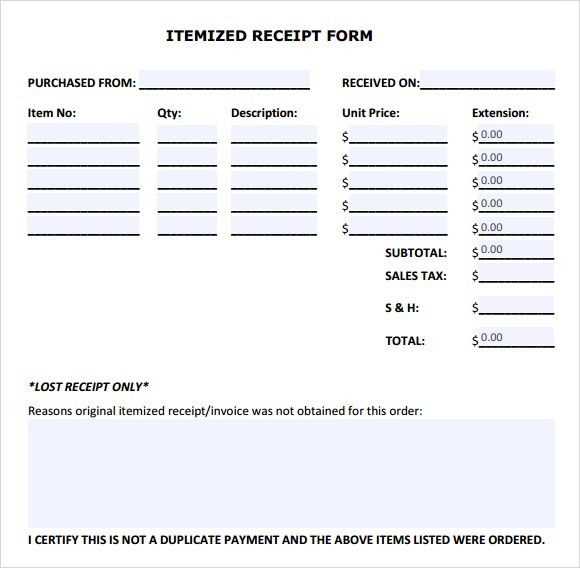

To create an accurate and detailed restaurant receipt, use an itemized template. This tool ensures all costs are clearly broken down, from individual menu items to taxes and tips. Whether you’re managing a small café or a large restaurant, having a structured receipt helps with transparency and improves customer satisfaction.

Choose a template that includes essential details: the item description, quantity, price per item, subtotal, and total. Including taxes and service charges is also necessary. Customizing the template to fit your business needs can save time and reduce errors in processing transactions. Many free options are available, offering simple, easy-to-fill formats for a professional look.

By adopting an itemized receipt, you enhance record-keeping and make tracking expenses easier. Customers appreciate the clarity it provides, especially when splitting bills or seeking refunds. Start using a free restaurant itemized receipt template today to improve your service efficiency and customer trust.

Here’s the revised text with repeated elements removed:

For creating a clear and well-organized restaurant receipt, use an itemized template. Ensure each item has its own row for easy readability. Specify quantities, descriptions, prices, and taxes. This eliminates confusion and helps your customers understand the breakdown of their bill.

Key Features of a Restaurant Itemized Receipt:

- Accurate item descriptions

- Visible price for each item

- Applicable taxes listed separately

- Final total clearly shown

Example Template:

| Item | Quantity | Price | Total |

|---|---|---|---|

| Grilled Chicken Salad | 1 | $12.99 | $12.99 |

| Spaghetti Bolognese | 2 | $9.99 | $19.98 |

| Soft Drink | 2 | $1.99 | $3.98 |

| Tax | – | – | $2.12 |

| Total | – | – | $39.07 |

This format provides transparency, helping customers quickly identify what they’ve ordered and the total amount due. It also simplifies the process for restaurant owners, ensuring accuracy in billing.

Here’s a detailed plan for the article, structured in HTML format with six practical headers, as per your request:

1. Introduction to Itemized Restaurant Receipts

An itemized restaurant receipt includes a breakdown of each individual item purchased. It provides transparency, making it easier for customers to understand the charges. A clear, well-organized receipt also helps businesses track sales accurately and resolve any discrepancies. Ensure your template clearly lists items, their prices, and any applicable taxes or service fees.

