If you’re a landlord in India, providing a rent receipt is not just courteous, it’s also necessary for record-keeping and legal purposes. A well-structured receipt ensures transparency between you and your tenant and can be used for various documentation requirements, like tax filings. You can easily find a free rent receipt template online that is perfectly tailored to meet Indian standards, making the process smooth and quick.

When choosing a rent receipt template, ensure it includes key details such as the tenant’s name, address of the rented property, monthly rent amount, and the payment date. Including your contact details and a unique receipt number will also add a layer of professionalism and accountability. A simple yet detailed template can save both you and your tenant from unnecessary confusion in the future.

Once you’ve chosen a template, it’s advisable to customize it to reflect any specific agreements made between you and your tenant. For example, if rent is paid in advance or there are any deductions for maintenance, make sure those are clearly noted. This minimizes disputes and ensures that the record reflects the true nature of the payment.

Here’s the revised version without redundant repetitions, while preserving the meaning:

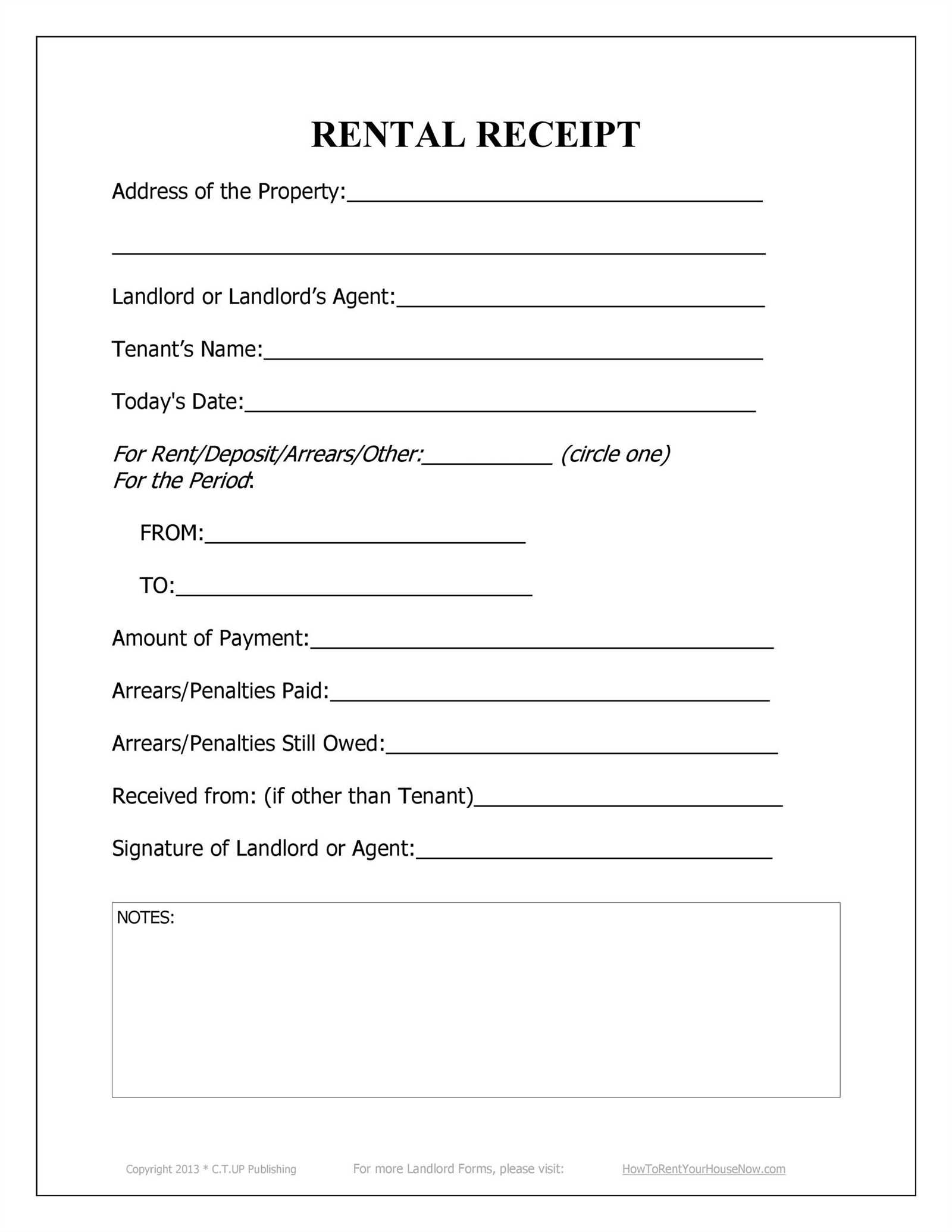

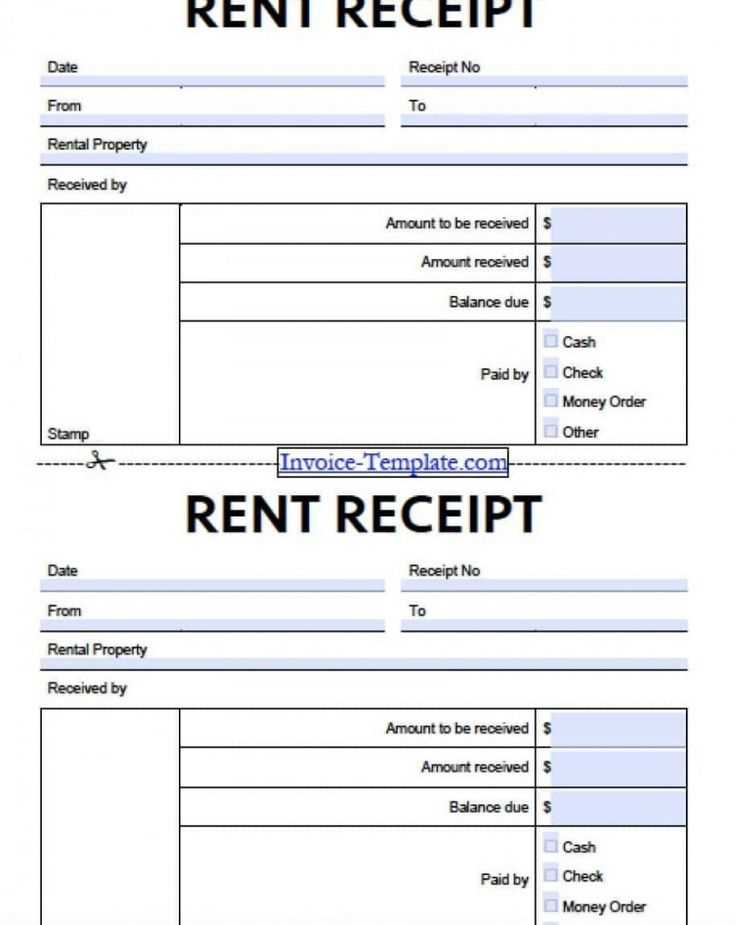

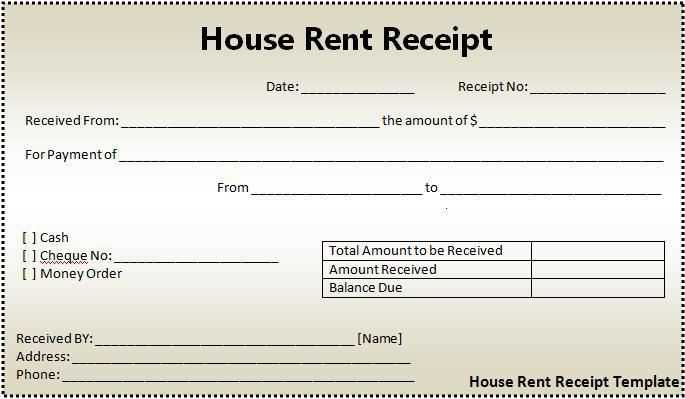

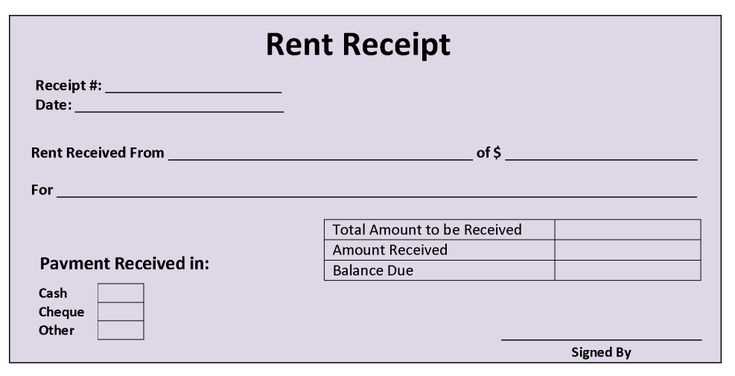

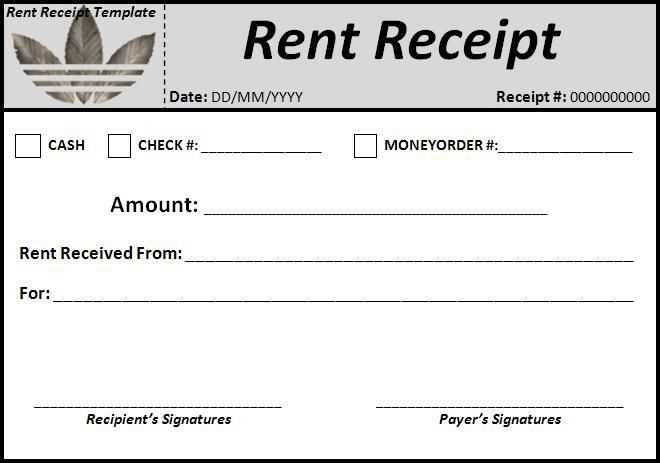

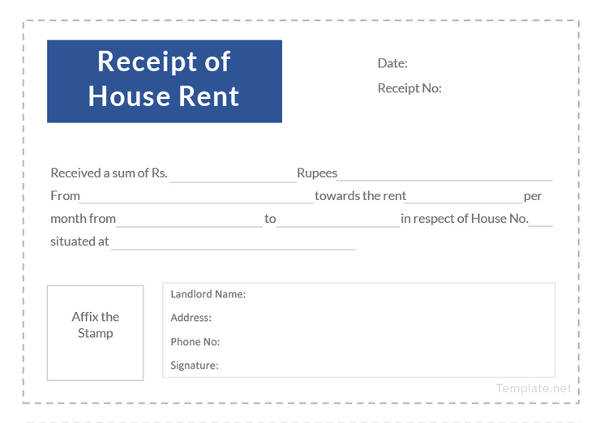

Use this simple template for creating a rent receipt. It should include the tenant’s name, the landlord’s name, the rental property address, the rent amount, the payment date, and the rental period. Make sure to state the payment method, whether it’s by cash, bank transfer, or check. The receipt should be signed by the landlord, confirming the payment was received. The date of issuance should be noted clearly on the document.

Key Points to Include:

– Tenant’s full name

– Landlord’s full name

– Property address

– Rent amount paid

– Payment method (Cash, Bank Transfer, etc.)

– Date of payment

– Rental period

– Signature of the landlord

– Date of receipt issuance

Sample Format:

Rental Payment Receipt

Received from: [Tenant’s Name]

For property: [Property Address]

Amount: [Amount Paid]

Payment Date: [Date]

Payment Method: [Cash/Bank Transfer/Other]

Rental Period: [Start Date] to [End Date]

Landlord’s Signature: ____________________

Issued on: [Date of Issue]

- Free Rent Receipt Template India

A rent receipt is a simple yet important document that landlords provide to tenants after receiving rent payments. It serves as proof of payment and includes specific details such as the tenant’s name, the rent amount, date of payment, and the period for which the rent is paid.

