If you’re entering into a partnership, it’s crucial to have a clear, written agreement about any deposit made. A well-drafted receipt of deposit can protect both parties and ensure transparency. Use a free template to create a document that outlines the details of the deposit, including the amount, date, purpose, and any terms of repayment or retention. This helps avoid misunderstandings and provides a reference in case of disputes.

The deposit receipt should clearly state who is receiving the deposit and who is making the payment. It’s also a good idea to include payment methods and deadlines for further actions, such as full payment or services rendered. Be sure to detail any conditions for the deposit’s return or non-return. This will help in maintaining a smooth partnership and mitigate risks down the line.

Using a free template can save you time and money. Just make sure the template you choose is customizable to your specific needs, and be sure to consult a legal professional if you have any doubts. A solid, clear receipt can strengthen your business relationships and protect your interests.

Here’s the revised version:

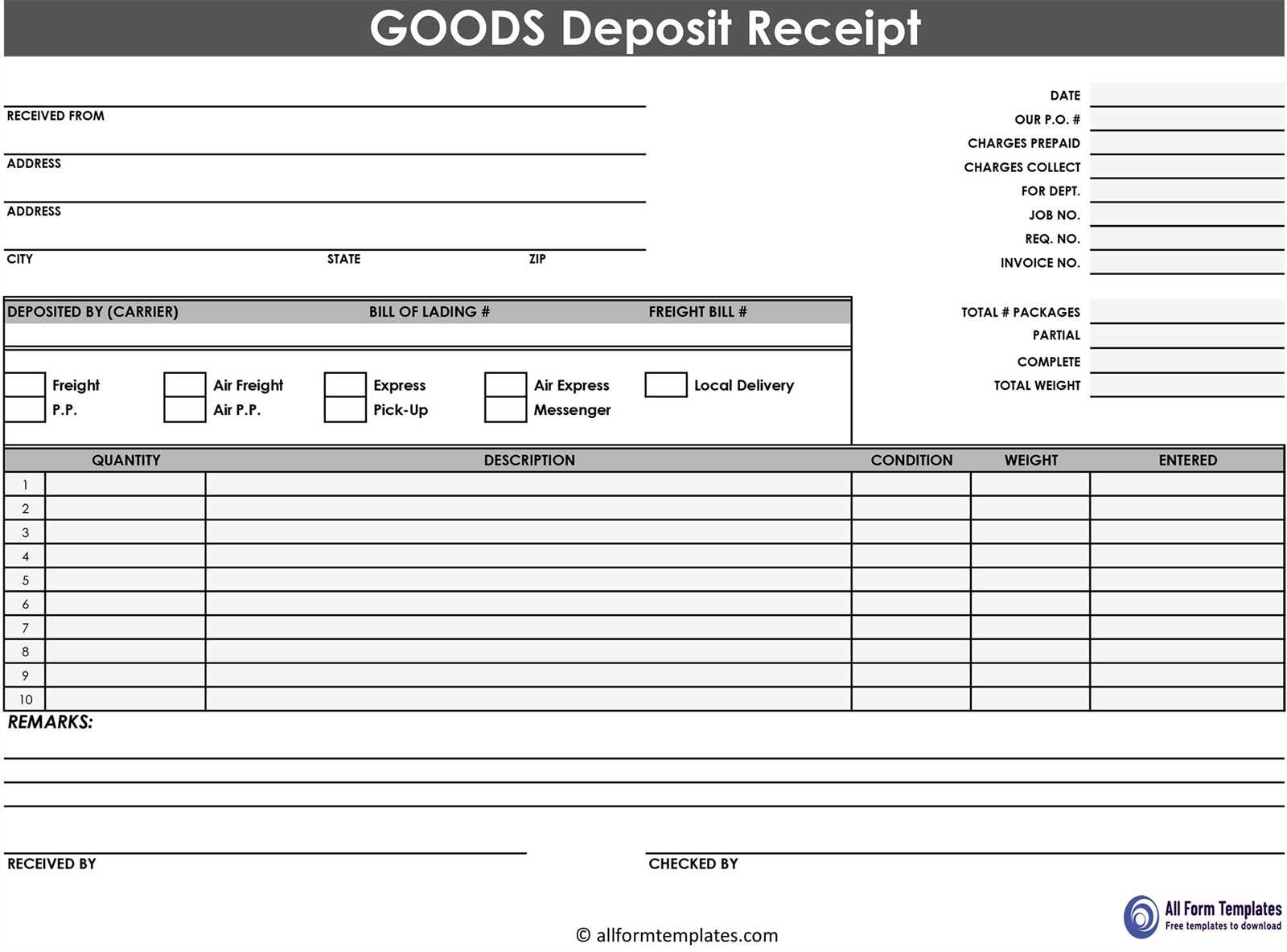

When preparing a template for a deposit receipt in a partnership, ensure clarity and accuracy in every section. It’s critical to include specific details about the deposit to avoid any confusion between partners.