2. Why Use a Template for Itemized Receipts?

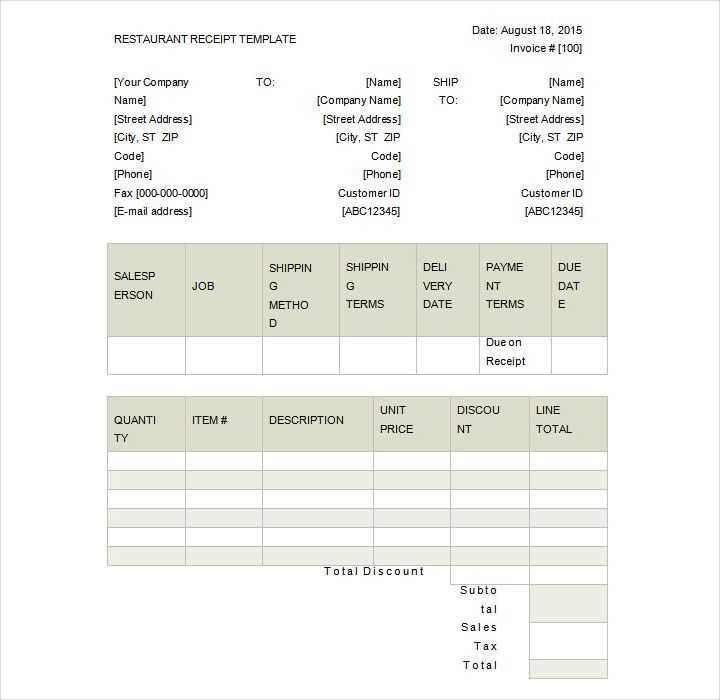

Using a template saves time and reduces errors. Templates can be customized to fit different restaurant types, allowing for quick generation of receipts without starting from scratch. By using a template, you can ensure consistency across all receipts and improve the professionalism of your service.

3. Key Components of a Well-Structured Receipt Template

The receipt should include the following elements:

- Restaurant Name and Address: Clearly visible for easy identification.

- Date and Time: For tracking the transaction.

- Itemized List: Include each item, quantity, price, and any discounts applied.

- Total Amount: The sum of all items, including taxes.

- Payment Method: Specify if paid by cash, credit, or another method.

- Service Charges or Tips: If applicable, list separately for transparency.

4. Customization Tips for Your Template

Adapt the template to reflect your restaurant’s branding and style. Choose clear fonts and a simple layout for readability. You may also want to add your logo for a personalized touch. Customize item categories (e.g., appetizers, entrees, drinks) to suit your menu. If using a digital template, ensure it is compatible with your point of sale (POS) system for seamless integration.

