If you’re tackling home improvement projects, keeping track of receipts is a must for budgeting, warranties, and potential tax deductions. Downloading free templates for these receipts can save you time and help keep your records organized. These templates are ready to use and customizable, ensuring you capture all the necessary details without extra hassle.

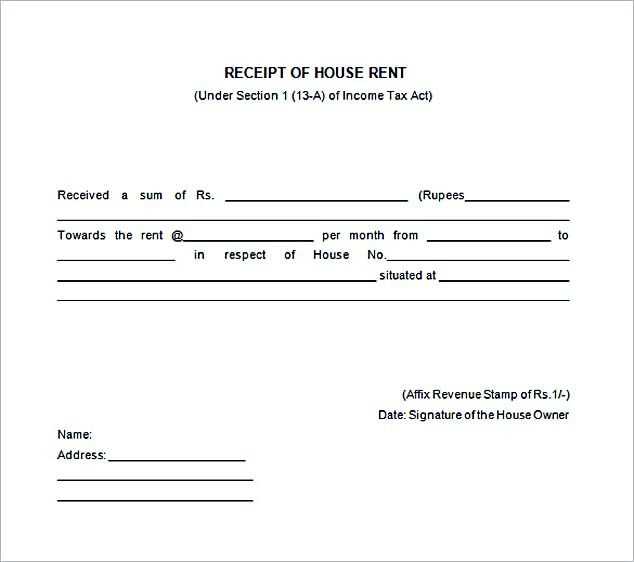

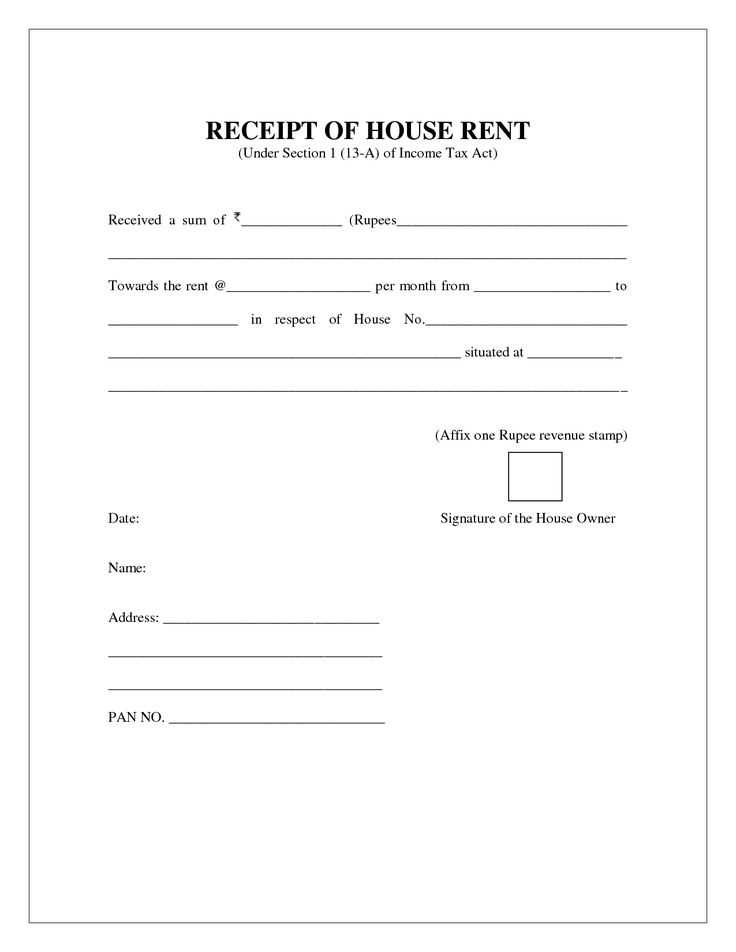

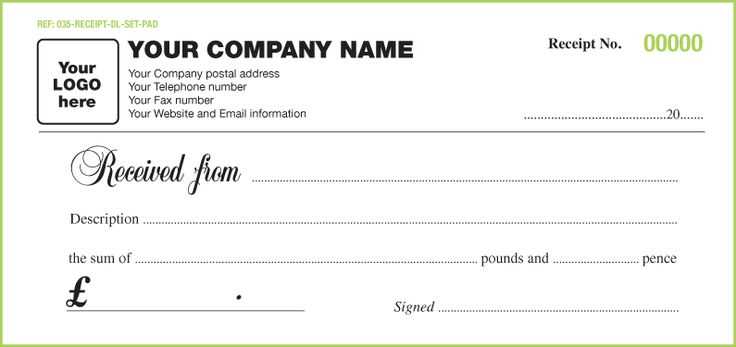

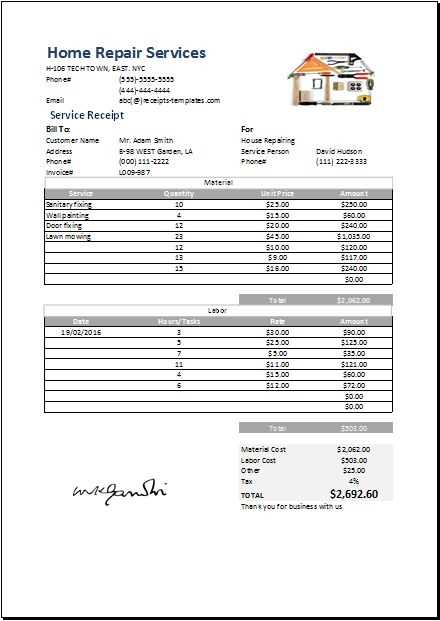

Each template typically includes fields for date, description of the item or service, cost, and vendor information. This structure helps you stay organized whether you’re managing a small DIY project or a larger renovation. You can quickly fill in the blanks and print the receipt for your records or share it digitally when needed.

Many websites offer these templates for free, so you don’t need to create one from scratch. Whether you prefer simple text formats or more detailed spreadsheets, there’s a template that fits your needs. Make sure to choose one that includes all the relevant details–like item names, quantities, and prices–to ensure the receipt holds up if you need to refer back to it later.

By using these free templates, you can easily maintain an accurate record of all purchases and services related to your home improvement projects. This organized approach will save you time and keep your expenses in check throughout the process.

Here’s the revised version:

Use simple and clear templates to track your home improvement receipts. These templates can help you organize your expenses, avoid mismanagement, and keep all the necessary information in one place. Make sure to include the following fields: Date, Item/Service, Vendor Name, Amount, and Payment Method. This ensures every transaction is documented accurately.

Template Structure

Each receipt should have a separate entry. Start by listing the vendor and a description of the work or product. Then, include the total cost. You may also want to add tax or discount information, especially for bigger projects. Keep the format consistent to make reviewing your receipts easy.

Additional Tips

Consider adding a field for project category (e.g., plumbing, electrical, or painting). This will help you organize the receipts based on project type, making it simpler to track expenses across different areas of your home improvement. You can also use a cloud-based template for easy access and sharing with others involved in the project.

Don’t forget to regularly back up your receipts. This will help you keep a record for future reference, warranty claims, or tax purposes.

- Free Templates for Home Improvement Receipts