Key Elements of a Rent Receipt

The rent receipt should contain the following details:

- Landlord and Tenant Details: Names and addresses of both parties.

- Amount Paid: Specify the exact amount received.

- Payment Date: Mention the date on which the payment was made.

- Period Covered: The rental period for which the payment is made (e.g., for the month of January).

- Property Address: Include the address of the rental property.

- Receipt Number: A unique receipt number for tracking purposes.

Why Use a Free Template?

Using a free rent receipt template makes it easier to generate professional receipts consistently without needing to design one from scratch. You can easily fill in the required fields and provide clear documentation for rent payments. There are many free templates available online tailored for Indian landlords and tenants. These templates are often editable and can be downloaded in formats such as PDF or Word for easy printing and sharing.

In India, rental receipts must include certain key details to meet legal standards. The document should clearly specify the names of both the landlord and tenant, the rental amount, and the date of payment. This helps ensure the receipt serves as proof of transaction for future reference.

The receipt must also mention the rental period, such as the month or specific dates for which the rent has been paid. If any advance payment has been made, it should be stated separately, along with the purpose of that payment.

In the case of commercial properties, GST registration details may also be required if the landlord’s annual turnover exceeds the prescribed threshold for GST. This ensures that the receipt aligns with tax requirements.

It is also advisable to keep a copy of the rental agreement attached to the receipt for additional clarity on terms and conditions. This helps protect both parties in case of any disputes regarding the rental terms.

Remember, while a rental receipt doesn’t need to be notarized, it should be signed by the landlord or their representative. The receipt can be handwritten or printed, as long as all the necessary details are accurately mentioned.

Include the name and address of the landlord or property owner at the top of the receipt. This ensures clear identification of the party receiving payment.

Next, specify the tenant’s name and address. This confirms the person making the payment.

Clearly state the amount paid. Indicate both the total rent amount and any other charges (like maintenance or utilities), if applicable. Make sure the payment method is also mentioned (e.g., cash, bank transfer, cheque).

Provide the date of payment to establish the timeline for the transaction.

Include the rental period for which the payment is made. This lets both parties know exactly which month’s rent or period the receipt covers.

Note any late fees, deposits, or adjustments applied. This ensures transparency and avoids future disputes.

Lastly, include a signature or authorization from the landlord or property owner. This adds authenticity to the receipt and shows acknowledgment of the payment.

To get a free rent receipt template, search trusted websites offering downloadable files. Popular platforms like Google Docs, Microsoft Office, and local sites tailored to India provide templates in formats like .docx, .pdf, or .xlsx. After finding a suitable template, click the “Download” button for the file type that fits your needs.

Steps for Downloading

1. Visit the website with free templates, such as websites that specialize in legal forms or document resources.

2. Choose the template that best suits your rental type (commercial or residential).

3. Select your preferred format (usually .docx or .pdf) and click to download.

4. Save the file to your computer or device.

Using the Template

Open the downloaded template with a compatible word processor or PDF viewer. Edit the fields like tenant details, rent amount, and payment date. Fill in your information accurately and save the file under a new name for your records. Print a copy for the tenant’s signature or send it digitally if required.

Choosing between printable and digital receipts depends on convenience, space, and environmental concerns. Below is a detailed comparison of both formats.

| Aspect | Printable Receipts | Digital Receipts |

|---|---|---|

| Storage | Requires physical space; can accumulate over time. | No physical space needed; stored on devices or cloud services. |

| Organization | May become disorganized or damaged due to wear and tear. | Easily organized and searchable in apps or email inboxes. |

| Environmental Impact | Uses paper, contributing to waste and deforestation. | Environmentally friendly; no paper usage involved. |

| Accessibility | Can be accessed anywhere without the need for a device. | Accessible via smartphones, computers, or cloud storage. |

| Backup | Harder to back up; lost receipts may not be retrievable. | Easy to back up and retrieve from cloud storage or email. |

| Security | Can be lost or stolen; may need extra protection. | Can be protected with passwords and encryption, but risks of hacking. |

Digital receipts are increasingly favored for their environmental benefits and ease of organization, but printable receipts can be more practical for quick access without relying on a device.

