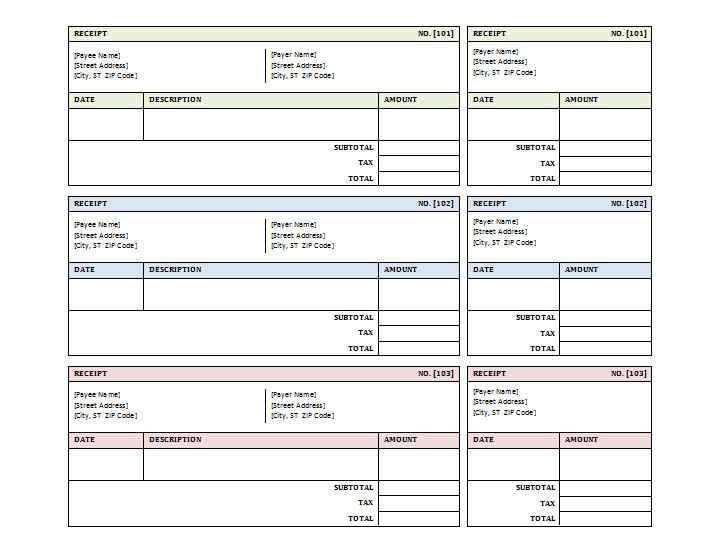

Download a printable sales receipt template to keep accurate transaction records. Whether you run a small business or need a simple way to document sales, a ready-made template saves time and ensures consistency. Just print, fill in the details, and hand it over to the buyer.

Choose a format that fits your needs. Some templates come in PDF for quick printing, while others are available in Excel or Word for easy editing. Look for options with pre-filled sections like date, item description, quantity, price, and total to speed up the process.

A structured receipt helps track payments and resolve disputes. Make sure the template includes space for a company name, contact details, and payment method. If you deal with taxes, find one that calculates tax amounts automatically.

Printing sales receipts doesn’t have to be complicated. With a well-designed template, you can create professional receipts without extra effort. Pick a template that suits your business, print as needed, and maintain organized records effortlessly.

Here’s a version without redundant word repetitions while preserving meaning:

Download a ready-to-use sales receipt template in PDF or Word format. Fill in essential details like date, buyer and seller information, item description, quantity, price, and payment method. Ensure accuracy to avoid disputes.

Customizing the Template

Modify fields to match business needs. Add a company logo, adjust font styles, or include a signature section for validation. Use spreadsheet software for automated calculations.

Printing and Storage

Print receipts on standard paper or preformatted stationery. Keep digital copies for tax and accounting purposes. Cloud storage offers secure backup and easy access.

- Free Printable Sales Invoice Template

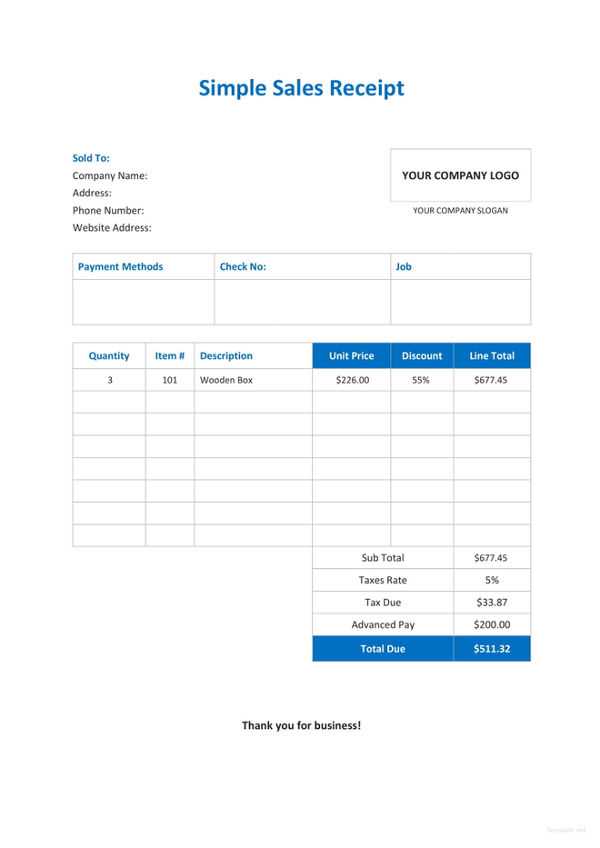

Choose a simple, customizable invoice template to fit your needs. Make sure it includes all key details: invoice number, date, buyer and seller information, item descriptions, quantities, prices, and total amount due. Clear itemization of charges avoids confusion and ensures smooth transactions. Include payment terms and any applicable taxes. Look for templates with easy-to-edit fields, ensuring quick customization for each sale. Keep the design clean and professional for a polished look that reflects your business.