If you’re managing home improvement projects, using free receipt templates can save you time and effort. Many websites offer simple, customizable templates that allow you to track expenses and keep organized records. These templates come in various formats, such as Word, Excel, or PDF, which means you can choose one that fits your needs and preferences.

For example, platforms like Vertex42 provide free downloadable templates for Excel that are specifically designed for home improvement projects. These templates allow you to input materials, labor costs, and even date ranges, making it easy to monitor your spending and project progress.

Another option is Smartsheet, which offers a free basic plan. While it’s more robust than simple templates, it lets you create detailed project sheets that can include receipt-like breakdowns of costs. The flexibility of adding project milestones and payment schedules makes it ideal for more complex home improvements.

If you prefer simplicity, try using Google Docs or Google Sheets, which also offer free templates through their template gallery. These allow you to input cost information and adjust the layout as needed. Plus, because these are cloud-based, you can easily access them from any device and share them with contractors or team members.

Finally, don’t overlook customizable receipt apps like Expensify. Although primarily used for business expenses, you can set up personal home improvement receipts by entering your items and costs manually. This gives you a neat, organized digital record that can be exported whenever needed.

Whichever option you choose, using a template helps ensure that you stay on top of your home improvement expenses and maintain clear records for future reference or tax purposes.

Include specific details to align with tax requirements. Clearly list the project description, materials, labor costs, and any taxes paid. For clarity, break down the costs into categories like “materials” and “labor” rather than combining them into one amount. This helps when filing taxes and ensures proper deductions.

Ensure the receipt includes the contractor’s business name, address, and contact information. This helps identify the service provider for tax documentation purposes. Additionally, specify the dates when the work was completed, as this is critical for determining which tax year the expenses belong to.

If you made any upfront payments, list them separately to show how they were applied. This transparency helps avoid confusion when claiming deductions related to home improvements. Don’t forget to include payment methods, such as checks or credit card transactions, for a full audit trail.