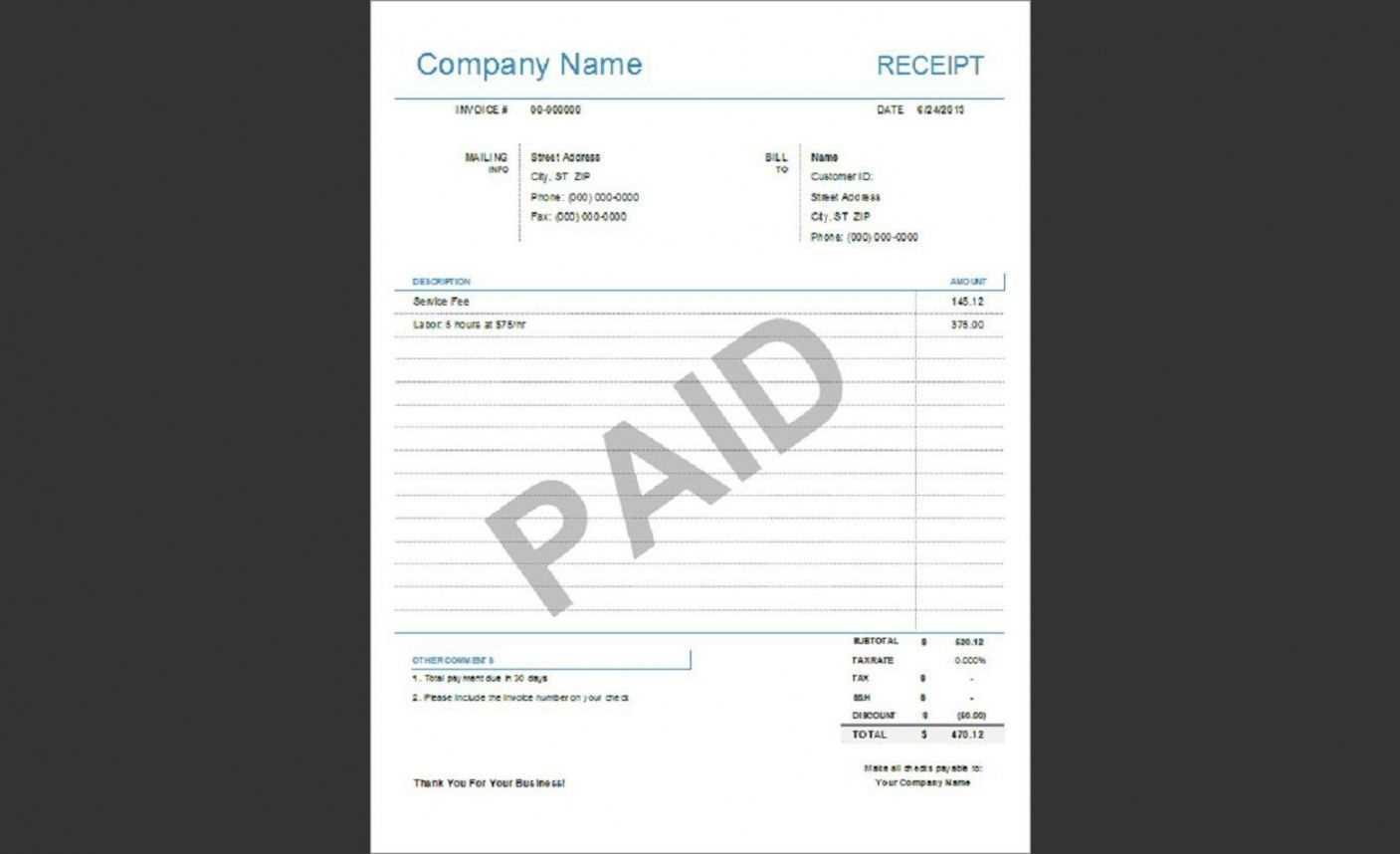

5. Benefits of Providing Itemized Receipts

Itemized receipts offer transparency, helping customers track their spending. They also serve as proof of purchase for refunds or exchanges. For businesses, they streamline accounting and tax reporting processes. A detailed breakdown helps avoid disputes and builds customer trust.

6. How to Implement an Itemized Receipt Template

To use your template effectively, integrate it into your POS system or print it manually. Ensure that all staff members are trained to provide the itemized receipts as part of the checkout process. Regularly update the template to reflect any changes in pricing or menu items.

- HTML Edit: Free Restaurant Itemized Receipt Template

Create an accurate and easy-to-read itemized receipt with this HTML template. It simplifies tracking customer orders, payments, and taxes while ensuring clarity for both customers and staff.

Structure

Here’s a basic structure for an itemized restaurant receipt:

- Restaurant Name and Address

- Customer’s Order with Item Descriptions

- Individual Item Prices

- Subtotal

- Applicable Taxes

- Total Amount

- Payment Method

Customization

You can modify this template by adding specific elements like service charge, discount options, or even an optional tip section. Customize the HTML code to suit your restaurant’s specific needs and branding style.

Find and download a free itemized receipt template for restaurants by visiting trusted websites that specialize in business forms. A simple search for “free itemized receipt template for restaurants” will yield multiple options. Look for templates that suit your business needs, such as those offering item breakdowns, taxes, and total costs. Some templates allow customization, so you can add your restaurant’s logo and other branding elements.

Step-by-Step Guide

Follow these steps to quickly download your template:

- Search for a reliable site offering free templates, such as template.net or canva.com.

- Browse the restaurant category or use search filters to narrow results to itemized receipt templates.

- Preview the available templates to ensure they meet your specifications.

- Select a template and click on the download link or button.

- Save the file to your computer in the desired format (PDF, Word, Excel).

Customization Tips

Once downloaded, open the template in an editor of your choice to tailor it to your restaurant’s needs. Add your restaurant’s name, address, and contact details. Modify the item list to reflect your menu and ensure the tax rates and totals are accurate. Save and print the customized receipt as needed.

