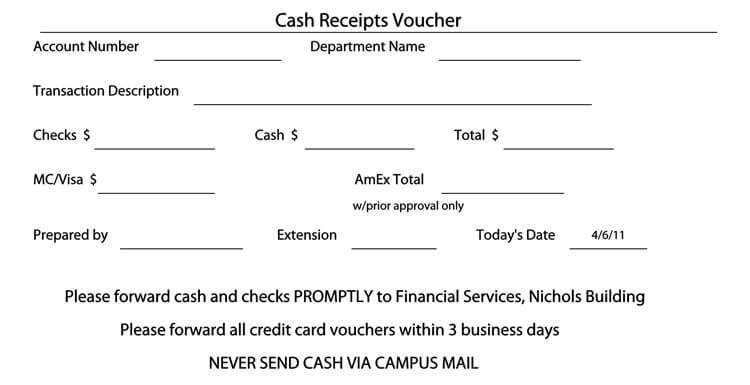

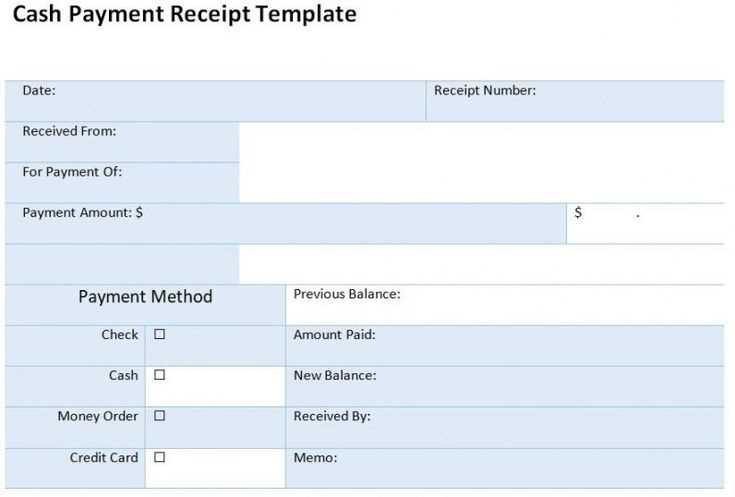

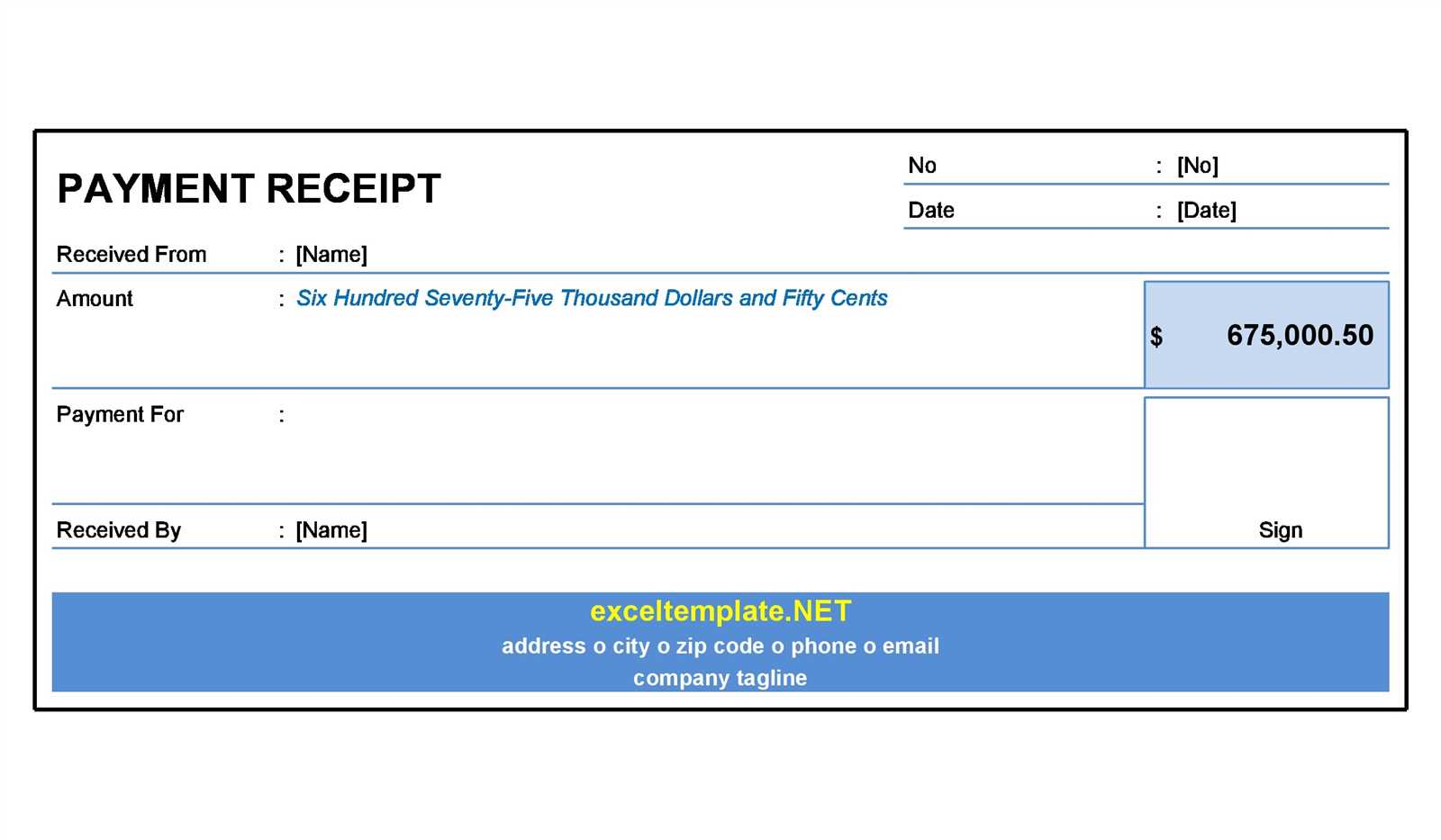

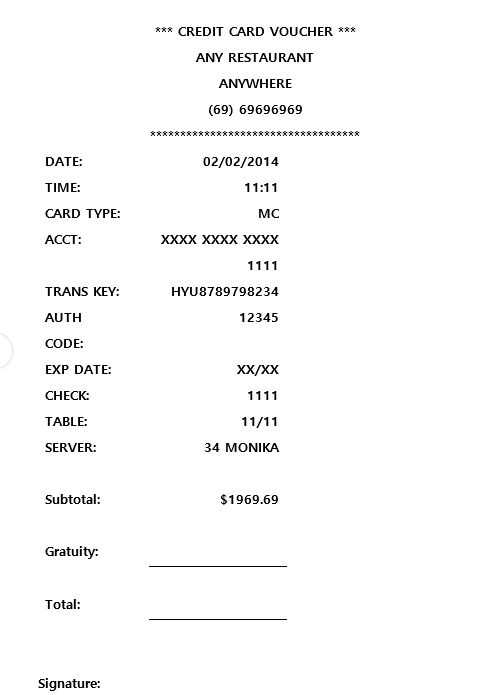

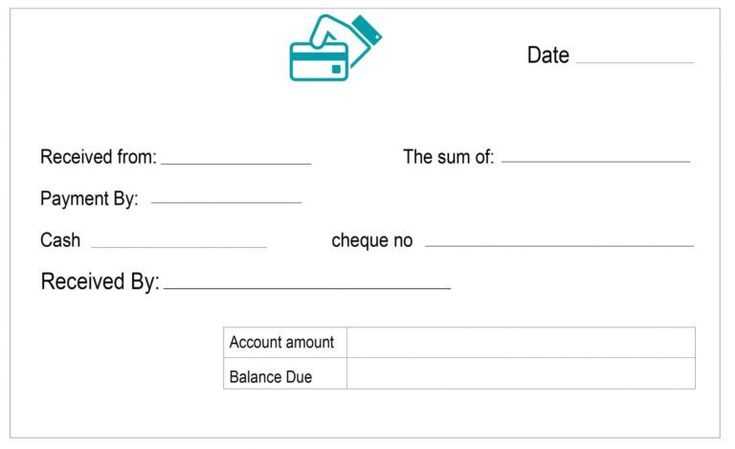

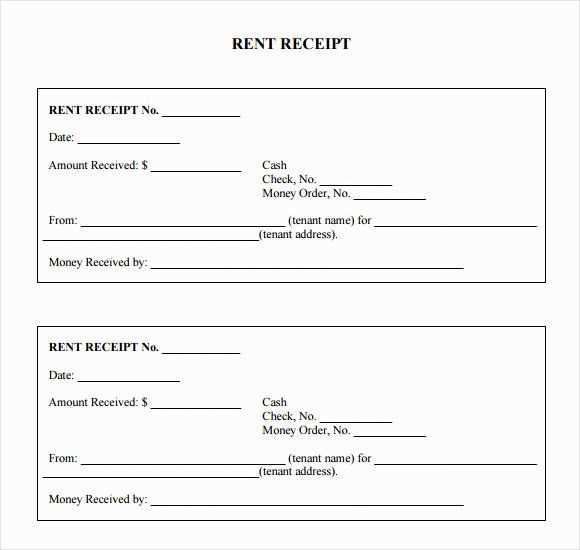

To create a free template for credit card payment receipts, begin by focusing on clarity. The template should include the essential fields such as the transaction date, amount, and the last four digits of the credit card number. Providing a space for the cardholder’s name ensures the receipt reflects personal details, reinforcing its authenticity.

Layout is key. A simple, easy-to-read structure will enhance the user experience. Group related details together, such as payment method and merchant information. Use bold or italicized text for key information like the payment amount and the transaction ID to make it stand out.

Include a section for a unique receipt number for tracking purposes. This is particularly helpful in case the customer needs to reference the transaction in the future. A clean footer with business contact details, including email and phone number, adds credibility to the receipt.

Lastly, ensure the template is customizable, allowing users to adjust it according to their specific needs. This flexibility will cater to a range of businesses and personal transactions, ensuring it serves a variety of purposes.

Here’s the updated version of your text with minimal repetition while maintaining the meaning:

