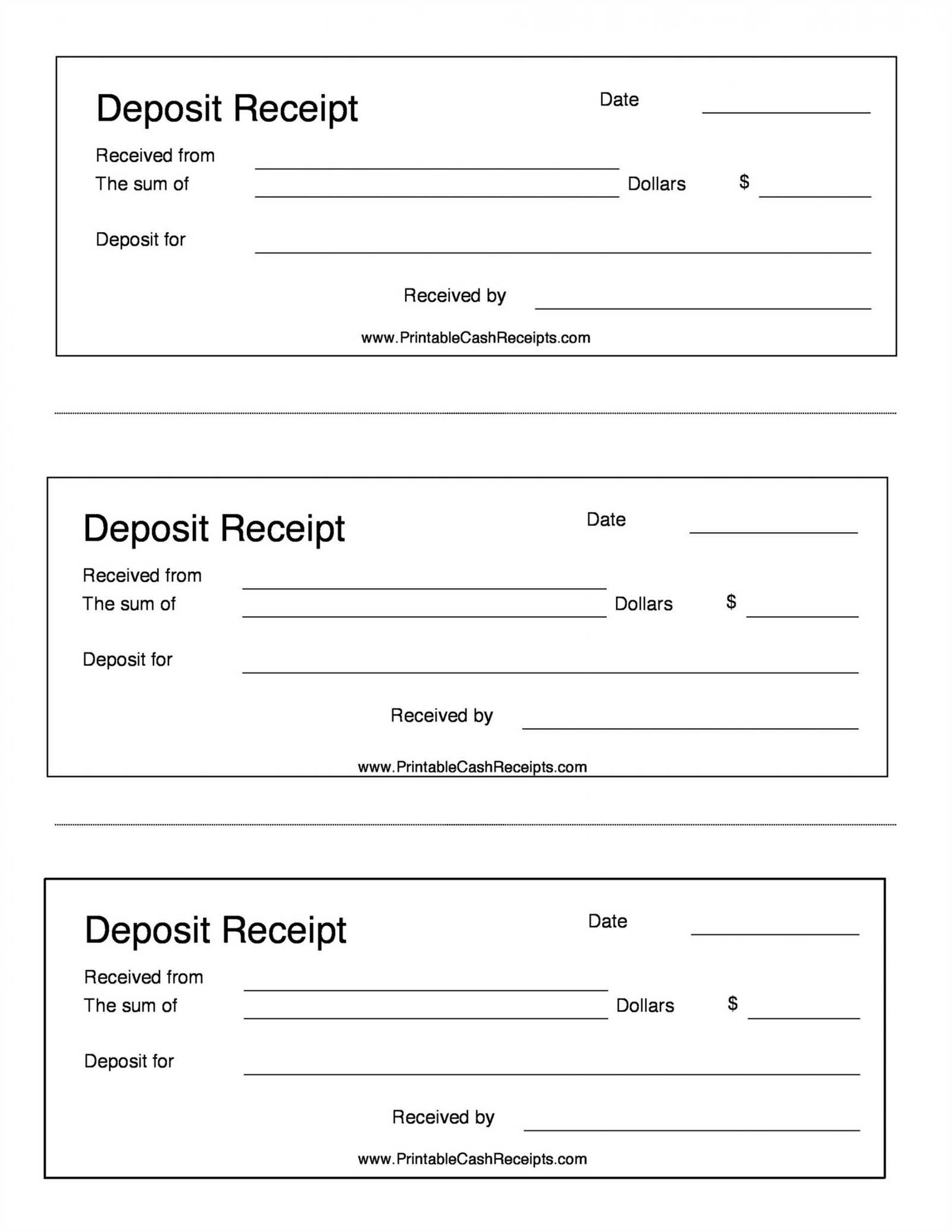

Creating a clear and professional receipt for deposit transactions is a straightforward process that can save time and ensure smooth business operations. A well-designed template is the best way to document deposits, whether you’re running a small business or handling rental transactions.

