If you’ve recently paid off a loan, you need an official document confirming that the balance has been settled. A Paid in Full Loan Receipt serves as proof that you’ve met your financial obligation and that no further payments are required. This document is critical for ensuring that both you and the lender have a clear record of the transaction.

Creating a simple yet professional receipt doesn’t have to be complicated. The free template provided here can help you quickly generate an accurate and legally sound receipt. It includes sections to detail the loan amount, payment date, lender information, and most importantly, a statement confirming that the loan is fully paid.

Using this template ensures that you maintain transparency and keep your financial records up to date. Whether you are dealing with personal loans, car loans, or mortgage payments, this tool is versatile and easy to use. By keeping a copy of the receipt for your records, you safeguard yourself from potential disputes or misunderstandings in the future.

Here’s the corrected version:

When creating a loan receipt template for a “Paid in Full” transaction, ensure that it includes the borrower’s name, the total amount paid, and the date of payment. It’s essential to indicate the loan’s full settlement and confirm that no outstanding balance remains.

| Field | Description |

|---|---|

| Borrower’s Name | Include the full legal name of the borrower. |

| Loan Amount | State the original loan amount and the total paid. |

| Payment Date | Specify the exact date when the loan was fully paid. |

| Loan Status | Clearly state “Paid in Full” to confirm settlement. |

| Signatures | Both lender and borrower should sign to confirm the receipt. |

Once the document is complete, both parties should keep a copy for their records. It’s advisable to use a template with a clean, professional layout to avoid confusion and ensure all necessary details are clearly listed.

- Paid in Full Loan Receipt Template Free

Creating a “Paid in Full” loan receipt is straightforward and ensures both parties have clear documentation of the transaction. A free template can save time and provide structure for this process. Here’s a simple structure for the template:

- Borrower Information: Include the full name and contact information of the borrower.

- Lender Information: Include the full name and contact information of the lender.

- Loan Details: Specify the loan amount, interest rate, and the date the loan was originally issued.

- Payment Summary: State the total amount paid, including any interest, and the date the final payment was made.

- Confirmation Statement: Add a statement confirming the loan has been paid in full, with no outstanding balance. Example: “The loan of [amount] is fully paid and settled as of [date].”

- Signatures: Both the borrower and lender should sign and date the receipt to confirm agreement.

- Additional Information: Optionally, include any references, such as transaction IDs or check numbers, to further clarify the payment.

This simple yet detailed structure provides a clear and professional record for both parties. You can find downloadable templates online, often customizable to fit your needs. Make sure to store a copy for both the borrower and lender as proof of payment completion.

