How to Use a Cash Receipt Template

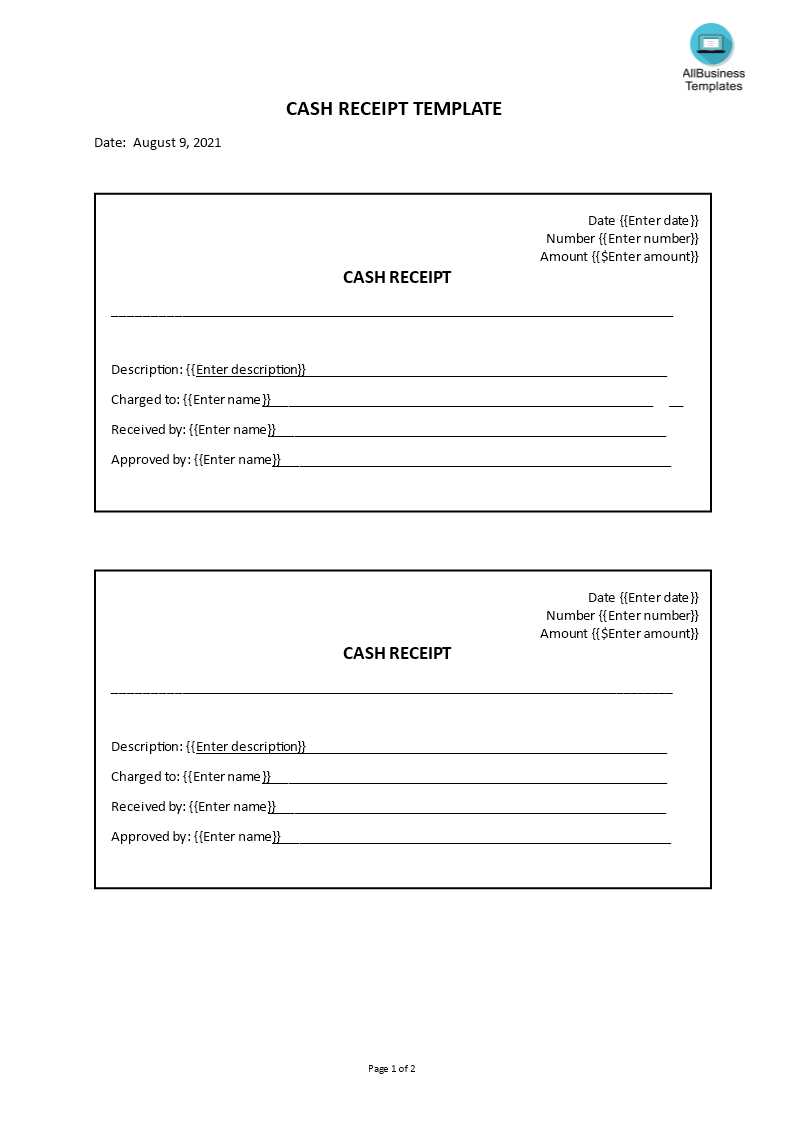

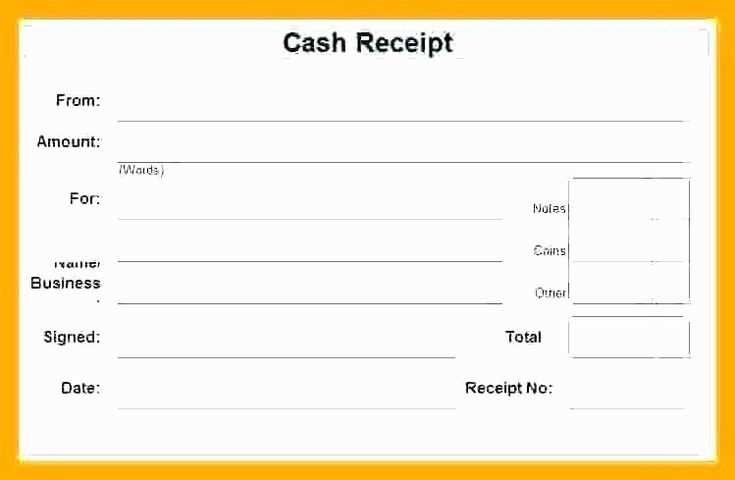

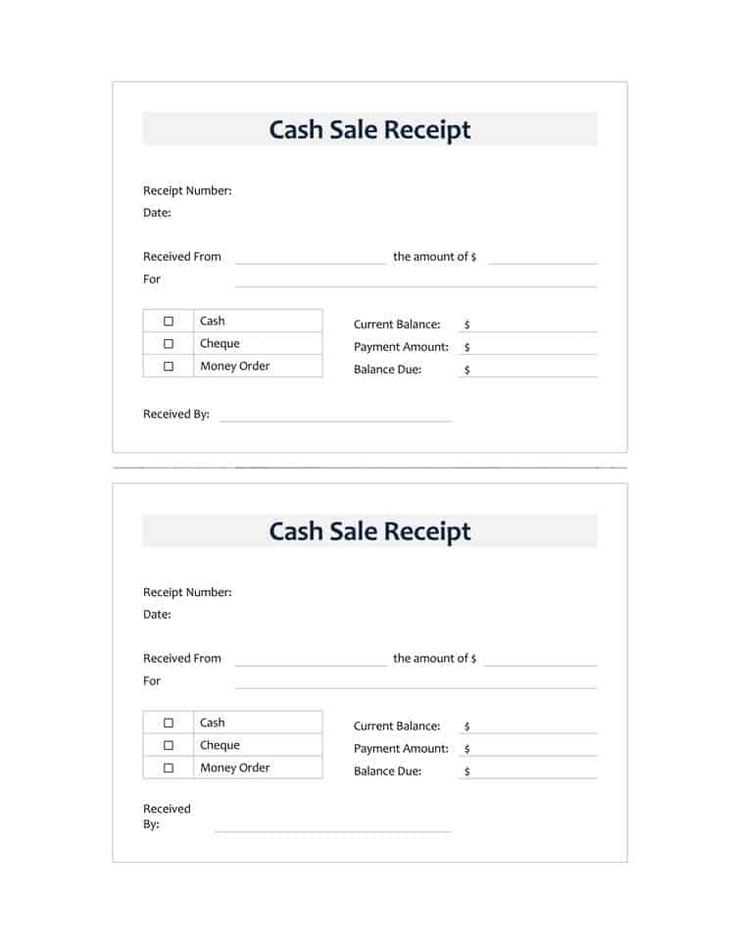

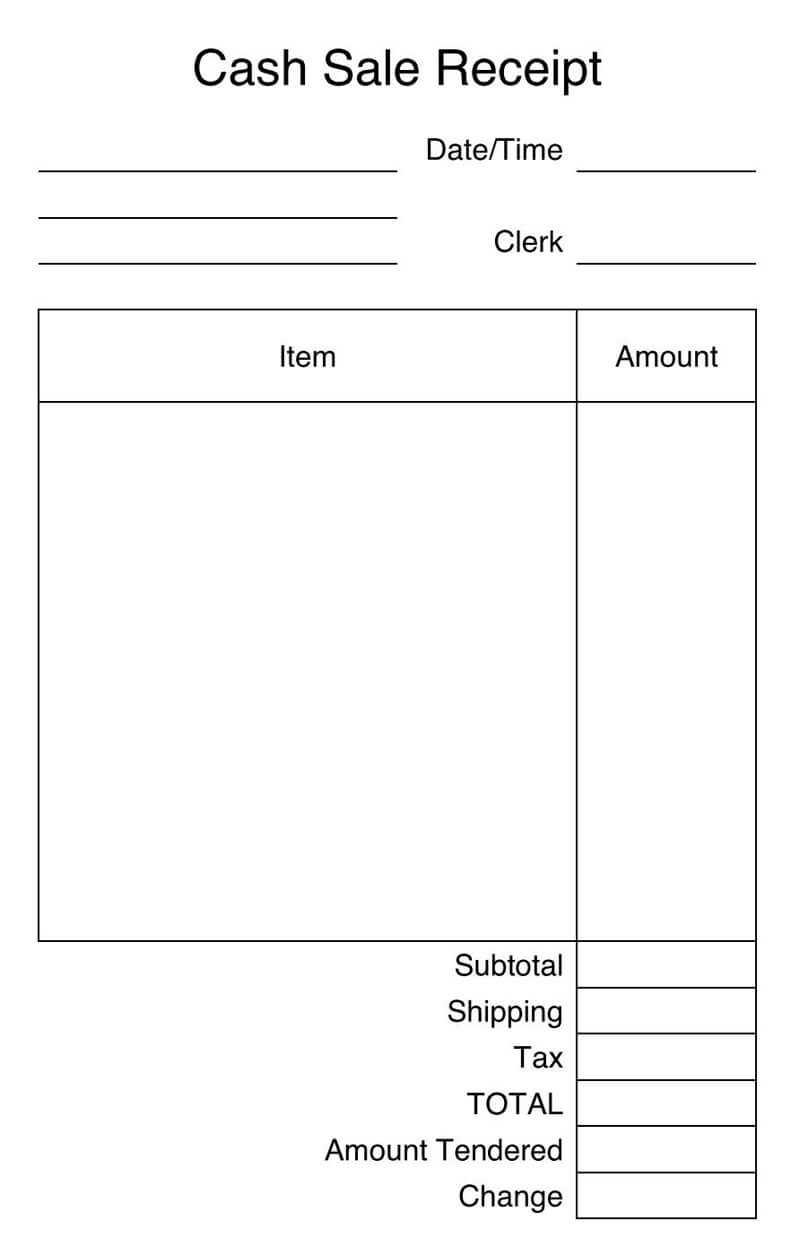

Start by selecting a cash receipt template that suits your needs. Ensure it includes essential information such as the date, the name of the payer, amount paid, and the purpose of the payment. A template makes it easier to track transactions and keep records organized.

