Use these free templates to streamline your business operations. Start with contracts: easily editable and designed to cover various agreements, ensuring clarity and professionalism. Customizable sections allow you to align them with your specific needs, saving you both time and money.

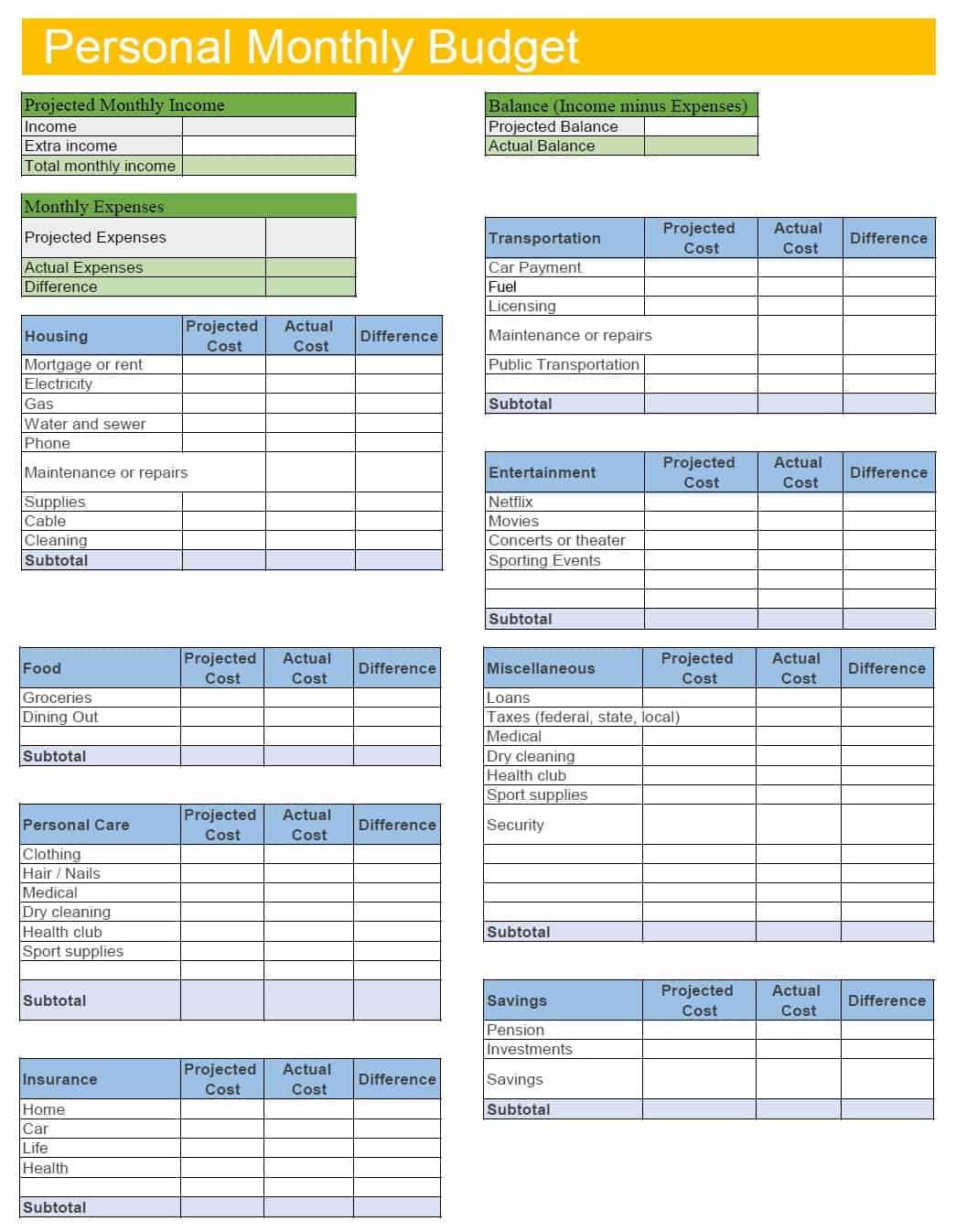

Next, manage your finances effectively with the budget templates. These sheets provide a simple yet detailed layout for tracking income, expenses, and savings. Easily adjust them to fit any business size or industry, helping you stay on top of your financial goals without unnecessary complexity.

For scheduling, the templates offer a clear structure for organizing appointments, meetings, or project timelines. Their user-friendly design helps ensure you never miss a deadline, improving productivity while maintaining organization.

