Download a free printable donation receipt template to simplify record-keeping and tax reporting. Whether you manage a nonprofit organization or accept donations for a cause, a well-structured receipt helps both donors and recipients track contributions and comply with legal requirements.

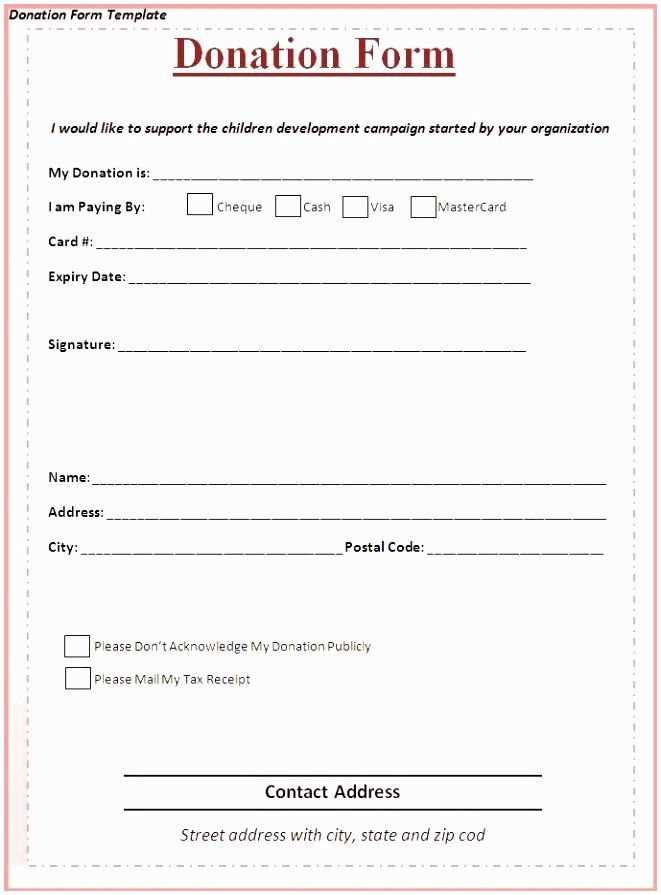

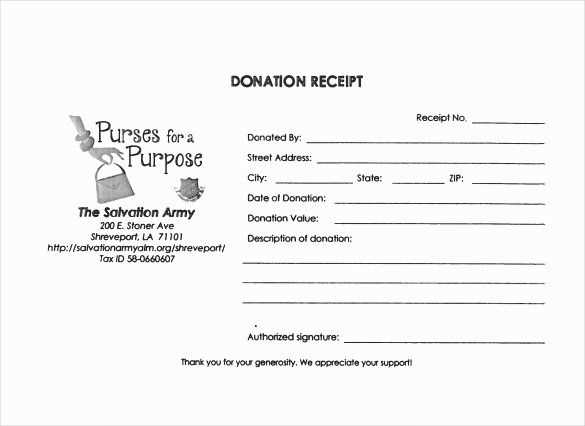

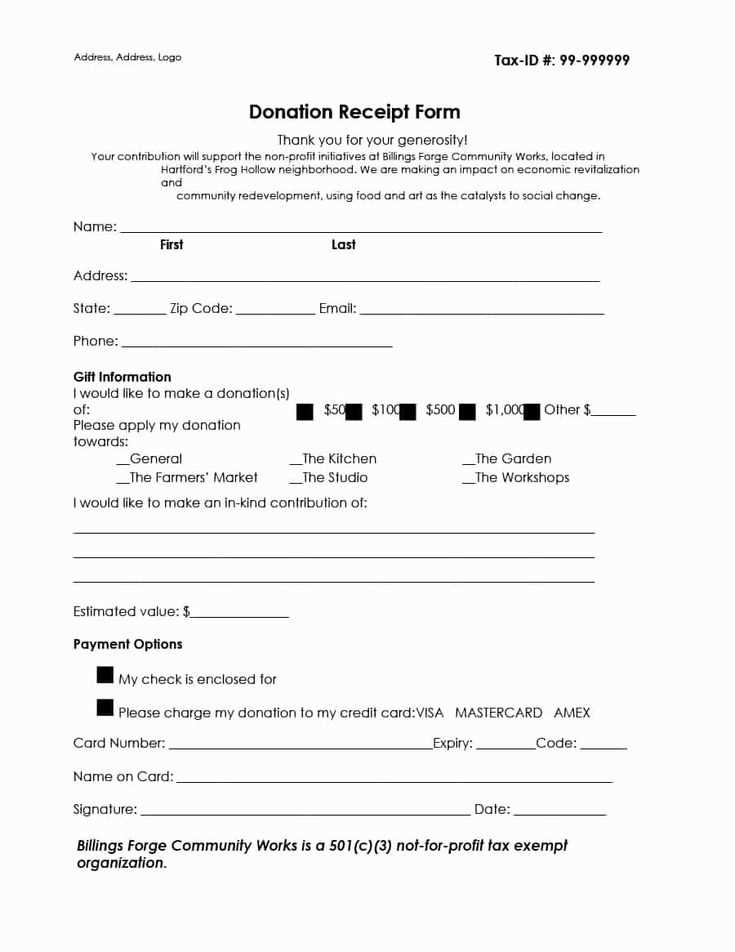

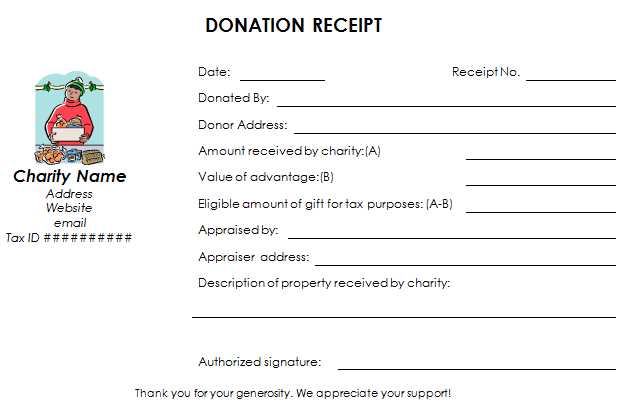

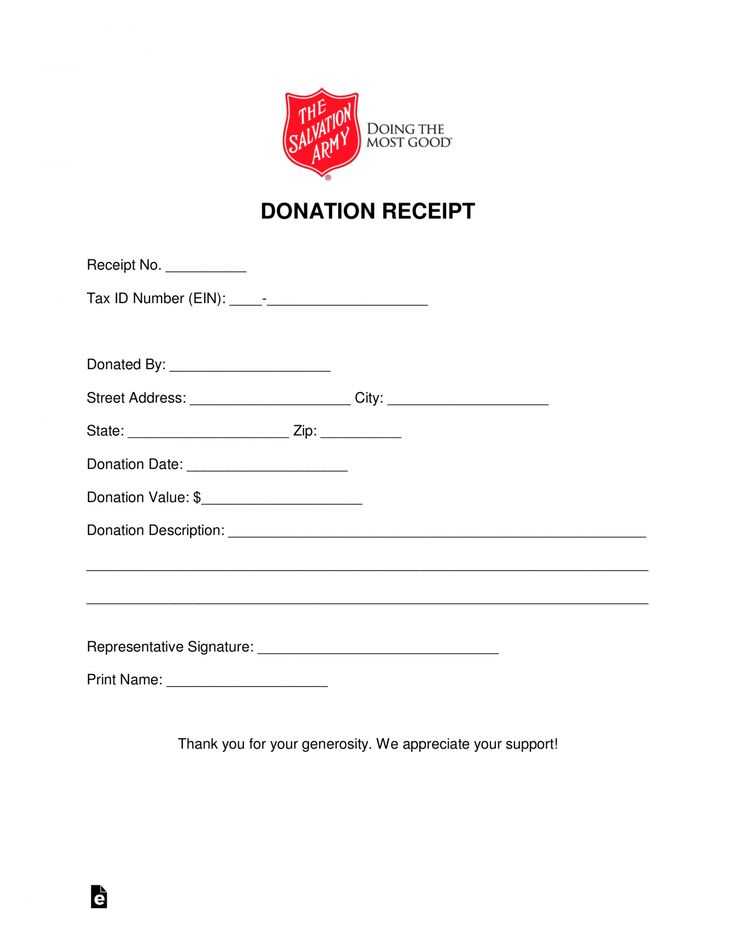

A proper donation receipt should include the donor’s name, date of donation, amount or item description, and the organization’s details. If the contribution exceeds a certain threshold, additional information may be required for tax deductions. Most templates come in PDF, Word, or Excel formats, making them easy to customize.

Choose a template that fits your needs, print it, and issue receipts instantly. For recurring donations, digital templates allow quick modifications and reusability. Keeping well-organized donation records ensures transparency and simplifies financial management for both donors and organizations.

Here is an option with redundancy removed while maintaining the meaning:

To create a clean and concise donation receipt template, focus on the key elements. Include the donor’s name, donation amount, and date, ensuring these details are clear and straightforward. Avoid excessive wording or repetitive information. The format should be simple yet informative. Use bullet points for clarity and include necessary details such as tax-exempt status, if applicable. Keep the language direct and avoid any unnecessary phrasing that doesn’t add value to the receipt itself.

Key Sections to Include

1. Donor’s Full Name

2. Donation Amount

3. Date of Donation

4. Acknowledgment of Donation (for tax purposes)

Tips for Design

Keep fonts readable and ensure there is enough white space to avoid clutter. Align key information clearly for easy reading, and use simple, professional colors. Avoid unnecessary graphics or distractions that could take away from the core details.

