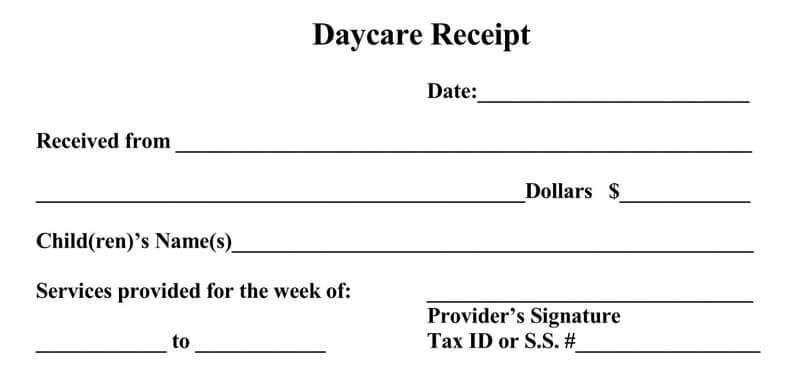

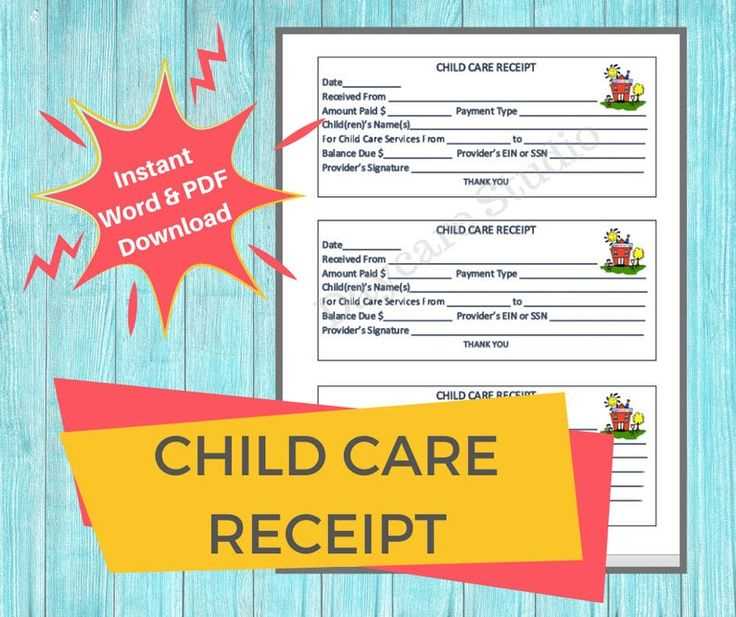

Having a reliable daycare receipt template can make financial tracking and tax filing much simpler. A printable template saves you time and ensures accuracy. Whether you’re a parent or a daycare provider, using a standard template helps maintain clarity in your records.

Stay organized with a pre-designed template that includes fields for all necessary details such as date, services rendered, amounts paid, and the provider’s information. This will help you quickly fill out receipts without missing important data.

By using a printable daycare receipt, you can easily adjust it to your needs. Simply enter the required information and print it out for your records. This method provides both convenience and efficiency, reducing the chances of errors.

Many online platforms offer free printable daycare receipt templates that you can customize. Look for a layout that suits your preferences and ensures compliance with any relevant tax regulations.

Here are the corrected lines:

Ensure that the receipt includes a clear header with your daycare business name and address. This establishes the legitimacy of the transaction right away.

Specify the date of service and the total amount charged. Make sure the dates match the time the service was provided, and the total amount should be clearly visible.