Claiming HRA (House Rent Allowance) provides significant tax savings under Section 10(13A) of the Income Tax Act. To maximize these benefits, it’s vital to follow specific guidelines.

To claim HRA, ensure that the rent receipt template is accurate and includes the landlord’s details and rent amount. Only rent payments made for a property occupied by you as your residence qualify for HRA exemptions. The exemption amount is determined by comparing three components: actual HRA received, rent paid minus 10% of salary, and 50% of the salary (if you live in a metro city, or 40% if in non-metro cities).

Document all rent payments with rent receipts, as they serve as proof for tax claims. Ensure that the rent receipts are signed by the landlord and include the month, year, and amount paid. Keep track of your salary details, as the calculation of HRA exemption will depend on your salary structure and the rent paid. Also, landlords should ideally provide their PAN number, as the tax department may ask for it during verification.

If the rent paid is over Rs 1 lakh per year, the tenant must also report the landlord’s PAN, failing which the HRA exemption may not be granted. However, even if the landlord does not have a PAN, you can still claim the exemption, but the process may involve additional paperwork and scrutiny from tax authorities.

Common Mistakes to Avoid When Issuing Receipts

Ensure you include all relevant details on the receipt. Missing important information, such as the tenant’s name, address, or payment date, can lead to confusion or disputes. Double-check the accuracy of each entry before issuing the receipt.

1. Not Including Payment Method

Always specify how the payment was made, whether it’s cash, cheque, or bank transfer. This clarity prevents future misunderstandings, especially when a payment method needs to be verified.

2. Forgetting to Provide a Receipt Number

A unique receipt number is essential for tracking payments and avoiding duplication. Without this, managing multiple transactions becomes difficult, especially for record-keeping purposes.

3. Overlooking the Rental Period

Clearly mention the rental period covered by the payment. Leaving this out can lead to questions about the payment’s relevance to the correct month or timeframe.

4. Failing to Sign the Receipt

Include a signature or official mark to authenticate the receipt. A signature adds credibility and serves as proof that the payment was received by the landlord or authorized individual.

5. Inaccurate Amounts or Currency

Verify the payment amount and ensure it’s correct. Mistakes here can cause discrepancies and might require you to issue a revised receipt, leading to unnecessary delays.

6. Issuing a Receipt for a Nonexistent Payment

Never issue a receipt without confirming that the payment has actually been made. This could cause financial discrepancies and lead to legal issues.

7. Not Providing a Copy to the Tenant

Always provide a copy of the receipt to the tenant. This is essential for their own record-keeping and for resolving any future payment-related concerns.

8. Using Unclear or Complex Language

Avoid jargon or ambiguous terms. Make sure that the receipt is straightforward and easy for tenants to understand, leaving no room for misinterpretation.

Rent Receipt Template Free India

For landlords in India, providing a rent receipt is necessary for both legal and tax purposes. You can easily create a rent receipt template for free using various online tools. Here’s how to do it effectively:

Steps to Create a Rent Receipt Template

- Include the tenant’s full name and address.

- State the landlord’s details: name, address, and contact information.

- Specify the rent amount, payment method, and due date.

- Mention the period covered by the rent (e.g., February 2025).

- Provide space for the landlord’s signature to authenticate the receipt.

- Add a unique receipt number for tracking purposes.

Free Rent Receipt Templates Available Online

Several websites offer free rent receipt templates that comply with Indian legal requirements. These templates are customizable, allowing landlords to adjust the details according to their needs. Some websites even allow downloading in various formats like PDF or DOCX for convenience.