- Deposit Amount: Clearly state the exact amount being deposited. This is the core information and must be easy to find.

- Date of Transaction: Specify the date when the deposit is made to track the timeline.

- Party Responsible for Deposit: Include the name of the partner or entity making the deposit. This ensures accountability.

- Purpose of Deposit: Describe why the deposit is being made. Whether it’s for an investment, service, or another reason, clarify this point.

- Agreement Terms: Reference the partnership agreement that governs the deposit. This links the receipt to the larger contractual framework.

- Payment Method: Specify how the deposit was made (e.g., bank transfer, check, cash). This provides transparency about the transaction method.

Including these key details helps prevent misunderstandings. Remember, keeping the document simple and to the point is key for both parties to easily reference it later.

- Free Template for Deposit Receipt in a Partnership

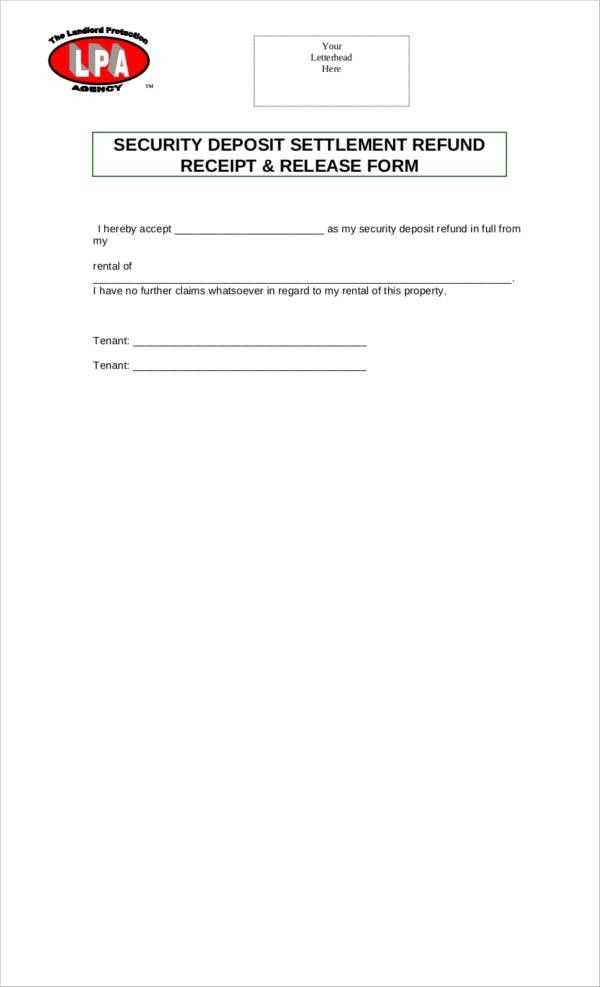

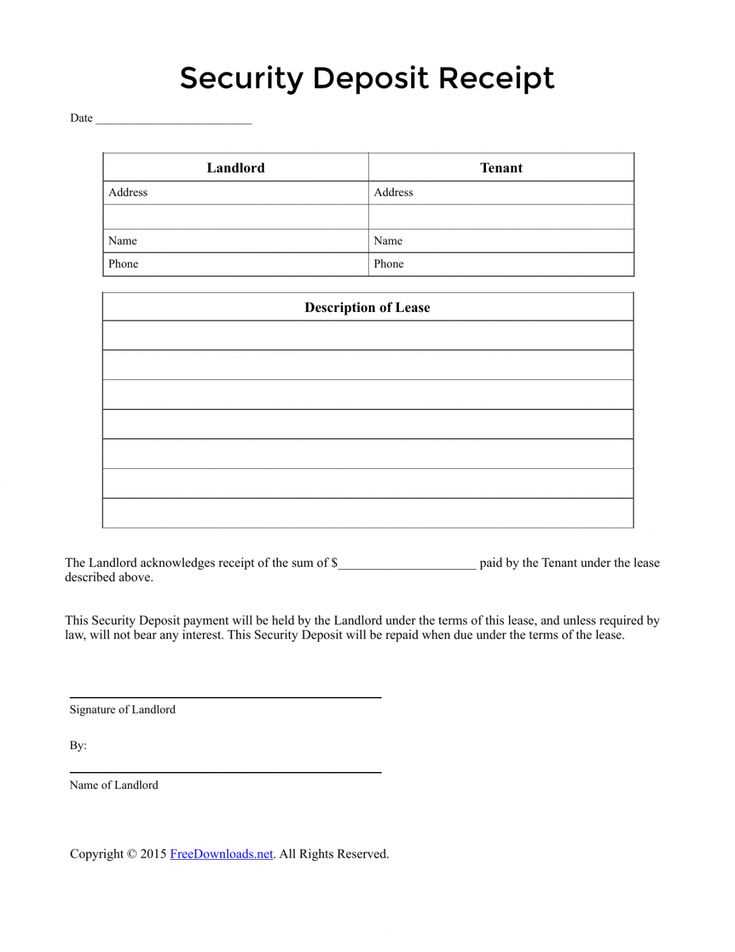

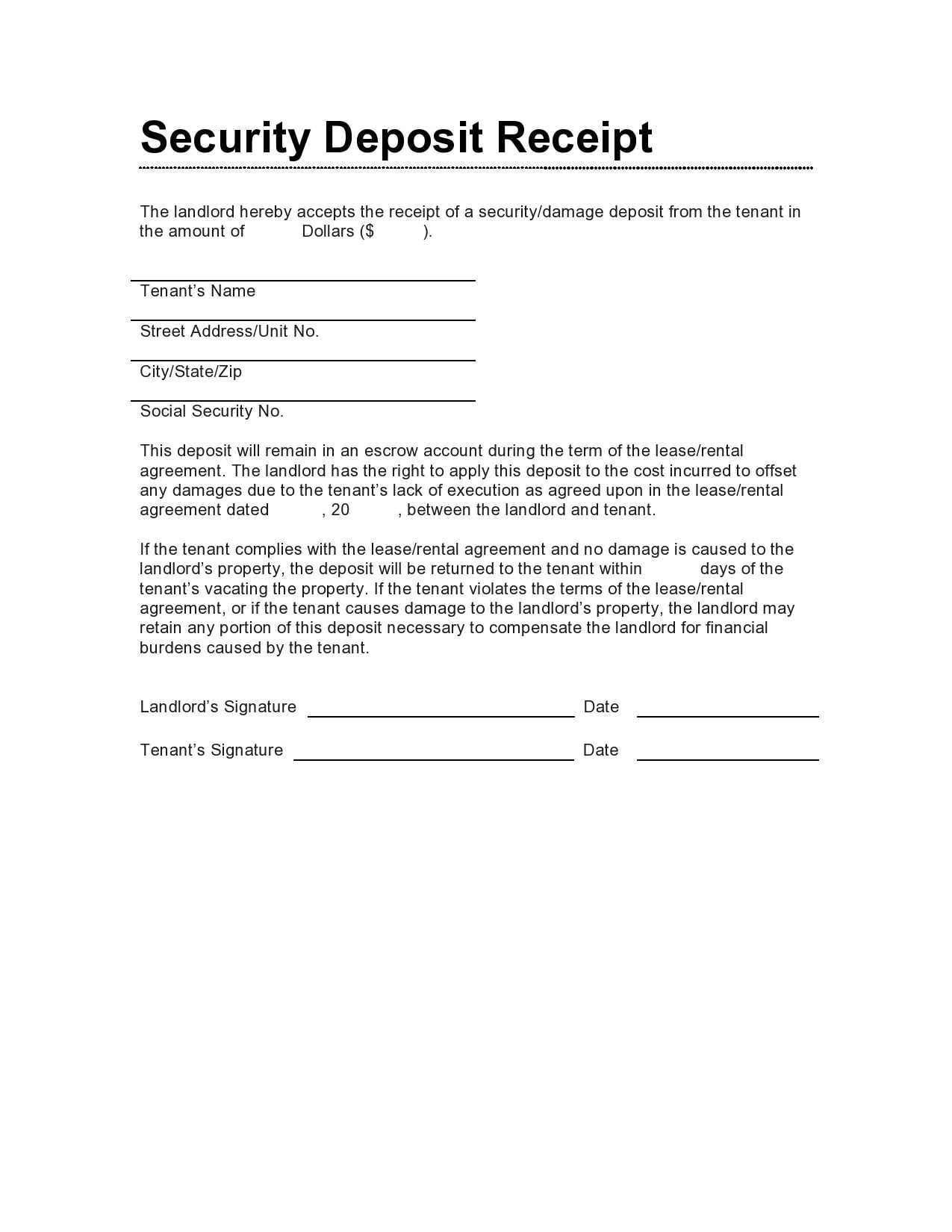

A deposit receipt in a partnership agreement must clearly state the terms of the deposit, ensuring both parties have a clear understanding of the transaction. Below is a simple template you can use to create a deposit receipt for your partnership agreement.