Include a breakdown of the services rendered. For example:

- Hourly rate for childcare

- Additional charges for meals or special activities

- Discounts (if applicable)

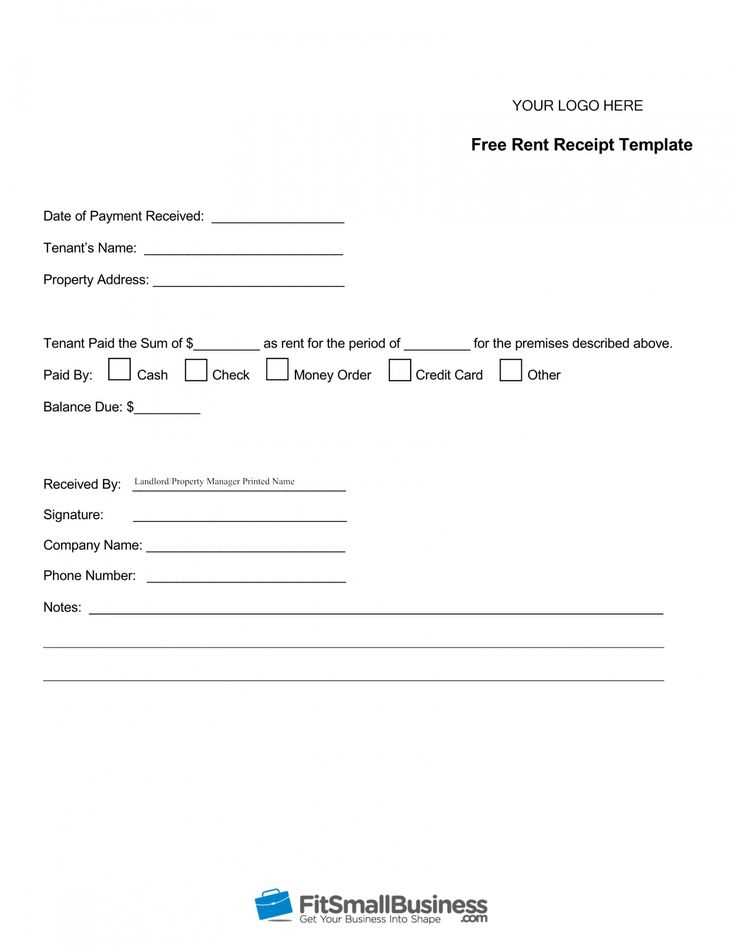

Provide the payment method, whether it’s cash, credit card, or another form. This adds transparency and helps maintain accurate records.

Make sure to include your contact information in case any questions arise later. This should include your phone number and email address.

Lastly, make the receipt available in both printable and digital formats. This way, parents can easily access the receipt when needed.

- Free Printable Daycare Receipt Template

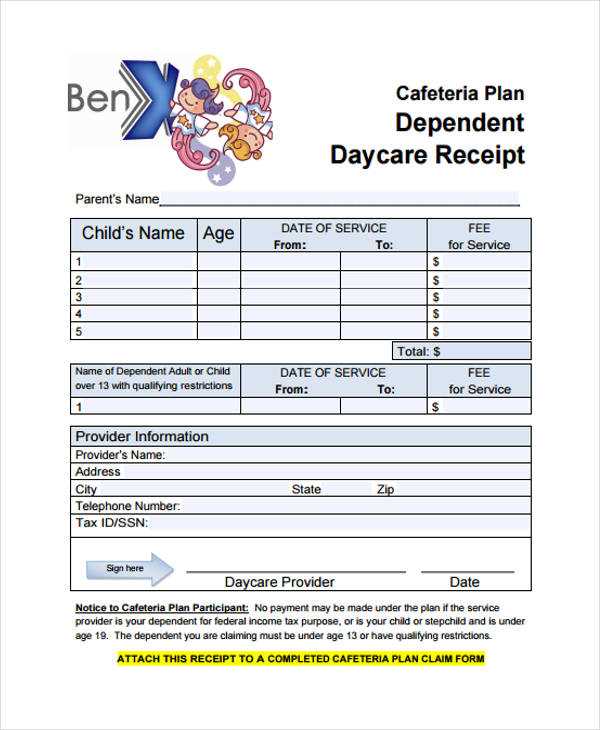

To create a daycare receipt, start by ensuring it contains all the necessary details for transparency and ease of use. A well-structured receipt should include the name of the daycare provider, address, and contact information. It should also list the parent’s or guardian’s name, the child’s name, the services provided, and the total amount paid. If applicable, break down the charges into categories such as tuition, meals, or activity fees.

