If you’re a landlord, providing tenants with a clear and professional receipt for their deposit is a simple yet effective way to build trust and ensure transparency. A receipt helps both parties keep a record of the transaction and avoids any misunderstandings regarding the deposit amount and conditions. Using a free receipt template designed specifically for rental deposits can save you time and effort.

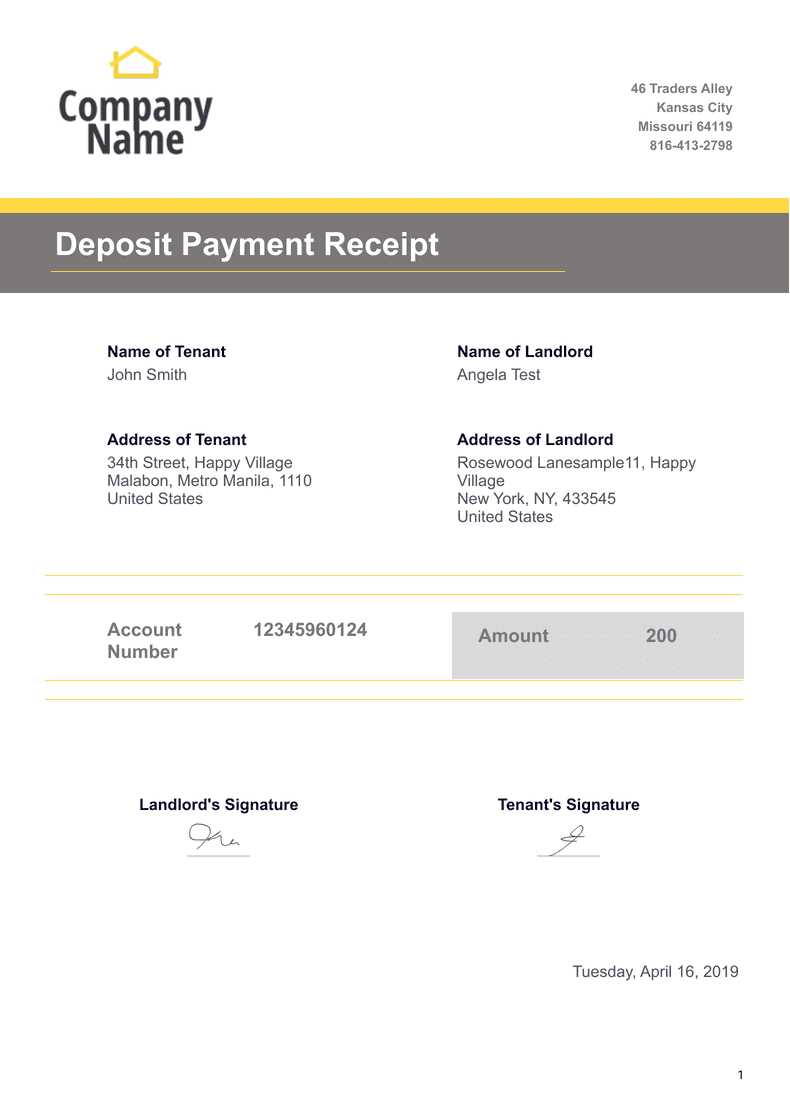

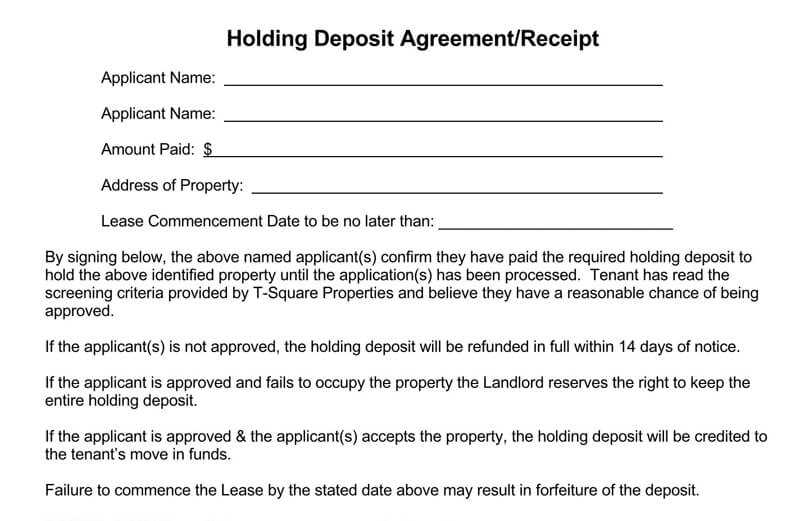

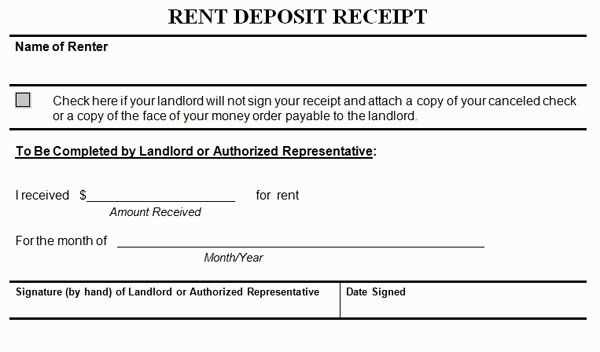

The template should include key details like the tenant’s name, the rental property address, the date the deposit was received, the exact amount paid, and the payment method. You may also want to include a brief note about the conditions under which the deposit will be returned. This can protect both you and your tenant in case of disputes over the property’s condition at the end of the lease.

When filling out the receipt, be sure to maintain accuracy and clarity. Double-check the information before handing over the receipt to your tenant to avoid confusion down the line. By using a straightforward template, you ensure that all necessary details are included in a professional and standardized format.

