To create a salary receipt, you can use a simple, customizable template that helps streamline the process. This approach saves time while ensuring all necessary details are included accurately.

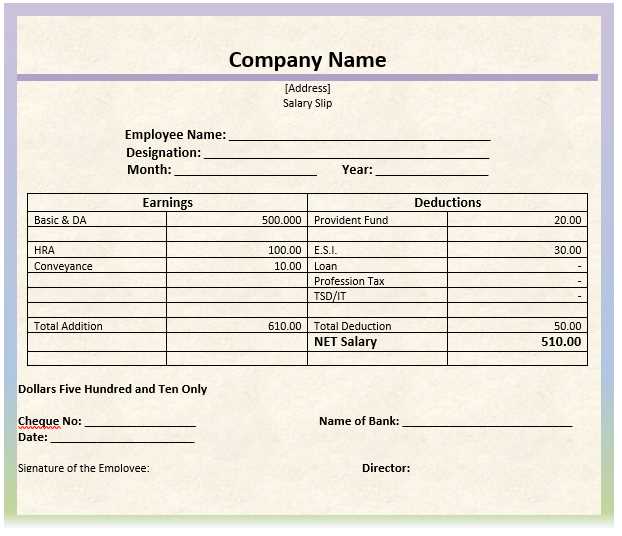

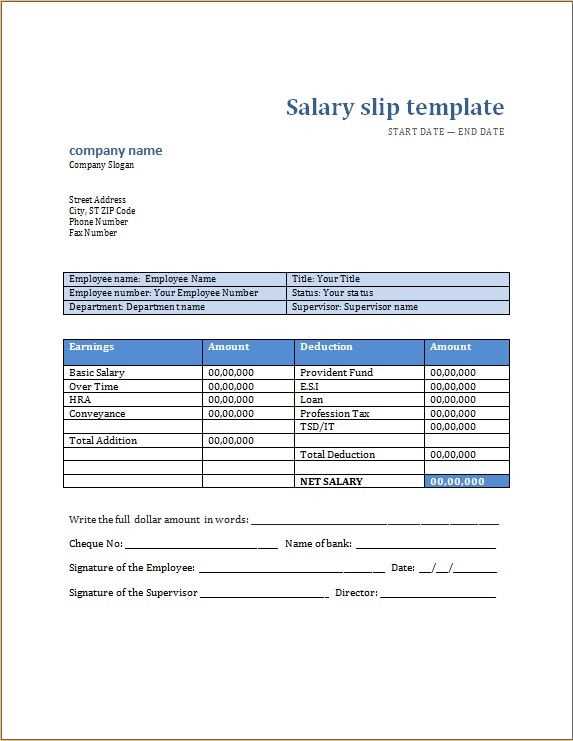

Begin by including the employee’s name, position, and the payment period. Clearly outline the total salary amount, breaking it down into base pay, bonuses, and deductions. This transparency ensures both the employer and employee have a clear understanding of the payment details.

Don’t forget to add the company’s name and contact details at the top. A salary receipt should also list the payment method, whether it’s a bank transfer, cheque, or cash, so there’s no confusion later on. Ensure that the document is easy to read and can be saved for future reference.

For ease of use, there are many free salary receipt templates available online. These templates allow you to quickly input data without starting from scratch, giving you a professional-looking document every time.

Here’s improved phrasing with minimal repetition of words:

To create a salary receipt template, focus on clarity and simplicity. Start by listing employee details in separate sections:

- Employee’s name

- Employee ID

- Job title

- Department

Next, outline the payment details:

- Gross salary

- Bonuses or commissions

- Deductions (taxes, insurance)

- Net salary

Include the payment date and the pay period covered. This keeps the information transparent. Ensure the template is easy to update each month. Avoid over-complicating sections; clarity is key to accuracy.

Use consistent formatting across all sections. This helps the recipient quickly understand the payment breakdown without confusion.

