Using a petty cash receipt template simplifies tracking small business expenses. With a template, you can create receipts quickly, ensuring accuracy and consistency for every transaction. These templates help you stay organized and avoid confusion, particularly for day-to-day cash transactions.

Choose a free template that suits your business needs. You can find templates that allow you to record the date, purpose of the expense, amount, and signature of the person receiving the cash. Customizable templates can be tailored to fit your company’s specific requirements, making them even more useful for bookkeeping.

With a petty cash receipt template, you save time, reduce errors, and improve transparency in your financial records. Whether you’re running a small business or managing a larger organization, implementing a standardized method for petty cash transactions ensures better financial control and accountability.

Here are the corrected lines:

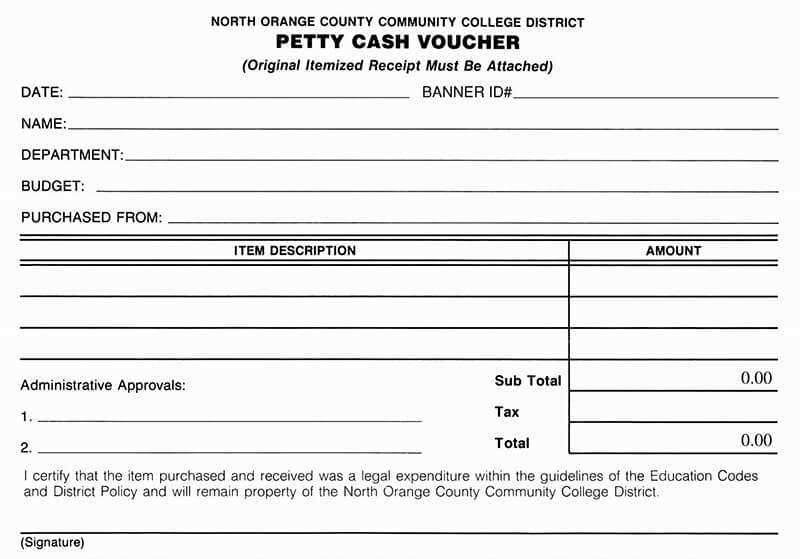

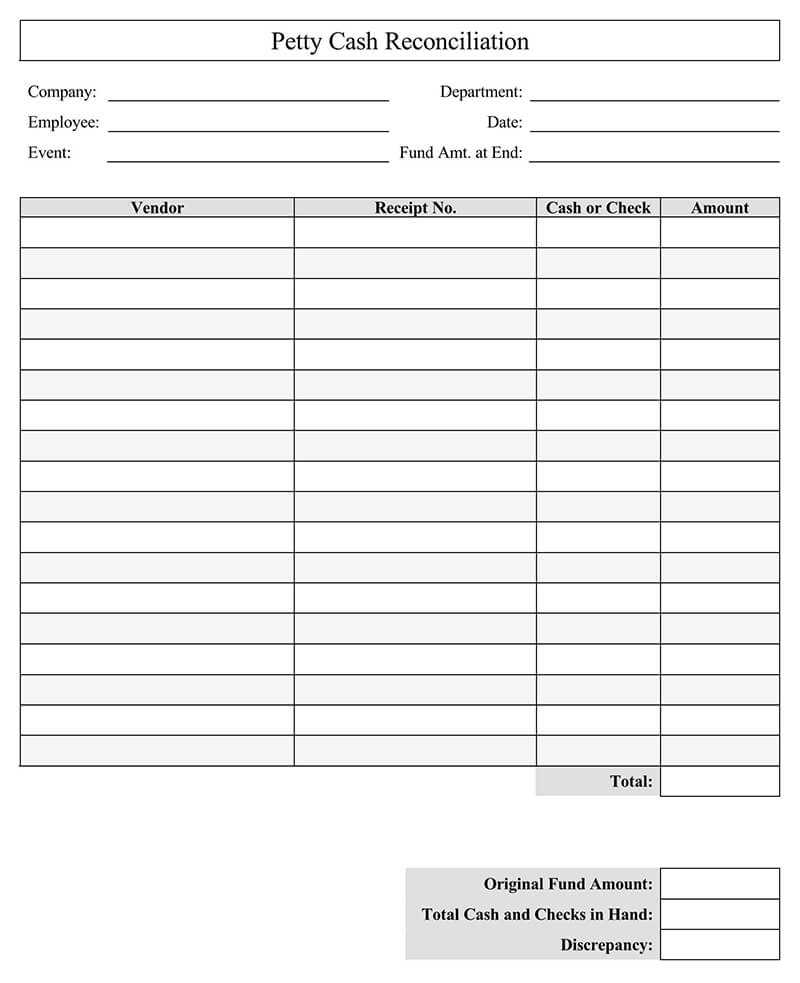

When designing a petty cash receipt template, it’s critical to include all necessary fields to ensure accuracy and clarity. Here’s a quick overview of what should be corrected or adjusted in your template:

Corrected Fields:

- Date: Always include a specific date for the transaction.

