If you are entering a partnership, using a clear deposit receipt template can streamline the process and ensure transparency. A well-crafted document protects both parties by detailing the terms and conditions surrounding the deposit. A template allows you to quickly fill in key details, saving time and avoiding confusion.

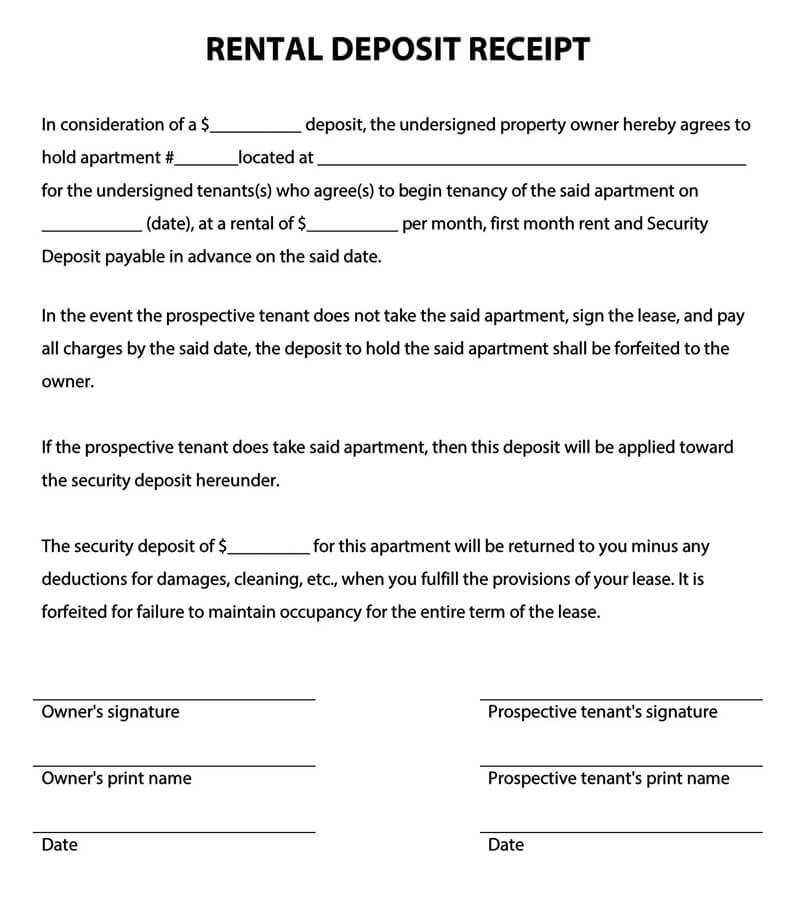

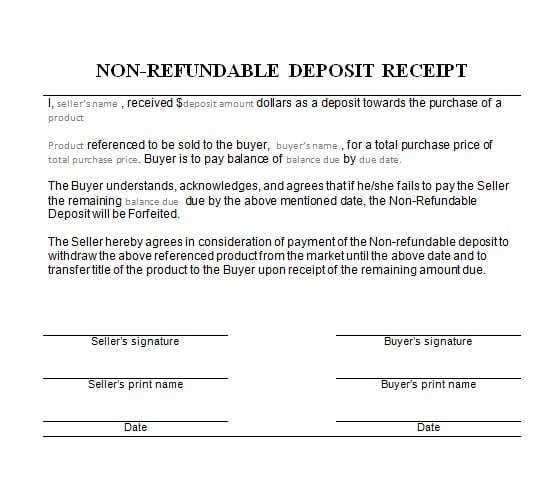

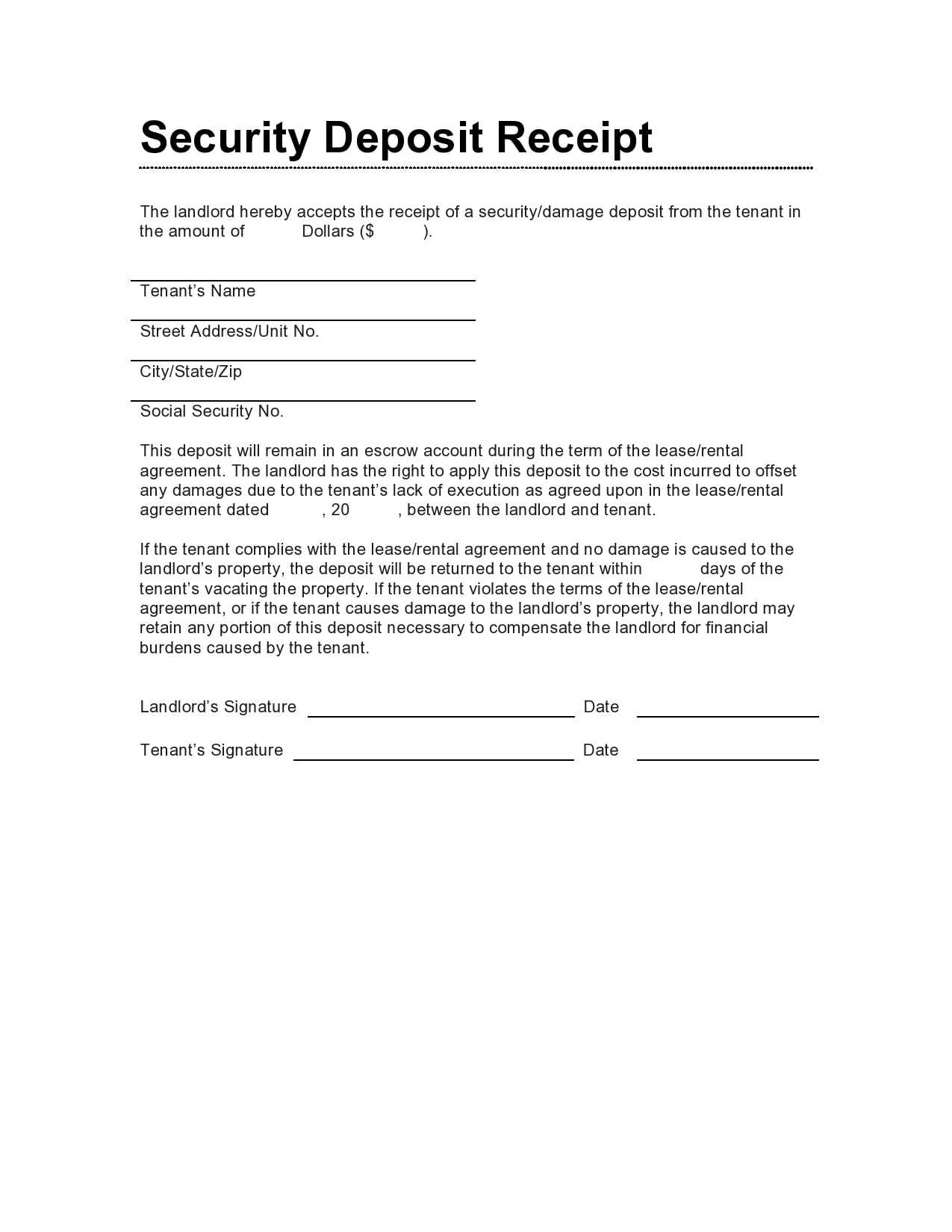

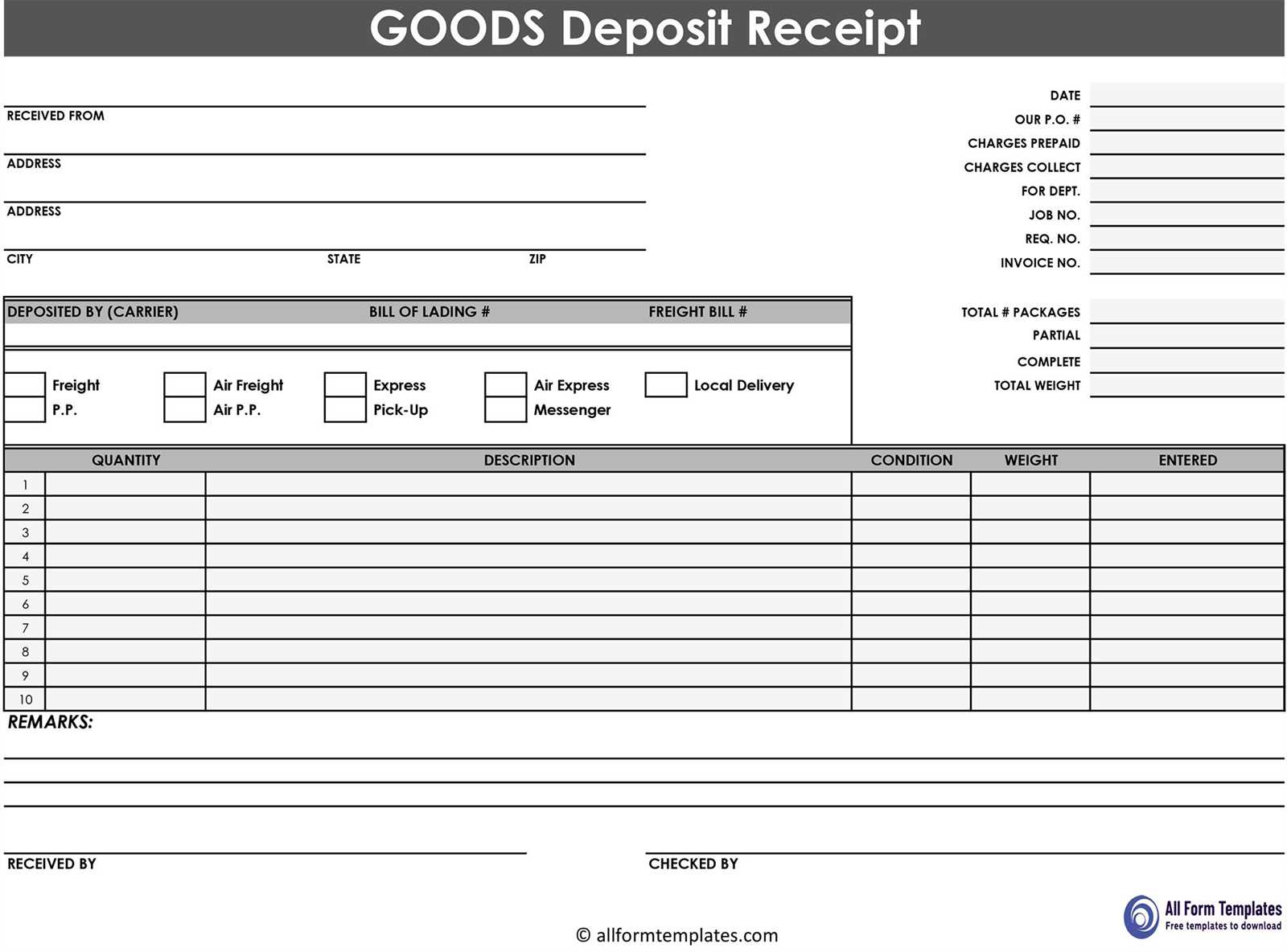

Start by specifying the amount of the deposit and the date it was received. Clearly state the purpose of the deposit, whether it is for securing a business agreement or covering initial expenses. Additionally, include the names of both the parties involved and the method of payment used.

It’s also important to outline the conditions under which the deposit is refundable or non-refundable. This helps avoid disputes in the future. A simple clause explaining the return policy or potential deductions for services rendered will help both parties understand their obligations.

