If you’re looking for a simple and convenient payroll receipt template, you’re in the right place. A payroll receipt helps both employers and employees keep track of payments, taxes, and deductions. Using a template saves time and ensures consistency in record keeping.

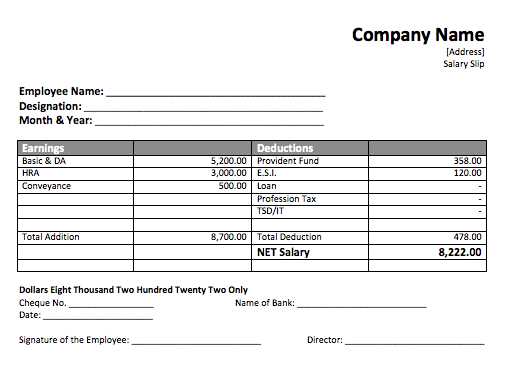

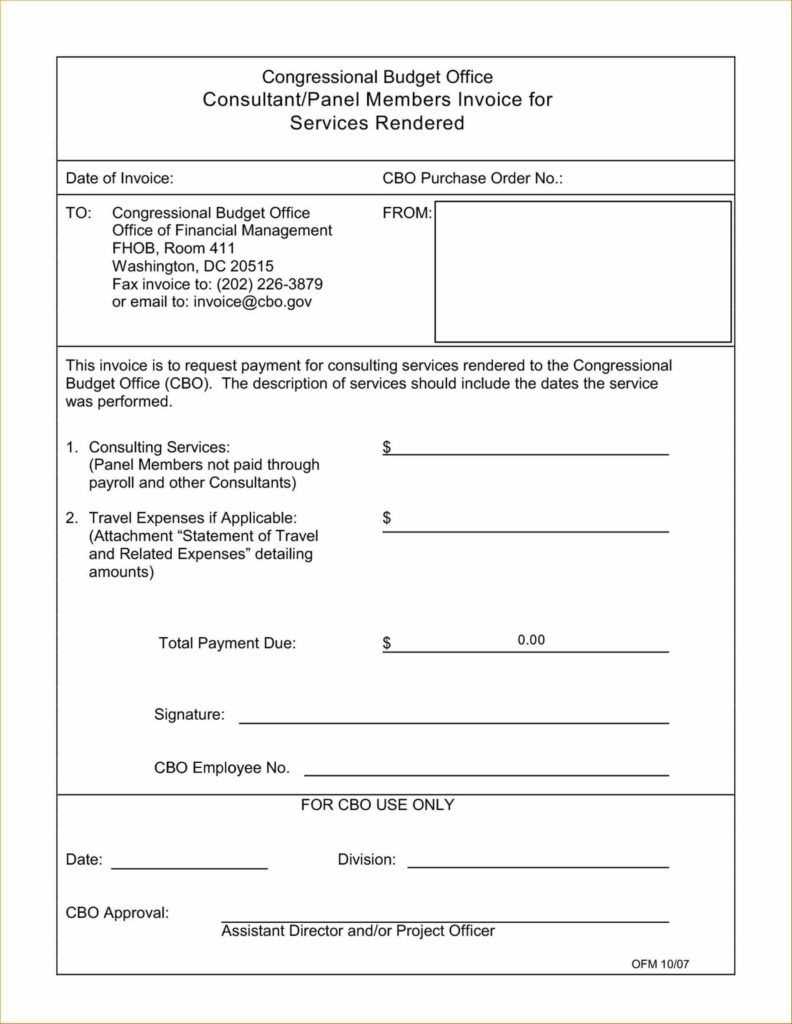

This free payroll receipt template is designed to include all necessary details, such as employee name, payment date, gross earnings, deductions, and net pay. It’s easy to customize, so you can add or remove fields according to your needs.

With this template, you won’t have to worry about manually creating each receipt from scratch. The format is straightforward, and everything you need to comply with payroll regulations is included. Download and start using it today to streamline your payroll process and keep accurate records for tax purposes.

Here’s the revised version with removed repetitions:

Use clear, concise headers to structure payroll receipt information. Include the employee’s name, position, and pay period at the top. List the gross pay, taxes, deductions, and net pay in separate sections for clarity. Ensure that totals are easy to find, and that each section is clearly labeled.

Key Elements to Include

Employee details: Name, address, and job title.

Payroll details: Gross pay, deductions, and taxes.

Net pay: The final amount to be paid after deductions.

Design Tips for Readability

Ensure the layout is clean with sufficient space between sections. Use bold for totals and key amounts. Use simple fonts and avoid unnecessary graphics or elements that can clutter the receipt.

