If you need a quick solution to create a payment receipt, using a free template can save you time and effort. A ready-made template ensures all necessary details are included, such as the amount, date, and payer’s information, without the need for designing from scratch.

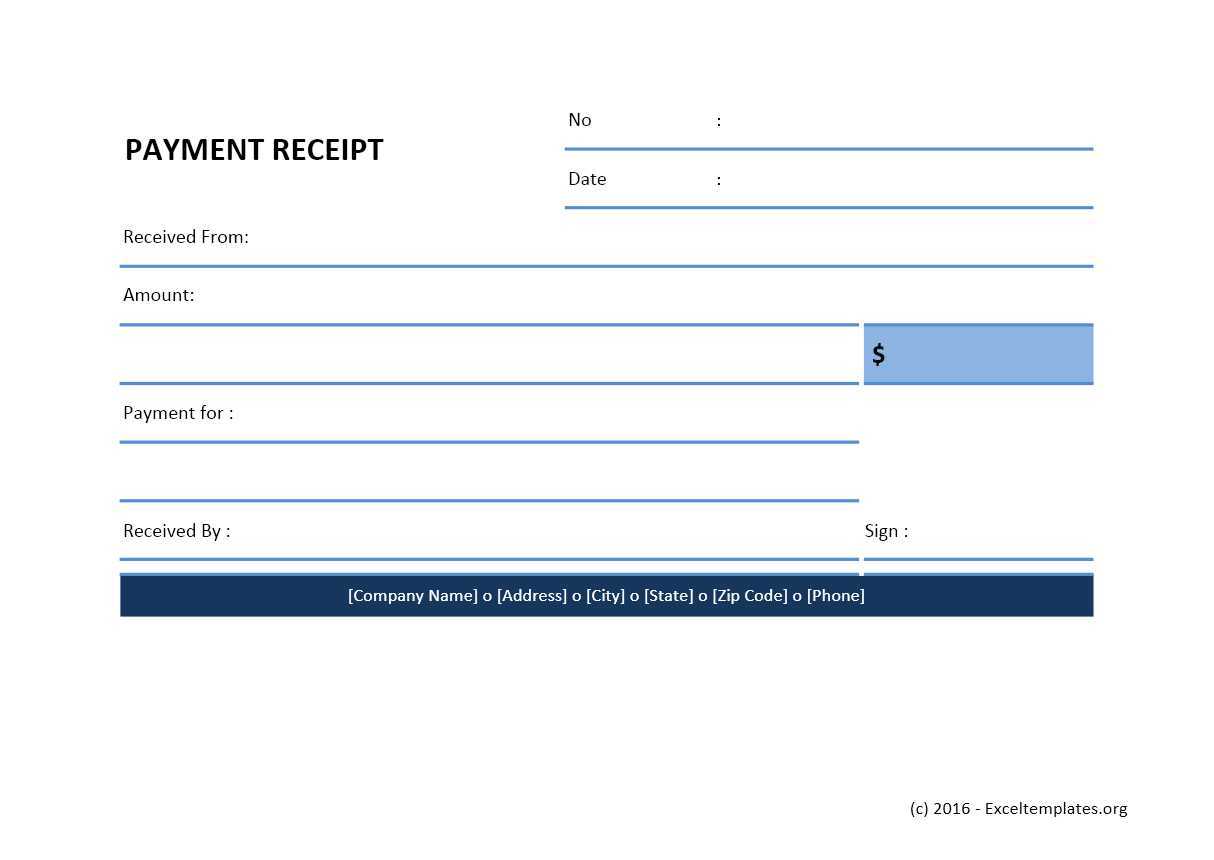

Look for templates that are simple yet customizable to fit various business needs. Choose one that allows you to add company branding, personalize recipient details, and clearly display transaction information. Adjust the layout to suit the type of transaction you’re dealing with, whether it’s for goods or services.

