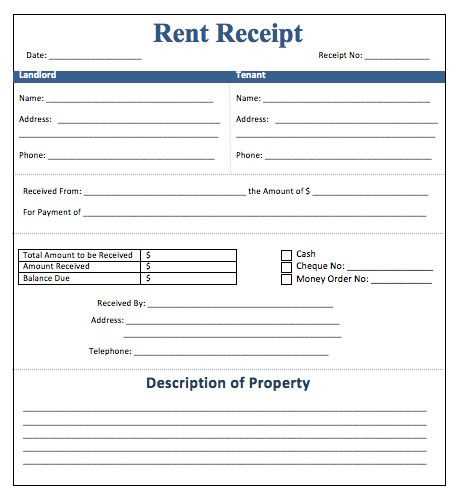

If you’re looking to create a rental receipt for your property in Canada, using a free template can save you time and effort. A rental receipt provides both the landlord and tenant with a clear record of payment transactions, and having a template ensures consistency in the process. You can easily customize it to suit your specific rental agreements and legal requirements.

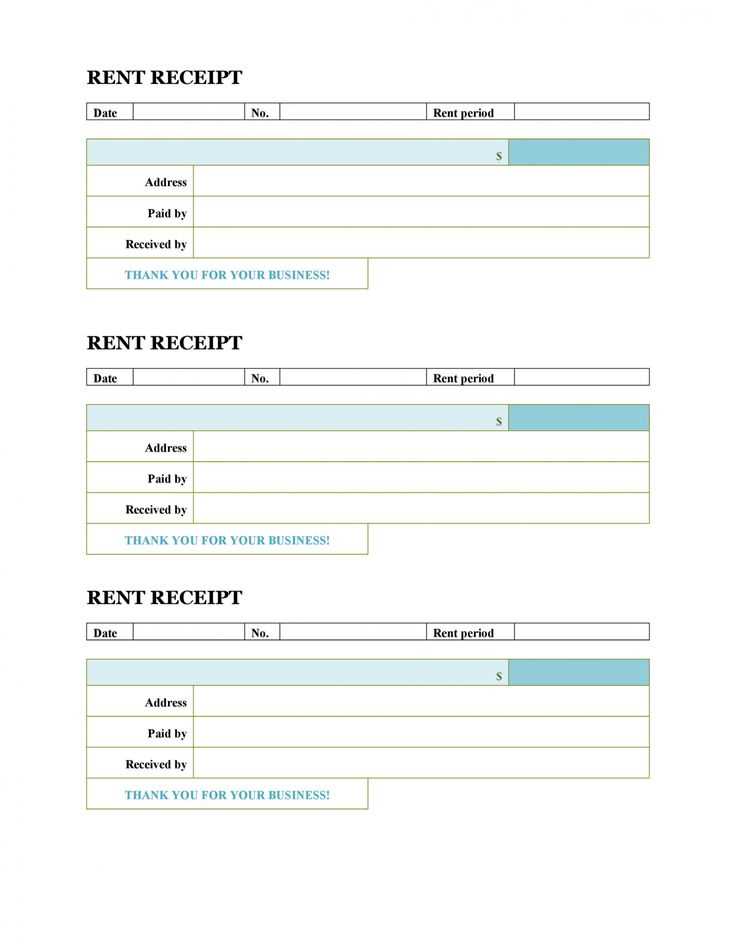

A good rental receipt template should include basic information such as the tenant’s name, rental property address, the amount paid, and the date of payment. It’s also helpful to specify the payment method used and include a unique receipt number for easy tracking. With this in place, both parties can feel confident that the payment process is well-documented.

In Canada, rental receipts are an important part of tenant-landlord relationships. They provide transparency and can help resolve potential disputes. By using a free rental receipt template, you can make sure you’re meeting legal obligations while keeping things simple. Templates are often available for download, or you can easily find online tools to generate them based on your needs.

Here are the corrected lines with duplicates removed:

Ensure that the rental receipt clearly states the full names of both parties involved. The date of the rental agreement must be specified without ambiguity. It’s important to note the rental amount and payment method, so both parties have a record of the transaction. The property or item being rented should be described with enough detail to avoid confusion. Include the rental period and any additional fees for a comprehensive record. Make sure all contact details are listed correctly for communication purposes. Double-check that the terms of the rental, such as return conditions, are clear and concise.

Remove any unnecessary terms that don’t add value or clarity to the document. Avoid repetition by ensuring each detail is only mentioned once. This will keep the receipt clean and easy to read. Make sure the rental period is unambiguous, specifying the start and end dates. The amount of deposit, if applicable, should be outlined separately. Double-check all calculations to ensure they match the agreed-upon figures. Confirm that both parties sign the document to validate the agreement.