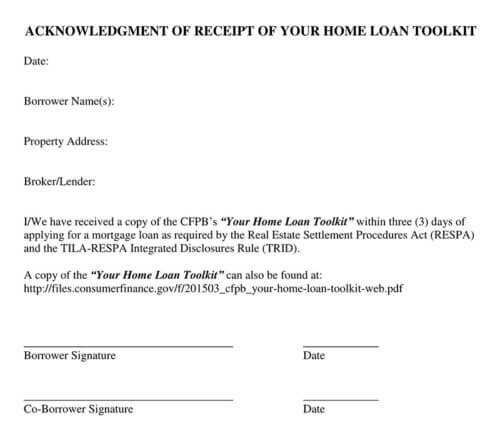

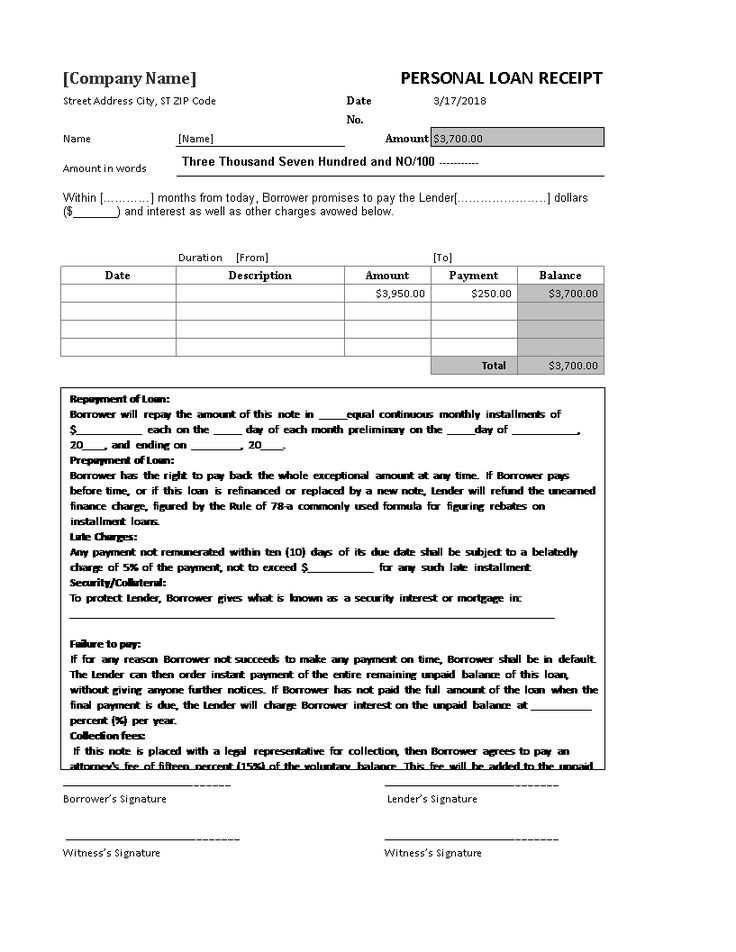

To tailor a free loan receipt template to your specific requirements, first adjust the basic details such as the borrower’s and lender’s names, addresses, and contact information. Ensure that the loan amount, repayment schedule, and interest rate (if applicable) are clearly stated. If necessary, add clauses for any specific terms related to the loan, such as collateral or late payment fees.