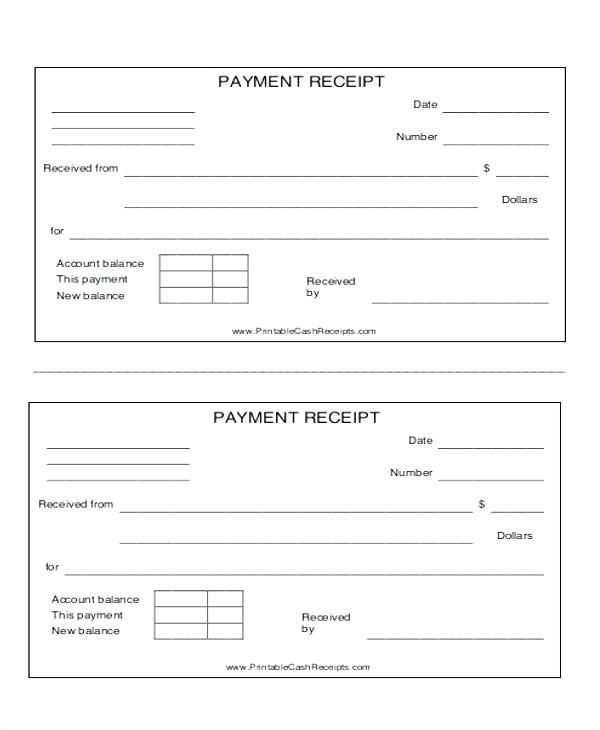

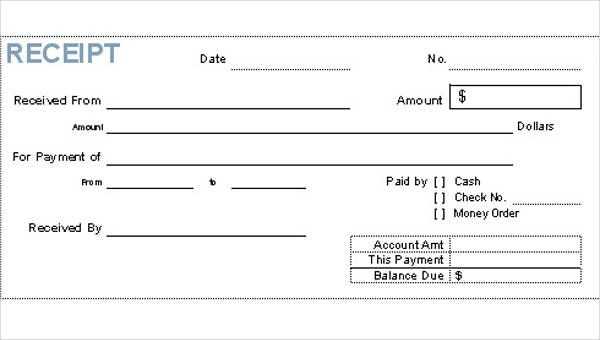

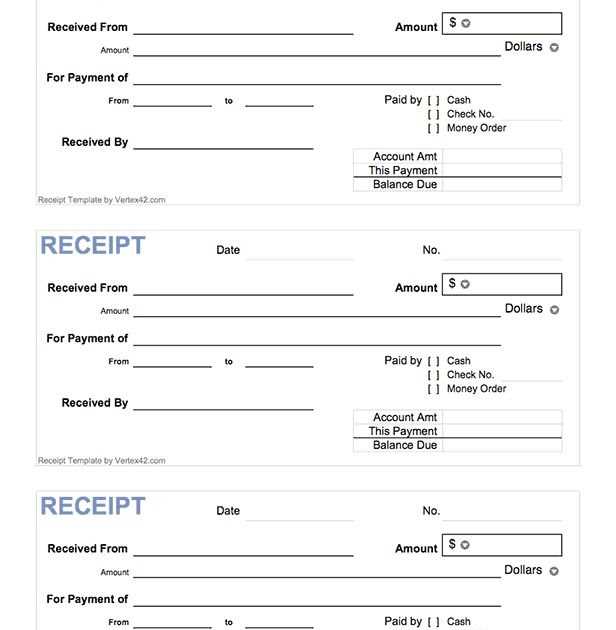

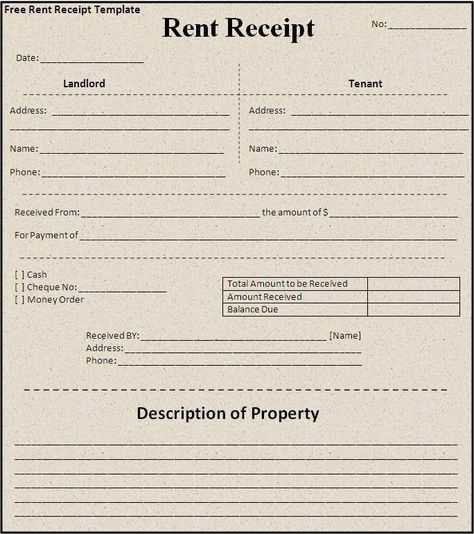

Use a payment receipt template that supports a clear, professional format. Include sections for the receipt number, description of payment, and method used. Make sure the document is easy to read and accurately reflects the payment transaction details.

Here’s the revised version with reduced repetition while maintaining the meaning:

To create a payment receipt template, focus on providing clear, concise information. Start by listing the transaction date and the amount paid. Include the payer’s details, such as their name and contact information, along with the recipient’s information. Clearly identify the method of payment and reference any invoice numbers or order IDs. Avoid overloading the receipt with unnecessary information; prioritize clarity and simplicity.

Use a clean layout, ensuring that all key details are easy to locate. Ensure there is a space for signatures if required. Provide an itemized list if multiple items or services were involved, and consider offering a space for additional notes or terms. This format helps both parties stay informed while maintaining a professional appearance.