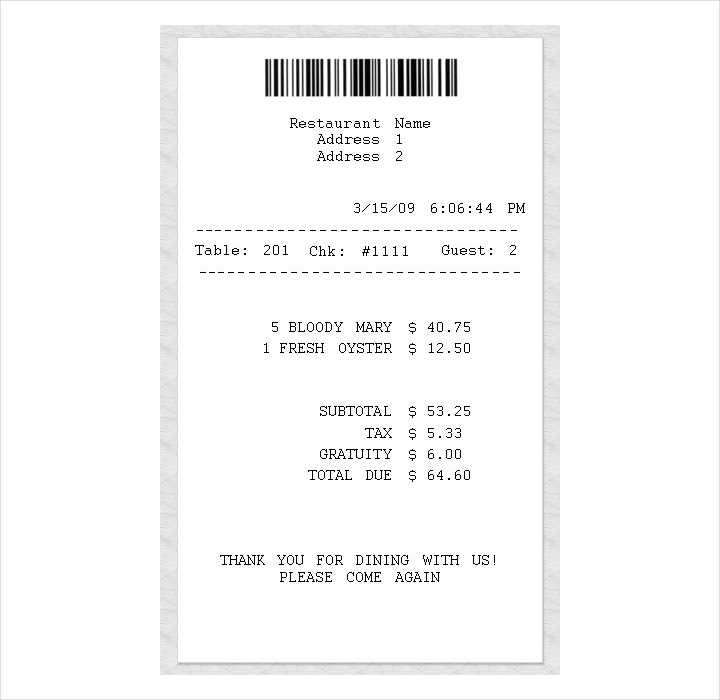

A restaurant receipt should provide clear and accurate information to both the customer and the business. Include the following key elements for clarity and proper documentation:

- Restaurant Name and Contact Information: The receipt should list the restaurant’s name, address, phone number, and email. This helps customers reach out for inquiries or complaints.

- Date and Time: Include the exact date and time of the transaction to avoid confusion, especially in cases of returns or customer disputes.

- Unique Receipt Number: A receipt number or transaction ID helps keep track of individual sales, useful for accounting or customer service purposes.

- Itemized List of Products: Every item ordered should appear with a brief description, quantity, and individual price. This eliminates confusion and clarifies any charges.

- Subtotal: Clearly list the total before taxes or discounts, so customers can see the cost of the items they ordered.

- Taxes: Specify applicable taxes and clearly state the percentage used. This ensures transparency in the final price.

- Discounts and Coupons: Any applied discounts or promotional offers should be noted, including the percentage or amount deducted.

- Gratuity or Service Charge: If a tip or service charge is added automatically, list it separately. Be transparent to avoid confusion.

- Total Amount: Show the final total after taxes, discounts, and tips. This provides clarity and avoids misunderstanding.

- Payment Method: Include how the customer paid (cash, credit card, mobile payment, etc.), along with the last four digits of any card number used.

- Return or Exchange Policy: If applicable, include a brief mention of the restaurant’s policy for returns or exchanges, helping customers understand their options.

Extra Considerations for Digital Receipts

- For digital receipts, ensure that the same elements are included and easy to read on mobile devices.

- Provide an option for customers to request a printed receipt if needed.

Tailoring your itemized receipt template ensures it reflects your restaurant’s branding while providing customers with clear and useful information. Here are key adjustments to consider:

- Logo and Branding: Include your restaurant’s logo at the top of the receipt to reinforce brand identity. Adjust colors and fonts to match your establishment’s theme, creating a cohesive look that aligns with your business image.

- Menu Item Descriptions: Use clear and concise descriptions of each item. If you offer specials or seasonal dishes, make sure to add them in a way that highlights their unique appeal. This gives customers a better understanding of what they’re paying for.

- Itemized Pricing: List each item with its individual price, and if necessary, break down any additional charges like service fees, taxes, or tips. Make sure the total is easy to spot at the bottom, and if applicable, show any discounts or loyalty rewards applied.

- Order Number and Date: Including an order number and the date/time of the transaction can help both you and your customers with future reference or potential inquiries. This also allows for smooth tracking in case of refunds or returns.

- Payment Method: Clearly state the payment method (e.g., credit card, cash) to avoid confusion. If possible, include the last four digits of the credit card or any other relevant payment details for transparency.

- Tax Breakdown: Show tax calculations in a clear manner. Some regions require specific tax rates to be displayed, so adjust the template accordingly to ensure compliance.

- Contact Information: Add your restaurant’s phone number, website, and address for convenience. This allows customers to easily reach out for future reservations, inquiries, or feedback.

- Thank You Message: A simple thank-you message at the bottom can help leave a positive impression and encourage repeat visits. Keep it short and friendly.

Adjusting these elements will help you create a functional and customer-friendly receipt template tailored to your restaurant’s needs.

