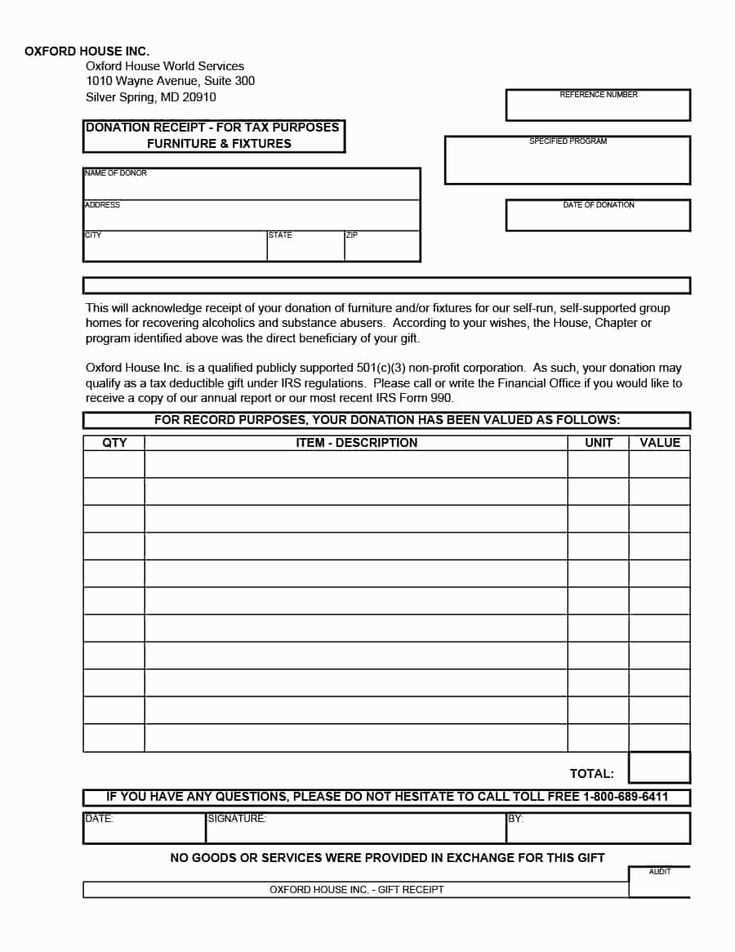

To create a tax-deductible donation receipt, use a simple and clear template that includes key details. Start by listing the donor’s name, the date of the contribution, and the amount donated. If the donation is in the form of goods or services, provide a description and fair market value of the items.

Ensure you mention whether the donation is tax-deductible under the relevant laws. Include your organization’s name, address, and tax identification number. This will help the donor claim their deductions with ease. If the donation is non-cash, an accurate valuation is necessary to comply with IRS guidelines.

The receipt should also clearly state that no goods or services were exchanged in return for the donation, if applicable. This avoids any confusion and makes the receipt more reliable for tax purposes. Using a ready-made template streamlines the process and ensures all required information is included.

Here’s the corrected version where word repetition is minimized:

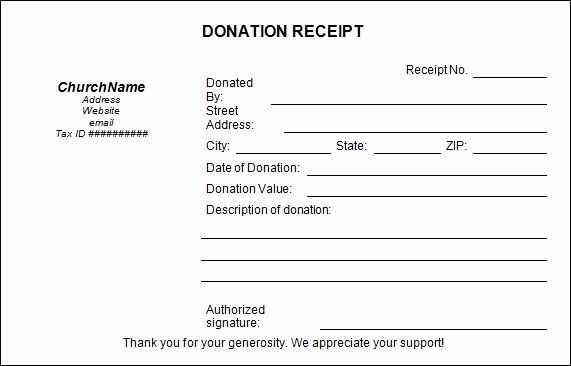

Ensure that the donation receipt template includes the donor’s name, donation amount, and the date of the donation. This information is crucial for proper record-keeping and tax deduction claims. Keep the layout clear and concise, avoiding unnecessary elements. Use a clean font and easy-to-read format to make the receipt professional and legible. Don’t forget to add your organization’s name and contact details for transparency. If applicable, include any specific language required by local tax laws. A well-organized template will save time and reduce errors when generating receipts for future donations.

Here’s a detailed plan for your article on “Free Tax Deductible Donation Receipt Template” with three practical and focused headings in HTML format:

Provide a clear structure for the article, ensuring each section serves a specific purpose. Begin by outlining the key components of a donation receipt template, highlighting the required information such as donor details, donation amount, and charity information. Make sure to present these elements in a straightforward format that is easy for readers to follow and replicate. Aim for clarity, keeping each section concise.

