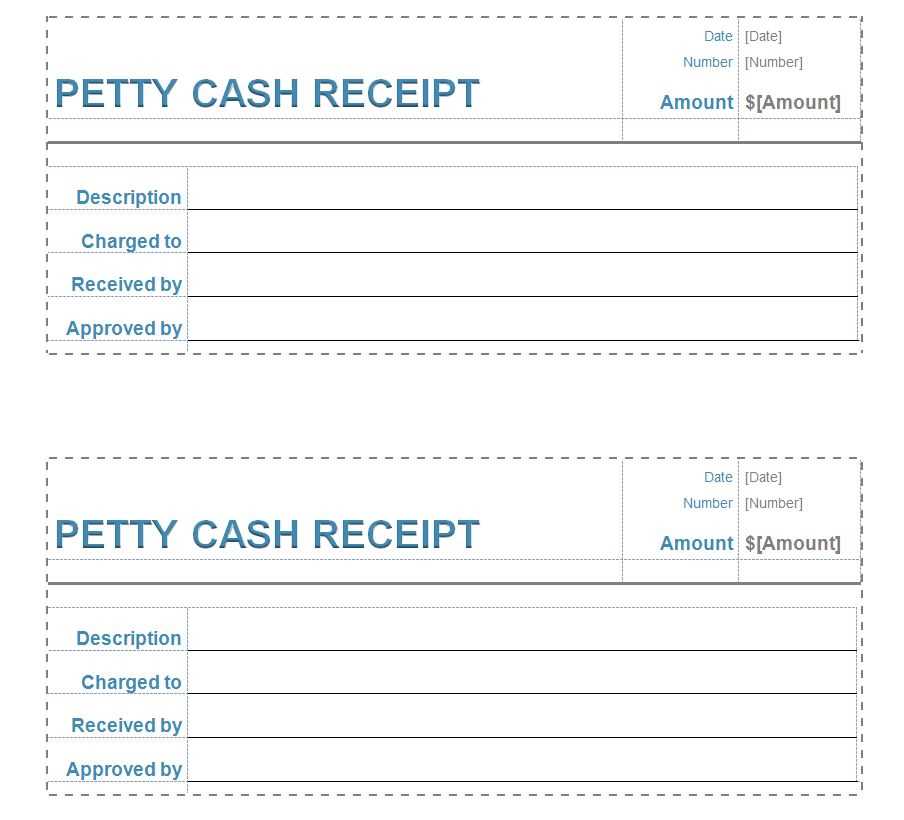

Using a clear and organized cash receipt template is an effective way to document transactions. This template will help you maintain accurate records, ensuring transparency in your financial dealings.

The sample cash receipt template provided here includes essential details such as the date, amount received, payer’s name, and payment method. You can easily customize it to suit your needs, whether it’s for a business or personal transaction.

Simply fill in the required information, and you’ll have a professional receipt ready for your records. This straightforward template is designed to save you time while keeping your financial information well-organized.

By using this template, you can avoid confusion and prevent errors in tracking payments. It serves as a useful tool to maintain a paper trail of all received cash transactions.

Here are the corrected lines:

To ensure clarity and accuracy in your cash receipt template, consider the following changes:

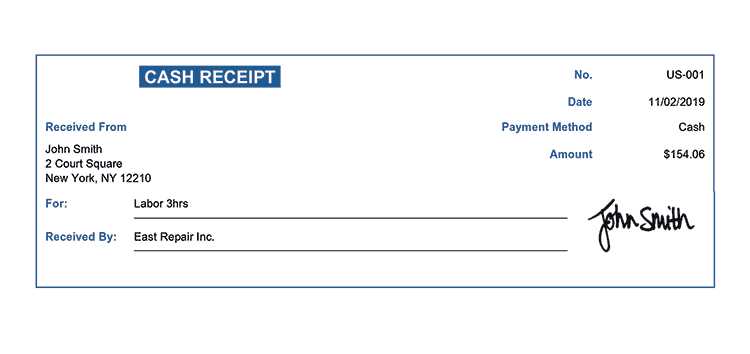

- Date: Always ensure the date field is clearly labeled and formatted to avoid confusion.

- Amount Received: Specify the exact amount received, including the currency, and clearly state if it’s cash or another payment method.

- Recipient Details: Include the full name of the person or business receiving the payment.

- Payment Purpose: Provide a brief description of what the payment is for.

- Receipt Number: Include a unique receipt number for tracking and reference purposes.