- Receipt Number: A unique receipt number helps track each transaction.

- Amount: Specify the exact amount, including any taxes or additional fees.

- Purpose: Clearly describe the purpose of the petty cash usage to avoid confusion later.

- Payee: Name of the individual receiving the cash.

Additional Adjustments:

- Signatures: Ensure both the payer and the recipient sign the receipt for verification.

- Account Code: Add an optional field for the accounting department to reference budget codes.

- Approval: Include a section for manager or supervisor approval before the transaction is processed.

Make these adjustments to maintain accurate and professional petty cash records. A well-structured template reduces errors and simplifies accounting processes.

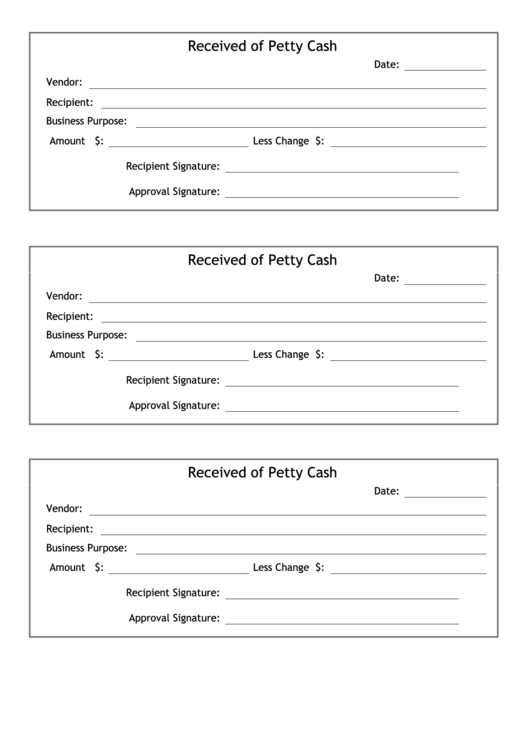

- Petty Cash Receipt Template Free

Use this simple petty cash receipt template to keep track of small business expenses. The template includes fields for the date, amount, purpose of the expense, and the signature of the person receiving the funds. This straightforward format ensures clarity and consistency in your petty cash records.

Make sure to include the following details in the template:

- Date: Specify the date the funds were disbursed.

- Receipt Number: Assign a unique number to each transaction to help with organization.

- Amount: Clearly state the amount received, including both the numerical value and the words.

- Purpose: Describe the reason for the petty cash disbursement.

- Authorized Signature: A signature of the person approving the transaction.

- Recipient Signature: The person receiving the funds must sign to acknowledge the receipt.

This format can be customized for any business and is available for free download. It’s perfect for keeping accurate financial records and ensuring that your petty cash is properly managed.

To create a petty cash receipt template in Excel, open a new workbook and start by labeling the first row with these columns: Date, Receipt Number, Payee, Description of Expense, Amount, Payment Method, and Authorized By. Adjust the column widths to make sure each field fits comfortably.

Next, set up a formula in the “Amount” column that calculates totals automatically. For example, use the SUM function to keep track of the total petty cash expenses at the bottom of the column. You can use a simple formula like =SUM(D2:D50) to calculate the sum of all entries in the “Amount” column.

To make the template user-friendly, apply borders to each cell to clearly distinguish each category. You can also add a background color to the header row for better visibility.

Consider adding a small section at the bottom to note the remaining balance of petty cash, which updates as you enter new transactions. This can be done by using a simple formula: =Previous Balance – SUM(Amount). This ensures you can easily monitor the current state of your petty cash fund.

Finally, save the template as a reusable file, making sure to leave rows empty for new data. You can save the document in Excel format (.xlsx) or as a template (.xltx) for easy access every time you need it.

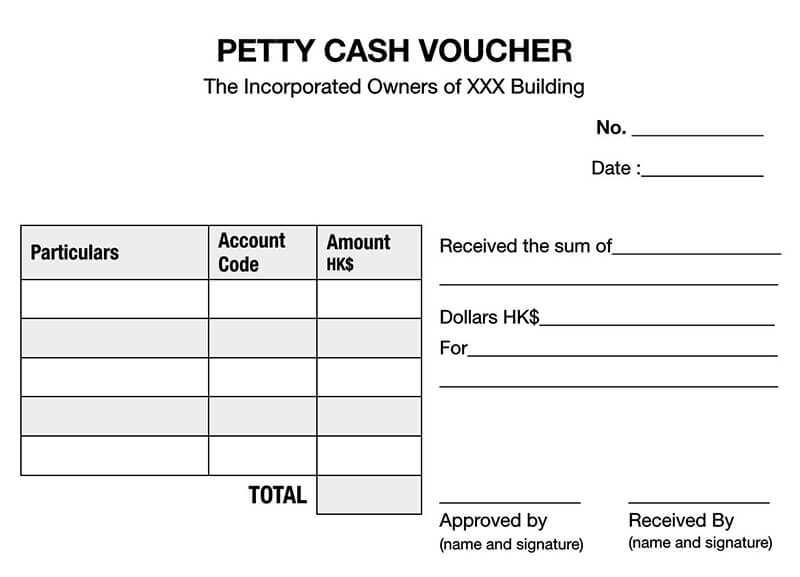

A petty cash receipt template should cover all necessary details to ensure clarity and prevent misunderstandings. Include the following key elements:

Date of Transaction

Always record the exact date of the transaction. This helps track when funds were spent and assists in reconciling the cash flow for accounting purposes.