Free Template Receipt of Deposit for Partnership

Use this template to acknowledge receipt of a deposit for a partnership agreement. Customize it according to the details of the transaction, ensuring clarity and accuracy for both parties involved.

Receipt of Deposit

Date: [Insert Date]

This receipt confirms the deposit of [insert deposit amount] received from [insert name of partner] as part of the partnership agreement between [Insert Business Name] and [Insert Partner Name].

Payment Method: [Insert payment method, e.g., bank transfer, cheque, etc.]

Deposit Amount: [Insert deposit amount]

Partnership Purpose: [Insert purpose of the partnership, e.g., joint venture, business collaboration, etc.]

Agreement Date: [Insert date of agreement].

Both parties agree that this deposit will be applied toward the total sum of [insert total amount] as outlined in the partnership agreement. The remaining balance, if any, is due by [insert due date].

Terms:

This deposit is non-refundable unless specified otherwise in the partnership agreement. The terms of the deposit and any further payments are subject to the final partnership agreement.

By signing below, both parties acknowledge the receipt of the deposit and agree to the outlined terms of the partnership.

Partner 1:

Signature: ___________________

Date: ___________________

Partner 2:

Signature: ___________________

Date: ___________________

Understanding the Legal Requirements for Partnership Deposits

Partnership deposits are a common financial arrangement to ensure that each partner fulfills their obligations. It’s important to understand the legal framework governing such deposits to avoid conflicts and ensure smooth operations within the partnership. The specifics of these requirements can vary based on jurisdiction, but certain general principles apply universally.

Key Legal Aspects to Consider

- Written Agreement: Always formalize deposit terms in the partnership agreement. Clearly state the amount, conditions for return, and what happens if a partner fails to meet their commitments.

