If you’re a freelancer, you need a well-structured receipt template to ensure smooth transactions with clients. A properly formatted receipt serves as proof of payment and helps maintain accurate financial records. Whether you’re billing for design work, consulting, or writing services, a clear and professional receipt reassures clients and simplifies tax reporting.

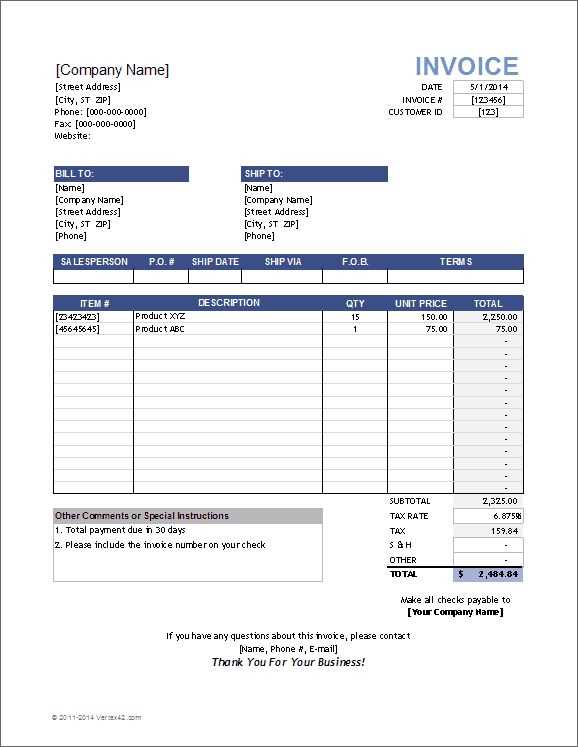

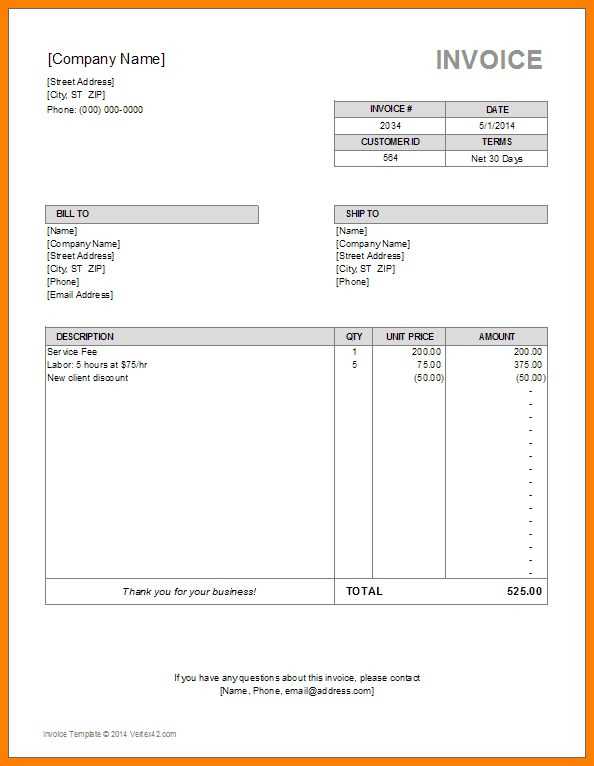

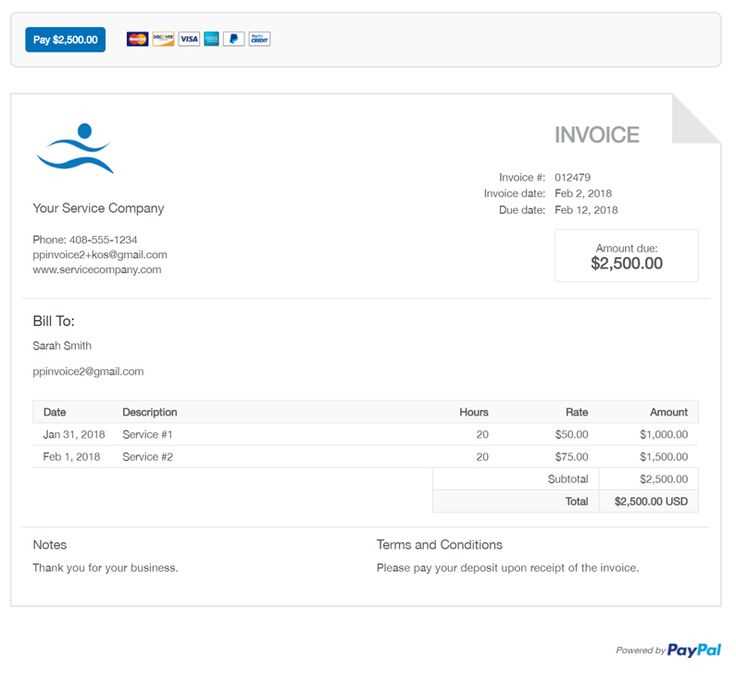

Your receipt should include key details such as your name or business name, contact information, invoice number, payment date, and a breakdown of services rendered. Adding a clear description of the work, along with the total amount paid, ensures transparency. If applicable, include tax details and payment methods to avoid any confusion.

Using a ready-made template speeds up the process and maintains consistency across your transactions. A simple yet professional design with structured sections improves readability. Consider using software like Excel, Google Docs, or invoicing tools that generate receipts automatically. If you prefer a manual approach, a well-organized Word document or PDF will also work.

Accuracy is key. Double-check all details before sending the receipt to the client. An error-free document builds trust and professionalism, making future collaborations smoother. If you’re unsure about formatting, plenty of customizable templates are available online to fit your needs.

Here’s the revised version with redundancy removed:

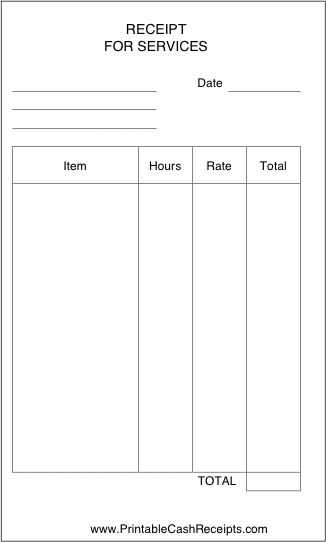

To create a freelancer receipt template, focus on clarity and simplicity. Include essential details like the freelancer’s name, address, and contact information at the top. Below that, list the services provided, including a brief description, rate, and hours worked or quantity. Add the total amount due, and if applicable, taxes or additional charges. Don’t forget to include the date and payment method. A concise footer with terms or payment instructions can be useful for clarity.

