Need a receipt template fast? Use an online receipt maker to create clear and professional receipts in minutes. Just enter the details, choose a format, and download a ready-to-use receipt instantly. No complicated software or design skills required.

Customization is simple. Adjust fonts, add logos, and modify fields to match your brand. Whether for business transactions, freelance work, or personal records, a flexible template ensures accuracy and professionalism.

Multiple formats available. Download your receipt as a PDF, Word document, or image file for easy sharing and storage. Many tools also support automatic calculations, saving time on manual entries.

Using a free receipt template maker helps maintain organized records and ensures every transaction has a clear paper trail. Try it today and streamline your invoicing process effortlessly.

Free Receipt Template Maker

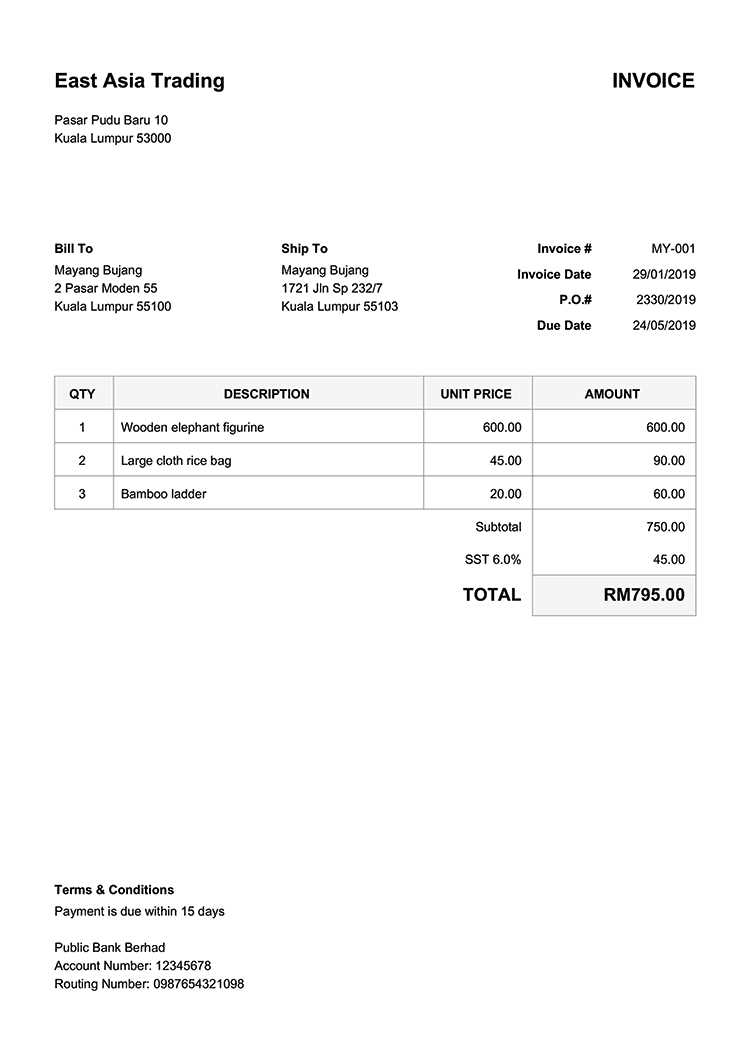

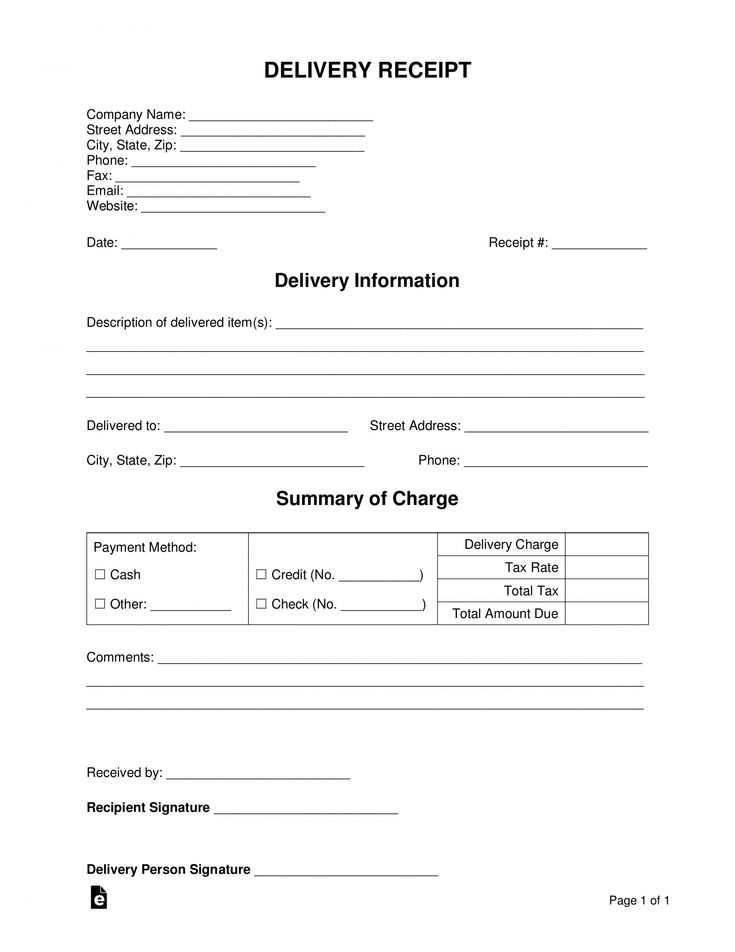

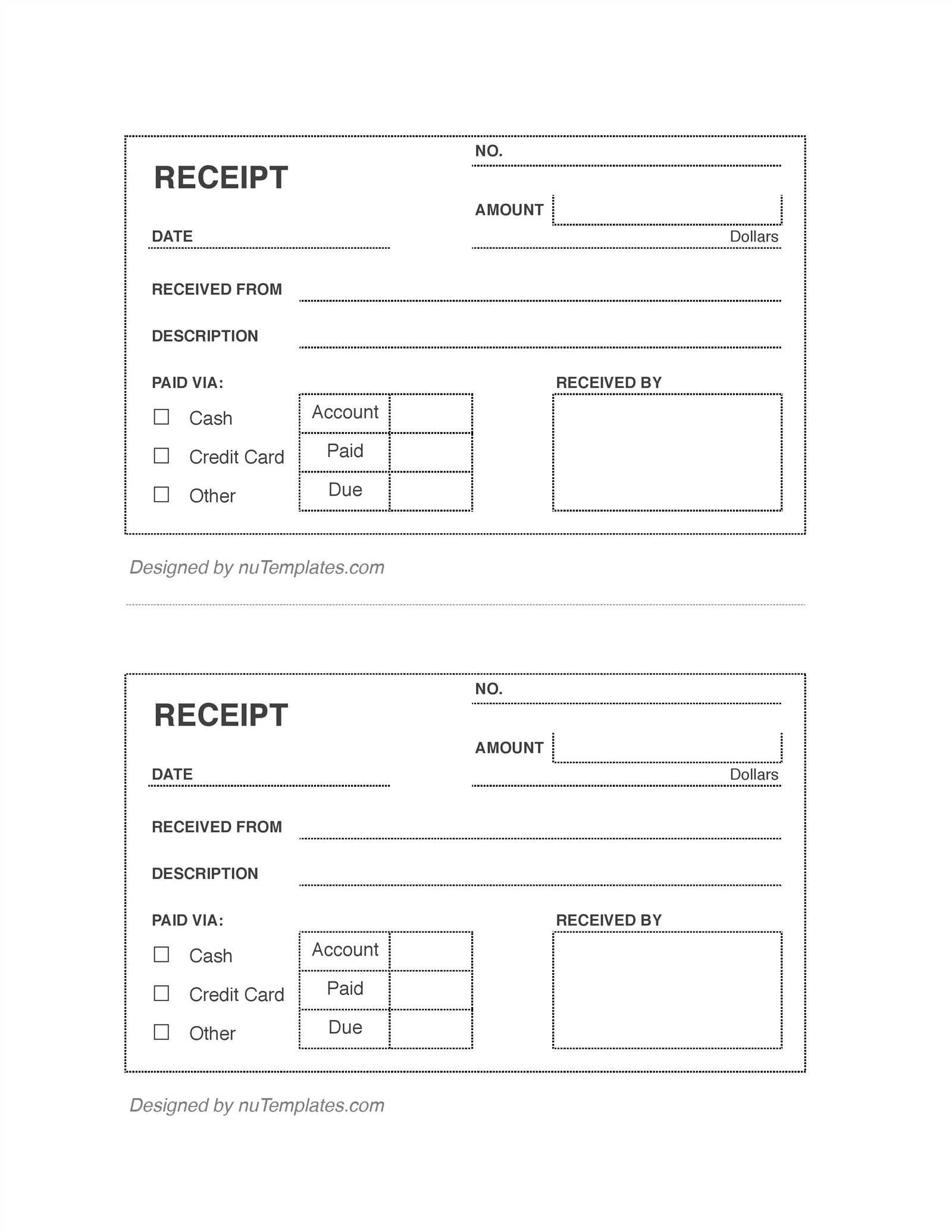

Generate professional receipts in seconds with an intuitive template maker. Simply enter transaction details, customize fields, and download a ready-to-use receipt in PDF or Word format.

| Feature | Description |

|---|---|

| Customization | Edit company name, logo, date, items, taxes, and totals. |

| File Formats | Download receipts in PDF, Word, or print directly. |

| Multiple Templates | Choose from various styles for different business needs. |

| Cloud Access | Save and retrieve receipts anytime from any device. |

No registration required. Just fill in the fields, preview your receipt, and save or print instantly.

How to Choose the Right Receipt Format for Your Needs

Choose a receipt format based on how you plan to use it. Digital receipts work best for online transactions, while printed versions suit in-person sales. Consider the following factors when deciding:

Digital vs. Printed Receipts

- Digital receipts: Ideal for e-commerce, email confirmations, and reducing paper waste. Use PDF or email-friendly formats.