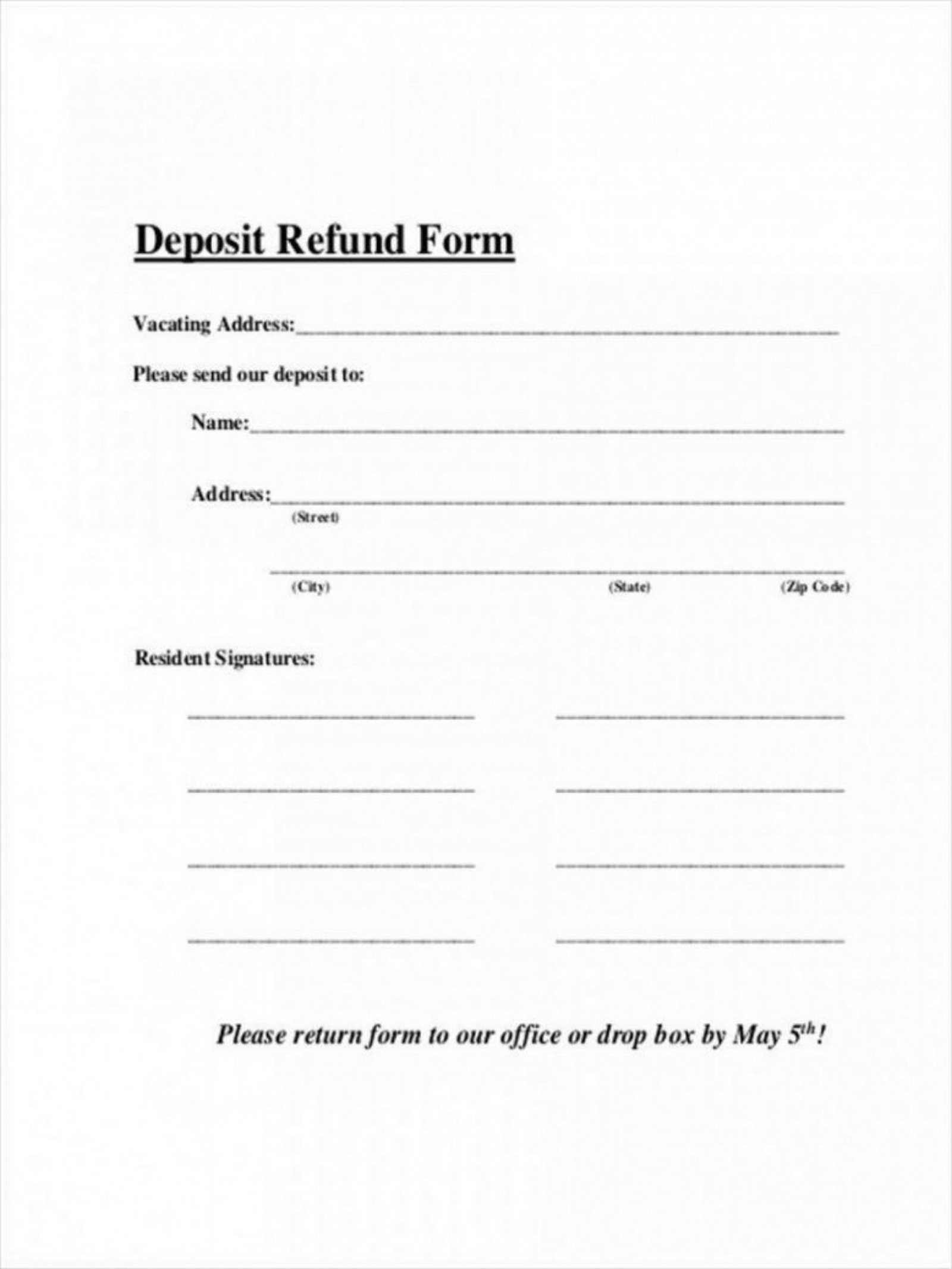

Start by including the full names and addresses of both partners involved. This establishes the legal identity of the parties entering into the agreement. Next, specify the amount of the deposit, along with the currency used. This section should also include the date the deposit was made and the method of payment (e.g., bank transfer, cash, cheque).

Clearly outline the purpose of the deposit–whether it’s for securing a business venture, covering initial costs, or another specific purpose. It’s important to mention any terms regarding the return or refund of the deposit, including conditions under which the deposit may be refunded or forfeited.

The deposit receipt should also address the role of the partner receiving the deposit. They must confirm the deposit’s receipt with a signature, and it’s beneficial to include a space for both partners to sign, acknowledging agreement to the terms outlined.

Here’s a quick sample format you can follow:

Deposit Receipt Template:

Partner 1 Name: [Full Name]

Partner 2 Name: [Full Name]

Deposit Amount: [Amount]

Date of Payment: [Date]

Method of Payment: [Payment Method]

Purpose of Deposit: [Purpose]

Refund Conditions: [Terms of Refund]

Both parties sign below to confirm the receipt and agreement to the terms of this deposit:

Signature of Partner 1: ______________________

Signature of Partner 2: ______________________

Ensure all details are accurate before signing. This simple template helps keep transactions transparent and well-documented, reducing misunderstandings in the partnership.

Include the full names of all parties involved in the partnership. This should clearly state the identities of both the depositor and the recipient. If a business is involved, use the registered name of the company.

The date of the deposit must be clearly indicated. This provides a reference point for both parties in case of any future disputes or clarifications.

Specify the exact amount deposited, including the currency used. If the deposit is made in installments, list the total amount and the breakdown of payments.

Indicate the purpose of the deposit. This helps ensure both parties understand the terms of the deposit and its intended use within the partnership.