Use clean fonts and proper alignment to ensure readability. Avoid cluttering the template with unnecessary information that doesn’t directly relate to the transaction. Keeping it straightforward ensures both the freelancer and client understand the terms quickly and easily.

- Freelancer Receipt Template: A Practical Guide

Create a clear and concise receipt by including key details like your business name, contact information, invoice number, and date of service. The recipient’s name and address should also be listed. Specify the service provided, along with the agreed-upon price, and outline the payment method.

For organization, break the total amount into smaller line items if applicable, listing each service or product separately. This helps the client see exactly what they are paying for. Include any taxes or additional fees as separate line items to avoid confusion.

If you charge sales tax, make sure the percentage and total tax amount are included. This is especially important for compliance with tax regulations. Specify the payment terms, including due date, and indicate any penalties for late payments.

Finally, a simple thank you message at the bottom of the receipt can add a personal touch, helping to maintain a positive relationship with the client.

Key Elements to Include in a Freelancer Invoice

A well-organized invoice helps maintain professionalism and clarity for both the freelancer and the client. Make sure to include these key elements:

- Freelancer’s Details: Include your name, business name (if applicable), address, phone number, and email. Make it easy for the client to contact you if needed.

- Client’s Information: Add the client’s name, company name (if applicable), and contact information. This ensures the invoice is correctly addressed.

- Invoice Number: Assign a unique invoice number for each invoice. This helps with organization and tracking of payments.

- Invoice Date: Include the date the invoice is created. This marks the start of the payment period.

- Payment Due Date: Specify the date by which the payment is expected. This sets clear expectations for both parties.