To create effective credit card payment receipts, ensure they contain key details like the transaction amount, card type, and date. Include clear, concise wording that avoids redundancy. Avoid using generic phrases or unnecessary jargon; instead, focus on accuracy and relevance. Display the total amount paid, including any fees, to prevent confusion. Provide an easy-to-read summary that’s straightforward for customers to verify their transaction details quickly. Keep the layout clean and well-organized, with essential information highlighted for immediate reference. This method enhances clarity and boosts customer trust.

- Free Template for Credit Card Payment Receipts

A free credit card payment receipt template provides a simple solution to track transactions efficiently. Use it to record essential details such as payment date, amount, merchant name, and card type. This saves time and reduces errors compared to manually creating receipts. The template is customizable to fit specific business needs, allowing you to add or remove fields based on your requirements.

Choose templates compatible with common office software like Microsoft Word or Excel for ease of use. Many templates offer a clean, professional design, making them suitable for both physical and digital receipts. By adopting such a template, businesses can ensure consistent formatting and quick generation of payment receipts without investing in complex software or systems.

To select the best free template for credit card payment receipts, evaluate your specific needs first. If you are handling only occasional transactions, a simple, minimalistic design may suffice. For businesses with more frequent interactions, opt for templates that include additional fields such as tax information, order numbers, or customer IDs.

Key Features to Consider

- Customization: Ensure the template allows enough flexibility for branding elements like your logo, colors, and fonts.

- User-Friendliness: Choose a design that’s easy to fill out and intuitive for your customers.

- Compatibility: Verify the template works well across devices and payment platforms.

Where to Look

- Explore trusted online resources that offer pre-designed templates with a high level of customization.

- Check forums or reviews to gauge the reliability and user experience of various templates.

Select the template that aligns with your business scale and enhances the professionalism of your payment receipts.

Modify the layout and design to fit your brand’s style. Start with adjusting the color scheme, fonts, and logos. Use simple tools to replace default text placeholders with your company details, such as your name, address, and contact information. Choose fonts that reflect your brand’s identity while maintaining readability.

Adjusting Receipt Content

Tailor the content to match the transaction details. Add or remove fields depending on your needs, such as including payment method, discount information, or tax breakdowns. Ensure that each item is clearly labeled to avoid confusion for the customer. Use concise language to present the information in a straightforward manner.

Adding Custom Elements

Incorporate elements like terms and conditions, return policies, or loyalty rewards. Place these sections in easily accessible areas without overcrowding the receipt. Customize the footer to include additional notes or promotional offers for your customers.

Begin with clear identification of the business. Include the company name, address, and contact details such as a phone number or email. These details ensure the receipt is connected to a specific location or entity.

