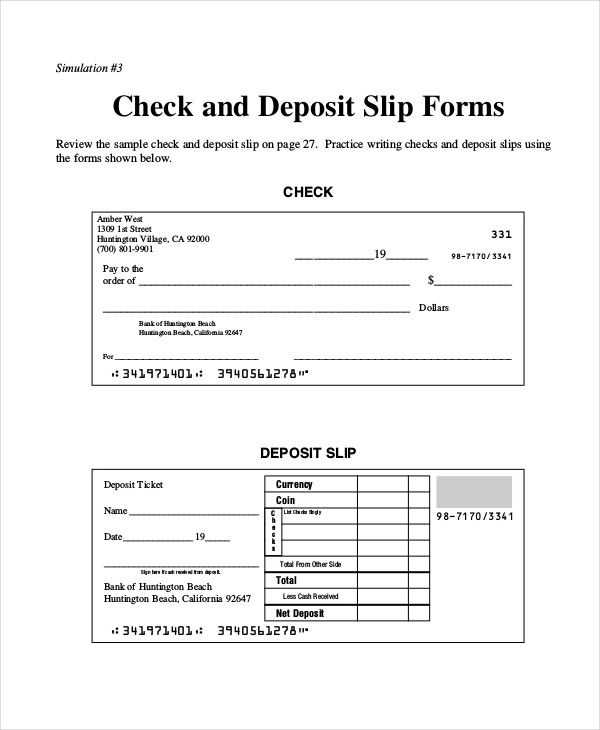

Free Payroll Check and Receipt Form

Customizing a paycheck template requires attention to detail. Ensure that the employee’s name, address, and payment period are clearly displayed. Include gross pay, deductions, taxes, and net pay to avoid confusion. You can modify the layout, but these elements must remain visible and easy to read.

How to Customize a Paycheck Template

Start by selecting a basic template that fits your company’s needs. Next, add fields for employee information such as name, job title, and department. Make sure to incorporate space for tax withholdings, benefits, and any other deductions specific to your business. Include a section that clearly shows the net payment after all deductions have been accounted for. Customize the colors and fonts to align with your company’s branding, but keep readability as your priority.

Best Practices for Using Receipt Templates

When using receipt templates, ensure that all payment details are captured, such as the amount paid, payment method, and date. Include a unique receipt number for record-keeping. For transparency, ensure that deductions and any additional charges are listed separately. Tailor the template to the type of receipt–whether it’s for payroll, reimbursements, or expense reports.

Common Mistakes to Avoid When Creating Payroll Forms

Avoid omitting critical details like employee tax information, pay period, and total deductions. Double-check for errors in the math, especially for taxes and benefits. Failing to include a pay stub or receipt number can lead to confusion. Additionally, ensure that the font size and layout are consistent throughout the form to maintain professionalism.