1. Required Information for a Tax-Deductible Donation Receipt

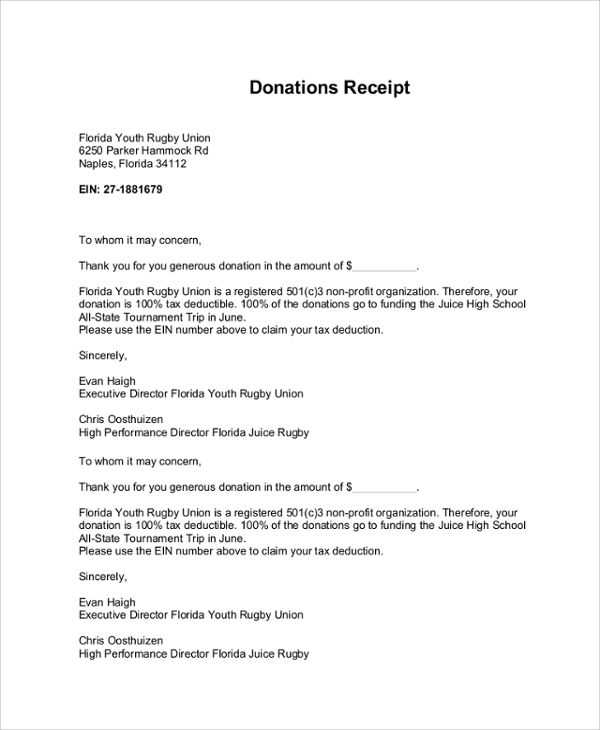

Clearly outline the necessary details that must be included on a donation receipt to ensure its legitimacy for tax deduction purposes. These include the donor’s name, donation date, donation amount, and the charity’s name, address, and tax-exempt status. Provide examples of how to format these elements correctly, and explain why each is important for both the donor and the receiving organization.

2. Formatting and Design Tips for a Receipt Template

Offer tips on how to design the donation receipt template in a clean and professional manner. Discuss the importance of readability, such as using legible fonts and spacing. Suggest incorporating the charity’s logo and contact details at the top of the receipt for better branding. Emphasize keeping the design simple but informative to avoid clutter and confusion.

3. How to Use the Template for Tax Filing

Provide actionable steps for donors and charities on how to use the receipt template during tax season. Outline how to organize and file receipts for tax deductions, and explain the relevance of maintaining proper records. Offer advice on how often receipts should be issued and how to store them digitally for easy access during audits or tax filing.

- Customizing Your Donation Receipt Template

Modify your donation receipt to reflect your organization’s branding and provide clear, useful information. Start by including your logo and contact details in a prominent place. This not only enhances credibility but also helps donors recognize your organization easily.

- Recipient Information: Ensure that the name of the donor, along with their address and any other identifying information, is included. This is crucial for tax purposes.

- Donation Details: Clearly state the date and amount of the donation. Specify whether the donation is monetary or in-kind, and provide a detailed description of any goods or services donated.

- Tax Information: Mention the tax-exempt status of your organization. Include a statement like “No goods or services were provided in exchange for this donation” if applicable, as this will help the donor claim their deduction.

- Personalized Message: Adding a short thank-you note can make the receipt more personal and strengthen your relationship with the donor.

Modify the design to be clean and easy to read. Avoid clutter and keep the focus on the key details, making sure the receipt is functional and user-friendly.

- Formatting: Use a clear font and organize the information logically. Consider a layout that separates donation details from tax information for easy reference.

- Custom Fields: Add specific fields if your organization requires additional information, such as donor ID or fund designation. This will make tracking donations simpler.

Always test the template for clarity and accuracy before using it for actual receipts. This ensures that everything is correct and that the donor’s experience is smooth.

Ensure your receipt includes the donor’s full name and address. This allows both parties to accurately track the donation for tax purposes.

Donation Details

Clearly state the date of the donation, the amount given, and the nature of the gift. If the donation is non-monetary, provide a description of the item(s) and estimated value. For monetary donations, ensure the amount is precise and without ambiguity.

Non-Profit Information

Include the charity’s name, address, and federal tax identification number. This verifies the organization’s legitimacy and allows the donor to confirm their tax-deductible status.

Provide a clear statement that no goods or services were exchanged for the donation if applicable. This is important for the donor’s ability to claim the full value of the donation.

Ensure the receipt includes the correct donor information, including the full name and address. Incorrect or missing details can invalidate the receipt for tax purposes. Always cross-check spelling and address format before issuing receipts.

Failing to Provide a Clear Description of the Donation

Avoid vague descriptions such as “miscellaneous donation.” Be specific about what was donated–whether it’s money, goods, or services. List the items or provide an accurate value of the donation, especially for in-kind contributions.

Not Including the Tax-Exempt Status of the Organization

Clearly state the organization’s tax-exempt status. If the donor intends to claim a deduction, the receipt must show the organization’s official tax-exempt number or IRS classification. Lack of this information can make the receipt unusable for tax deductions.

Keep accurate records of every receipt issued. Mistakes, like issuing duplicate receipts or missing required information, can complicate your organization’s compliance with tax regulations and frustrate your donors when they file taxes. Double-check all entries before printing or sending receipts.

To create a clear and legally acceptable donation receipt, include the following information:

Key Elements of a Donation Receipt

- Donor Information: Full name and address of the donor.

- Organization Details: Name, address, and tax-exempt status of the receiving organization.

- Date of Donation: The exact date the donation was made.

- Description of Donation: A detailed description of the item(s) or the cash amount donated.

- Value of Donation: If non-cash, provide an estimate of the fair market value.

- Statement of No Goods or Services: Include a statement confirming that no goods or services were exchanged in return for the donation.

Formatting Tips

Use a simple layout that is easy to read. Keep sections clear and well-organized, ensuring all required information is included. Add a footer with the organization’s contact details and website, so the donor can reach out if necessary.