Canva is a versatile tool that offers a user-friendly interface for creating custom receipt templates. With its drag-and-drop feature, you can easily design detailed itemized receipts using various fonts, colors, and logo placements. Canva provides both free and paid versions with advanced editing features for more professional customization.

Adobe Spark

Adobe Spark stands out with its sleek design templates and customization options. It allows you to add logos, adjust fonts, and insert custom elements to tailor your receipt to your restaurant’s brand. Adobe Spark’s intuitive platform makes it easy for beginners to create professional-looking receipts quickly.

Microsoft Word

For users who prefer working with familiar software, Microsoft Word offers a great solution for editing receipt templates. You can create a structured itemized receipt with tables and automated calculations, which is especially useful for businesses that need to manage billing and pricing details with precision.

Google Docs also provides a simple and accessible platform for editing receipt templates. Its cloud-based nature means you can access and edit your receipts from anywhere. With built-in templates and straightforward tools, Google Docs is ideal for creating basic, no-frills receipts that look professional.

Lucidpress is a great tool for businesses looking for professional-quality receipt templates. It offers a wide range of customizable templates and features drag-and-drop functionality. Lucidpress allows you to save your work in various formats, making it easy to integrate your receipt into different systems or print it directly.

Itemized receipts provide clarity and transparency, giving both your business and customers a clear breakdown of charges. This helps prevent misunderstandings over pricing, ensuring everyone is on the same page. Clear documentation allows customers to verify individual items or services and their costs, building trust and loyalty.

For accounting purposes, itemized receipts simplify the process of tracking expenses and revenue. They make tax preparation easier, as each item can be categorized and allocated correctly. This can also be a time-saver when reconciling financial records, reducing the risk of errors or discrepancies.

When disputes arise, having detailed receipts helps resolve conflicts efficiently. Whether it’s a chargeback or customer complaint, an itemized receipt offers the necessary proof to back up your business’s position. This can save you both time and money by preventing lengthy investigations or the need for refunds that could affect your reputation.

From a legal perspective, itemized receipts can be a protective measure. In certain industries, they are required by law to ensure compliance with pricing regulations. Not providing these detailed receipts can expose your business to fines or penalties.

Itemized receipts also support better inventory management. When each item is listed separately, you can identify which products are selling well and which may need more attention. This insight is valuable for making informed business decisions, whether it’s adjusting your menu or ordering new stock.

Track every expense with precision using an itemized receipt template. This approach simplifies tax filing by providing clear, detailed records of business expenses. When preparing for taxes, an itemized receipt helps ensure accuracy by separating each item and service purchased, along with their associated costs, taxes, and tips. This breakdown reduces the chances of mistakes and ensures you’re claiming all eligible deductions.

By organizing expenses into categories–such as meals, drinks, service fees, and tips–you make it easier for tax authorities to review your receipts. This clarity can support your claims and prevent complications during audits. Additionally, keeping accurate itemized records can help when calculating your total business expenses and establishing tax liability. Make sure your template includes fields for date, vendor name, and an itemized list with prices and totals, so you’re ready to submit them during tax season.

For any deductions related to business meals or client meetings, having a detailed receipt template is a must. It allows you to list each item individually, which strengthens your case if you need to justify the deductions to the IRS or another tax authority. Organizing receipts using such a template saves time and helps maintain compliance with tax rules.

Now the same word is repeated no more than two to three times, and the meaning is preserved.

To maintain clarity in your restaurant receipt template, avoid unnecessary repetition of the same terms. For instance, rather than saying “meal” multiple times, use synonyms like “dish” or “course” to keep the text fresh and engaging.

Be Clear but Concise

Focus on the key details: the item, its price, and any applicable taxes. Too many descriptors can make the receipt harder to read. Use simple terms that everyone understands without overloading the document with unnecessary jargon.

Use Short Descriptions

Instead of lengthy explanations, opt for brief, to-the-point descriptions of each item. For example, instead of “Grilled chicken breast served with a side of mashed potatoes and steamed vegetables,” just write “Grilled chicken with sides.” This method keeps your receipt neat and clear, while still providing enough information.

Keeping your language simple and direct ensures customers can easily understand their receipt without being overwhelmed. A clean and precise layout with limited repetition ensures that the essential details are communicated effectively.