Free Rental Receipt Template for Canada

A rental receipt is a simple but crucial document for both landlords and tenants in Canada. It acts as proof of payment and ensures transparency in rental transactions. Here’s a template you can use to create a rental receipt that complies with Canadian standards.

Key Elements of a Rental Receipt

The rental receipt should include the following details:

- Landlord’s name and contact information: Ensure the landlord’s full name, address, and phone number are clearly stated.

- Tenant’s name: List the name of the person making the payment.

- Payment date: Record the exact date when the payment was made.

- Amount paid: Clearly state the amount received from the tenant.

- Rental period covered: Specify the period for which the payment applies (e.g., February rent or security deposit).

- Payment method: Indicate whether the payment was made in cash, cheque, or via bank transfer.

- Landlord’s signature: A signature from the landlord verifies the receipt of the payment.

Sample Template

Here is a simple rental receipt template that you can adapt for your needs:

Rental Receipt Received from: [Tenant’s Name] Amount: $[Amount] Date: [Date] For the period: [Start Date] to [End Date] Payment Method: [Cash/Cheque/Bank Transfer] Landlord’s Name: [Landlord’s Name] Landlord’s Contact: [Landlord’s Address/Phone Number] Signature: ______________________

Ensure both parties keep a copy of the receipt for their records. This will help avoid misunderstandings regarding payments and strengthen the landlord-tenant relationship.

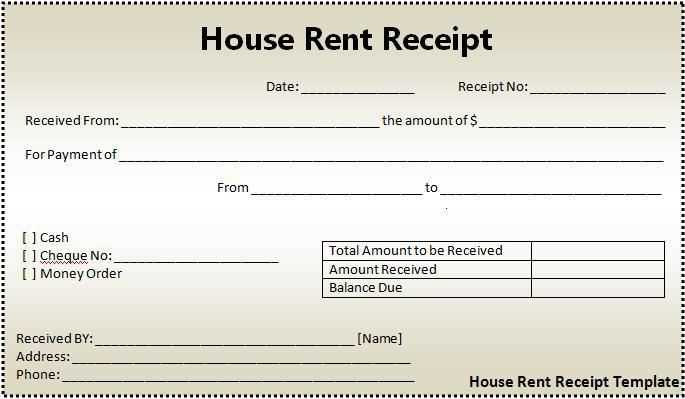

To create a rental receipt tailored to Canadian tenants, include the following critical details:

| Field | Recommendation |

|---|---|

| Landlord Information | List the full name and contact details of the landlord or property manager. |

| Tenant Information | Include the tenant’s full name and address for clarity. |

| Rental Property Address | Specify the address of the rented property where the tenant resides. |

| Payment Details | State the amount of rent paid, the date of payment, and the payment method (e.g., cheque, e-transfer). |

| Receipt Number | Assign a unique receipt number for future reference and tracking. |

| Rental Period | Include the dates for which the rent is being paid (e.g., February 1 to February 28, 2025). |

| Late Fees (if applicable) | Clearly outline any late fees incurred, along with the date they were applied. |

| Signature | Include the landlord’s or property manager’s signature to validate the receipt. |

Ensure that the format of the rental receipt is clear, with no ambiguous language. It’s also helpful to provide a separate line for each rent payment component, such as rent, utilities, or additional fees. For added convenience, consider creating a template that can be easily modified for future use while maintaining consistency.

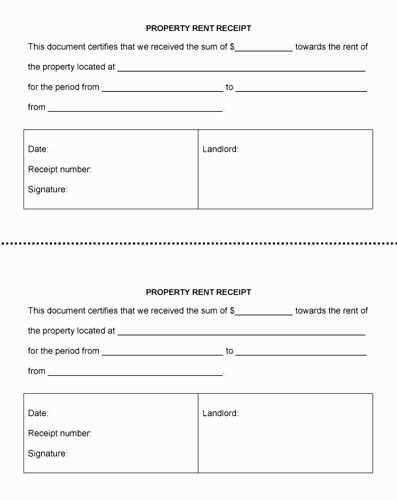

Ensure that your Canadian rental receipt contains the following key details to make it clear and legally sound:

1. Date of Payment – Clearly state the exact date the rent payment was made. This helps both tenant and landlord track payment history.

2. Tenant’s Information – Include the tenant’s full name and address. This provides identification for both parties in case of future disputes.

3. Landlord’s Information – The landlord’s full name and address should also appear. This establishes the relationship between the two parties for record-keeping and legal purposes.

4. Rental Property Address – Specify the address of the rental property, including unit number if applicable. This clarifies the location tied to the payment.