Provide a receipt number or a unique identifier for tracking purposes. This helps in managing records and offers a reference in case of questions or audits.

If applicable, mention the agreed-upon repayment or return conditions of the deposit. This ensures transparency about how and when the deposit will be handled moving forward.

Include any penalties or fees related to the deposit. Clearly stating these terms helps avoid confusion if the agreement is violated or if the deposit needs to be returned.

Signatures of both parties or their representatives should be included. This ensures that both parties agree to the terms set out in the receipt, preventing any future disagreements.

Ensure that the deposit acknowledgment includes key details: the amount received, the date of receipt, and the purpose of the deposit. This clarity prevents confusion and strengthens the document’s legal standing.

1. Specify the Deposit Amount

Clearly state the amount of the deposit, both in numerical and written form. This minimizes the risk of disputes over payment terms. For example, “A deposit of $500 (Five Hundred Dollars) is received as part of the agreement.”

2. Clarify the Deposit’s Purpose

Indicate the specific purpose of the deposit. Whether it’s a security deposit or part of a larger agreement, defining its use is vital. This could read, “This deposit serves as a reservation fee for the event scheduled on [Date].”

Additionally, specify any conditions tied to the deposit, such as refund policies or non-refundable terms, to avoid ambiguity. Include clear instructions on how the deposit will be treated should the agreement change or be canceled.

Common Mistakes to Avoid When Drafting a Receipt

Ensure the correct date is listed. An incorrect or missing date can lead to confusion, especially when referencing the timing of a deposit or payment. Double-check the date to prevent issues in the future.

Verify the recipient’s details. Always include the full name and contact information of both parties involved. Omitting these details can create ambiguity and complicate communication if follow-up is necessary.

Be precise with the amount. Mistakes in the amount received or the currency type can cause legal disputes. Double-check the numbers and ensure clarity, especially when dealing with foreign currency or partial payments.