- Signature: Add a space for both parties to sign as confirmation of the transaction.

By making these adjustments, the template becomes more structured and user-friendly, reducing the likelihood of errors or confusion.

- Free Sample Receipt Template

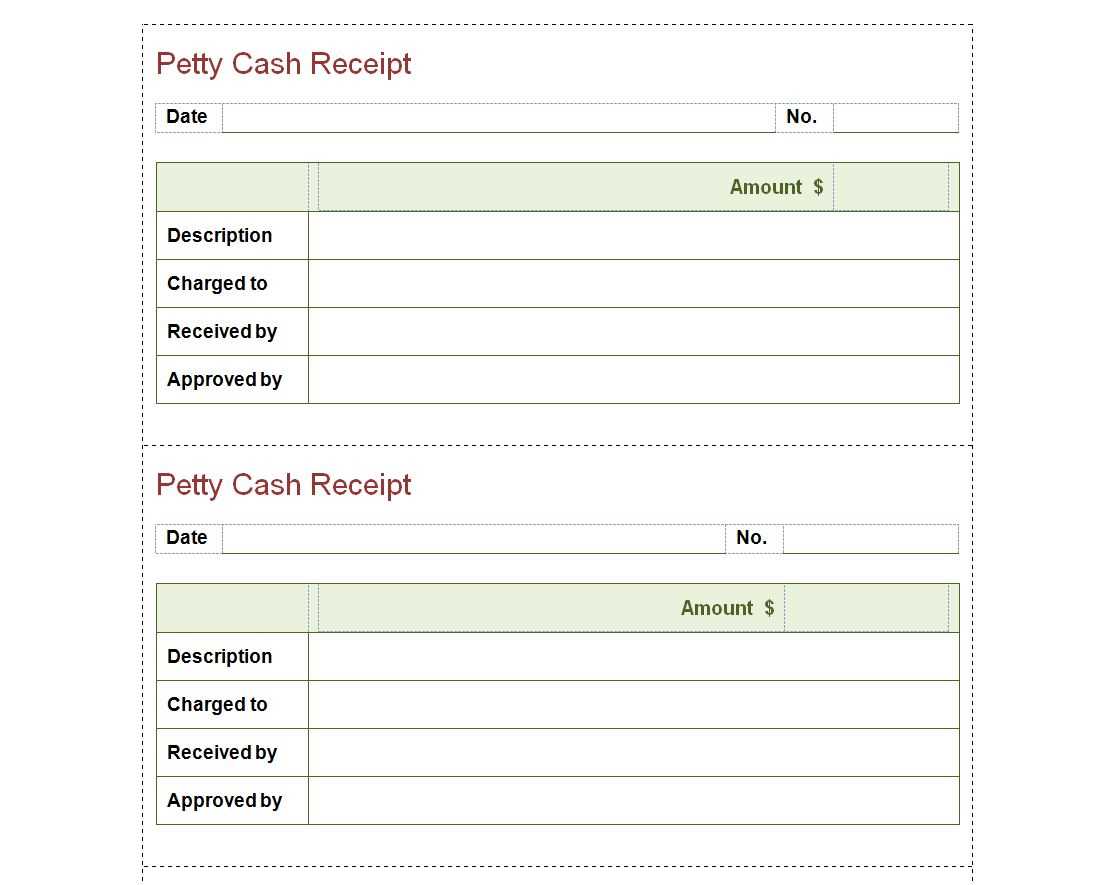

Download a free cash receipt template to streamline your transactions. This simple template allows you to record the date, amount, payer’s information, and the purpose of the payment. Fill in the relevant details and issue the receipt right away.

The template is fully customizable, making it easy to adapt to various transaction types. Whether you’re handling small business sales, personal loans, or other cash payments, it keeps your records clear and professional.

Ensure the amount is stated clearly and include the method of payment (cash, check, etc.) for transparency. This way, you can quickly reference past transactions with a straightforward system.

For additional customization, you can add your business logo or contact information at the top, making it personal and easily recognizable for clients or partners.

Begin by identifying the fields that need customization. A standard receipt includes the business name, transaction date, items purchased, and payment method. Adjust these sections to match your business requirements.

Modify Business Information

- Replace the default business name with your company’s name and logo.

- Ensure the address, contact details, and website are visible to your customers.

Adjust the Layout

- Move or resize sections to prioritize important details, such as the total amount or discount applied.

- Add or remove fields that reflect your specific product or service, like warranty information or item serial numbers.