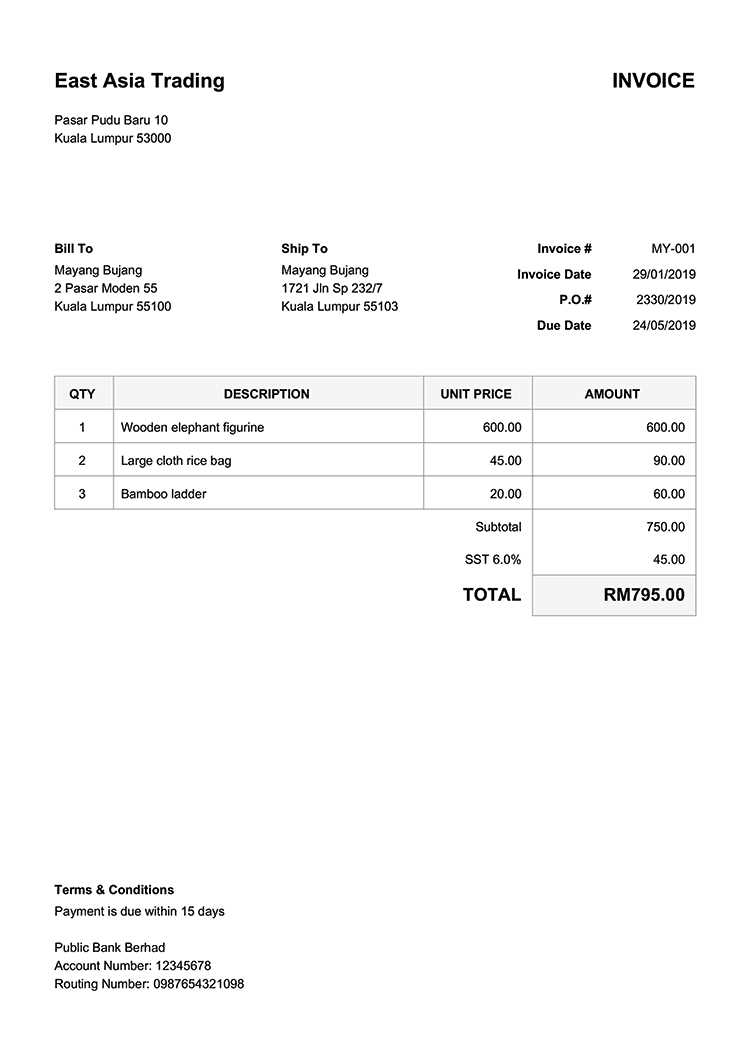

5. Payment Amount – Clearly list the amount paid. If the payment includes more than one component (e.g., rent, utilities, parking), break down the payment accordingly.

6. Payment Method – Indicate how the payment was made (e.g., cheque, bank transfer, cash). This serves as proof of transaction method.

7. Rental Period Covered – State the rental period the payment covers (e.g., February 1 to February 28). This provides clarity on the term for which the payment applies.

8. Receipt Number – Assign a unique receipt number for tracking purposes, especially for bookkeeping or future reference.

9. Signature – Have both parties (landlord and tenant) sign the receipt to verify that the payment was made and acknowledged.

10. Additional Notes – If applicable, include any other relevant details such as late fees, discounts, or repairs made to the property.

To find free and legally compliant receipt templates in Canada, start by exploring government websites. The Canada Revenue Agency (CRA) offers templates and guidelines that help businesses meet the necessary standards for receipts, including those for rental transactions.

Another great option is online template providers such as Smartsheet and Template.net, which offer free downloadable templates. These platforms also provide customizable templates that can easily be tailored to Canadian tax requirements.

If you’re comfortable using Microsoft Word or Excel, both programs offer built-in receipt templates that you can adapt for free. Ensure that these templates meet the legal requirements by including key details such as the business name, rental amount, and date of the transaction.

For simplicity and legality, it’s helpful to use templates that explicitly state the rental terms, including the start and end date of the rental, payment due date, and any applicable taxes. Double-check these details against provincial and federal tax regulations.

Use a rental receipt template to keep a clear record of transactions between landlords and tenants. It’s a simple yet effective tool to ensure both parties have the necessary documentation for rental agreements.

- Include Tenant and Landlord Information: Clearly list names, addresses, and contact details for both parties. This ensures proper identification in case of disputes.

- Specify the Rental Period: Mention the start and end date of the rental, as well as the rental term (e.g., weekly, monthly). This helps clarify payment expectations.

- Detail the Payment Amount: State the rental fee being charged, along with any additional charges or deposits, if applicable. This provides transparency about the full amount due.

- Payment Method: Record how payment was made (e.g., cash, cheque, bank transfer). This adds an extra layer of verification for both parties.

- Include Receipt Number: Assign a unique number to each rental receipt. This makes tracking payments easier and helps prevent confusion.

- Include Date of Payment: Make sure the date when the payment was made is clearly indicated. This helps in confirming when the transaction occurred.

By following these guidelines, your rental receipts will be clear and professionally formatted, helping avoid misunderstandings down the line.