Utilizing a free receipt template for deposits is an easy and efficient way to keep your rental transactions organized and clear. It also helps to maintain positive relationships with tenants, ensuring they feel secure and informed throughout their lease term.

Here are the corrected lines:

Always include the date of the deposit receipt at the top. This establishes a clear reference point for both the landlord and tenant. Specify the amount of the deposit clearly, along with the method of payment used (e.g., cash, bank transfer). This helps in case any disputes arise over the amount later.

Clearly identify both parties, including full names and addresses, to avoid confusion. If the deposit is being held for a specific reason (e.g., damage to property, unpaid rent), include those details as well. Transparency will prevent misunderstandings down the line.

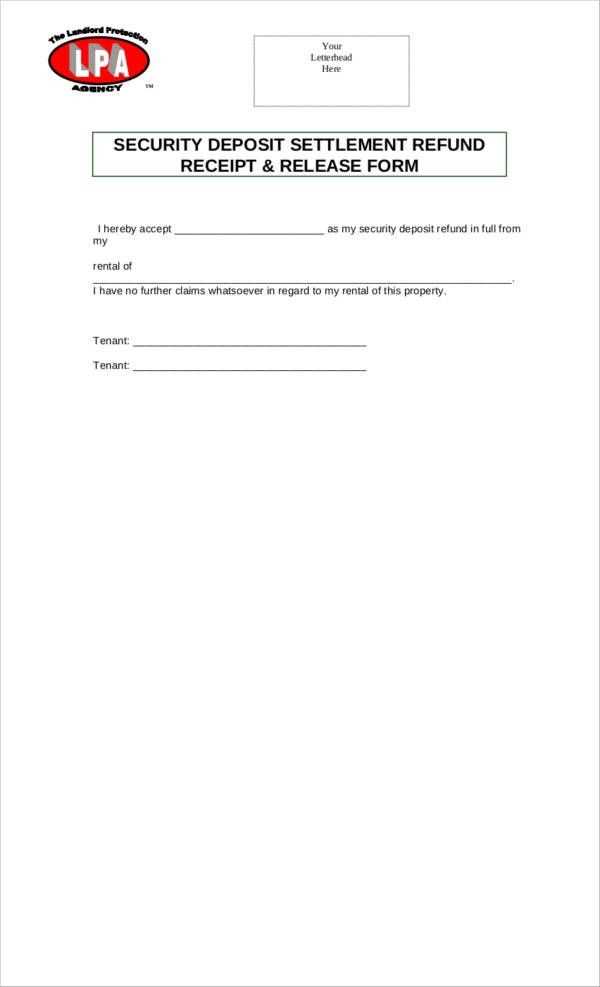

Make sure to list the terms for the return of the deposit. This includes the timeframe in which the deposit will be refunded and any deductions that might be applied. This section provides clarity on the process and expectations.

Finally, both parties should sign the receipt, confirming that they agree to the terms laid out. Having both signatures ensures mutual consent and serves as proof of the transaction.