Transaction Information

Always list the transaction date, time, and payment method. Including the payment type (credit card, debit card, etc.) adds clarity. Display the total amount charged, ensuring it reflects the exact transaction value.

Card Details

For card payments, provide the last four digits of the card number to offer security without exposing full card details. Also, mention the card type (Visa, MasterCard, etc.) for reference.

Finally, include any taxes applied to the transaction. This transparency will prevent confusion and ensure compliance with tax regulations.

Linking payment receipts directly with accounting software eliminates manual entry errors and saves time. Most modern accounting platforms, such as QuickBooks or Xero, offer integrations with payment processors. Once receipts are captured, the integration automatically records and categorizes transactions, syncing seamlessly with your financial reports.

Steps to Integrate Receipts

1. Choose a payment gateway that supports accounting software integration. Popular options like Stripe, PayPal, and Square work well with platforms such as QuickBooks and Zoho Books.

2. Set up the integration by connecting your payment processor account with your accounting software. Most platforms have a simple authentication process to allow this connection.

3. Ensure your accounting software is configured to automatically classify payments, taxes, and fees for proper bookkeeping. Most tools allow you to set up custom categories based on receipt data.

Benefits of Integration

Automation reduces the risk of data entry mistakes, making bookkeeping more accurate. It also speeds up reconciliation, so you can quickly verify that all transactions match your bank statements. With real-time updates, your financial reports stay up-to-date without extra effort.

Automating receipt generation streamlines payment processes and improves efficiency. Use payment gateway integrations that offer built-in receipt generation, such as Stripe, PayPal, or Square. These systems automatically create receipts as soon as a payment is processed, sending them directly to customers via email or making them available for download in their account. Set up your payment platform to include transaction details such as payment amount, date, and any discounts applied to make each receipt clear and complete.

Integrating Receipt Generation with Your Website

To automate receipt generation on your website, implement a custom solution using APIs from your payment gateway. Many platforms offer API endpoints that allow you to automatically trigger receipt creation and email delivery right after a transaction. For instance, after confirming a successful payment, a simple API call can retrieve payment details and send out a professionally formatted receipt to the customer.

Customize Receipts for Branding

Ensure receipts match your business’s branding by customizing the receipt templates. Use the provided options from your payment processor to include your logo, business name, and contact details. Some platforms allow for HTML or PDF customization, giving you control over the design to align with your company’s style guide.

Pay close attention to formatting. A common mistake is using inconsistent font sizes, colors, or margins, which can make your receipt look unprofessional. Stick to a standard layout to ensure readability and clarity.

1. Missing Important Fields

Leaving out necessary fields like transaction date, payment method, or amount paid can lead to confusion. Always double-check that all required fields are included in your receipt template.

2. Overcomplicating the Design

A cluttered template can overwhelm the reader. Keep your design simple and organized. Avoid using too many graphics or decorative elements that distract from the key information.

3. Incorrect Currency Formatting

Ensure currency symbols and amounts are formatted correctly according to local standards. Mistakes in currency formatting can lead to misunderstandings and potential legal issues.

4. Failing to Update Template Regularly

Templates should reflect any changes in tax rates, legal requirements, or business details. Regular updates prevent outdated or inaccurate receipts from being issued.

5. Using Untrusted Sources

Be cautious when downloading templates from unreliable sources. Poor-quality templates may contain bugs or compromise security. Always choose templates from reputable providers.

For creating clear and professional payment receipts, use free templates that help streamline the process. These templates ensure accuracy and consistency in each receipt, making it easier for both businesses and customers to track transactions.

Advantages of Using Free Templates

Free templates for credit card payment receipts provide a simple and cost-effective solution for businesses. They allow quick customization without the need for complex software. By filling in essential details like transaction amount, date, and payment method, you can produce professional-looking receipts in minutes.

Customizing Your Receipt Template

Most free templates offer fields for transaction details such as cardholder name, card number (partially masked), and merchant contact. Make sure to customize your template to fit your business needs, including adding your logo or branding. Adjusting the design and formatting to match your company’s style creates a more personalized experience for customers.

| Field | Details |

|---|---|

| Transaction Amount | Include the total amount charged, ensuring it matches the card payment. |

| Payment Method | Specify the type of payment (e.g., credit card, debit card, etc.). |

| Transaction ID | Provide a unique identifier for each transaction for easy tracking. |

| Cardholder Name | Display the name of the person using the credit card, partially masked for security. |