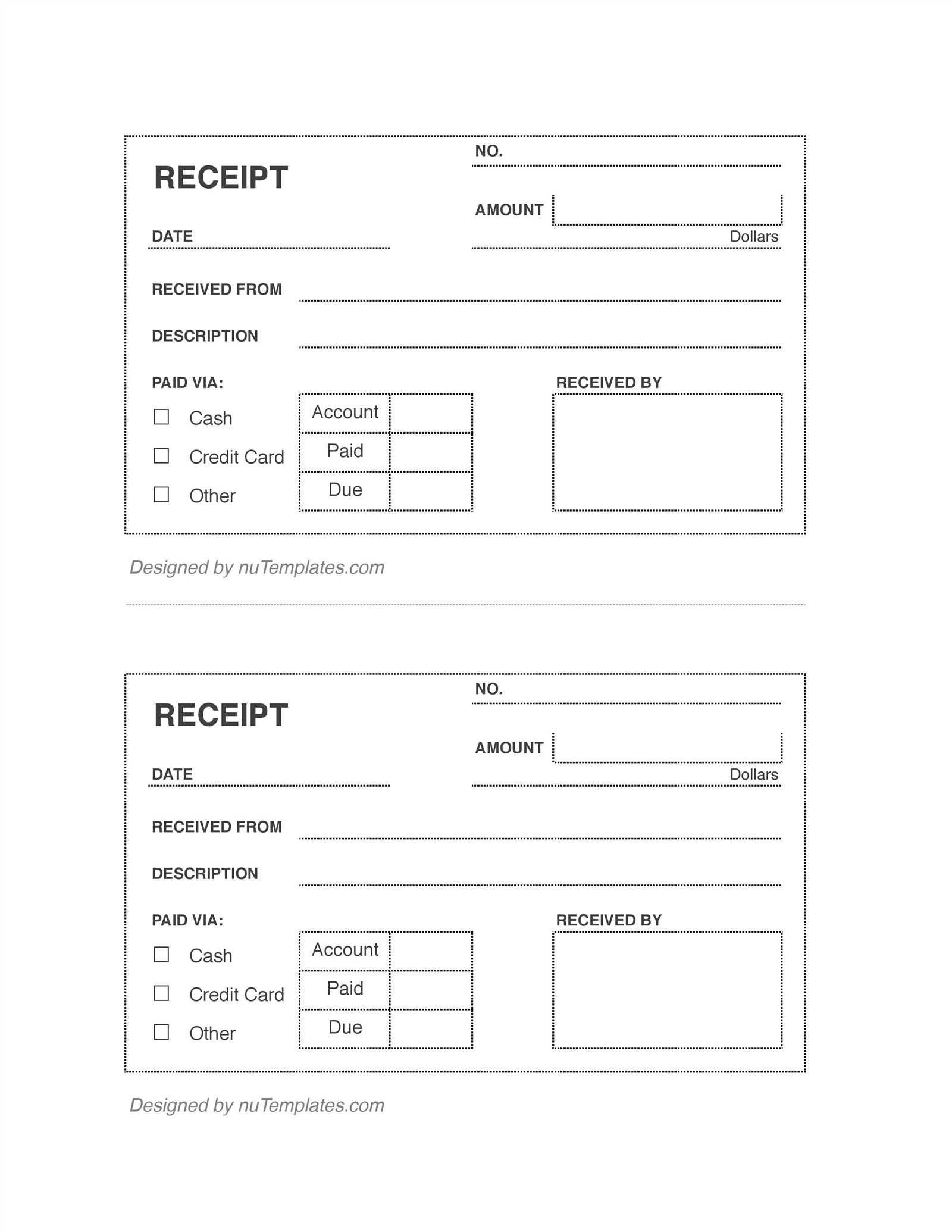

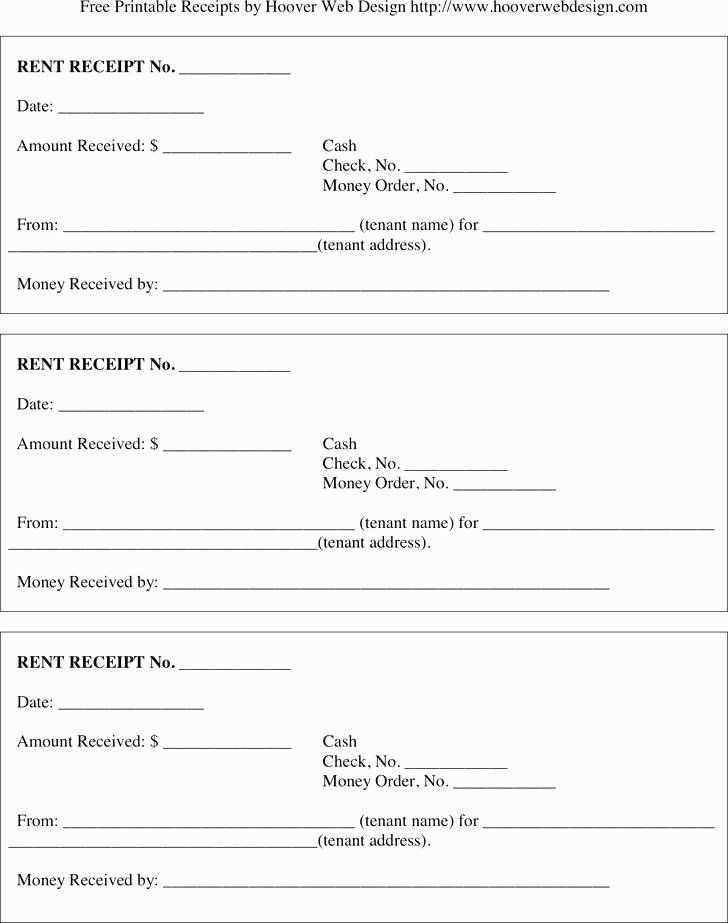

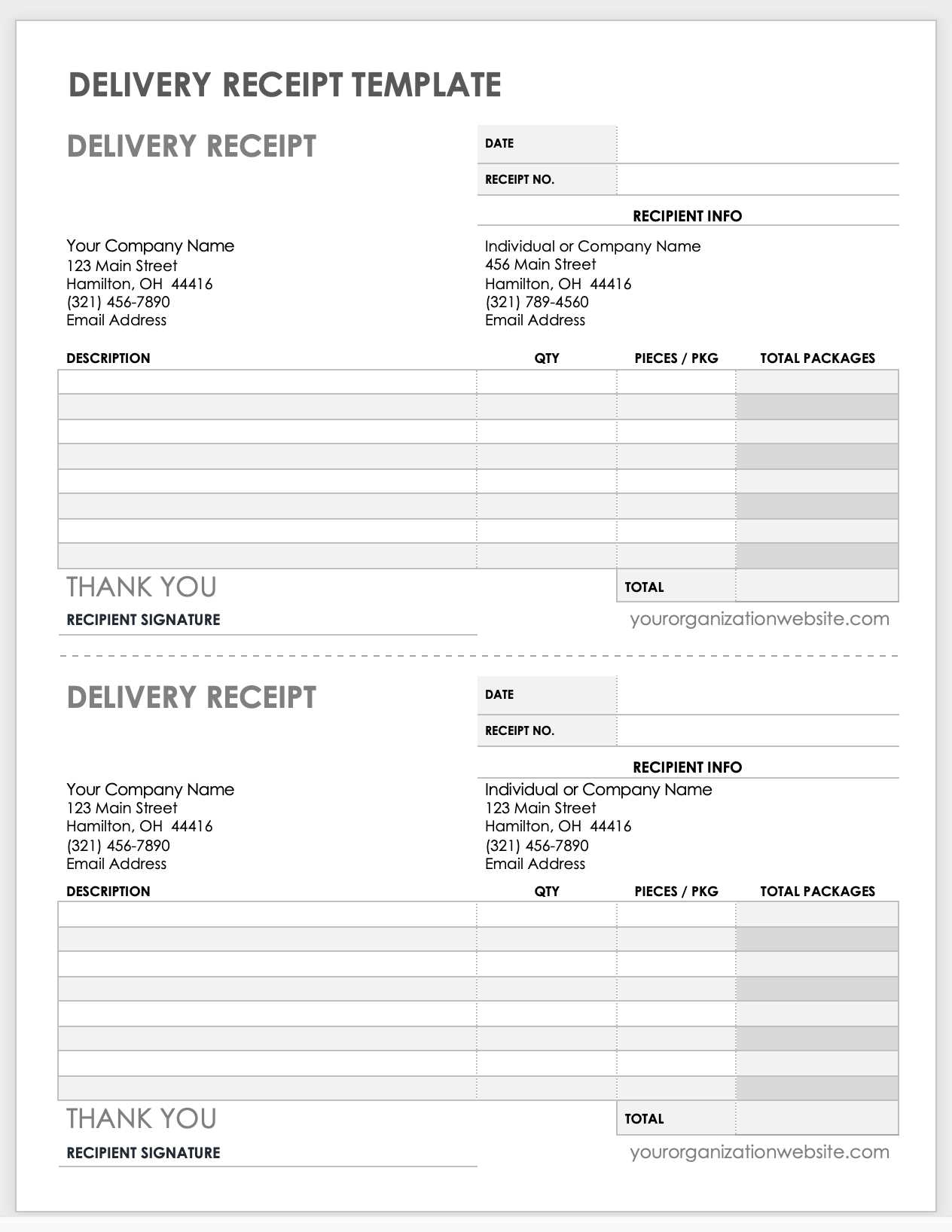

Download a ready-made receipt template to save time and keep your financial records organized. Whether you need a simple sales receipt, a rent payment confirmation, or a business invoice, a well-structured template ensures clarity and professionalism.

Customizable options allow you to adjust details such as date, amount, payment method, and item descriptions. Many formats, including PDF, Word, and Excel, are available for flexibility. Choose a template that suits your needs and fill it out within minutes.

For businesses, clear receipts improve bookkeeping and simplify tax reporting. For individuals, they serve as proof of transactions. A well-designed template ensures all necessary details are included, reducing misunderstandings and disputes.