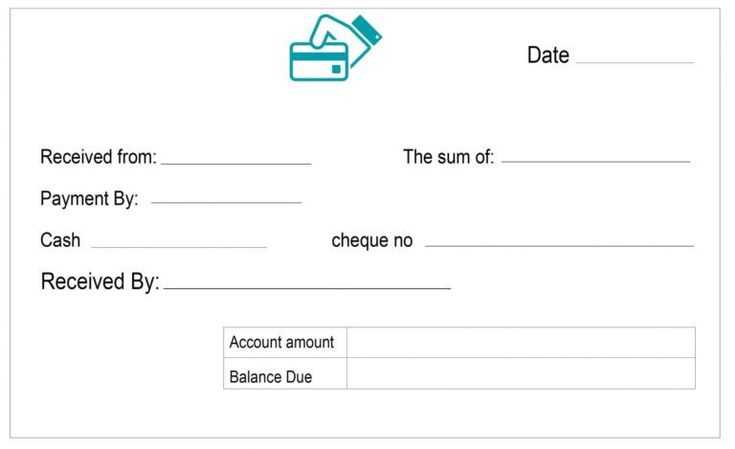

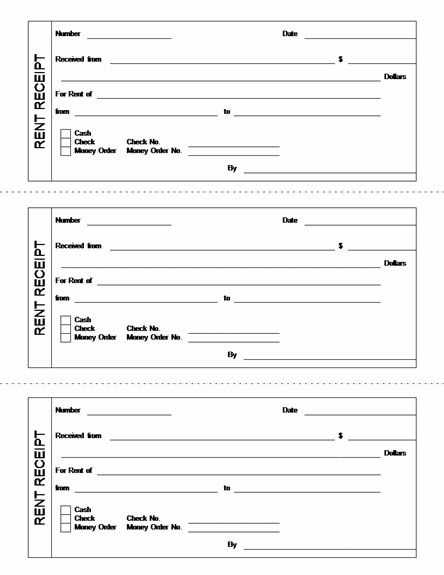

Finally, the receipt templates help you keep a clean record of every transaction. Simple, printable, and organized, they allow you to issue receipts that meet legal standards and provide a professional impression to clients.

Here’s the revised version:

When managing your business finances, keeping contracts, budgets, and receipts organized is key to smooth operations. Start by utilizing free printable templates tailored for your specific needs. These templates save you time, ensure consistency, and help you maintain a professional image. Below are three types of templates you can integrate into your workflow:

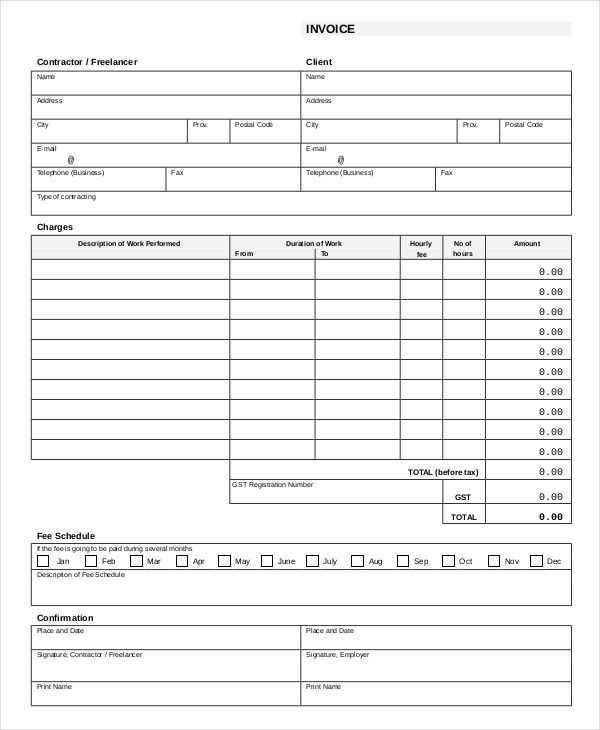

Contract Templates

Use customizable contract templates for client agreements, vendor services, and partnership deals. These templates come with pre-filled fields for terms, conditions, payment schedules, and signatures. Adjust the language as necessary, but keep the core details clear and concise.

Budget and Scheduling Templates

Budget templates provide an easy way to track income, expenses, and financial forecasts. Schedule templates allow you to manage project timelines, appointments, and deadlines efficiently. Download these templates and tailor them to match your specific business requirements.

By consistently using these templates, you’ll streamline your administrative tasks and focus more on growing your business. They ensure that you don’t miss important financial details and help you keep everything documented and accessible when needed.

- Free Printable Contracts, Budgeting, and Receipt Templates for Your Business

Choose templates that simplify your administrative tasks. Start with contract templates that are legally sound and adaptable to various business needs. Free printable contracts cover key areas like service agreements, non-disclosure agreements, and freelance contracts. You can find customizable options online that allow you to include specific terms tailored to your situation.