- Free Printable Donation Receipt Form

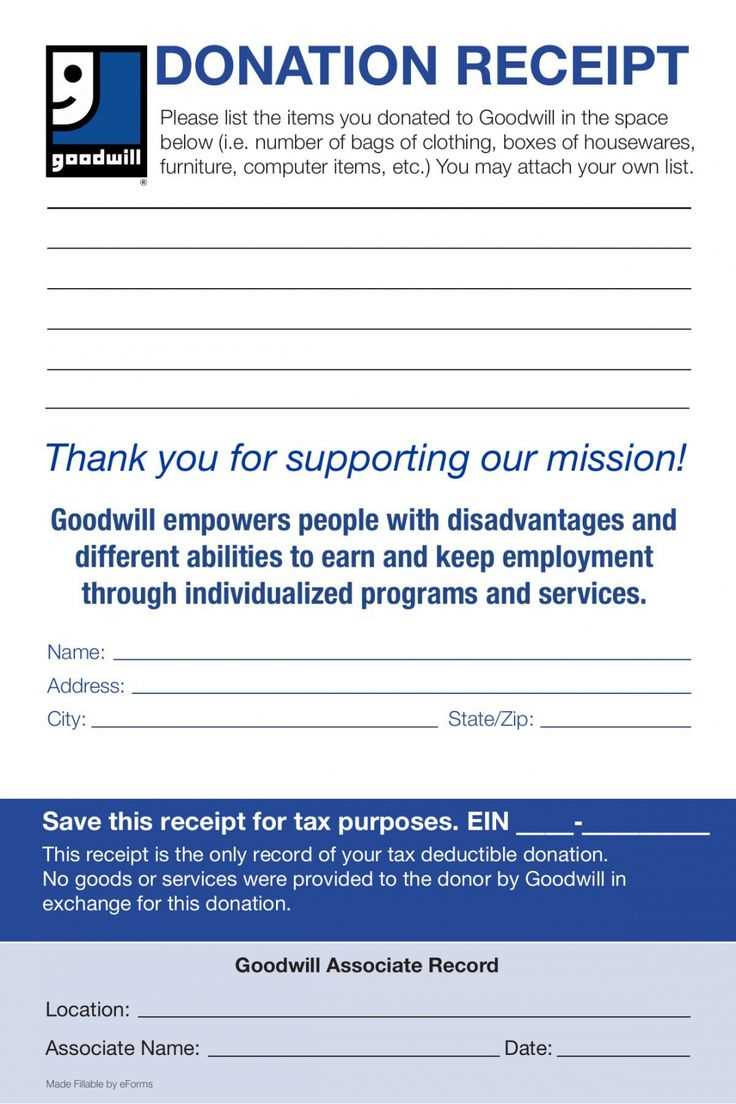

To create a donation receipt form, include the donor’s name, the donation date, and the amount given. Specify whether the donation is monetary or material. If it’s a non-cash donation, provide a description of the item(s) donated and their estimated value. It’s essential to include the name of the receiving organization, along with its address and contact information. Clearly state if the donation is tax-deductible, and include a statement confirming no goods or services were provided in exchange for the donation, unless applicable.

Template Guidelines

Design your form to capture the necessary details quickly and clearly. Start with a heading indicating the receipt is for a charitable donation. Below that, list the donor’s information, followed by the donation specifics. For ease of use, include a section for both cash and non-cash donations with clear input fields. If applicable, leave space for any comments or additional notes. Ensure the form fits on a single page for printing without extra hassle.

Printable Format

Offer the form as a downloadable PDF to ensure proper formatting across different devices and platforms. This makes it easier for users to print or store the document without worrying about compatibility issues. Make sure the form is editable, so it can be filled out directly on a computer or printed and completed manually.

Tip: Regularly review your form for accuracy, especially regarding the tax-deductible status of donations, as legal requirements may change. Keep your receipts in a well-organized system for easy reference when needed.

To make a donation receipt clear and usable for tax purposes, include the following key elements:

- Donor’s Name and Contact Information – Include the name of the donor and their contact details, such as address or email, to verify their identity.

- Date of Donation – Record the exact date the donation was received, which is critical for tax records.

- Donation Amount – Specify the dollar amount donated. If the donation is in the form of goods, describe the items and their estimated value.

- Organization Name and Contact Info – Clearly mention the name of your organization along with its address, phone number, and tax-exempt status number.

- Statement of No Goods or Services – If applicable, include a statement that no goods or services were provided in exchange for the donation. This is necessary for tax deduction purposes.

