If you’re in need of a quick and simple solution for generating receipts, using a free receipt template for New Zealand businesses can save you time and effort. These templates are easy to find online and can be customized to suit various business needs, ensuring that you stay organized and professional.

For businesses in New Zealand, a free receipt template is not only a convenient tool but also an affordable one. Many templates allow you to add essential details such as the transaction date, buyer information, and itemized list of goods or services. Whether you’re running a small shop or offering services, customizing your template to fit your branding is straightforward.

Choosing a template that complies with New Zealand’s tax requirements is crucial for smooth operations. Most free templates provide an option to include GST details, ensuring that you’re keeping up with legal requirements while offering clear and transparent receipts to your customers.

Additionally, many templates are available in different formats such as Word, Excel, and PDF, which gives you flexibility in how you want to manage and store your receipts. With easy-to-use layouts and no complex software needed, you can get started right away without any hassle.

Here’s the revised version with reduced word repetitions:

Use a simple format for your receipts to make them clear and concise. Include only necessary details like transaction date, item description, quantity, and price. Avoid overloading the document with redundant terms. Keep the design clean to ensure the focus stays on the key information. Customize the layout to match your branding without adding unnecessary clutter. Always provide clear totals and tax breakdowns, if applicable, to enhance readability and understanding.

- Free Receipt Template NZ

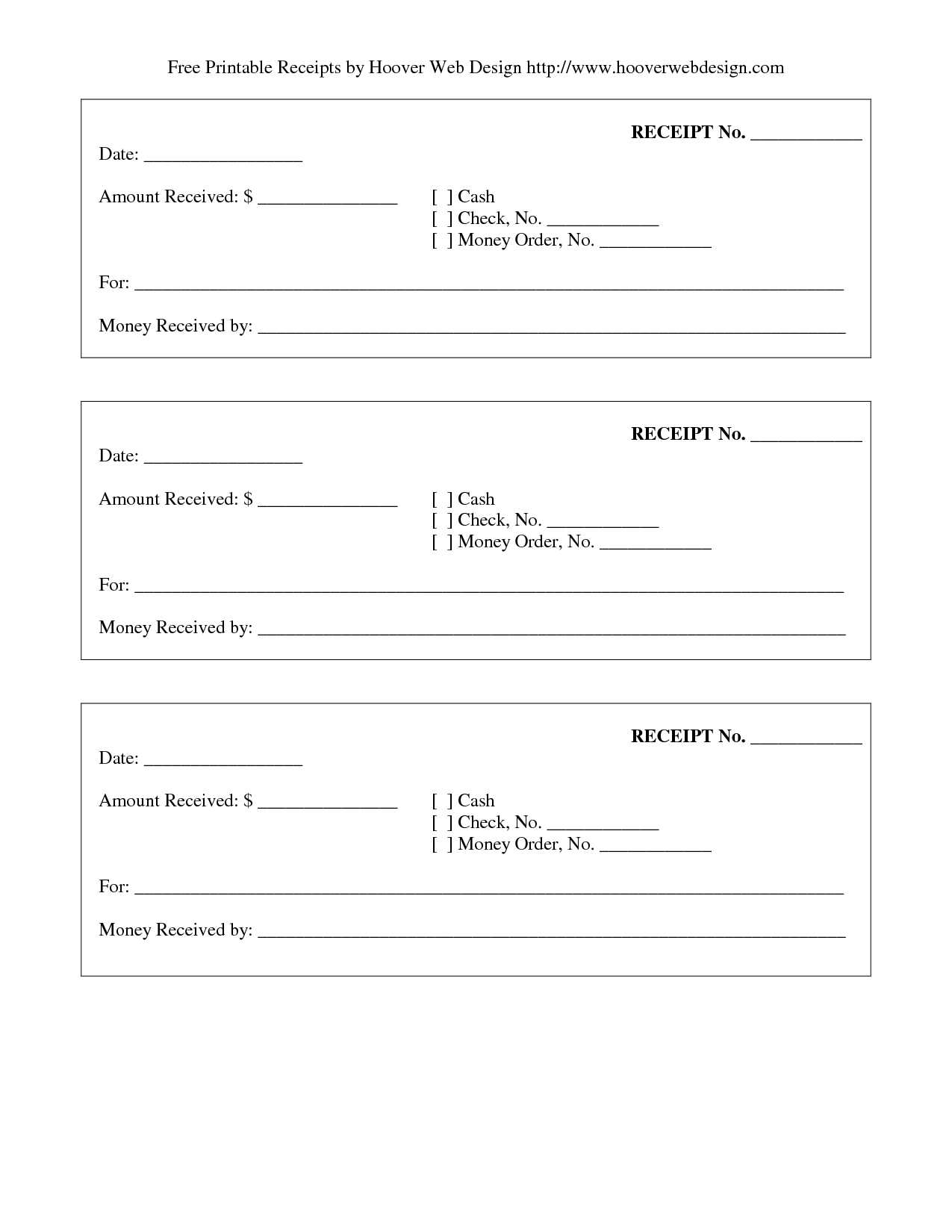

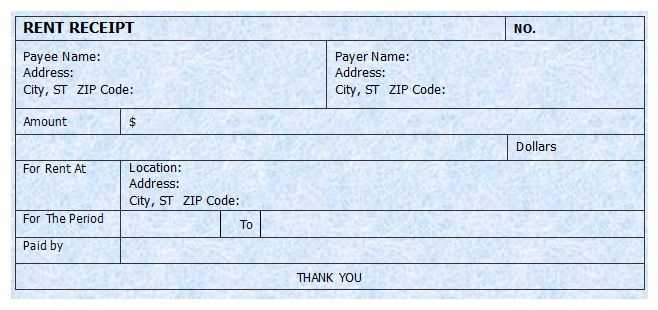