Consider adding a line that confirms if the work was related to a qualified home improvement, like energy-efficient upgrades. Certain improvements may be eligible for tax credits, so it’s helpful to mark this directly on the receipt for easier reference later.

Finally, save digital copies of receipts. These can be stored in tax software or your cloud storage for easy access when filing taxes. This is a reliable way to keep track of receipts in case you need them for future audits or deductions.

If you’re looking for a quick and easy way to generate receipts for home improvement projects, these websites offer free templates you can use right away. They provide customizable options to fit various needs, from simple repairs to large-scale renovations.

1. Template.net offers a wide range of receipt templates tailored for home improvement. You can find customizable designs that suit specific projects, including plumbing, electrical work, and general contracting. The platform is user-friendly and allows you to download templates in multiple formats like Word, PDF, and Excel.

2. Canva has a selection of stylish and practical receipt templates for home improvement purposes. The drag-and-drop editor allows you to easily add project details and logos. Templates can be adjusted to match your preferred layout and color scheme, offering a more professional look for your receipts.

3. Vertex42 is known for its simple and functional templates, including home improvement receipts. You can download templates in Excel format, which makes them perfect for anyone who wants to track project costs or keep detailed records. The templates are pre-formatted and ready to use, saving you time on design and structure.

4. JotForm provides customizable receipt templates for home improvement projects through its form builder. This platform allows you to create receipts that can be filled out and automatically generated for clients. You can even set up online forms that let customers submit payment details or request services directly.

5. Microsoft Office Templates offers a variety of receipt templates available for free download. You can use Word or Excel to create home improvement receipts that include sections for labor costs, materials, and taxes. Their templates are easy to adjust, making it simple to fit the details of your project.

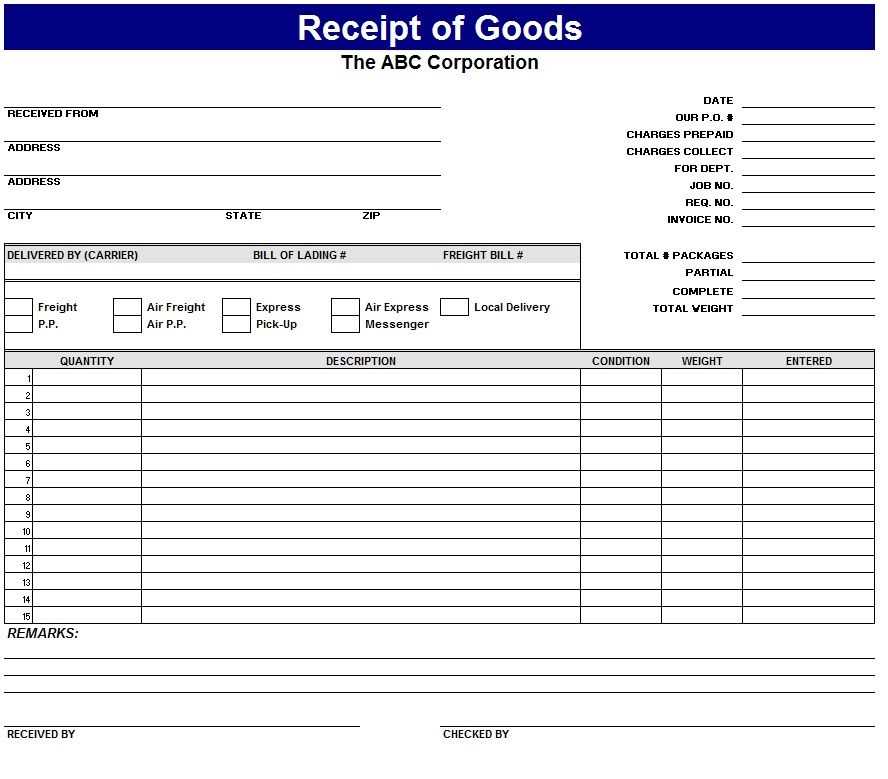

To include itemized costs in a home improvement receipt, start by listing each individual service or product provided. Create a separate row for each item, with columns for the description, quantity, unit cost, and total amount. For services, specify the hourly rate or flat fee and the number of hours worked. For materials, include the quantity and price per unit. Make sure to clearly label each section to avoid confusion.

After listing each item, calculate the subtotal for each category. Add up the itemized costs for a grand total. This helps the client understand exactly what they’re paying for and gives transparency to your billing process.

To keep things organized, group related items together. For instance, list all materials in one section and services in another. Consider including taxes and additional fees separately for clarity.