- Common Features in Payment Receipt Templates

Payment receipt templates typically share a set of core features to ensure clarity and professionalism. These elements help users quickly customize and generate accurate payment confirmations. Key features include:

1. Payment Details

Each receipt should clearly list the payment amount, currency, and method used. This section avoids confusion by detailing the transaction type (e.g., cash, card, bank transfer) along with any relevant reference numbers.

2. Date and Time

It is important to include the precise date and time of the transaction. This allows both parties to easily reference when the payment was made and helps with organizing financial records.

3. Seller and Buyer Information

Clear identification of both parties helps maintain transparency. The seller’s business name, contact details, and buyer’s name should be clearly displayed to avoid any ambiguity in the transaction.

4. Itemized List

If applicable, a breakdown of the purchased items or services is valuable. This list ensures the buyer understands exactly what was paid for and confirms the accuracy of the transaction.

5. Unique Receipt Number

A unique receipt number acts as a reference for future inquiries or disputes. This number helps track individual payments, especially when managing large volumes of transactions.

6. Taxes and Discounts

If relevant, the receipt should show any taxes applied or discounts offered. This maintains transparency in the final amount paid and complies with local tax regulations.

7. Signature Section

A signature space can add authenticity to the receipt, particularly for high-value or contractual transactions. This reinforces trust between the buyer and seller.

By integrating these features, payment receipt templates provide clear, professional documentation for both the buyer and seller, ensuring smooth transactions and record-keeping.

For an easy and quick start, try searching these websites for free templates tailored to payment receipts:

1. Template.net

Template.net offers a wide variety of customizable payment receipt templates. You can filter by different categories, such as business or personal use, and download templates in formats like Word, Excel, or PDF.

2. Invoice Simple

Invoice Simple provides free templates with a focus on simplicity and clarity. Their templates are editable online, allowing users to input payment details and print or send them immediately.

These sources offer flexibility, making it easy to find a template that suits your needs for different payment scenarios. Whether you need something formal or casual, these platforms give you the tools to create professional receipts in just a few steps.

Ensure receipt templates include all necessary information required by local laws. This will help avoid potential legal issues for businesses and individuals. Here are some key elements that must be present:

- Business Information: Include the name, address, and contact details of the business issuing the receipt.

- Date and Time: Specify the date and time of the transaction. This is critical for record-keeping and auditing purposes.

- Transaction Details: Clearly list the products or services purchased, their prices, and any applicable taxes or discounts.

- Payment Method: Indicate the payment method used, whether it is cash, credit card, or another form of payment.

- Unique Receipt Number: Assign a unique identifier to each receipt for tracking and reference purposes.

Some jurisdictions may also require additional information like the seller’s registration number or a specific format for taxes. Stay informed about the specific legal requirements in your location to ensure full compliance.

By keeping templates simple and including all mandatory details, you minimize the risk of mistakes that could lead to disputes or legal consequences.

Payment receipt templates streamline the documentation process by providing a ready-made structure for entering transaction details. With a template, there’s no need to manually format receipts each time, saving hours of repetitive work. Simply fill in the necessary information, and the receipt is ready to go. This eliminates the need to worry about layout or forgetting important details like payment amounts, dates, or payment methods.

Instant Accessibility

Having a template on hand means receipts can be generated instantly. You no longer need to recreate the format from scratch for each transaction, ensuring that you don’t waste time on design elements or tracking down information. With consistent formatting, templates guarantee accuracy in every receipt, preventing mistakes and ensuring uniformity for records or customer reference.

Reduced Human Error

When using a template, the risk of missing crucial fields or entering information in the wrong format is minimized. This eliminates the need for follow-ups or corrections, allowing you to focus on other tasks. By saving time on editing and revising, you improve your overall workflow.

Use a simple and clean layout for a payment receipt template. This allows for clear visibility and easy use. Stick to essential details like the payer’s name, payment amount, date, and description of the transaction.

Recommended Structure

The template should begin with basic transaction information. Follow with a table to organize the payment breakdown and other related data. This ensures both clarity and readability.

| Detail | Information |

|---|---|

| Payer Name | [Payer’s Full Name] |

| Payment Amount | [Amount Paid] |

| Date of Transaction | [Transaction Date] |

| Description | [Details of Payment] |

| Receipt Number | [Unique Identifier] |

Key Tips

For convenience, ensure the template is easy to edit. Keep fields like “Payer Name” and “Amount Paid” flexible, so they can be adjusted as needed. Also, consider adding a space for signatures or a company logo if required.