Choose a free receipt template that meets your needs. A simple, clear design helps avoid confusion for both parties. Look for templates with sections for date, description of goods or services, amounts, and payment details. Ensure that the template allows customization, especially for different transaction types or varying amounts.

Why You Need a Template

Having a receipt template saves time and reduces the chance of errors. Whether for business or personal use, this tool provides a uniform structure that maintains professionalism and accuracy. Customizable options make it adaptable for various transaction styles, like cash payments or credit card transactions.

Where to Find Free Templates

You can find many free receipt templates online. Make sure they are designed for New Zealand users by checking if they reflect local standards, including GST details or other tax-related information. Download options range from simple Word or Excel formats to PDF files, which you can print and use immediately.

Opt for a format that aligns with the nature of the transaction and the information needed. For small businesses, a simple itemized receipt with clear prices, taxes, and total cost is often sufficient. If your business involves services, include a detailed breakdown of hours worked or services provided, alongside the cost per hour or service rate.

Consider Your Audience

Think about whether your customers prefer printed or digital receipts. Digital formats are ideal for businesses that offer e-commerce or contactless payments. For physical stores, a printed receipt may be preferred. Ensure that your format accommodates the method of delivery chosen by your customer.

Clarity and Readability

Ensure the receipt is easy to read and understand. Use a clean font and avoid overcrowding the document with excessive details. A clear layout helps customers quickly find relevant information, such as the total amount, payment method, and items purchased.

Begin by selecting a template that fits your needs. Look for one with a clean structure and adaptable layout. You can find free templates on various NZ websites, designed to meet local requirements for receipts.