To create a clear and functional receipt form, include the following details:

- Transaction Date: Always record the exact date of the transaction. This helps in tracking purchases and serves as proof of the exchange.

- Receipt Number: A unique reference number helps with tracking receipts and is useful for both customer and business records.

- Business Information: Include the name, address, and contact details of the business to ensure customers can reach out if needed.

- Customer Information (optional): Including the customer’s name and contact can help with returns or refunds, but it’s not always necessary for all businesses.

- Purchased Items: List each item with a brief description, quantity, and price. This ensures the customer knows exactly what was purchased.

- Total Amount: Clearly display the total amount of the transaction, including taxes, fees, and discounts if applicable.

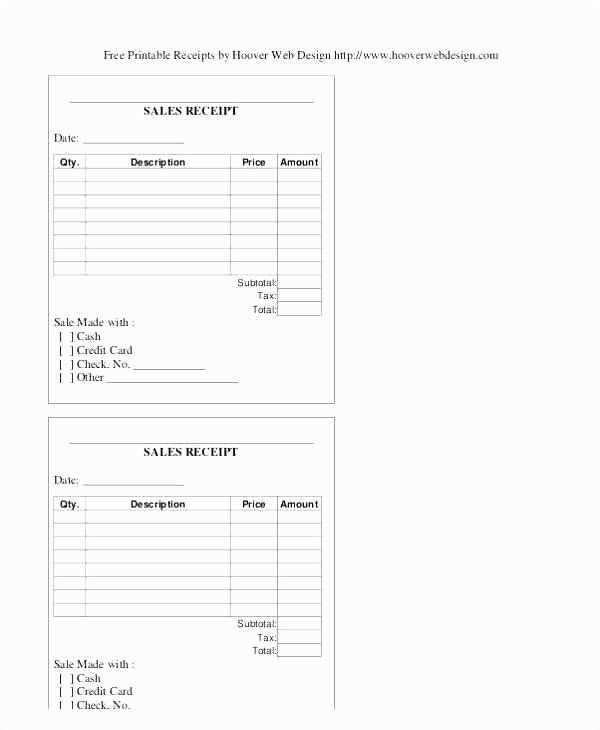

- Payment Method: Indicate whether the payment was made by cash, credit card, or another method. This adds clarity to the transaction history.

Additional Considerations

- Tax Information: If your business is required to collect sales tax, make sure to include this in the breakdown to comply with regulations.

- Return and Refund Policy: Clearly outline any relevant terms or conditions regarding returns and refunds, especially for items that may have restrictions.

To make your printable bill stand out, start by adjusting the template to include your business logo. Place it at the top left or center for visibility. You can also change the font style and size to match your brand’s aesthetic, ensuring consistency across all documents.

Next, personalize the header with your business name, address, and contact details. If the template doesn’t already include these, add them in a clear, readable format. This will make the bill look professional and provide essential contact information at a glance.

For the body, modify the item description columns to fit your product or service. Add extra rows if needed to list all items accurately. If your products or services require more details, such as serial numbers or quantities, include separate columns for each to enhance clarity.

Include tax and discount information if applicable. Customize the template to add a tax row and ensure that the total is updated accordingly. If you’re offering a discount, make sure to specify the percentage or amount deducted and adjust the subtotal to reflect this.

Finally, review the footer. Include payment terms, due dates, or any other instructions relevant to the transaction. This ensures that your customers have all the information they need for completing their purchase.

| Field | Recommendation |

|---|---|

| Logo | Upload your business logo at the top for branding. |

| Header | Add your business name, address, and contact info clearly. |

| Item Details | Customize columns for item description, quantity, and price. |

| Tax & Discounts | Include tax rows and any applicable discounts. |

| Footer | Add payment terms and due date to ensure clarity. |

PDF is the most reliable format for digital receipts. It preserves the layout and details of the receipt, ensuring that no information is lost. PDF files are universally supported across all devices and platforms, making them ideal for archiving and printing purposes.