Make sure your home improvement receipts follow these clear steps to avoid any legal issues:

- Provide Accurate Dates: Always include the date of service or purchase. This helps in confirming the timeline of the work done or the goods bought, which is important for warranty or tax purposes.

- Include Full Business Information: Ensure the contractor’s name, business name, address, phone number, and license number (if applicable) are visible on the receipt. This guarantees transparency and accountability.

- Detail the Scope of Work: Itemize every service or product provided. Instead of a general “home improvement,” list specifics like labor hours, materials used, or any other services offered. This breakdown reduces confusion and ensures accuracy for tax records.

- Provide Payment Method: Specify the form of payment, whether it was by cash, check, credit card, or other means. This helps in tracking payments for potential future disputes or tax deductions.

- Tax Identification Number (TIN): Make sure the receipt includes the TIN of the service provider if required in your area. This may be necessary for tax reporting or claiming deductions.

- State Sales Tax Information: If applicable, clearly indicate whether sales tax has been included and the rate. Accurate tax information is crucial for avoiding potential fines or audits.

Why These Steps Matter

By following these steps, you ensure that your receipts are compliant with legal and financial standards. It not only simplifies the documentation process but also protects you in case of future audits or disputes.

To keep multiple receipts organized, create separate categories based on the type of improvement work, such as plumbing, electrical, painting, etc. This will make it easier to locate specific receipts when needed. Use a binder with labeled sections or digital folders to separate these categories. Within each category, store receipts chronologically to track progress and expenses over time.

1. Use a Spreadsheet for Better Tracking

Set up a simple spreadsheet to record details like the date of purchase, vendor name, cost, and category. This allows you to quickly sum up total expenses for each category. You can even include columns for payment method and warranty information, which will help you keep all details in one place.

2. Consider Scanning Physical Receipts

If you prefer to keep digital records, scan each receipt and save it in a folder labeled by category and date. There are various apps that automatically categorize receipts for easy tracking, allowing you to access them on your phone anytime.

3. Track Receipts Regularly

Set a routine to update your records, whether it’s weekly or monthly. This prevents receipts from piling up and ensures that you don’t forget important expenses. It’s also a great way to monitor your budget and spot any discrepancies early on.

4. Save for Tax Purposes

If you plan to claim these expenses for tax deductions, keep digital copies backed up. Consider using cloud storage for added security. Properly organizing and tracking receipts will make tax time much smoother and less stressful.

Ensure you choose a template that matches the specific details of your home improvement project. A well-structured template helps you avoid omissions or errors in calculations and descriptions. Accuracy in itemization is critical when dealing with multiple contractors or services. Ensure that all costs are reflected correctly, especially when dealing with materials, labor, and taxes.

Verify Categories and Line Items

Double-check that the template you use includes clear categories for each type of expense. This makes it easier to identify any discrepancies or missing charges before finalizing the receipt. For instance, ensure there’s a separate section for labor costs, materials, permits, and other charges. Avoid lumping everything under one category, as this could lead to confusion later.

Review Tax Calculations

Many templates come with built-in fields for taxes, but it’s vital to verify the accuracy of these calculations. Different regions have varying tax rates for home improvement services. Confirm that your template is set up to reflect the appropriate tax rate based on your location and the nature of the work performed. Mistakes here can result in overpayment or future disputes.

| Category | Estimated Cost | Actual Cost | Notes |

|---|---|---|---|

| Labor | $500 | $480 | Adjustment for hours worked |

| Materials | $300 | $310 | Price change on lumber |

| Permits | $50 | $50 | No change |

Always make sure your template reflects all the work done, including any adjustments or extra charges. A template should be flexible enough to accommodate changes but clear enough to avoid confusion. Regularly updating your template with accurate data will prevent potential mistakes that could disrupt your home improvement process.

Everything must be correct and without unnecessary repetition!

For home improvement receipts, clarity is key. Use a template that clearly outlines all costs and descriptions of work. Avoid adding redundant sections like extra columns for taxes unless needed. It’s important to maintain a simple, clean format that is easy to follow for both the contractor and the homeowner. The structure should include sections for the project description, labor costs, materials, and the total amount. Keep it clear, concise, and organized.

Organize with Sections

Break down the receipt into distinct sections. The first should be a brief project description, followed by labor and materials costs. If you’re including additional services, list them separately. This way, the receipt can serve as a clear record for both sides, with no confusion about what is being charged and why.

Ensure Accuracy in Figures

Double-check the figures for both labor and materials. Any errors can lead to miscommunication or disputes. Keep track of receipts for purchases related to the project, and make sure to reference them accurately. This avoids overcharging or undercharging, which can lead to problems later on.