- Free Receipt Template for Landlords for Deposit

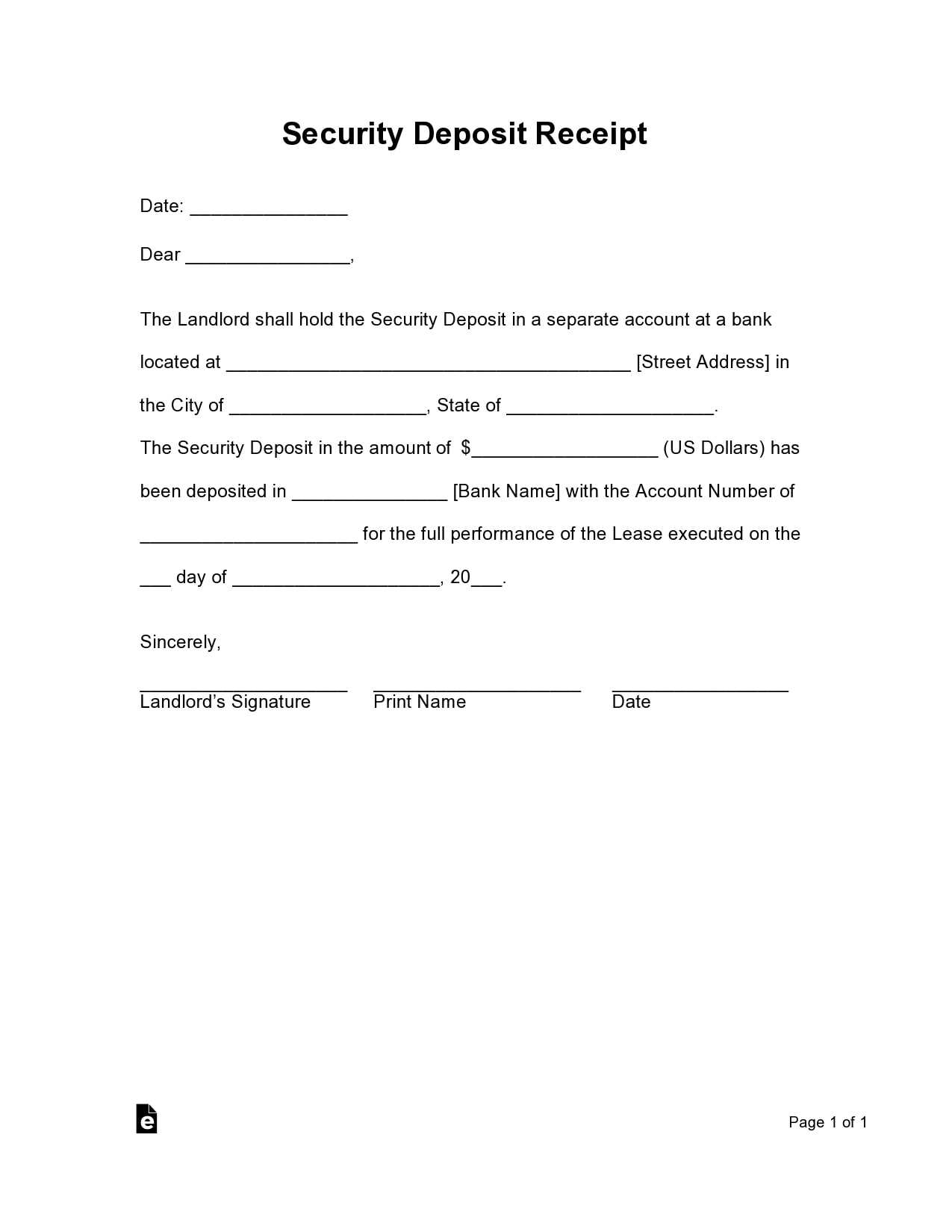

A deposit receipt is an important document for both landlords and tenants. It serves as proof of payment and outlines the amount deposited. Using a template can streamline the process, ensuring that all required information is captured accurately and professionally. Here’s a practical receipt template for landlords to use when receiving a security deposit from tenants.

Key Elements to Include in the Receipt

Your deposit receipt should cover the following details:

- Landlord’s Name and Contact Information: Make sure to include your full name, address, and phone number to ensure the tenant can reach you if needed.

- Tenant’s Name and Contact Information: Include the tenant’s full name and address.

- Property Address: Clearly state the address of the rental property.

- Deposit Amount: Specify the exact amount received for the deposit.

- Payment Method: Indicate how the deposit was paid (e.g., check, cash, bank transfer).

- Date of Payment: List the exact date the deposit was paid.

- Purpose of the Deposit: Mention that the deposit is for securing the rental property and state if it’s refundable or non-refundable.

