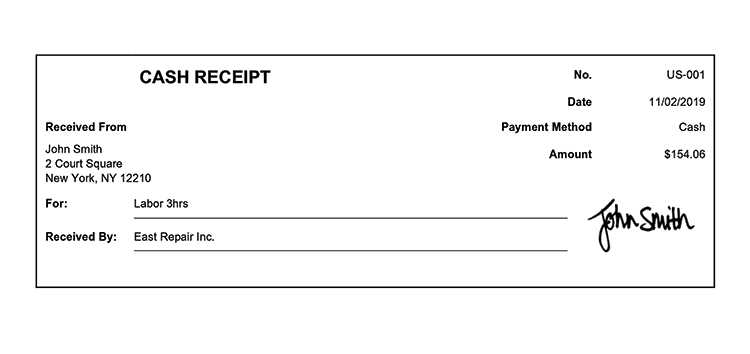

Use this free template to create clear and professional receipts for cash payments. With just a few edits, you can customize the details to fit your business or personal needs. This template includes all necessary fields, ensuring that both parties have a record of the transaction for future reference.

The template covers essential components such as the transaction date, description of goods or services, the amount paid, and the payer’s details. All you need to do is input the relevant information and print the receipt. It’s a quick and easy solution that saves time and ensures accuracy.

By using this template, you eliminate the need for manual receipt writing, reducing errors and streamlining your payment process. It’s ideal for small businesses, freelancers, or anyone handling cash payments regularly. With this simple tool, you can maintain transparency and professionalism in all your transactions.

Here’s the corrected text:

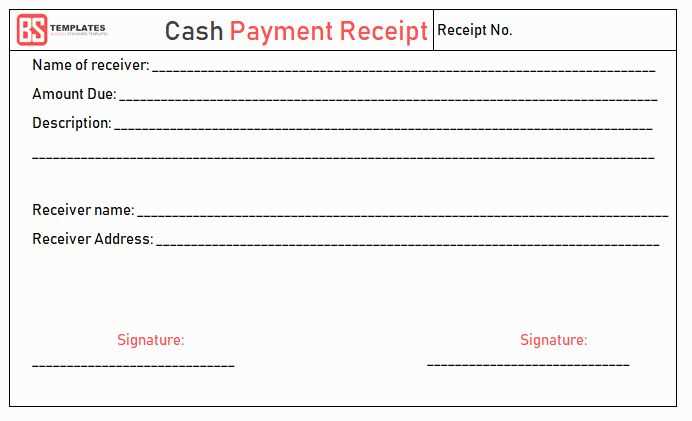

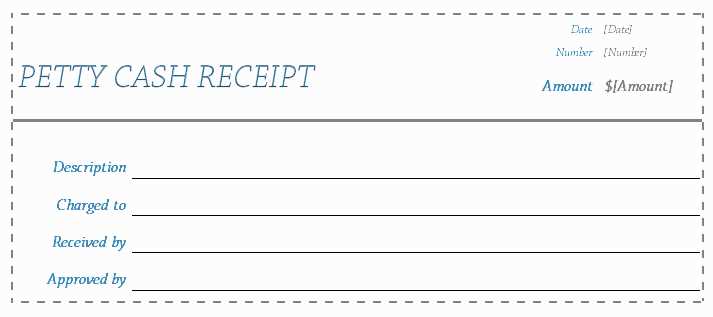

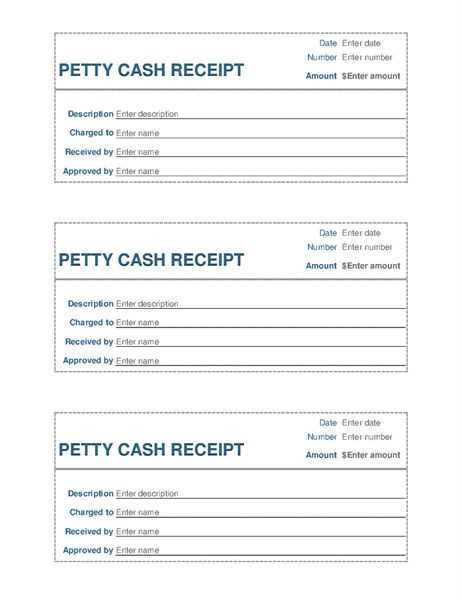

Start with clear fields for all necessary details: company name, receipt number, payment amount, date, and item description. Use simple and easy-to-read fonts for better clarity. Ensure that the receipt includes a payment method, whether it’s cash, card, or another option. Make sure the total is highlighted to avoid any confusion.