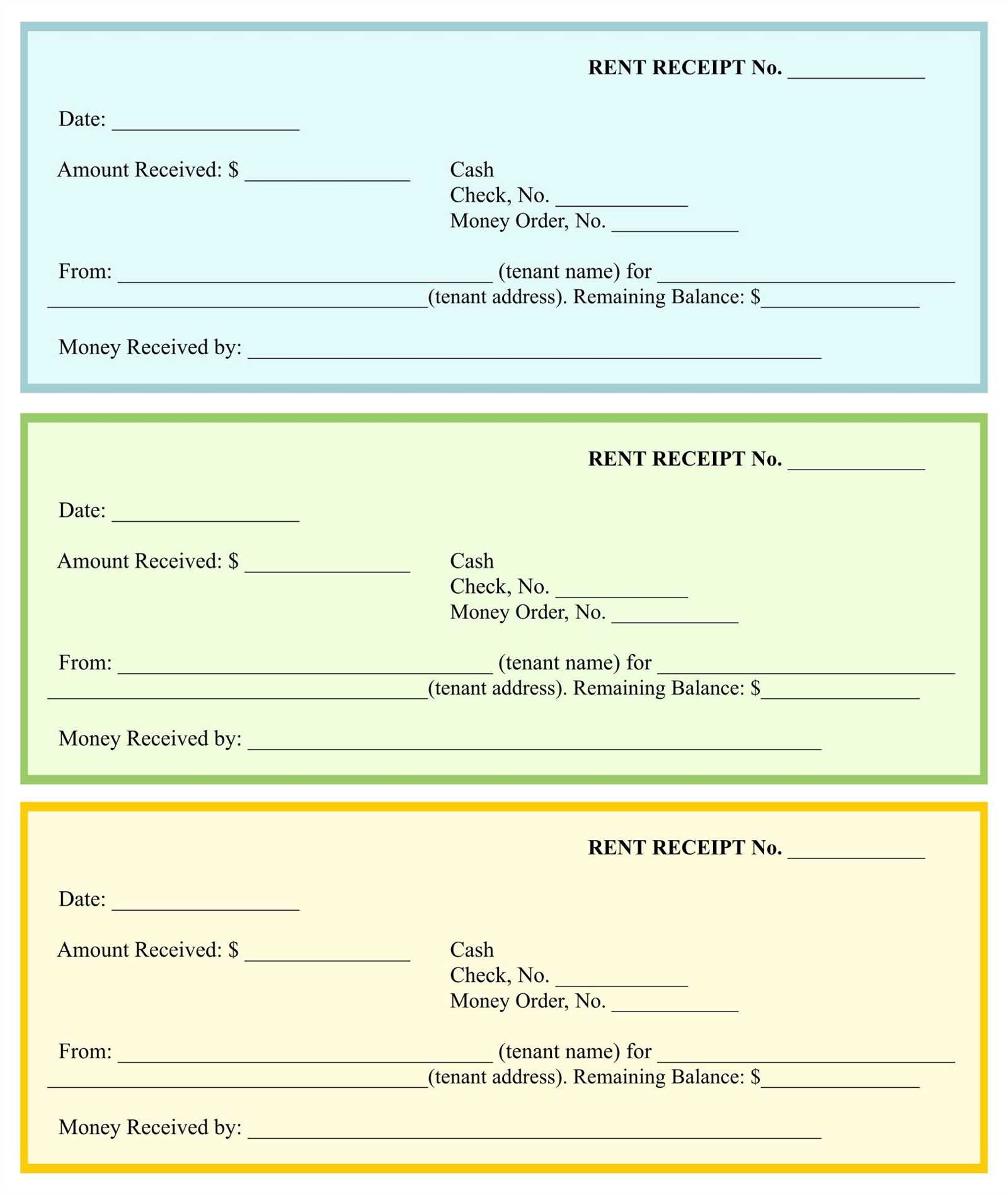

Next, include a section where both parties can sign and date the receipt, confirming that the loan has been fully paid. This adds legal validity to the document. If you’re dealing with multiple payments, consider including a table or chart that tracks partial payments and balances.

For personal loans, it may be helpful to add a brief description of the loan’s purpose, such as “Personal loan for medical expenses.” This will clarify the nature of the transaction for both parties in the future. If you plan to use the receipt for business purposes, customize the template to include your company name and any business-specific terms.

Finally, consider incorporating a section for notes or additional conditions, if required, so that the receipt can cover all possible scenarios, such as early repayment or modifications to the loan agreement.

Start with the date of payment to mark the official settlement of the loan.

Include the borrower’s and lender’s names for identification. This ensures both parties are clearly acknowledged in the receipt.

Loan details such as the initial loan amount and the final payment amount should be stated clearly. This helps confirm the exact balance that was paid off.

Clearly state that the loan has been paid in full with a phrase like “This loan is paid in full.” This makes it clear that no further payments are needed.

Document the payment method, whether it was cash, check, or bank transfer, to create a complete record of the transaction.

If available, include any reference numbers or loan account numbers for tracking purposes. This provides an easy way to verify the payment.

Both parties’ signatures should be present to authenticate the receipt and confirm agreement on the transaction.

Finally, note that no additional payments are due with a statement such as “No further obligations remain.” This officially closes the loan.

To find trustworthy free templates for paid-in-full loan receipts, you can explore several reputable sources. One of the most reliable options is template websites that specialize in legal and financial documents. Websites like Template.net and FormSwift offer various customizable receipt templates for free. These sites ensure that the templates are professionally designed and legally sound, making them ideal for personal and business use.

Public Resource Platforms

Additionally, platforms like Google Docs and Microsoft Office provide free templates. These platforms have a variety of loan receipt templates that are easy to adapt. You can access them directly and modify them according to your needs.

Community and Open-Source Sites

Open-source communities such as GitHub also feature free templates shared by individuals who want to help others. Although these templates may not be as polished as those from professional sites, they can still serve as a good starting point and are customizable for your specific situation.

Paid in Full Loan Receipt Template

To create a clear and legally binding receipt for a paid-in-full loan, ensure the document includes key details such as the full loan amount, payment method, and date. Begin by identifying the lender and borrower, followed by a statement confirming the full payment was made. You can use the following format:

- Lender’s Information: Include the name, address, and contact details of the lender.

- Borrower’s Information: List the borrower’s name, address, and contact details.

- Loan Details: Clearly specify the loan amount, interest rate (if applicable), and the original terms.

- Payment Confirmation: Include a statement like “This loan has been paid in full on [date].”

- Payment Method: Specify how the loan was paid, whether by check, wire transfer, or cash.

- Signatures: Ensure both the lender and borrower sign the document to confirm the agreement.

- Date: Always include the date of payment to avoid any confusion in the future.

By following this template, you create a formal acknowledgment that the loan has been settled, offering peace of mind to both parties.