Receipt Number or Reference Code

Assign a unique receipt number to each transaction. This provides an easy reference for both tracking and auditing purposes.

Description of the Expense

Clearly describe the item or service purchased. Be specific about the nature of the expense to avoid confusion. This also helps when categorizing expenses during financial reviews.

Amount Spent

State the exact amount spent, including any applicable taxes. Be sure to specify the currency to avoid ambiguity, especially if transactions are cross-border.

Payment Method

Indicate whether the expense was paid in cash, by card, or through another method. This adds another layer of transparency and can help reconcile the petty cash fund.

Authorized Signatures

Include spaces for both the person requesting the cash and the person authorizing the transaction to sign. This confirms approval and accountability for the expense.

Vendor Information (if applicable)

If the expense involves a third party, such as a supplier or service provider, include their name and contact details. This ensures you have proper documentation for any future queries.

Remaining Cash Balance

It’s helpful to include the current balance of the petty cash fund on the receipt. This provides a snapshot of the available balance after the transaction, helping maintain accuracy.

Free petty cash receipt templates are widely available online, making it easy to track small expenses without spending time creating a template from scratch. Here are some of the best places to find these templates:

1. Google Docs

Google Docs offers customizable receipt templates that can be downloaded or edited directly within your browser. You can search for “petty cash receipt” in their template gallery and choose from various formats that suit your needs. The templates are easy to modify and share with others in your organization.

2. Microsoft Office Templates

Microsoft provides a variety of free petty cash receipt templates for Word and Excel. Simply search for “petty cash receipt” in the template section of Office.com. These templates are straightforward and can be tailored to fit your company’s specific requirements.

3. Template Websites

Several websites specialize in free printable templates, including petty cash receipts. Websites like Template.net and Vertex42 have easy-to-use templates that can be downloaded for free. They often come in PDF, Excel, or Word formats, making them compatible with various devices.

4. Online Receipt Generators

There are also free online receipt generators that allow you to fill in details and download or print your receipt. Sites like Receipt Generator provide simple forms where you input details like the date, amount, and purpose of the petty cash usage. Once completed, you can download the receipt instantly.

| Website | Template Type | Format | Link |

|---|---|---|---|

| Google Docs | Editable Templates | Google Docs | docs.google.com |

| Microsoft Office | Word & Excel Templates | Word, Excel | office.com |

| Template.net | Printable Templates | PDF, Word, Excel | template.net |

| Receipt Generator | Online Generator | receipt-generator.com |

The essence remains, and word repetition is minimized.

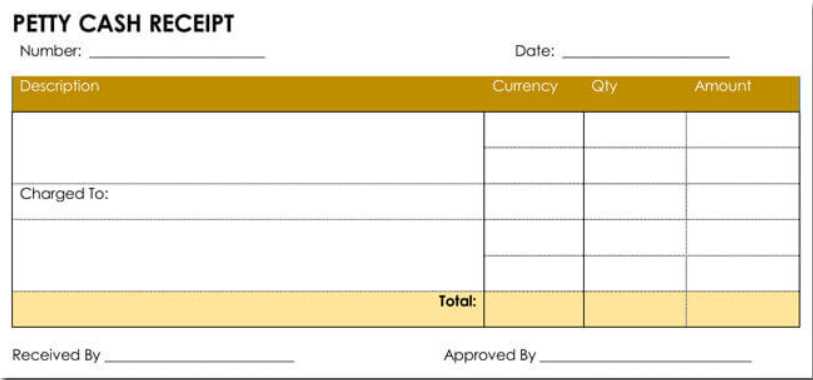

To create an effective petty cash receipt template, focus on including the necessary details in a clean and organized format. Ensure that the receipt includes the date, amount received, purpose of the expense, and the name of the person handling the cash. These elements will keep the record clear and prevent misunderstandings.

Key Fields to Include

List the following fields to guarantee accuracy and transparency in every transaction:

- Date of transaction

- Amount received

- Purpose of the expense

- Signature of the person receiving or issuing the cash

- Reference number for easier tracking

Simple Design for Clear Documentation

Maintain simplicity in design. A clean layout with proper spacing between each section ensures that all the required details are easy to find and read. Avoid overloading the receipt with unnecessary graphics or complex layouts. A clear, professional design will promote trust and help in the event of audits or reviews.