- Ownership of Deposit: Define who holds the deposit and under what circumstances it may be used or returned. This helps prevent disputes over funds that were intended for a particular purpose.

- Interest on Deposits: If the partnership agreement includes interest on deposits, make sure the percentage and payment terms are explicitly outlined. This protects both parties’ financial interests.

- Withdrawal or Use of Deposit: Clarify conditions under which the deposit can be accessed or withdrawn by a partner. It could include instances like partner withdrawal, dispute resolution, or partnership dissolution.

- Deposit Refund Terms: If a partner leaves the partnership, determine whether they are entitled to a full or partial refund of their deposit. This should be defined to avoid misunderstandings.

Local Legal Requirements

- Tax Obligations: Verify if deposits are subject to tax. In some jurisdictions, deposits may be classified as income and could impact both the partner’s and partnership’s tax filings.

- State-Specific Regulations: Depending on where the partnership is established, there may be state or national regulations that dictate how deposits should be handled, including required documentation or specific limitations on their amount.

- Dispute Resolution: The partnership agreement should include a clear process for resolving conflicts related to the deposit, such as whether third-party arbitration is needed and who bears the costs.

Thoroughly understanding and properly documenting deposit terms will help protect both the partnership and individual partners from future legal disputes. Always consult with a legal professional to ensure compliance with local laws.