- Landlord’s Signature: Provide space for you to sign the receipt, confirming the transaction.

- Tenant’s Signature: Allow space for the tenant’s signature as acknowledgment.

Sample Template

Here’s a simple format you can use:

Receipt for Security Deposit

This receipt acknowledges the payment of a security deposit for the rental property located at [property address].

Landlord’s Information:

Name: [Your Name]

Address: [Your Address]

Phone: [Your Phone Number]

Tenant’s Information:

Name: [Tenant’s Name]

Address: [Tenant’s Address]

Property Address: [Rental Property Address]

Deposit Amount: $[Amount]

Payment Method: [Payment Method]

Date of Payment: [Date]

Purpose: Security deposit for rental property [Property Address].

Signatures:

Landlord: ______________________ Date: ________________

Tenant: _______________________ Date: ________________

Keep a copy for your records and provide one to your tenant. This helps prevent any misunderstandings later in the rental process.

To create a clear and legally valid receipt for a deposit, include the following key elements:

- Transaction Date: Clearly state the date when the deposit was received. This helps establish a timeline for both parties.

- Amount: Indicate the exact amount of the deposit. Avoid rounding off figures to ensure accuracy.

- Purpose of Deposit: Specify that the payment is for a security deposit. Include any details related to the agreement, such as the rental property or lease terms.

- Landlord and Tenant Information: Include the full names of both the landlord and the tenant. This ensures that the receipt is associated with the correct individuals.

- Payment Method: Mention how the deposit was paid (e.g., cash, bank transfer, check). This is important for clarity in case of future disputes.

- Signature: Both parties should sign the receipt to confirm the transaction. This acts as a mutual agreement and provides proof that both individuals acknowledge the terms.

Double-check the information to ensure it’s clear and precise. Any ambiguities could lead to misunderstandings or legal challenges later. By including these details, you can provide a receipt that holds up in court if needed.

Always include the tenant’s full name and the property address. This ensures that the receipt clearly identifies the parties involved and the property in question.

Clearly state the deposit amount. Specify the currency used and double-check the figure to avoid any misunderstandings later. It is also helpful to include whether the deposit is refundable or non-refundable.

Include the date the deposit was received. This is important for both the tenant and landlord to keep track of the timeline of the lease.

Make a note of any conditions attached to the deposit. For example, if certain damages or cleaning fees are covered under the deposit, document them clearly. This avoids any confusion when the tenant moves out.

Provide the payment method (e.g., cash, cheque, bank transfer). This can help clarify how the tenant made the payment and provides proof of the transaction method.

Include the signature of both the landlord and tenant. This confirms that both parties acknowledge the receipt and the terms outlined in the document.

Clearly state the deposit amount. Avoid vague or unclear descriptions that could lead to confusion later. Specify the exact sum in both numerical and written form.

List all payment details. Make sure to include the method of payment, such as cash, check, or bank transfer, and the date the deposit was received. Failing to do this leaves room for misunderstandings.

Always provide a receipt copy to the tenant. Some landlords forget to give tenants a copy of the deposit receipt, which can create disputes over the terms. Ensure both parties have documentation.

Be accurate with tenant and landlord details. Double-check names, addresses, and contact information. A small error in personal information can cause problems down the line.

State the purpose of the deposit. Clarify if it’s for security, damages, or other reasons. An unclear purpose can cause issues when trying to return the deposit at the end of the lease.

Avoid omitting terms related to deposit deductions. If certain situations allow for deductions from the deposit (like property damage), make this clear on the receipt to prevent disputes later.

Don’t skip the signature line. Both parties should sign the receipt to confirm the details. Without signatures, the document may not hold up in case of a disagreement.

Keep a copy of every receipt issued. While it might seem redundant, having your own records ensures you can resolve any potential issues in the future.

Deposit Receipt Template: Limiting Repetition of “Deposit”

To maintain clarity, limit the repetition of the word “Deposit” in each line of your receipt. For a cleaner, more readable format, ensure that each section mentions “Deposit” no more than twice. This improves the flow of the document and avoids redundancy, making it easier for tenants to understand the terms. A well-structured receipt avoids overuse of the same term, ensuring that other important details are highlighted without overcrowding the text. Keep the focus on the specifics of the transaction, such as the amount, date, and any conditions related to the deposit.

This approach is especially useful in official documents like receipts, where legal clarity is paramount. A receipt should provide key information in a straightforward manner, allowing tenants and landlords to clearly understand the terms of the deposit agreement. Repeating “Deposit” less frequently helps to achieve this balance.