- Payroll Receipt Template Free

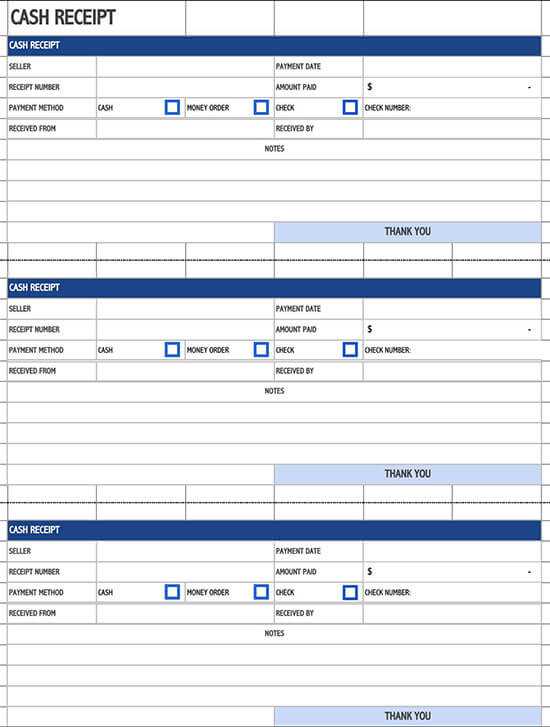

A free payroll receipt template offers a practical way to document employee compensation details. These templates typically include sections for the employee’s name, pay period, gross wages, deductions, and net pay. Use this template to maintain accurate records for your workforce.

Key Components of a Payroll Receipt Template

- Employee Information: Include the employee’s name, job title, and unique employee ID.

- Pay Period: Specify the date range for which the payment is made.

- Gross Pay: List the total earnings before any deductions, including overtime or bonuses.

- Deductions: Break down the various deductions like taxes, benefits, and retirement contributions.

- Net Pay: The final amount the employee takes home after all deductions.

How to Use a Payroll Receipt Template

- Download a template that suits your company’s payroll structure.

- Input employee and payroll details in the respective fields.

- Review the calculations for accuracy before issuing the receipt.

- Provide a copy to the employee and retain one for your records.

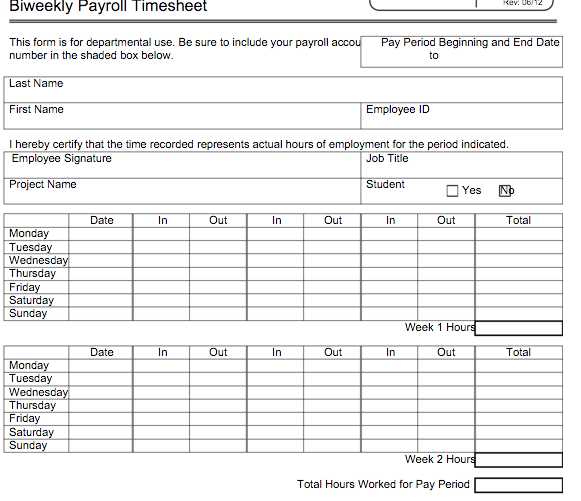

Begin by collecting all the necessary information for the payroll receipt. This includes employee details, pay period dates, and the total hours worked. Include the employee’s name, job title, and pay rate. Ensure that the document also lists the total earnings, tax deductions, and other withholdings like insurance or retirement contributions.

Next, break down the pay into regular hours, overtime hours, and bonuses. Specify the hourly rate for each category and calculate the total for each. Be transparent with deductions, such as federal and state taxes, social security, and Medicare. Include a section where the net pay is clearly shown after all deductions.

Make the receipt easy to read by organizing the details in a clear table format. Add a space for both the employer’s and employee’s signatures, if required, to confirm the payment details. A payroll receipt can be generated using a simple spreadsheet tool or payroll software to streamline the process for consistency and accuracy.

Ensure the document is dated with the exact payment date. This helps avoid any confusion about when the payment was processed and ensures that the record is clear for future reference.

Include the employee’s full name and address at the top of the payroll receipt. This ensures clear identification of both the employee and the employer.

Payment date is another key detail that must appear, indicating the specific pay period covered. Include both the start and end dates of the pay period.

Gross pay should be clearly listed. This is the total amount before any deductions like taxes, benefits, or retirement contributions.

After gross pay, specify all deductions made from the paycheck. This could include federal and state taxes, social security, healthcare, and any other withholdings.

The net pay follows deductions and represents the actual amount the employee will receive after all subtractions. This figure is what the employee will deposit or cash.

To ensure clarity, break down taxes and benefits separately. Include information on how these amounts are calculated, especially for items like social security or pension contributions.

Employer contributions should also be listed, such as those made towards health insurance or retirement plans. This allows the employee to see the employer’s financial contributions on their behalf.

Finally, include the payment method (direct deposit, check, etc.), along with any transaction IDs if applicable, so the employee can verify the payment easily.

Adapt your payroll receipt template to accommodate various pay structures by focusing on key adjustments to the template’s layout and calculations. If your business operates with different types of compensation plans, such as hourly rates, salaried employees, or commission-based pay, customize the template to clearly display the breakdown for each scenario.