Key Elements to Include in a Deposit Receipt Template

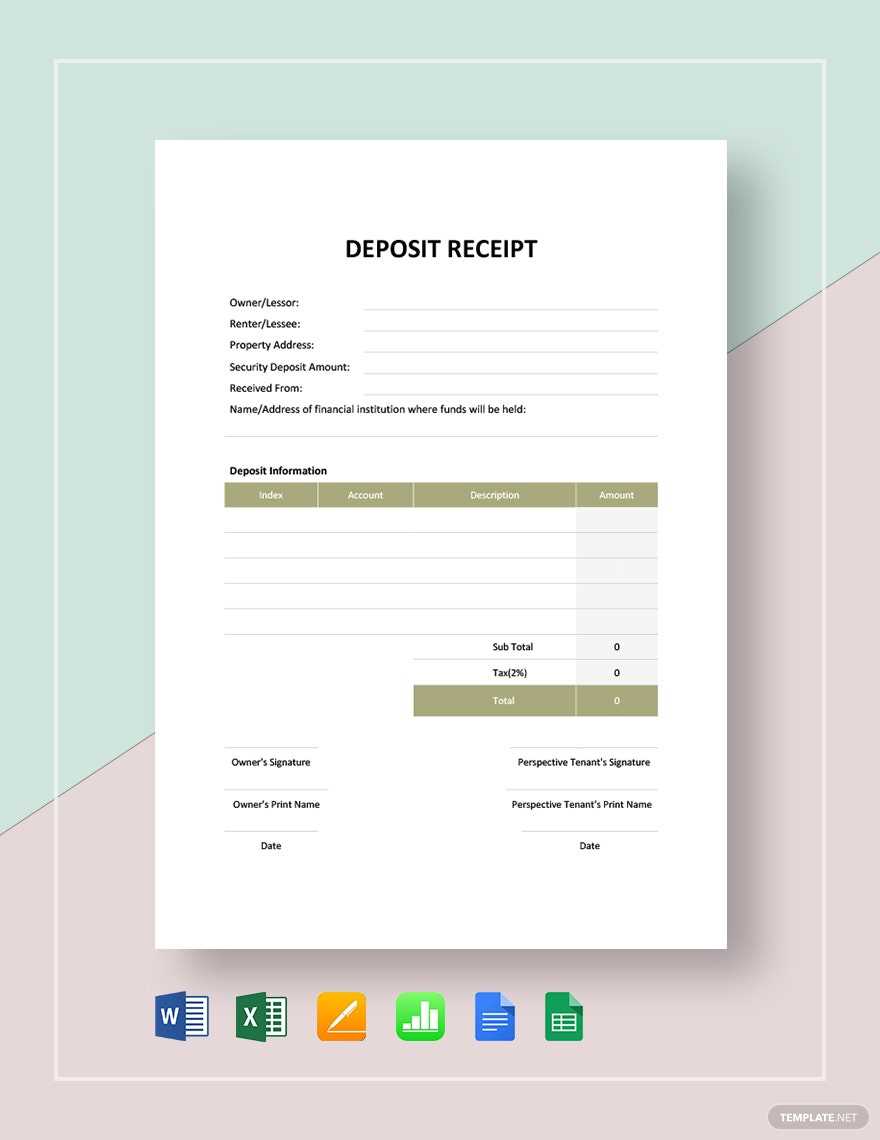

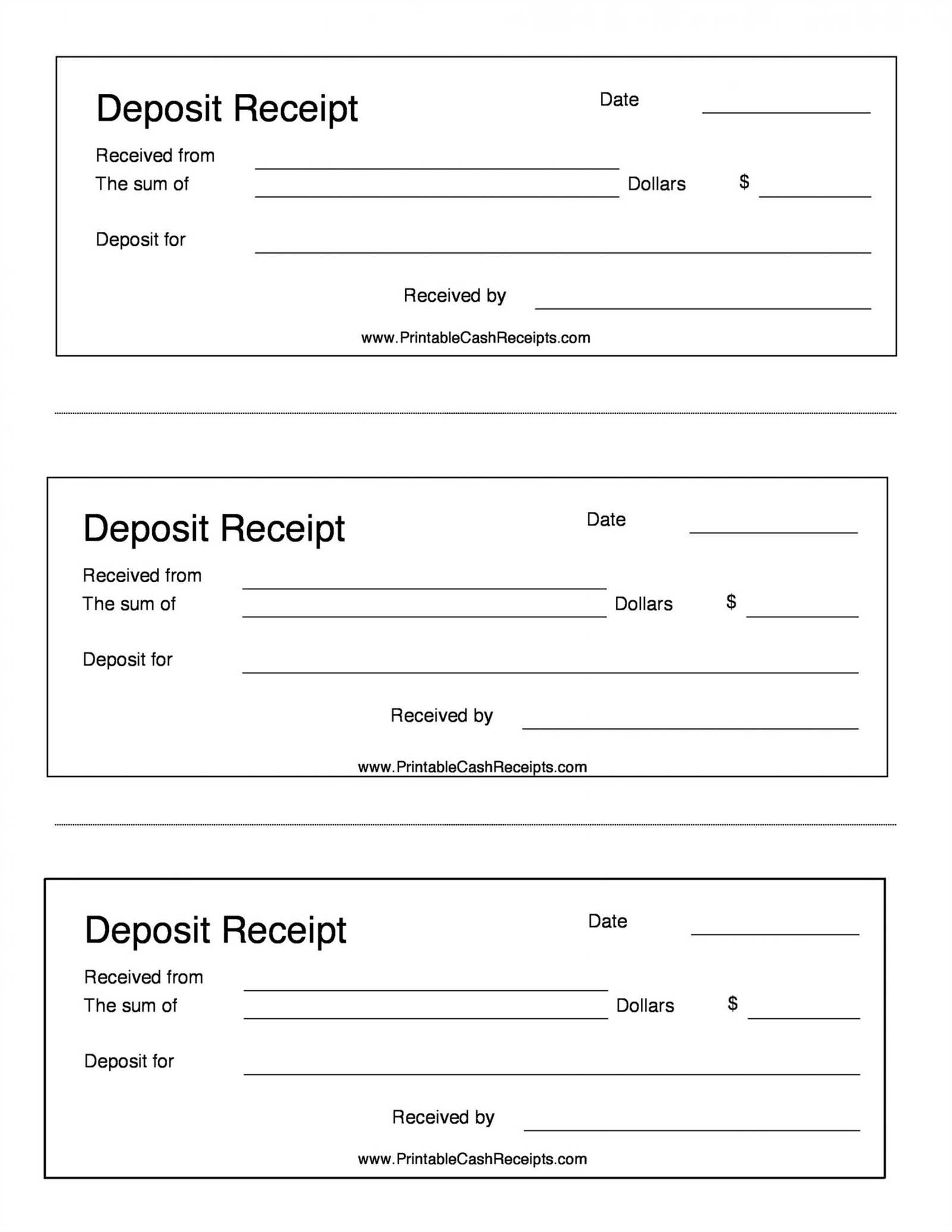

Clearly state the deposit amount. Specify the exact sum received to avoid confusion later. This ensures both parties have a record of the transaction.

Include the date of the deposit. This allows for precise tracking of financial activities and establishes a clear timeline of the transaction.

Identify the payer and recipient. Full names or company details should be listed for both sides to confirm their involvement in the transaction.

Provide a detailed description of the reason for the deposit. This clarifies the purpose of the payment, whether for a partnership, purchase, or service.