- Itemized List of Services: Break down the services provided, including descriptions, hours worked, and rates. This provides transparency and clarity on what is being charged.

- Total Amount Due: Clearly state the total amount owed, including any taxes or additional fees. Make sure there are no hidden costs.

- Payment Instructions: Specify the payment methods accepted, such as bank transfer, PayPal, or other methods. Include relevant account details if necessary.

- Terms and Conditions: If applicable, include any specific terms related to the payment, late fees, or other agreements. This prevents misunderstandings.

- Thank You Note: A simple note of appreciation can go a long way in maintaining good client relations.

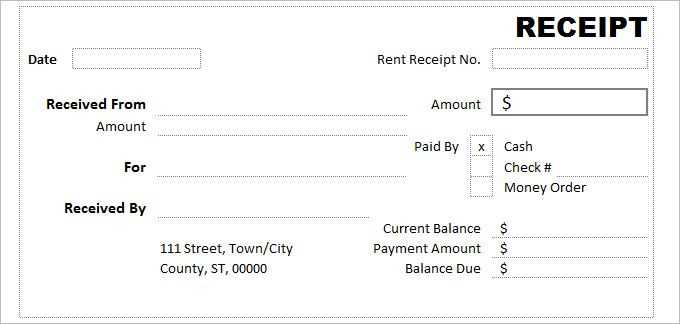

When creating a receipt for different payment methods, adjust the details to match the type of transaction. This ensures transparency and accuracy in the documentation.

1. Cash Payments

For cash transactions, include the amount paid in full, the date of payment, and a note indicating the payment was made in cash. Add a line confirming that no change is due if the amount given matches the total. A simple “Paid in Cash” notation will suffice for clarity.

2. Credit or Debit Card Payments

For card payments, include the last four digits of the card number, the payment date, and the transaction amount. It’s a good idea to include a note indicating the payment was made via credit or debit card to avoid confusion. For security, avoid including full card numbers or any sensitive details.

3. Bank Transfer

For bank transfers, specify the transaction reference number, the date the transfer was made, and the transferred amount. Include the name of the bank and the account holder’s name, if possible, for added clarity. Always verify that the payment has been completed before issuing the receipt.

4. Online Payment Platforms

For platforms like PayPal or Stripe, include the payment ID, the transaction date, and the total paid. Mention the platform used for payment (e.g., “Paid via PayPal”) and, if available, the email or account associated with the transaction. This provides a clear trail in case of disputes.

By including the relevant information based on the payment method, you provide a clear, understandable receipt for your clients, whether it’s cash, card, bank transfer, or an online platform.

FreshBooks provides a user-friendly interface for freelancers who want to quickly create and send professional invoices. It offers customizable templates, time tracking, and automated payment reminders, making it a reliable option for invoicing.

Invoice Ninja allows you to create, customize, and send invoices with ease. With its open-source software, freelancers can also host it on their own server. Invoice Ninja includes recurring billing options and integrates with a variety of payment gateways.

Zoho Invoice offers an intuitive design and a variety of features for freelancers. You can create customized invoices, track expenses, and accept payments online. Its multi-currency support is perfect for freelancers working with international clients.

Wave is a free invoicing software with all the basic features needed for freelancers. It enables invoice creation, expense tracking, and receipt scanning. Its integrated payment processing helps freelancers manage transactions seamlessly.

HoneyBook combines invoicing with project management tools, making it a good fit for freelancers who manage client projects. You can create invoices, set up automated payment reminders, and track project milestones all in one platform.

QuickBooks Self-Employed provides tax-specific tools along with its invoicing features. You can send customized invoices, track mileage, and easily categorize expenses for tax season. This software is designed specifically for solo entrepreneurs and freelancers.

Always include your full name or business name, contact information, and tax identification number (TIN) on invoices or receipts. This ensures transparency and establishes your identity as a legitimate service provider. Make sure the document includes the date, a clear description of the work completed, and the agreed-upon payment terms. Such details are often required by tax authorities for accurate record-keeping and auditing purposes.

Ensure the amount listed is accurate and corresponds to the agreed payment. Tax regulations in many countries require freelancers to charge VAT or sales tax, depending on the location of the client and the type of service provided. Check the specific tax laws in your country and consider consulting a tax professional to avoid issues.