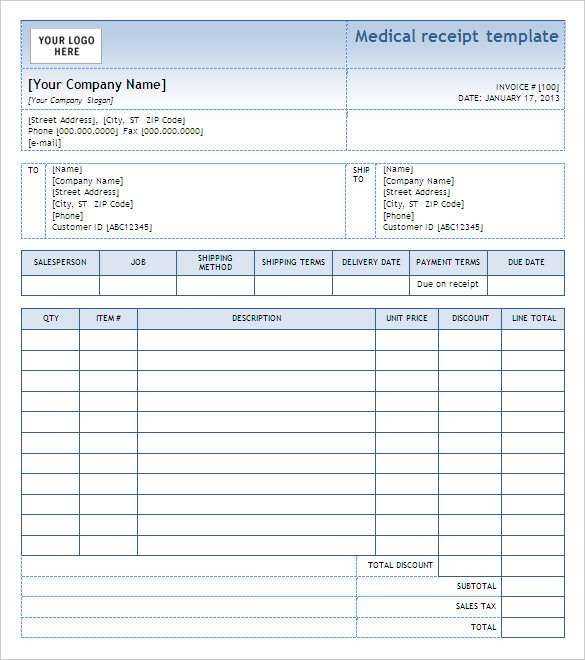

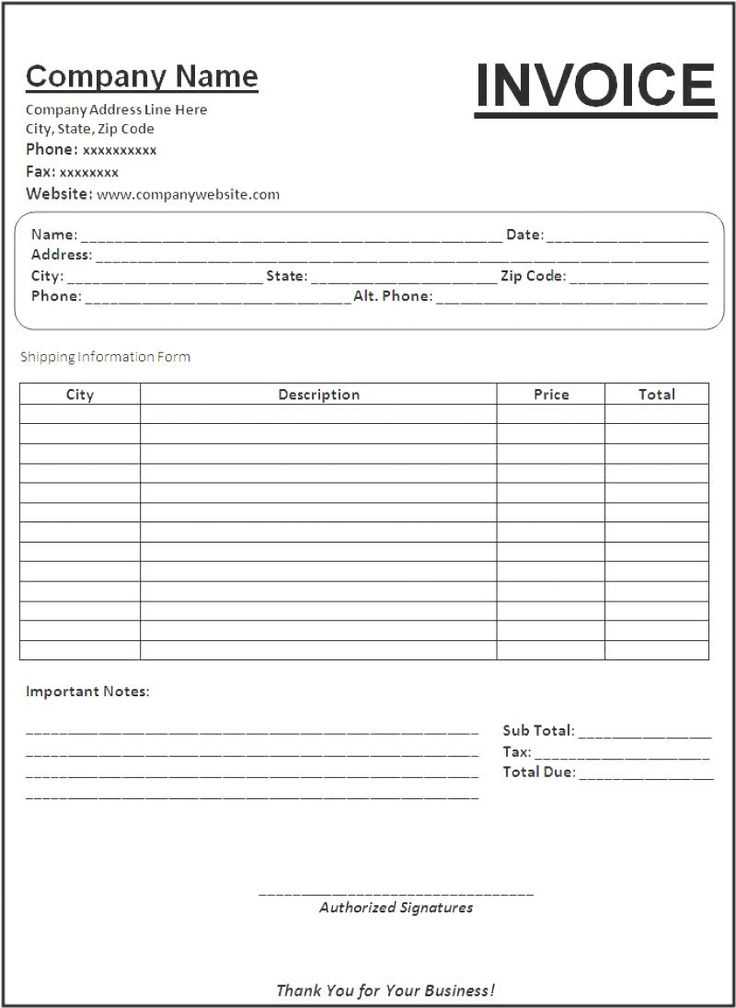

Edit the template’s details like business name, contact info, and logo. Replace placeholder text with your business-specific information to maintain professionalism and clarity. Make sure to update the date, receipt number, and payment details to match the transaction accurately.

Adjust the colors and fonts to match your branding. Many free templates allow you to change these elements easily using online tools or simple software like Word or Google Docs.

Include fields for tax, GST, and any other local financial details required in New Zealand. Make sure these elements are clearly visible and formatted correctly to comply with local regulations.

Save the customized template as a reusable file. PDF is a good format for receipts, as it preserves your layout and ensures the document looks consistent on different devices.

First, verify the tax requirements for your region by checking with the local tax authority. Every jurisdiction has specific rules on tax rates, exemptions, and reporting periods that you need to follow.

Next, ensure your receipt template includes all required details such as the business name, address, tax number, and a breakdown of the goods or services provided. This information is often mandatory for tax purposes.

Regularly review and update your receipts to reflect any changes in tax laws or rates. Tax regulations can shift, and keeping your records current prevents mistakes and potential penalties.

Stay on top of your tax filing deadlines. Mark these dates in your calendar to ensure you submit your returns on time and avoid fines or interest charges.

Consider using accounting software that integrates tax calculations to reduce human error. These tools automatically apply the correct tax rates, making it easier to stay compliant.

Finally, consult with a tax professional periodically to ensure your receipts and business practices align with the latest tax laws. This step provides peace of mind that you’re always on the right track.