Outline any terms or conditions related to the deposit. If there are specific clauses tied to the deposit, such as refunds or further payments, ensure these are clearly noted.

Note the payment method. Specify whether the deposit was made via cash, bank transfer, check, or another method. This adds transparency to the transaction.

Offer a receipt number or unique identifier. This helps both parties reference the deposit if any disputes or inquiries arise in the future.

Include both parties’ signatures. These confirm the accuracy of the transaction and create a formal acknowledgment of the terms agreed upon.

How to Structure a Clear Payment Terms Section

Begin by clearly stating the payment amount. Avoid ambiguity–include the exact sum, currency, and any taxes or fees that apply. This gives both parties a transparent understanding of the total due.

Outline payment methods. Specify which methods are accepted, such as bank transfers, credit card payments, or checks. List any preferred platforms or systems if necessary.

Set a payment schedule. Be specific about due dates or milestones. If payments are to be made in installments, include the amount and date for each payment.

- For example: 50% due upon signing, 50% due upon delivery.

- Provide penalties for late payments, such as interest rates or fixed fees.

Define consequences for non-payment. Include clauses that outline actions the partnership can take if payment is not made on time, such as suspending services or terminating the agreement.

Clarify refund policies. If applicable, specify under what conditions refunds are allowed and how they will be processed. Be clear about any non-refundable amounts.

Include invoicing procedures. Explain how invoices will be sent, the timeline for sending them, and what information will be included (e.g., payment reference, due dates, breakdown of charges).

- Make sure both parties know how disputes will be handled, whether through arbitration, negotiation, or another method.

Customizing the Template for Different Partnership Agreements

Modify the template to reflect the specifics of your partnership agreement. Focus on adapting sections that define the roles, responsibilities, and financial contributions of each partner. Make sure the deposit amount aligns with your partnership’s scale and purpose.

Adjusting Payment Terms

Tailor the payment structure to match the agreed terms. If the deposit is a one-time payment or spread over time, clarify the schedule and amounts. For joint ventures or equity partnerships, ensure the deposit section reflects both parties’ financial obligations, possibly linking it to future contributions or milestones.

Modifying Legal Clauses

Update the legal sections according to the partnership’s scope. Include clauses for dispute resolution, confidentiality, or exit strategies that apply to your specific partnership type. If it’s a partnership based on shared risk, emphasize how deposits are handled in case of dissolution or breach of agreement.

| Section | Adjustment Tip | Example |

|---|---|---|

| Deposit Amount | Set deposit based on the partnership’s size | $10,000 for small partnership, $50,000 for large |

| Payment Terms | Adjust based on cash flow and timing | 50% upfront, 50% after 3 months |

| Legal Clauses | Modify for partnership-specific risks | Exit clause based on performance benchmarks |

Each partnership has its own set of dynamics. Customizing the template allows you to ensure that deposit terms align with the expectations and security of all parties involved.

Common Mistakes to Avoid When Issuing Deposit Receipts

One common mistake is failing to clearly indicate the payment purpose. The receipt should specify the exact nature of the deposit, whether it’s a down payment, security deposit, or prepayment. Without this, confusion can arise, especially if the partnership involves multiple types of payments.

Not Including Payment Method

Always specify how the deposit was made. Whether it was via bank transfer, check, or cash, listing the payment method prevents misunderstandings later. This detail becomes important if there is any need for verification or disputes regarding the transaction.

Missing Party Information

Ensure that both parties’ full names, addresses, and any relevant identifiers are listed. Skipping this step may create confusion in case there is a dispute or need for follow-up communication regarding the receipt.

Another frequent issue is leaving out the date and time of the transaction. Without this, it becomes difficult to establish a timeline, which may be essential if a partnership is legally challenged or if payments are tied to specific deadlines.

Also, avoid vague descriptions or ambiguous wording. A detailed receipt helps prevent future misunderstandings, especially in legal or financial matters. Be precise about the amount received, and provide clear terms on any future obligations tied to the deposit.

Ensuring Compliance with Local Regulations in Your Receipt

Always verify that your receipt clearly states the necessary legal information required by local laws. This includes tax identification numbers, business registration details, and applicable taxes. Make sure the format adheres to regional standards, such as including the proper currency and date format. Double-check that any reference to consumer rights is compliant with local consumer protection laws. Consider consulting with a local legal expert to ensure full compliance with regional taxation and partnership regulations. A receipt that meets these standards helps maintain transparency and avoid potential legal issues.