- Printed receipts: Necessary for physical stores, cash transactions, or when customers need immediate proof of purchase.

Key Format Options

- PDF: Ensures a professional appearance and easy sharing.

- Excel/CSV: Useful for bulk data entry and accounting.

- Word: Allows customization but may lack structured formatting.

- Plain Text: Simple, lightweight, and easy to generate automatically.

For best results, match the format to your business needs. An online store benefits from email-friendly PDFs, while a retail shop requires thermal-printed receipts. Select a template that aligns with your workflow and customer expectations.

Customizing Fields and Layout in a Receipt Template

Modify the receipt template to fit specific needs by adjusting fields and layout directly in the editor. Add, remove, or rename fields to match business requirements.

- Adding Custom Fields: Insert additional fields such as tax ID, customer notes, or a unique invoice number. Ensure consistency by aligning them with existing content.

- Rearranging Layout: Drag and drop elements to reposition sections. Place essential details like company name and total amount at the top for visibility.

- Adjusting Font and Spacing: Modify font size and spacing to improve readability. A clear structure helps customers quickly find relevant information.

- Incorporating Branding: Upload a company logo and use a matching color scheme. A branded receipt enhances recognition and professionalism.

- Saving and Reusing Templates: Store the customized version for future use. This saves time and ensures consistency across transactions.

Refine the layout by previewing changes before finalizing. A well-structured receipt improves clarity and customer experience.

Best File Formats for Saving and Printing Receipts

PDF ensures receipts look the same on any device and print without layout shifts. It supports embedded fonts, images, and digital signatures, making it ideal for both storage and verification.

Why PDF Stands Out

Most businesses prefer PDF because it preserves formatting and works across all operating systems. It also supports password protection, which helps secure sensitive transaction details.

Other Practical Options

JPEG and PNG work well for receipts with graphics or logos, but they lack text searchability. CSV and Excel store data efficiently for accounting, but they don’t maintain visual layout. For quick edits, DOCX allows modifications before saving as a final version.

For archiving, PDF remains the best choice. For bulk data processing, structured formats like CSV and Excel simplify financial tracking.

Legality and Compliance of Digital Receipts

Businesses must ensure digital receipts comply with tax regulations and consumer protection laws. In many jurisdictions, electronic receipts hold the same legal weight as paper receipts, provided they meet record-keeping standards.

Tax Compliance Requirements

Tax authorities often require receipts to include essential details like transaction date, amount, and tax breakdown. Some countries mandate digital receipts to be stored in a tamper-proof format for a specified period, ensuring auditability. Businesses should verify local retention policies to avoid compliance issues.

Consumer Protection and Privacy

Digital receipts must align with data protection laws, such as GDPR or CCPA, when collecting customer information. Businesses should secure receipt storage and offer customers opt-out options for email or SMS receipts. Transparency in data usage helps build trust and prevents legal risks.

Consulting a legal expert or tax professional ensures compliance with local laws and minimizes regulatory exposure.

How to Share and Store Receipts Securely

Use encrypted cloud storage. Choose services that offer end-to-end encryption, such as Tresorit or Sync.com. This prevents unauthorized access and ensures that only you and intended recipients can view the files.

Share receipts through secure links. Instead of email attachments, use password-protected links from Google Drive, Dropbox, or OneDrive. Set expiration dates to limit access time.

Convert paper receipts to digital format. Use apps like Adobe Scan or CamScanner to create PDF copies. Store them in encrypted folders to prevent data loss or theft.

Avoid public Wi-Fi when sending receipts. If you must share files outside a secure network, use a VPN to encrypt your internet connection and protect sensitive data.

Enable multi-factor authentication (MFA). Activate MFA on storage and sharing platforms to add an extra layer of security. Even if a password is compromised, unauthorized access remains unlikely.

Regularly back up files. Schedule automatic backups to an external drive or a secure cloud service. This ensures receipt records remain intact even if devices are lost or compromised.

Common Mistakes to Avoid When Creating Receipts

Ensure all relevant details are included. Missing information such as date, items purchased, prices, and total can lead to confusion and disputes. Always double-check for accuracy before finalizing.

Avoid using unclear terminology. Use straightforward language that customers can easily understand. Technical jargon may confuse recipients and create unnecessary complications.

Do not forget to include your business information. Clearly state your business name, address, and contact details on the receipt. This transparency builds trust and allows for easy follow-up if needed.

Neglecting proper formatting can lead to a chaotic receipt. Maintain a consistent layout with clear sections for items, prices, and totals. Use spacing and headings effectively to enhance readability.

Ensure your receipt is legible. Small fonts or cramped text can make it difficult for customers to read. Choose an appropriate font size and style that ensures clarity.

Overcomplicating the design can detract from the essential information. Stick to a clean, simple design that highlights key details. Use colors sparingly to avoid overwhelming the recipient.

Finally, always keep a copy for your records. Failing to do so can create issues with accounting or returns. Utilize digital templates that automatically store copies for easy access.