Download a template, edit the details, and print or share it digitally. Whether for personal or business use, a structured receipt helps maintain accurate records with minimal effort.

Receipts Template Free: Practical Guide

Choose a template with clear sections for date, amount, and payment method. This ensures quick data entry and easy reference. Use a structured format that aligns with your record-keeping needs.

Key Elements to Include

| Field | Purpose |

|---|---|

| Transaction Date | Confirms when the payment was made. |

| Amount | Indicates the total cost. |

| Payment Method | Specifies how the transaction was completed. |

| Itemized List | Breaks down the charges for transparency. |

Customization Tips

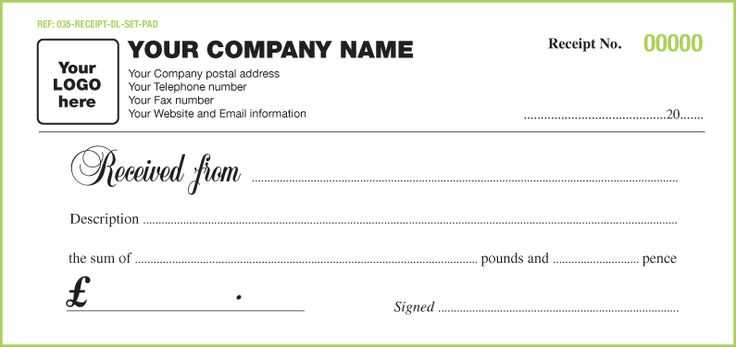

Modify fonts and colors to match your branding. If using a digital format, include automated calculations to save time. For printed receipts, ensure high contrast for readability.

Where to Find Free Receipt Templates

Start with online document editors that offer customizable receipt templates. Google Docs and Microsoft Word Online provide free templates that can be edited and downloaded instantly. Simply search for “receipt template” in their template galleries.

Specialized Template Websites

Platforms like Invoice Home and Zoho Invoice offer pre-designed receipt templates in multiple formats. These websites let you input transaction details and generate receipts without any design work.

Accounting and Business Tools

Free versions of Wave and Square include basic receipt templates. These tools also help track payments and send digital receipts automatically, making them useful for small businesses.

Explore these options based on your needs–whether it’s a simple printable receipt or an automated solution.

Customization Options for Different Needs

Adjusting receipt templates ensures they meet specific business needs. Choose layouts that fit your transaction type, whether for retail, services, or online sales.