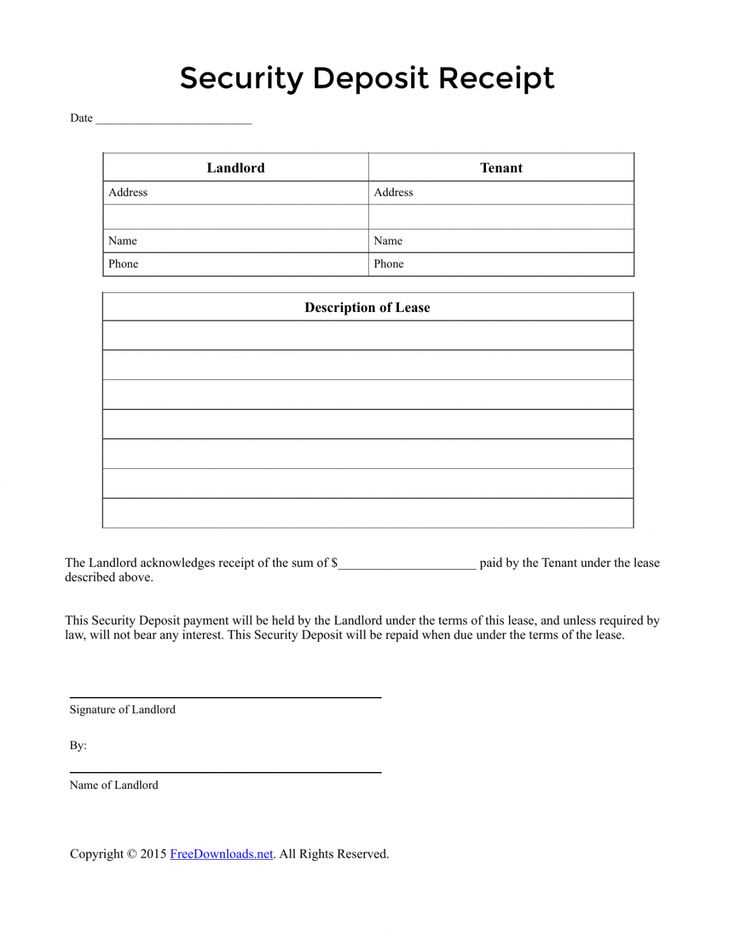

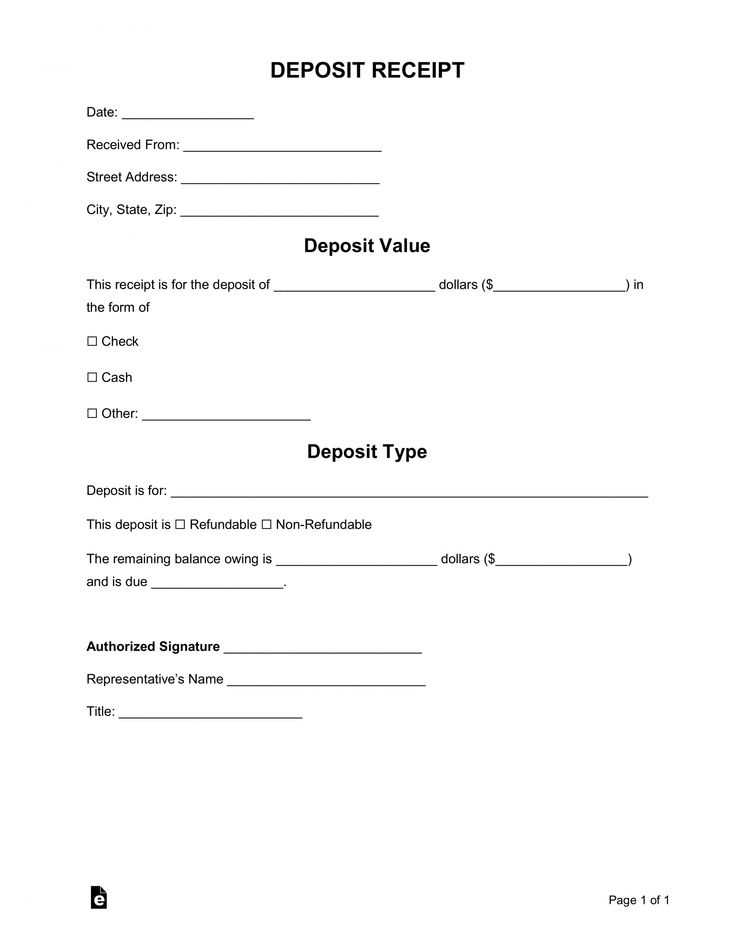

Use this free template to quickly generate receipts that meet legal and professional standards. The template can be customized to include necessary details like deposit amounts, payment methods, and terms. Clear sections for both the sender and recipient information will avoid confusion and provide transparency for both parties.

Having a receipt that reflects all relevant details not only keeps records organized but also helps in case of disputes. Make sure to include deposit dates, payment references, and any agreed-upon conditions tied to the deposit to ensure your documentation stands up in any situation.

Download and modify this template for your specific business needs, and start using it to streamline deposit management today.