Consider using color schemes or fonts that align with your brand. Make sure that the template is clear and legible, as clarity improves customer trust.

Include the date and time of the transaction. This helps both parties keep track of the payment timeline and provides a reference for future queries.

List the name of the seller and the buyer. It is important to clearly identify who is involved in the exchange to avoid confusion later.

Specify the amount paid, breaking it down into smaller components like taxes or discounts. Clear breakdowns improve transparency and prevent misunderstandings.

Provide a description of the goods or services provided. A concise but clear description ensures both parties agree on what was purchased.

Include the payment method, whether it’s cash, card, or another form. This creates a clear record of how the payment was made.

Incorporate a unique receipt number for easy reference. This number acts as an identifier for the transaction, simplifying future follow-ups.

First, accurately fill out the date. This should reflect the actual date of the transaction, providing clarity for future reference. Next, list the buyer’s name, ensuring it matches the details from the payment or order. Include any relevant contact information if necessary for verification.

Proceed to specify the items or services provided. Clearly describe each product or service, including quantities and individual prices. If applicable, include taxes or additional charges, making sure all amounts are clear and concise.

Breakdown of Transaction

| Item/Service | Quantity | Unit Price | Total |

|---|---|---|---|

| Example Product | 1 | $10.00 | $10.00 |

| Service Fee | 1 | $5.00 | $5.00 |

Now, calculate the total amount due. This includes summing all item prices, services, and taxes. Clearly display the final total at the bottom of the receipt. If payment was made via card or cash, note the payment method as well.

Finally, provide space for any additional notes. This might include return policies, special offers, or thank-you messages to customers. A signature area may also be useful, especially for higher-value transactions.

Ensure you always include the correct transaction date. Missing or incorrect dates can create confusion during future reference or audits. A clear, accurate record is key for both you and your customer.

Incorrect Amounts

Always double-check the amounts on the receipt before issuing it. Incorrect charges, even by a small margin, can lead to disputes and potential customer dissatisfaction. It’s best to verify all totals and taxes to ensure accuracy.

Failure to Include Required Information

Omitting necessary details, such as business name, contact information, or itemized list of products, can cause confusion and legal issues down the line. Make sure every receipt is complete with all required details for proper tracking.

Using a receipt template streamlines the invoicing process, saving businesses valuable time. By automating the creation of receipts, companies can reduce human error and ensure consistent documentation for every transaction.

Time-saving

Instead of manually creating receipts for each sale, a template lets you fill in the details quickly. This allows your team to focus on other key tasks, improving the overall workflow of the business.

Professional Appearance

Receipt templates offer a polished, uniform look, helping businesses present a more professional image to customers. This consistency enhances trust and reinforces brand identity, especially for smaller businesses trying to establish credibility.

By using a template, businesses can keep financial records organized, reducing the risk of errors or inconsistencies in their accounting processes. Having templates for various transaction types ensures that all necessary information is captured every time.

Explore these reliable platforms for free receipt templates:

| Website | Description |

|---|---|

| Vertex42 | Offers various customizable receipt templates for different needs, available in Excel format. |

| Microsoft Office Templates | Provides easy-to-download templates for receipts in Word, Excel, and other Office applications. |

| Template.net | Wide selection of receipt templates, including business and personal receipts in various file formats. |

| Canva | Offers visually appealing, customizable receipt templates, especially useful for small businesses and freelancers. |

| Smartsheet | Free receipt templates that integrate well with their project management tools for businesses. |

These platforms provide a range of options that are both functional and easy to personalize for any business or personal use. Download and start customizing your receipt today!

To create a simple and useful cash receipt template, follow these steps to ensure clarity and accuracy:

- Include Basic Information: Start with fields for the date, transaction number, and the payer’s details (name, address, or business name).

- Detail the Amount: Clearly list the amount received, including the currency and any applicable tax or fees.

- Itemize Products or Services: If applicable, break down the items or services for which payment was made. Use bullet points or a table to keep it organized.

- Include Payment Method: Specify how the payment was made (e.g., cash, check, credit card, online transfer). If needed, include reference numbers for checks or transactions.

- Signatures: Leave space for signatures of both the payer and the recipient to validate the transaction.

- Additional Notes: Provide a section for any additional comments, such as payment terms or follow-up instructions.

Customize Your Template

Adjust the layout to suit your needs. You can add logos, change the font, or adjust the sections depending on the type of business or transaction.

Save and Share Easily

Once the template is ready, save it as a PDF or other format that can be easily printed or emailed for convenience.