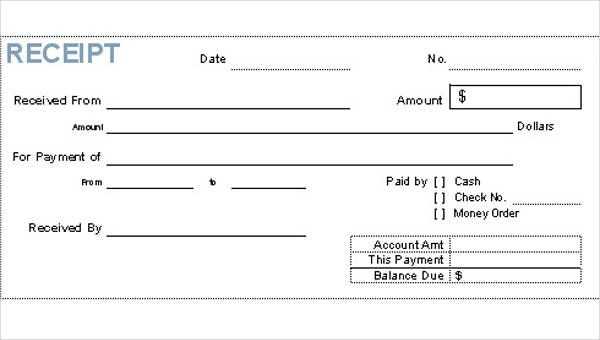

To add payment methods to your receipt template, follow these steps:

- Choose Payment Options: Select which payment methods you want to include, such as credit/debit cards, PayPal, bank transfers, or cash.

- Integrate Payment Gateway Information: Include the necessary details for each method. For online payments, add links or instructions for payment gateways like PayPal or Stripe.

- Specify Transaction Reference: If applicable, include fields for a transaction ID or reference number to help track payments.

- Include Payment Terms: Add payment deadlines, late fee policies, or any special terms for specific payment methods, if necessary.

- Design for Clarity: Ensure that the payment methods are clearly listed and easy to read, possibly with logos or icons for visual appeal.

- Test Payment Instructions: Before finalizing your template, test how payment details appear to ensure accuracy and clarity for your clients.

Free templates streamline the invoicing process for small businesses, saving both time and money. By using a receipt template, you ensure consistency in documentation, which is key for accurate accounting. Templates are typically designed to cover all necessary fields, such as product details, pricing, tax calculations, and payment methods. This reduces the risk of human error and speeds up transaction processing.

Opting for a free template can be a smart choice for businesses just starting out or operating on a tight budget. Many templates are easy to customize, allowing you to add your logo and personalize the design to match your brand. This level of professionalism enhances your business’s credibility and can leave a positive impression on clients.

By keeping records organized through templates, you simplify tax preparation and financial reporting. It’s easy to track sales, refunds, and customer details, which makes it simpler to spot trends or areas for improvement. Whether you’re dealing with a single client or multiple transactions, having a uniform receipt structure helps maintain clarity and accuracy in your business operations.

Template formatting issues often occur due to incorrect or mismatched elements. If a template appears broken or misaligned, check for inconsistencies in the HTML tags and CSS. Ensure that each element is properly closed and that there are no stray tags causing layout problems.

Another common issue is text alignment, which can happen if the container or the text box is not correctly defined. Make sure the text-align property is applied to the container, and use margins and padding to fine-tune positioning.

Font and color mismatches are also frequent. This can occur when the template’s default styles conflict with your custom settings. To resolve this, review the CSS rules and ensure your custom styles override the template’s defaults where needed.

Responsive design issues might appear when viewing the template on different screen sizes. Test the template on various devices, and adjust the media queries in your CSS to ensure proper scaling across all screen sizes.

| Issue | Solution |

|---|---|

| Broken Layout | Check for unclosed tags or mismatched containers in HTML. |

| Text Alignment Problems | Apply text-align and adjust margins and padding as needed. |

| Font and Color Mismatches | Override template’s default styles using custom CSS rules. |

| Responsive Issues | Test on various devices and adjust media queries for better scalability. |

When creating a free receipt template for NZ, focus on clarity and simplicity. A good template should allow for easy customization to suit different business needs. Here’s how you can structure a basic template:

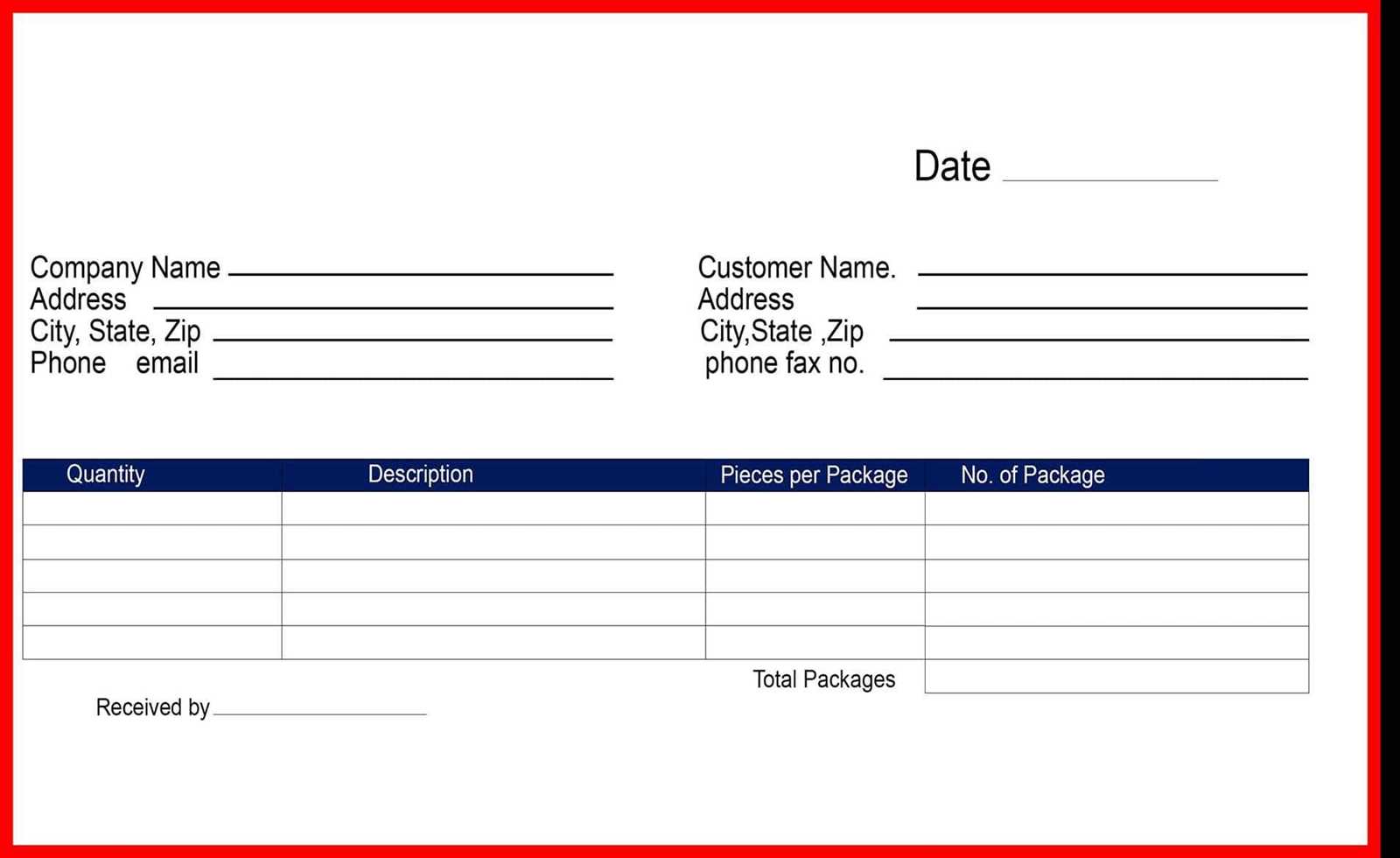

- Company Information: Include your business name, contact details, and logo. This is essential for brand recognition.

- Receipt Number: Add a unique reference number for tracking. This helps in managing records and can be automatically generated if needed.

- Date of Purchase: Make sure to have the date of the transaction clearly visible. This helps with refunds or returns and is required for tax purposes.

- Itemized List: List the products or services purchased. For each item, include a description, quantity, unit price, and total cost. This provides transparency for the customer.

- Subtotal and Taxes: Display the subtotal before tax, then list the applicable taxes, including GST if relevant. Ensure that the final amount includes both the subtotal and taxes.

- Payment Method: Specify how the payment was made (cash, card, bank transfer, etc.). This adds clarity and helps for auditing purposes.

- Terms and Conditions: If applicable, include basic terms regarding returns, warranties, or refunds. This protects both parties in case of disputes.

By following these guidelines, you can create a free receipt template that is both functional and compliant with New Zealand’s requirements.