Here’s the revised version:

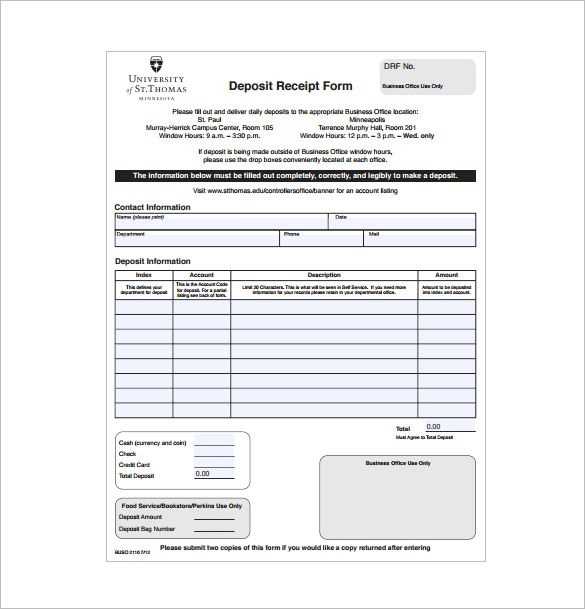

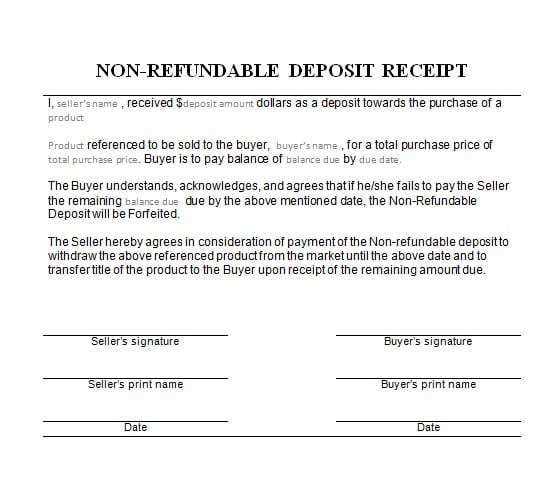

When drafting a deposit receipt for a business transaction, make sure it clearly outlines the key details. Start with the name and contact information of both parties involved. Specify the amount of the deposit, the date it was received, and the purpose of the deposit. Be explicit about any terms attached to the deposit, such as whether it’s refundable or non-refundable, and mention the agreed-upon conditions for its return, if applicable.

Next, state the method of payment used for the deposit (e.g., bank transfer, credit card, cash) and include transaction reference numbers where possible. This will help avoid future confusion. If any interest is being accrued on the deposit, mention the rate and how it will be applied. Lastly, provide a section for both parties to sign, confirming the receipt of the deposit and agreement to the terms laid out in the document.

By ensuring all these elements are included, you reduce the risk of misunderstandings and protect both parties’ interests. It’s best to make the document as clear and detailed as possible to prevent any future disputes.

- Free Template for Deposit Receipt in Business

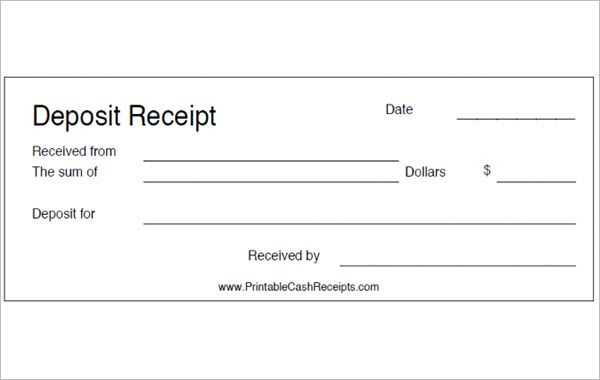

A well-structured deposit receipt ensures clarity for both parties in any business transaction. Having a free template on hand can save time and reduce the risk of misunderstandings. Below is a simple template that you can easily modify for your business needs:

Deposit Receipt Date: [Insert Date] Received from: [Customer's Full Name] Amount: [Deposit Amount] Payment Method: [Cash, Credit, Bank Transfer, etc.] For: [Description of the Product/Service] Deposit Terms: - Remaining Balance Due: [Balance Amount] - Due Date: [Balance Due Date] - Any Special Conditions: [If applicable] This receipt acknowledges the partial payment made toward [Product/Service] as outlined above. This deposit is non-refundable unless otherwise specified in the agreement. Thank you for your business! Signed by: [Your Name or Business Name]

Modify the template to reflect the specific details of your business and transactions. Include fields that are relevant to your industry, such as payment schedules, late fees, or any other special conditions. This template not only simplifies record-keeping but also helps maintain professionalism in client interactions.