- Tax-Exempt Status – If your organization is tax-exempt, include a reference to the IRS tax-exempt number.

These elements ensure that the receipt meets legal requirements and provides clear information for the donor’s tax records.

How to Customize a Printable Template for Receipts

To customize a printable receipt template, begin by adjusting the header section. Replace default text with your organization’s name, logo, and contact details. Ensure that the font is legible and matches your branding style. If the template allows, add color to make it align with your visual identity.

Edit Receipt Details

Next, update the fields for transaction details. Include the recipient’s name, the amount donated, and the donation date. Modify any placeholder text and ensure that the donation amount is displayed clearly. If necessary, add a description of the purpose of the donation or any relevant reference number for record-keeping.

Adjust the Footer

Customize the footer with a thank-you message or additional instructions. Include any necessary tax information or disclaimers for legal compliance. Check the alignment of text in the footer to maintain a clean, professional look across the document.

Once you’ve tailored the sections, double-check all input fields for accuracy. Ensure that the template’s layout is balanced and visually appealing before printing. Save the document as a PDF to preserve formatting and make it easy to share digitally.

Donation receipts should clearly identify the donor, organization, and donation amount. This ensures transparency and meets IRS requirements for tax deductions. Ensure the receipt includes the organization’s name, address, and EIN (Employer Identification Number). It should also specify whether the donation is tax-deductible, along with any goods or services the donor received in return.

For cash donations, a receipt must state the amount donated. For non-cash donations, provide a description of the item, its condition, and the estimated value. The IRS does not require organizations to assign a value to donated goods, but it is recommended to include a fair market value estimate for the donor’s benefit.

Donation receipts must be provided in a timely manner. For donations over $250, organizations need to provide a written acknowledgment before the donor can claim a tax deduction. If goods or services were exchanged for the donation, the receipt must list the fair market value of the items received and clearly state that the deduction is for the amount exceeding this value.