If you are working with international clients, pay close attention to currency exchange rates and mention the payment currency on the invoice. Some countries also impose specific invoicing rules, like providing bilingual documents or adhering to local electronic invoicing standards.

Keep records of all receipts and invoices for several years, as required by most tax authorities. These records may be necessary if you need to file taxes, respond to an audit, or claim deductions. Regularly updating your invoicing practices to match local legal and tax requirements helps avoid penalties and keeps your business compliant.

Customize your receipt with key elements that reflect your brand’s identity, making it feel personal and aligned with your business values. Start by adding your logo at the top to immediately establish brand recognition. Ensure that your logo is clear and appropriately sized for both visual appeal and professionalism.

Brand Colors and Fonts

Incorporate your brand’s color scheme into the receipt design. Choose colors that match your website, business cards, and other marketing materials. Stick to a limited palette to avoid overwhelming the recipient. Use your brand’s fonts for headings and body text. This creates a consistent and cohesive look across all your materials.

Contact Information and Social Media

Place your contact information at the bottom of the receipt. This includes your business address, email, phone number, and website. Adding social media handles will give customers another way to stay connected with your brand, reinforcing your online presence.

| Element | Recommendation |

|---|---|

| Logo | Place it at the top, clear and professional |

| Colors | Match your brand’s color scheme, limit the palette |

| Fonts | Use brand-specific fonts for consistency |

| Contact info | Include email, phone, and website at the bottom |

| Social Media | Add handles to encourage engagement |

Keep your receipt layout clean and easy to read. Ensure that all necessary details–like the transaction date, description of the services, and total amount–are presented clearly. A clutter-free receipt improves the customer’s experience and reinforces professionalism.

Double-check your payment terms. A common mistake is not specifying when payments are due or forgetting to include the payment method. Always mention the exact due date and provide clear details about how the client can pay–bank transfer, PayPal, or other methods.

- Incorrect or missing client details: Ensure the client’s name, address, and contact information are accurate. An invoice with incorrect client details can delay payments or cause confusion.

- Failure to itemize services: Listing a vague description like “consulting services” instead of breaking down the tasks or hours worked is unprofessional. Clearly outline each service, the time spent, and the rate applied.

- Not including tax information: If applicable, add the proper tax rate and amount to your invoice. Failing to do so can lead to disputes or problems with tax authorities.

- Missing invoice number: Every invoice should have a unique invoice number. This helps you track your invoices and avoids confusion for both you and the client.

- Overlooking payment deadlines: Always specify the due date for payment. If payment terms are flexible, clearly state them (e.g., 30 days net, 15 days from receipt, etc.).

Double-Check Calculations

Before sending, always verify the math. Double-check rates, hours, and totals. Simple errors can create frustration for both you and the client.

Maintain Consistency

Ensure consistency in formatting and language. A disorganized invoice can be seen as unprofessional. Stick to a format you use consistently for all invoices, making it easier for clients to understand and pay quickly.

Optimizing Your Receipt for Freelancers

To keep your receipt clear and professional, focus on including specific details that make it easily understood and legally compliant. Here’s how you can design an effective template for your freelance work.

Key Elements to Include

Every invoice or receipt for freelance services should contain these essential components:

- Client Information: Name, address, and contact details of the client.

- Freelancer Details: Your name, address, and contact information, including your business registration number if applicable.

- Invoice Number: Unique reference number for easy tracking and record-keeping.

- Date of Service: The start and end dates of the project or service rendered.

- Payment Breakdown: A clear list of services, quantities, rates, and totals. Include a description of the work performed.

- Payment Terms: Due date, late fees (if any), and acceptable payment methods.

- Tax Information: Relevant tax rates and your tax identification number, if applicable.

Structure of a Freelance Receipt

Here’s a simple example of how to structure your receipt:

| Description | Amount |

|---|---|

| Web Design Services (3 hours) | $300 |

| Revision Charges | $50 |

| Total | $350 |

By structuring your receipt this way, you provide a transparent and professional document for your client, while ensuring that you’ve met all necessary legal requirements.