Why PDF?

PDF files offer high compatibility, meaning they can be opened and read on almost any device without losing formatting. They’re also compact, allowing for easy storage without sacrificing quality. This format supports security features like password protection, which is helpful for sensitive transactions.

Other Formats to Consider

JPEG and PNG formats are also popular for digital receipts, especially for businesses that generate receipts from images or scanners. These formats are perfect for quick, one-off transactions but may not be ideal for long-term storage due to their lack of text-searching capabilities and potential for quality loss after multiple compressions.

For businesses looking for speed and flexibility, CSV and Excel files are useful, especially when receipts are tied to data analysis or inventory systems. These formats can be easily integrated into other tools and offer the benefit of editable data.

When creating payment slips, ensure they reflect accurate and clear information. Proper documentation protects both businesses and customers in case of disputes. Always include the transaction date, amount, and the names of the buyer and seller.

For tax purposes, payment slips should include the correct tax rate and any applicable sales tax, depending on local laws. Failing to display this information could lead to legal complications.

| Item | Required Details |

|---|---|

| Transaction Date | Indicates when the payment occurred. |

| Amount | The total value of the transaction, including any taxes. |

| Buyer and Seller Names | Clearly identify both parties involved in the transaction. |

| Tax Information | Include sales tax or VAT where applicable. |

Make sure payment slips are stored securely and are easily accessible for record-keeping. Depending on the jurisdiction, businesses may be required to retain these records for a set period of time. Regular audits and proper documentation reduce the risk of penalties or legal action.

One common mistake is failing to adjust the template’s fields to match your specific business needs. Templates often come with generic placeholders, but if you don’t update them with accurate information, the receipt might lack important details. Always double-check the name, address, and tax information before printing.

Another mistake is ignoring the formatting. Templates can sometimes have inconsistent font sizes or spacing, which can lead to a cluttered look. Ensure that all text is aligned properly and easy to read. This improves both the professionalism of the receipt and customer satisfaction.

Overlooking customization options is also a mistake. Templates are designed to be flexible, yet many users stick to the default design without taking advantage of the customization features. Personalize your template with your brand’s logo, colors, and font style for a more polished appearance.

Some users fail to check the template for errors after customization. Even a small typo or incorrect number can make a big difference. Always preview your final receipt before using it for transactions.

Lastly, don’t forget to save your templates in the correct file format. Some programs may not support all file types, so it’s crucial to use a format that’s compatible with your software to avoid issues during printing.

There are multiple places to find free receipt templates. Some of the most reliable sources include:

Online Template Websites

- Sites like Template.net offer a wide range of free receipt templates that can be customized easily.

- Invoice Simple provides downloadable receipt templates that are ideal for small businesses and freelancers.

Google Docs & Sheets

- Google Docs has several free templates for receipts. You can access these directly through the template gallery.

- Google Sheets also has customizable receipt templates that are easy to adjust according to your needs.

Microsoft Office Templates

- Microsoft Office’s template section has free receipt forms available for Word and Excel users, suitable for both simple and detailed receipts.

Small Business Websites

- Sites like Small Business Administration (SBA) offer free downloadable receipt templates that can be easily modified for various business needs.

For a quick and simple way to create your own sales receipts, use a free printable template. These templates save time by providing a structured format with fields for essential information like the item name, price, and transaction date.

Pick a template that suits your business needs. Many templates are available for free online, offering various designs and layouts, from basic to more detailed ones. Choose one that fits your style and makes tracking easy.

Fill in your details on the template. Enter the customer’s name, purchase items, and their prices. Make sure to include any applicable taxes or discounts to maintain transparency.

Save and print the completed receipt. After filling in the required information, save the file in a suitable format (e.g., PDF). Print the receipt, and hand it over to your customer as a confirmation of their transaction.

Using a sales receipt template streamlines your process, ensuring accuracy and professionalism with each sale. Plus, it’s an easy way to stay organized and maintain good records.