Key Elements of a Cash Receipt

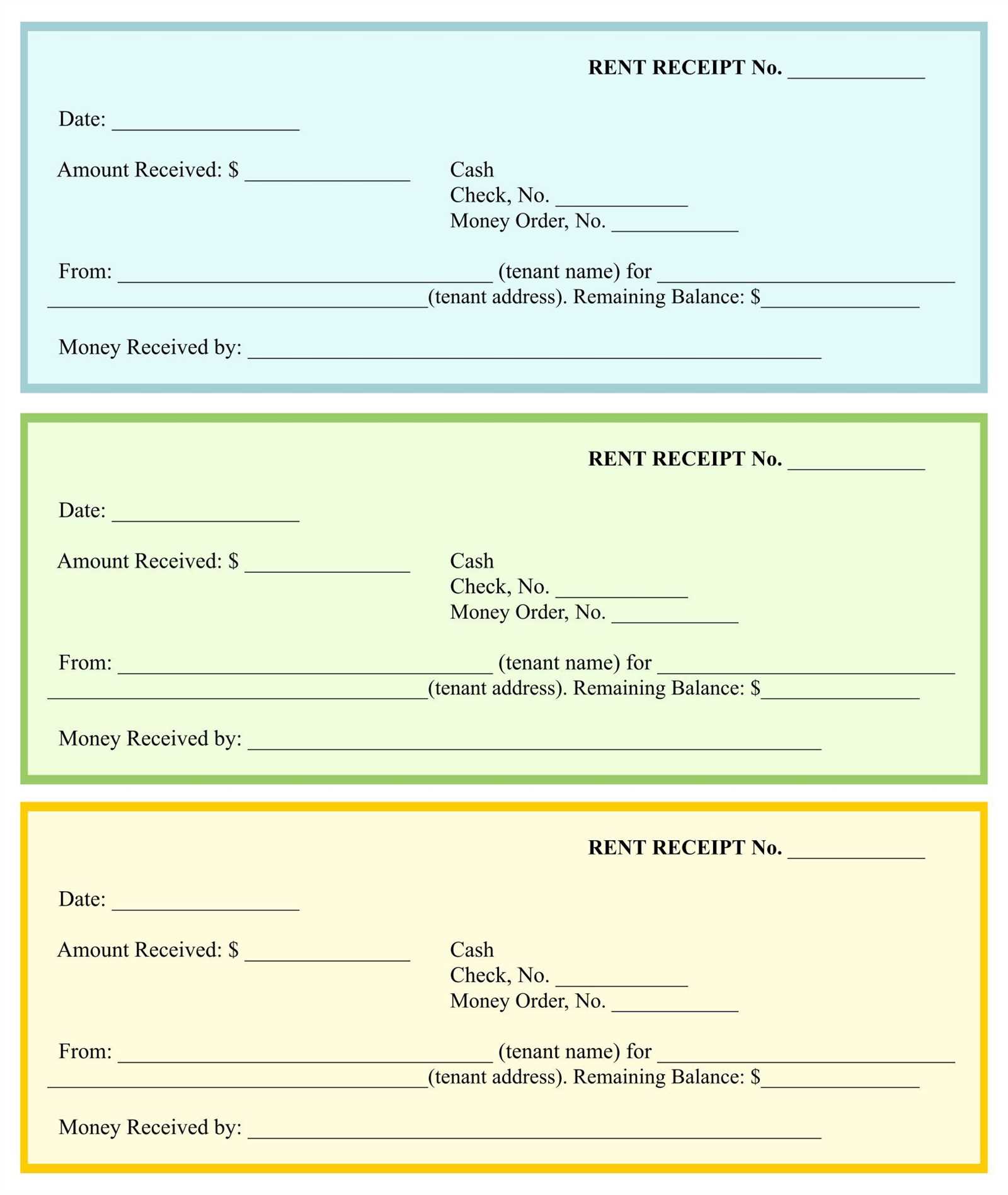

- Receipt Number: Assign a unique number for tracking purposes.

- Date of Payment: Record the exact date when the payment was made.

- Payer Information: Include the name and contact details of the payer.

- Amount Paid: Clearly state the amount of money received.

- Purpose of Payment: Specify what the payment is for (e.g., goods, services, etc.).

- Signature: Provide a space for both the payer’s and recipient’s signatures.

Where to Find Free Templates

Several websites offer free downloadable cash receipt templates in PDF format. Choose a reliable source that offers editable versions, allowing you to customize the receipt for each transaction. Websites like Canva, Template.net, and Microsoft Office templates provide user-friendly options to download and print directly.

Customizing Your Cash Receipt

Customizing a cash receipt template can make it more professional and better suited to your needs. Add your company logo, adjust fonts for readability, or include any other relevant fields such as tax information or payment methods.

Advantages of Using a Template

- Consistency: Templates ensure uniformity in your receipts.

- Time-Saving: Reduce time spent creating receipts from scratch.

- Accuracy: Minimize errors by using a pre-designed format.

Free PDF Download Cash Receipt Template

Where to Find Free PDF Templates for Cash Receipts

How to Customize a Receipt Template for Your Business

Key Details to Include in a Cash Receipt

Advantages of Using PDF Format for Receipts

Step-by-Step Guide to Completing a Cash Receipt Template

Common Errors to Avoid When Using Receipt Templates

For an easy way to track payments, download free PDF cash receipt templates from trusted websites such as Template.net, Jotform, and Invoice Generator. These resources provide templates that are ready to use, saving you time and effort in creating your own. Choose one that suits your business needs and download it in PDF format.