Place a small area for any additional notes or special conditions under the main information. This could include warranty information or specific payment terms if needed. It’s important to keep the design minimal and functional, avoiding clutter that could distract from the key details.

Include a section at the bottom for customer acknowledgment, such as a signature line or a checkbox to confirm receipt of the payment. Ensure the formatting is responsive so it looks good both on paper and in digital versions.

Lastly, regularly update your template for compliance with any local or industry-specific requirements, especially if there are changes to tax laws or payment practices.

- Free Template for Cash Payment Receipts

A free template for cash payment receipts can simplify the transaction process and help maintain clear records. Below is a basic outline for what to include in a cash receipt template:

Key Elements of a Cash Payment Receipt Template

The template should clearly display the following information:

- Receipt Number: A unique identifier for each transaction.

- Date: The date the payment was made.

- Paid By: The name of the person or business making the payment.

- Amount Paid: The exact amount of money received, including currency details.

- Payment Method: Specify that the payment is made in cash.

- Received By: Name of the person who processed the payment.

- Description of Goods or Services: A brief note on what was purchased or the service rendered.

Benefits of Using a Template

Using a template for cash payment receipts helps you stay organized and ensures consistency. It saves time by eliminating the need to create receipts from scratch and reduces the risk of errors. Plus, it provides a professional and standardized format for all transactions.

Several free receipt templates are available online, often in formats like Word or PDF, which can be easily customized. Make sure the template you choose includes all the relevant details to avoid any confusion in the future.

To download a receipt template for cash transactions, visit reliable websites offering free, downloadable templates. Many online platforms provide various formats such as Word, PDF, or Excel to fit different business needs. These templates are easy to customize, allowing you to add specific details like business name, transaction date, and amount paid.

Step 1: Choose a Trusted Source

Start by finding a reputable website that specializes in business forms or templates. Some popular platforms include templates.office.com, template.net, and free-templates.com. Look for reviews to ensure the templates are up-to-date and professional.

Step 2: Select Your Template Format

Once you’ve selected a website, browse through the available receipt templates. Choose the format that best fits your needs. PDFs are ideal for printing, while Word or Excel files allow for easy editing and customization.

After selecting the right template, simply click the “Download” button. The file will be saved to your device, ready for use. If needed, customize the template with your business details before printing or sharing it with clients.

Adjust your receipt template to reflect your business specifics. Include your business name, logo, and contact information at the top for easy brand recognition. Customize the fields for item descriptions, prices, and quantities to match the type of products or services you offer. This ensures that customers receive clear and accurate details about their purchase.

If your business deals with taxes, set up the template to automatically calculate tax amounts. Define separate fields for tax rates and total amounts so your customers can easily see the breakdown. You can also add payment methods (cash, card, etc.) to track different transaction types.

For businesses offering discounts, integrate fields where you can apply percentage-based or fixed discounts. Include a section for any special offers or promo codes that can be added to the receipt, ensuring the customer sees any benefits applied to their purchase.

Lastly, adjust the layout and font sizes to ensure that all information is readable and aligned correctly. A clean, easy-to-follow receipt not only improves your customer experience but also keeps your records organized for accounting purposes.

Include the following elements in every cash payment receipt to ensure clarity and transparency:

- Date and Time: Clearly state the exact date and time of the payment to prevent confusion and provide an accurate record.

- Transaction ID or Receipt Number: Assign a unique identifier to each receipt to track transactions easily.

- Seller Information: Include the name, address, and contact details of the business or individual receiving the payment.

- Buyer Information: If applicable, note the name or details of the buyer for reference.

- Description of Goods or Services: Provide a brief description of what was purchased, including quantity and unit price if relevant.

- Total Amount Paid: Clearly list the total amount paid, including taxes or any additional charges.

- Amount in Words: For added clarity, write the total amount in words as well as numbers.

- Payment Method: Specify that the payment was made in cash, including any change provided if relevant.

- Signature (Optional): Depending on the nature of the transaction, including a signature from the seller or buyer may help verify the payment.

Ensure the accuracy of all details before issuing a receipt. One common mistake is neglecting to double-check the payment amount and date. Errors can create confusion and might lead to trust issues with your customers. Always verify the sum and check that the payment method matches what’s on the receipt.