Budgeting templates are an easy way to keep track of income and expenses. Use templates that break down your finances into clear categories, such as revenue, costs, savings, and investments. These tools help maintain a steady overview of your financial health and are simple to use, requiring minimal setup while giving you instant insight into your cash flow.

For receipt tracking, printable receipt templates are available to help organize purchases and expenses. These templates allow you to record key details like date, amount, and vendor, streamlining your record-keeping. They are especially useful for tax preparation and budgeting, helping you avoid errors and save time during audits or financial reviews.

All these templates are free to download, making them an accessible solution for any business. Save time, reduce errors, and stay organized by integrating these tools into your daily operations.

Custom contracts can streamline business operations and ensure that agreements align with specific needs. Tailoring contracts ensures clarity and protects all parties involved. Start by outlining the specific terms that are unique to each business arrangement.

Identify Key Details for Each Agreement

For every contract, focus on the unique elements of the deal. Whether it’s a service agreement, a partnership, or a product sale, include the scope of work, deliverables, deadlines, and payment terms. Highlight any contingencies or terms that might change based on the specific circumstances of the agreement.

Include Terms for Dispute Resolution and Termination

Clearly state the procedures for resolving disputes, should they arise. Specify mediation or arbitration as the first steps before legal action. Additionally, include a termination clause that details how and when the agreement can be ended by either party, including notice periods and conditions for early termination.

By personalizing your contracts, you minimize misunderstandings and lay the foundation for stronger business relationships. Keep the language simple, direct, and relevant to your specific business needs.

Creating a budget template for your business requires focusing on income, expenses, and setting realistic financial goals. A simple, yet functional budget template can help keep your business finances under control. Here’s how to build one:

- Track all income sources: List every revenue stream your business generates, including sales, services, and investments. Organize this section by categories such as product sales, service fees, and others.

- Detail fixed expenses: Identify all fixed costs such as rent, salaries, subscriptions, utilities, and insurance. These are regular, predictable payments that don’t change month-to-month.

- Account for variable expenses: These include supplies, marketing costs, transportation, and other costs that can fluctuate. Keeping track of these helps predict cash flow and adjust for fluctuations.

- Set financial goals: Include short-term and long-term financial goals. Break these down into actionable tasks that help meet profit targets, pay down debt, or save for future investments.

- Monitor monthly budget: Review your budget regularly, comparing actual income and expenses to what was planned. This allows for adjustments and improvements in your financial strategies.

- Leave room for unexpected costs: Allocate a portion of your budget to handle unforeseen expenses, such as repairs or urgent business needs.

- Use a spreadsheet tool: Implement tools like Excel or Google Sheets to easily track and update your budget. Templates are available, or you can design a customized one with columns for each category and row for each month.

By consistently following these steps and adjusting based on your business’s growth, your budget template will become an effective tool to manage your finances efficiently and plan for future success.

Organizing receipts effectively can save you a significant amount of time and effort in managing your business finances. By using receipt templates, you can quickly track expenses, simplify bookkeeping, and avoid the mess of paper receipts that are prone to getting lost. Customizable templates allow you to include all necessary details, such as the date, item description, amount, and payment method, ensuring your records are accurate and easy to reference later.

Automating Receipt Generation

Automating your receipt creation process with templates ensures consistency. Instead of writing out receipts by hand for every transaction, a template can generate them instantly. This is particularly beneficial if your business deals with frequent or small transactions. Many free templates available online can be tailored to fit your needs, saving you from creating receipts from scratch each time. By automating the process, you also reduce human error and improve the quality of your records.

Making Tax Season Simpler

Receipt templates simplify tax season by keeping all your receipts organized in one place. With categorized sections for expenses, your accounting team can easily prepare for tax filing without having to sift through piles of receipts. The clear format and consistency of templates ensure you won’t miss any deductions. Moreover, having a digital copy of each receipt stored securely can be helpful in case of audits.

Incorporating receipt templates into your business routine helps keep financial documentation clear and manageable, so you can focus on growth rather than paperwork. It’s a small but impactful change to improve your business operations.

Organizing your business contracts, budgets, and receipts efficiently begins with selecting the right templates. A well-structured document saves time, reduces errors, and simplifies your workflow. Start by finding a template that suits the specific needs of your business.

Choose Clear and Simple Templates

Ensure the templates you select are straightforward and easy to modify. Avoid overly complex layouts. A clean design allows you to focus on the content rather than figuring out the format. Look for templates that already include placeholders for key information such as dates, payment terms, and signatures.

Integrate Customization Options

Your templates should be adaptable to accommodate unique business requirements. Look for contracts and receipts templates where you can easily add or remove clauses. Having a customizable budget template helps adjust figures and categories as your business evolves.

Finally, make sure the templates you use are printable. This ensures that you can hand over physical copies or keep hard copies for records. Efficient templates reduce administrative time and help maintain accurate documentation.