Clearly state the purpose of the deposit. Vague descriptions can lead to misunderstandings. Specify whether the payment is for a partnership, service, or another type of agreement. This helps both parties understand the nature of the transaction.

Do not forget the signature. A missing signature can make the receipt legally unenforceable. Both parties should sign the receipt, confirming agreement and acknowledgment of the terms listed.

Include a receipt number or reference code. This makes it easier to track payments, especially for future queries or disputes. A unique identifier helps streamline the process and ensures proper documentation.

The most efficient formats for creating deposit receipts are PDF and Word documents. Both offer flexibility in customization and professional presentation. PDF is widely used for its stability and consistency across different devices, ensuring the document appears the same to all parties involved. Word documents, on the other hand, are convenient for quick edits and easy collaboration with partners or clients.

PDF Format

PDFs are perfect for finalized receipts. They preserve the layout and content exactly as intended, making them ideal for sending to clients, banks, or partners. You can create these with various tools like Adobe Acrobat, which allows for easy conversion from Word or Excel files into a polished document. You can also include security features, such as password protection or digital signatures, to ensure authenticity.

Word Format

For those needing to frequently modify or update receipt templates, Word documents are a practical choice. They are simple to create and adapt using Microsoft Word or Google Docs. Templates for deposit receipts are widely available, enabling quick edits for date, amount, or party details. Additionally, Word’s cloud-based options make it easy to collaborate and share in real-time.

Other tools such as online receipt generators or template builders like Canva or Invoice Simple also offer ready-made templates that are both user-friendly and visually appealing. They are especially helpful for those without advanced design skills but who want professional results.

To verify the receipt of funds, first, check your account statements or payment gateway records. Confirm that the amount deposited matches the expected sum and the payment method is correct. Once the payment is confirmed, issue an official acknowledgment to the partner in writing, either through email or a signed receipt document.

Verification Process

Ensure that all transaction details are accurate by comparing the transaction ID, date, and sender information. Cross-check any reference numbers provided with the payment. If the transaction is through a third-party platform, such as PayPal or Stripe, ensure the funds have been credited to your linked account.

Acknowledgment of Receipt

The acknowledgment should include the following key elements:

| Element | Description |

|---|---|

| Date of receipt | Include the exact date when the payment was received. |

| Amount received | State the exact amount that was deposited. |

| Payment method | Specify the payment method used, such as bank transfer, PayPal, etc. |

| Transaction ID | Provide the unique identifier for the transaction. |

After the acknowledgment is sent, keep a copy for your records. This can be helpful in case any discrepancies arise later or if further clarifications are needed regarding the transaction.

Amend the deposit acknowledgment immediately if any error or misunderstanding is discovered after issuance. Common reasons include incorrect deposit amounts, errors in the recipient’s details, or mismatches in the terms outlined. To ensure clarity and avoid future disputes, follow a clear procedure for amending the document.

Steps to Amend the Acknowledgment

Begin by identifying the specific areas that need correction. Then, issue a formal written amendment that details the changes. This can be done through a new acknowledgment document or by creating an addendum to the original. Both parties–depositor and recipient–should sign this amendment for validation. Ensure that the amendment clearly references the original acknowledgment to avoid any confusion.

When to Amend

Amendments should be made as soon as discrepancies are identified. Delaying the amendment can lead to confusion or disputes, especially if the terms of the deposit are questioned later. It’s essential to document any changes promptly to maintain the integrity of the agreement.

Use a clear and concise heading for your deposit receipt template. This helps both parties understand the purpose of the document quickly.

- Transaction Details: List the date, amount, and method of deposit to ensure both sides agree on the key facts.

- Parties Involved: Clearly state the names of the individuals or entities involved, including the depositor and recipient.

- Purpose of Deposit: Describe the reason for the deposit to avoid ambiguity. For example, mention if it’s a part of a partnership agreement or for future investments.

- Deposit Terms: Specify the conditions regarding the deposit, such as refundable terms, return policies, or penalties if applicable.

- Signatures: Both parties should sign the document for legal validity. Include the full names and positions of the signatories.

- Contact Information: Add email addresses or phone numbers to facilitate communication in case of disputes or inquiries.

Ensure the format is clean and professional, as this document will serve as a formal acknowledgment of the deposit agreement.