Keep in mind that both the donor and organization are responsible for maintaining records of donations. Donors should retain receipts for their tax returns, while organizations should ensure their records are up to date in case of an audit. Accurate and clear documentation reduces the likelihood of issues arising during tax filing or audits.

Best File Formats for Printable Receipts

For printable donation receipts, choosing the right file format ensures compatibility, ease of use, and high-quality prints. Here are the best options:

| Format | Advantages | Best For |

|---|---|---|

| Widely accepted, preserves formatting, easy to print and share | Official donation receipts, tax purposes | |

| JPEG | Common, compact file size, compatible with most printers | Simple receipts, digital sharing |

| PNG | Supports transparent backgrounds, high-quality images | Receipts with logos or graphics |

| DOCX | Editable, easy to update and customize | Internal records, quick edits |

PDF stands out as the best option for most donation receipts, as it guarantees consistent formatting across different devices. JPEG and PNG are great for more casual receipts, especially when visuals are important. DOCX is ideal for internal uses when frequent changes are needed. Choose based on your needs and the level of professionalism required.

Several online platforms offer free donation receipt templates for download or customization. Popular resources include Google Docs, Microsoft Word, and dedicated websites that specialize in nonprofit tools. These sites usually allow you to select a template, make necessary edits, and print the receipt immediately.

Google Docs

Google Docs has a variety of donation receipt templates that can be accessed directly through the template gallery. Search for “donation receipt” within the templates section, and you’ll find customizable options ready for quick use. The benefit is the easy integration with Google Drive, making it simple to save and share receipts online.

Microsoft Word

If you prefer working in Microsoft Word, many websites, including Office Templates and Template.net, provide free downloadable templates. These are often editable and available in various formats, such as .docx and .pdf. You can personalize the template with your organization’s branding and recipient information.

Additionally, nonprofit websites and community-driven platforms may provide free donation receipt templates tailored to specific needs, including tax-exempt status details and donor acknowledgment guidelines. Make sure to check trusted nonprofit tool websites for specialized options.

Ensure your donation receipts include accurate information to prevent errors that could cause confusion or lead to compliance issues. Double-check details like donor names, donation amounts, and dates before issuing receipts.

1. Incorrect Donor Information

Donor names should match their official records. Small typos in names or addresses can lead to difficulties during tax filing. Always verify details directly with donors before issuing receipts.

2. Missing Legal Disclaimers

Nonprofit organizations must include specific legal disclaimers on receipts, such as the statement that no goods or services were exchanged in return for the donation. Missing these can make a receipt invalid for tax purposes.

Always consult your country’s tax regulations to ensure your receipts meet the necessary legal standards and include required statements.

3. Failure to Acknowledge Non-Cash Donations Properly

Non-cash donations, such as goods or property, require a specific valuation method on the receipt. Failing to do so can lead to complications with both the donor’s tax filings and your organization’s records.

Encourage donors to provide an estimated value of their non-cash donations, or include a disclaimer that they are responsible for determining the value themselves.

4. Omitting the Organization’s Information

Receipts must include your organization’s name, address, and tax-exempt status number. Without this, the receipt may not be valid for tax deductions. Always provide this information in a clear and accessible way on the receipt.

How to Create a Donation Receipt Template

Create a donation receipt that is simple and clear. Focus on these key components:

- Donor’s Information: Include the name, address, and contact details of the donor. This helps both parties for tax reporting and record-keeping.

- Organization’s Information: Add your charity or nonprofit’s name, address, and tax ID number.

- Donation Details: State the amount of the donation, whether it’s a monetary gift or an item, and the date received.

- Donation Type: Clearly specify whether the donation was cash, goods, or services, to ensure accurate tax deductions.

- Acknowledgment Statement: Include a phrase like, “No goods or services were provided in exchange for this donation,” if applicable, to confirm the tax-deductible status of the donation.

Ensure the template is easily editable so that it can be customized for each donor. Keep the design clean, with enough space to fill in all necessary details, and provide a simple confirmation of receipt for the donor’s peace of mind.