Key Elements to Include

Here’s a checklist for a daycare receipt template:

- Provider’s name and business details

- Parent or guardian’s name and contact details

- Child’s name

- Date(s) of service

- Detailed description of services rendered (e.g., daily care, after-school program)

- Total amount charged and any discounts applied

- Payment method (cash, check, or credit card)

- Date of payment

- Receipt number or reference for tracking purposes

How to Use a Printable Template

Choose a free printable daycare receipt template that already includes these fields. Customize the template with your daycare’s logo and contact information, then print or send it electronically to parents. Make sure the template is easy to edit and that it accommodates different payment structures, whether you charge weekly, monthly, or based on services rendered. For efficient record-keeping, save copies of the receipts for tax or audit purposes.

To make a daycare receipt more relevant, include specific details such as the daycare’s name, address, and contact information at the top. This provides clear identification and ensures the receipt looks professional. Additionally, list any required tax identification numbers or business registration information based on local regulations.

Clarify Payment and Service Breakdown

Customize the receipt to reflect the payment structure you use. If clients pay weekly, monthly, or by specific sessions, include these time frames. Break down the amount for each service, such as hourly rates or additional charges like late fees. Including a breakdown of services and payments can help avoid confusion and make the receipt more useful for clients’ records.

Incorporate Personalization for Each Client

Each receipt should include the child’s name, the date of the service, and the total amount paid. This adds clarity and makes the receipt tailored to each client. A payment method field (e.g., cash, check, credit card) should also be included, allowing clients to track how they paid for services. This personalized approach makes receipts more organized and straightforward.

Click the download button to start the process of saving your receipt template. Make sure the file is saved in a location where you can easily access it later, such as your desktop or downloads folder.

Once the file is downloaded, open it using a PDF reader or spreadsheet software, depending on the file format you selected. Most templates are in PDF format for ease of use, but some may be in Excel or Word formats. Ensure that you have the required software installed to view and edit the template.

If you need to make any customizations, such as adding your daycare’s name or logo, open the template in the appropriate software and fill in the necessary fields. Save the document after making changes to avoid losing your edits.

To print, click on the “Print” option in the software you’re using. Check the print settings to ensure the template fits correctly on your page. Adjust margins or scaling if needed before hitting the print button.

Once printed, you’re ready to use the receipt template for your daycare transactions. Keep a copy for your records and issue the printed receipt to clients as needed.

Make sure to include the following key details on your daycare receipt for both tax and legal purposes:

1. Daycare Provider’s Information

Include the full name of the daycare provider, along with their business name (if applicable), address, phone number, and email. This ensures your receipt is traceable to a legitimate service provider for tax verification and potential legal matters.

2. Dates of Service

Clearly indicate the start and end dates of the service period covered by the receipt. This is important for both tax deductions and for keeping records in case of legal disputes regarding the care provided.

3. Amount Paid

List the total amount paid for the services. If applicable, include a breakdown of the charges (e.g., hourly rate, flat fee, or additional fees for activities or meals). This is crucial for both tax reporting and legal documentation purposes.

4. Tax Identification Number

For tax purposes, include the daycare provider’s Tax Identification Number (TIN) or Employer Identification Number (EIN). This helps verify the legitimacy of the provider and allows for proper tax deductions or credits.

5. Payment Method

Specify the method of payment, whether it was cash, check, credit card, or another method. This creates a clear trail for financial reporting and helps confirm the payment was made.

How to Customize Your Printable Daycare Receipt

To create a functional daycare payment record, you can easily modify a printable template that suits your needs. Focus on providing accurate information such as the date, service details, and the total amount paid.

Key Elements to Include

| Field | Description |

|---|---|

| Date | The specific day of the transaction. |

| Provider Name | Include the daycare provider’s full name or business name. |

| Service Provided | Detail the daycare services rendered, including any special care or additional services. |

| Amount Paid | State the exact amount paid for the services. |

| Payment Method | Indicate how the payment was made, whether by cash, check, or credit card. |

Formatting Tips

Ensure that your receipt is clear and organized. Align text properly and leave space between key sections for easy reading. If you’re printing multiple copies, use a template that allows for customization, like a word processor or spreadsheet software.