Incorporating a receipt template into your workflow will ensure consistency and prevent errors in tracking deposits. You can customize it according to your needs, whether it’s for a one-time service or long-term project. It’s an easy way to stay organized and transparent in financial dealings.

To tailor a deposit receipt template for your business, focus on incorporating key elements that reflect your company’s identity while ensuring legal and operational requirements are met. Here’s a streamlined approach:

1. Include Your Business Information

Make sure the header of the receipt prominently displays your company name, address, and contact details. This helps establish your brand and provides clear contact information for follow-up inquiries.

2. Add Transaction-Specific Details

The receipt should outline the specifics of the deposit, such as the date of the transaction, amount deposited, and the method of payment (cash, check, bank transfer). You can also add a reference number or transaction ID for easier tracking.

| Field | Recommendation |

|---|---|

| Deposit Amount | Clearly indicate the exact amount in both numbers and words. |

| Transaction Date | Ensure the date format matches your local standard. |

| Payment Method | Specify whether it’s cash, check, credit, or bank transfer. |

3. Add Legal and Compliance Notes

Depending on your location and business type, there may be certain legal disclaimers that need to be included. Check local regulations to ensure compliance, and add any necessary information regarding refunds, terms of service, or conditions related to the deposit.

4. Use Your Brand’s Visual Identity

Incorporating your brand’s logo, color scheme, and font style into the receipt helps maintain consistency with your other business documents. This also adds professionalism to the receipt and makes it instantly recognizable as coming from your company.

5. Review and Test the Template

Before finalizing the template, review it for any errors and test it with real data. Make sure the template is easy to read and provides all necessary details without overcrowding the space. You can also ask a colleague for feedback to ensure clarity.

Ensure that your deposit receipts comply with the specific regulations set forth by your industry. For businesses in the financial sector, the receipt must include detailed information such as the amount of the deposit, the date, the name of the person making the deposit, and the recipient’s details. Always issue receipts with clear, legible terms and conditions to avoid legal complications.

If your business operates in an industry like real estate or law, specific state or national regulations may govern how receipts are issued. For example, in real estate, a deposit receipt often needs to be signed by both parties, and may require notarization depending on the jurisdiction. Make sure to consult local laws or a legal advisor to ensure compliance with regional standards.

For non-financial businesses, even if not all industry regulations mandate receipt issuance, it’s still best practice to provide one to ensure transparency and protect both parties involved. Failing to issue a deposit receipt can lead to disputes and potential legal claims. Keep records of all deposit transactions to avoid any future legal challenges.

Each jurisdiction may have different rules regarding tax implications for deposits, so check whether your region requires deposit receipts to include tax information. This is particularly relevant for businesses that charge VAT or sales tax on deposits. If your industry is regulated, confirm whether the receipts must adhere to additional documentation standards for audits or compliance checks.

Organize your deposit receipts by creating a clear and consistent naming system. Use dates, reference numbers, and customer names in file names. For instance, “2025-02-11_Receipt_#12345_JohnDoe” helps identify the document at a glance. This structure simplifies retrieval when you need to reference a receipt quickly.

Use Cloud Storage Solutions

Cloud storage is a reliable option for managing deposit receipts. It provides access from anywhere, ensures automatic backups, and reduces the risk of physical damage or loss. Use services with strong encryption and user authentication for enhanced security. Organize receipts into folders by month, client, or type of transaction, which helps streamline searching and ensures easy access to specific records.

Maintain Physical and Digital Copies

While digital storage is efficient, it’s also wise to keep physical copies of receipts for legal or audit purposes. Store physical receipts in a safe, secure location, such as a locked file cabinet. For each physical receipt, scan and store a digital copy to ensure you have an easily accessible backup.

Regularly back up your digital files to avoid losing critical documents. Consider setting up automatic backups to an external drive or cloud service. This habit ensures your receipts remain protected, even in case of hardware failure or other disruptions.

Receipt of Deposit Business Template

To ensure a smooth process, always include the following key elements in your deposit receipt template:

- Transaction Date: Specify the exact date of the deposit. This helps avoid any confusion in the future.

- Depositor’s Information: Include the name, address, and contact details of the person making the deposit.

- Deposit Amount: Clearly state the exact amount deposited. Double-check the figure for accuracy.

- Payment Method: Note whether the deposit was made via cash, bank transfer, check, or any other method.

- Transaction Reference Number: Add a unique identifier for easy tracking and reference in the future.

Additional Details

- Include a section for signatures from both the depositor and the recipient to validate the transaction.

- Ensure there’s space to mention the purpose or reason for the deposit if necessary.

- Consider including terms regarding refund policies or conditions tied to the deposit.

By following this template, you ensure clarity and protect both parties involved in the deposit transaction.