For hourly employees, include fields for hours worked, overtime, and hourly rate. Ensure that overtime calculations are based on the correct multiplier (e.g., time-and-a-half for hours worked beyond 40 hours). This can be done by adding a specific row in the table to calculate overtime pay:

| Regular Hours | Overtime Hours | Hourly Rate | Overtime Rate | Total Pay |

|---|---|---|---|---|

| 40 | 5 | $15 | $22.50 | $750 |

For salaried employees, focus on clearly displaying the salary breakdown per pay period. Make sure the template reflects the gross salary, deductions (e.g., tax, benefits), and net pay. A simple structure may include a “Salary” section and a deduction column to clearly show the total adjustments:

| Gross Salary | Tax | Benefits | Net Salary |

|---|---|---|---|

| $3,500 | $350 | $200 | $2,950 |

For commission-based pay, customize the template to list individual sales or earnings and the commission rate applied. Add fields for each commissionable sale and include the total commission calculated. You may also want to include a column for bonuses or incentives based on performance:

| Sales Amount | Commission Rate | Commission | Total Earnings |

|---|---|---|---|

| $5,000 | 10% | $500 | $500 |

Lastly, ensure that any additional deductions or bonuses are incorporated into the template’s structure for clarity. This allows the payroll to be fully aligned with the specific pay structure used for each employee, minimizing errors and simplifying payroll processing.

How to Ensure Compliance with Local Regulations for Payroll Receipts

To stay compliant with local payroll regulations, first confirm the specific requirements in your jurisdiction. Regulations vary based on country, state, or even local municipalities, so research thoroughly before creating payroll receipts.

Key Compliance Areas

- Wage Information: Include the total wages, hourly rate, or salary, depending on the payment structure. Be sure the wage rate matches legal minimum wage standards.

- Tax Deductions: Clearly outline all taxes withheld, including federal, state, and local taxes. Different jurisdictions may require different breakdowns.

- Benefits and Contributions: Include any employer contributions to retirement plans, healthcare, or other benefits. These amounts must be listed separately to ensure transparency.

- Hours Worked: Provide accurate records of hours worked, including overtime, holiday, or weekend pay if applicable. This ensures that employees are paid correctly for their time.

Specific Local Requirements

- Minimum Wage Regulations: Ensure your payroll receipts reflect the current minimum wage for your region, as some areas frequently adjust these rates.

- Overtime Laws: Verify that your payroll receipts properly include any overtime pay calculations in accordance with local laws, which can differ depending on the region.

- Public Holiday Pay: If employees work on public holidays, make sure the payroll receipt reflects any legal premium rates for such work.

Stay up to date with any changes to local payroll laws by subscribing to legal or government updates, attending seminars, or consulting with experts. Regularly review your payroll processes to ensure that you remain in compliance with any adjustments to these regulations.

For a wide variety of free payroll receipt templates, check out platforms like Microsoft Office’s official website, which offers templates that are easily customizable for different payroll needs. Simply visit the “Templates” section, search for “payroll receipt,” and choose the one that fits your requirements. You can download them in formats compatible with Word or Excel.

Another great resource is Google Docs. Go to Google Drive, open Docs, and search for payroll receipt templates. The available options are free to use and allow for easy editing in Google’s cloud environment. You can save or print the completed document directly from Google Docs.

For more diverse and industry-specific options, websites like Template.net provide a collection of payroll receipt templates for different business sizes and types. These templates are free for download and can be modified as needed. Make sure to select the free version to avoid unnecessary charges.

If you prefer a more customizable experience, check out Canva. It offers free payroll receipt templates with drag-and-drop functionality, allowing for personal style adjustments without the need for complex software. Templates are available for both personal and professional use.

One of the most frequent mistakes is neglecting to update tax rates. Tax laws change regularly, and using outdated rates can lead to incorrect calculations. Always verify the current tax rates before finalizing your payroll.

1. Incorrect Employee Classification

Misclassifying employees as contractors or vice versa can cause issues with tax reporting and employee benefits. Ensure you understand the classification rules and double-check each employee’s status on the template.

2. Missing Overtime and Benefits Information

Failure to include overtime pay or benefits in payroll calculations can result in discrepancies and noncompliance. Be sure to input accurate overtime hours and any applicable benefits such as health insurance or retirement contributions.

3. Overlooking Payroll Deductions

Ignoring deductions such as retirement plan contributions, insurance premiums, or garnishments can lead to incorrect net pay. Double-check all deduction fields on your payroll template to avoid errors.

4. Inaccurate Pay Periods

Payroll templates should reflect the correct pay periods. Using the wrong period (e.g., monthly instead of bi-weekly) can distort the total pay, leading to confusion and potential complaints from employees.

To create a payroll receipt template that works for your needs, ensure the structure includes key sections. First, include employee information such as name, position, and employee ID. Clearly define the payment period, starting and ending dates. Be sure to include the total gross income, deductions (taxes, benefits, etc.), and the net income after deductions. Using bullet points or clear sections for each of these categories makes the template easy to read and understand. Additionally, consider adding space for overtime pay and any bonuses.

Ensure the receipt reflects all statutory information such as tax withholding and social security contributions. Including the employer’s name, address, and contact details is also important. This helps employees reference payroll details with ease. Make sure the template layout is simple, with no extra clutter, to ensure readability. Once completed, save it in a compatible format for easy use and customization across different payroll periods.