- Logo and Branding: Add a company logo, adjust colors, and use custom fonts to align receipts with your brand identity.

- Tax and Currency Settings: Modify tax rates and select the appropriate currency for local or international transactions.

- Itemized Details: Customize item descriptions, pricing formats, and discount displays for clarity.

- Payment Methods: Include accepted payment options and add custom messages for digital or cash payments.

- Customer Information: Enable fields for names, addresses, and contact details when necessary.

- Legal and Compliance Notes: Add refund policies, tax disclaimers, or industry-specific details.

Choose a template with flexible sections to adapt quickly as business needs change. Test different formats to find the best fit for your operations.

File Formats: PDF, Excel, Word, and More

Choose PDF for fixed formatting. This format ensures that receipts look the same on any device, making it ideal for sharing and printing. Most free receipt templates are available in PDF, and many tools allow easy conversion from other formats.

Use Excel for calculations. If receipts involve itemized lists or automatic calculations, Excel provides flexibility. Spreadsheets support formulas, making it easy to total amounts and apply taxes dynamically.

Word works best for customization. Editing text, adjusting layouts, and adding a company logo is easier in Word. This format is useful for creating reusable templates that require frequent modifications.

Consider alternative formats. Google Docs and Sheets offer cloud-based access and collaboration. TXT and CSV files provide simple data storage for importing into accounting software. Choose based on whether you need visual consistency, automation, or ease of editing.

Legal Aspects of Using Receipt Templates

Ensure that every receipt template complies with tax regulations and consumer protection laws. Businesses must include key details such as transaction date, itemized costs, total amount, and applicable taxes. Missing essential information can lead to disputes or legal penalties.

Required Information

- Business Identification: Include the company name, address, and tax identification number.

- Transaction Details: Clearly list purchased items, services, prices, and applicable taxes.

- Payment Confirmation: Indicate the payment method and confirm that the transaction was completed.

Common Legal Risks

- False Information: Providing incorrect or misleading details may result in fines or legal action.

- Data Privacy Violations: If receipts contain personal information, ensure compliance with data protection laws.

- Tax Evasion: Avoid omitting revenue details, as tax authorities may conduct audits.

Using a legally sound template reduces risks and enhances transparency. Always review local regulations or consult a legal professional before finalizing a receipt format.

Best Practices for Organizing Digital Receipts

Store your receipts in well-labeled folders. Organize them by category (e.g., groceries, utilities, travel) to easily locate any document when needed. Avoid keeping everything in one general folder, as it increases time spent searching.

Use consistent file naming. Include the date of purchase, vendor name, and amount in the file name. For example, “2025-02-08_StoreName_50USD.” This allows for quick identification without opening the files.

Take advantage of cloud storage for easy access from any device. Services like Google Drive or Dropbox provide secure storage, so receipts are protected from device malfunctions or accidental deletions.

Set up a system to scan and upload receipts regularly. Make it a habit to upload receipts weekly or as soon as you receive them, preventing clutter from building up.

Use apps that specialize in receipt scanning. Many apps can automatically extract key information like date, total, and merchant, reducing manual entry and ensuring accurate records.

For extra security, back up your receipts to an external drive or use dual cloud services. This minimizes the risk of losing important data due to unforeseen circumstances.

Printing and Sharing: Methods and Tools

To print receipts from templates, use a reliable printer connected to your device. Most users prefer inkjet or laser printers, which offer high-quality output for both text and graphics. Make sure your printer is compatible with the document format (PDF, Word, etc.) and that it has adequate ink or toner for optimal print quality.

Printing Options

Start by selecting the correct paper size and quality settings on your printer. Letter and A4 sizes are most common for receipt printing. Use the highest print quality for professional-looking receipts, especially when including logos or detailed designs. Double-check the alignment before printing to ensure all text is readable and properly formatted.

Sharing Methods

Sharing receipts digitally is simple with email, cloud storage, or messaging apps. Save the receipt as a PDF or image file and send it directly to the recipient via email. If the file is too large, use cloud storage platforms like Google Drive or Dropbox and share the link. For quick communication, messaging apps like WhatsApp or Telegram allow easy document sharing with high security.