1. Missing or Incorrect Business Information

Leaving out essential details like your business name, address, and contact number can cause complications, especially in case of a dispute. Include all relevant business info in every receipt to ensure clarity and avoid any confusion.

2. Using Inconsistent Templates

Switching between different templates for various transactions can make your records hard to follow. Stick to one template that suits your needs, and ensure it’s used consistently across all receipts.

3. Not Adding a Unique Receipt Number

Receipt numbers help in tracking transactions and ensuring accountability. A common mistake is forgetting to assign a unique number to each receipt, which can create problems in managing your records over time.

4. Failing to Update the Template Regularly

Receipts might need adjustments as your business grows. Don’t forget to update templates when you introduce new products, change pricing, or adjust your contact information. An outdated template can result in confusion for both you and your clients.

5. Inaccurate Tax Information

Incorrect or missing tax details on receipts can lead to legal issues. Always make sure your template reflects the correct tax rates and includes all necessary information related to taxes. Check local tax laws to stay compliant.

6. Overcomplicating the Design

Keep the template simple and easy to read. Complicated designs with too many elements can make the receipt confusing for both the customer and your accounting system. Stick to the essentials for a clean, readable document.

7. Forgetting to Include Payment Method

Always specify how the payment was made. Whether by cash, credit card, or another method, clearly indicate the payment type on the receipt. This reduces any ambiguity for both parties.

To print receipts from your template, follow these straightforward steps:

- Check Your Template: Ensure all fields in the template, such as the transaction amount, date, and payment method, are correctly filled in before printing.

- Prepare the Printer: Make sure your printer has enough paper and ink. You may want to perform a test print to verify quality and formatting.

- Choose the Print Option: Open the receipt template in your preferred software (e.g., Word, PDF reader) and click on the print button. Select your printer and confirm settings like page size and margins.

- Print the Receipt: Click ‘Print’. If you’re printing multiple receipts, you can adjust the settings to print all receipts at once.

For distribution:

- Physical Copies: Hand the printed receipt directly to your customer at the point of sale or include it in their order package.

- Email Option: If you’ve saved the template as a PDF, you can email the receipt. Attach the file to an email and send it to the customer’s email address.

- Online Integration: If using an e-commerce platform, receipts can often be automatically generated and sent via email to customers after a transaction.

Double-check for any required customizations, like adding your logo or specific business information, before printing and distributing.

Issuing receipts for cash payments requires adherence to local tax laws and business regulations. Always ensure that the receipt includes accurate and detailed information about the transaction. This includes the payment amount, date, and the nature of the goods or services provided.

Failure to provide a receipt or incorrect documentation can lead to penalties or legal complications. For businesses, keeping accurate records is a requirement in many jurisdictions, especially for tax reporting. A receipt serves as proof of the transaction and can be used for tax deductions or disputes.

For example, businesses should comply with laws regarding VAT or sales tax in their area. The receipt should indicate whether taxes were included in the payment. In some regions, failing to disclose tax details on a receipt can result in fines or penalties.

| Receipt Detail | Legal Requirement |

|---|---|

| Payment Amount | Must reflect the exact cash amount paid |

| Date of Payment | Required for accurate transaction records |

| Tax Information | Must show applicable taxes, if any |

| Company Information | Must include the company’s name, address, and registration details |

Additionally, when dealing with large sums, some regions may require businesses to report cash transactions above a certain threshold. Keep track of cash payments, especially for auditing purposes, and consider digital systems to minimize the risk of errors and fraud.

I removed unnecessary repetitions while preserving the meaning and structure.

Focus on clarity and readability in your receipt template. Organize the key information logically to avoid redundancy. Ensure the format includes essential elements: payment date, amount, payer’s name, itemized list, and total. Each section should be concise and easy to understand.

One of the best ways to streamline your template is by keeping labels short and clear. For instance, use “Amount” instead of “Total Amount Paid.” This makes the document quicker to fill out and easier for the customer to read.

| Section | Recommendation |

|---|---|

| Header | Include the business name, receipt number, and date at the top for easy reference. |

| Itemized List | Break down the products or services with short descriptions and individual prices. |

| Total | Display the total amount clearly with a bold font to make it stand out. |

| Footer | Leave space for any additional notes or contact information, if needed. |

Make sure the layout is simple yet structured. This approach reduces visual clutter, helping both the business and the customer stay organized.

By following these tips, you’ll create a functional and professional-looking receipt template without unnecessary repetition.