How to Customize a Receipt Template for Your Business

To tailor a receipt to your business, start by adding your company name, logo, and contact details at the top. Include payment-specific fields such as the payer’s name, payment amount, and date of transaction. You can also add fields for services or products purchased, payment method, and any discounts offered. Make sure the layout is clear and easy to read to avoid confusion.

Key Details to Include in a Cash Receipt

A complete cash receipt should include the date of the transaction, the name of the payer, payment amount, payment method, and the details of the product or service provided. It’s also helpful to include a unique receipt number for tracking purposes, as well as your business’s contact information. Ensure accuracy to maintain proper records for tax and accounting purposes.

Using PDF format for receipts offers several advantages. PDFs are universally accessible, ensuring that your receipt can be opened on any device without the need for specialized software. They are also secure, as the information can be protected with passwords and encryption, preventing unauthorized access or changes. Additionally, PDFs retain their formatting, making them look professional and ensuring that details are not altered.

To complete a cash receipt template, follow these steps: open the template in a PDF editor or a word processor that supports PDF format, fill in all necessary information like the transaction details, and double-check for accuracy. Once you’ve reviewed the receipt, save it and send it to the payer or keep it for your records.

Common errors to avoid include incorrect payment amounts, missing payer details, and forgetting to add a receipt number. Additionally, ensure that the receipt clearly states whether the payment is partial or complete. Double-checking all information before finalizing the document will help avoid costly mistakes and ensure that both you and your customer have a clear record of the transaction.