- Free Salary Receipt Template

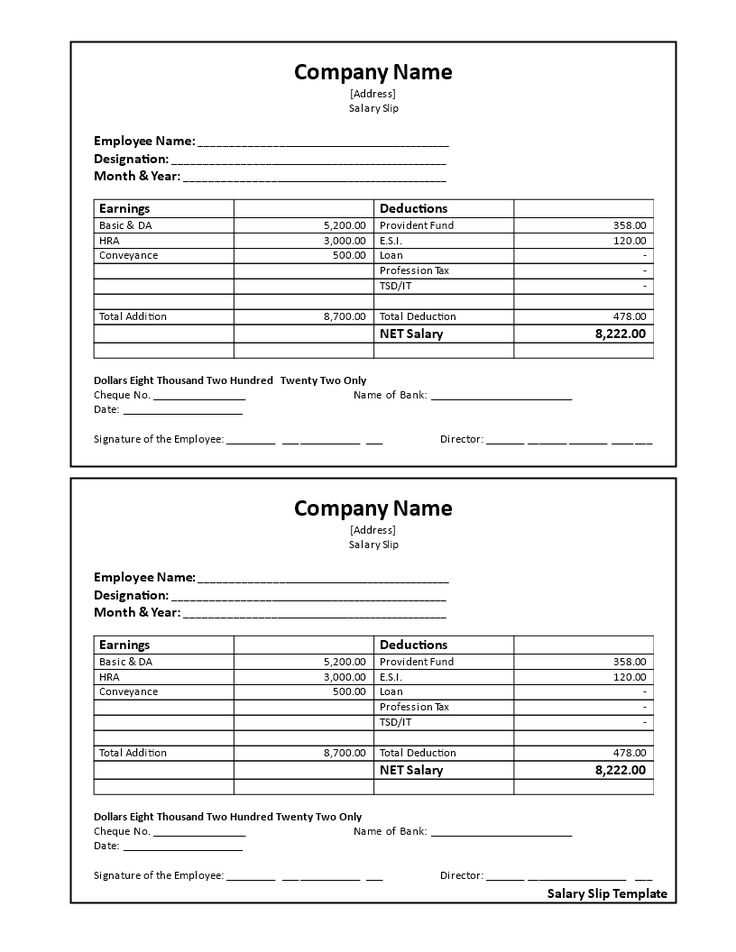

To create a salary receipt template, ensure it includes these key components: employee details, salary breakdown, deductions, and the total amount. This basic structure allows both parties to track payments effectively. Begin by adding the employee’s name, position, and pay period at the top of the document.

Key Information to Include

Each salary receipt should clearly state the gross salary, specifying the base pay and any bonuses or commissions. Deduct any taxes, insurance, or other contributions from the total. Finally, show the net salary–the amount the employee actually receives after deductions.

Customizing the Template

Many templates are customizable, allowing you to adjust sections like benefits or overtime. Adjust the formatting to fit your business needs and ensure the design is professional. You can find free templates online that provide a solid starting point, which you can modify to match your requirements.

Create a salary receipt template directly in spreadsheet tools like Google Sheets or Excel. These programs offer a simple and accessible way to structure salary receipts without needing extra software.

Start by setting up columns for key information such as employee name, salary month, gross salary, deductions, net salary, and payment date. Use rows for individual salary details for each employee. This makes it easy to track and update records quickly.

Add formulas to calculate the net salary automatically by subtracting deductions from the gross salary. A formula such as =B2 – C2 (assuming B2 is gross salary and C2 is deductions) will save time and reduce errors.

Customize the format to make the template clear. Bold headings, and use borders or shading to separate sections. Keep the layout simple and consistent for easy readability. You can also include a column for notes or comments if additional information is required.

Once the template is ready, save it as a reusable file that can be updated for each pay period. Sharing this document via email or cloud services makes it easy to distribute receipts without needing specialized software.

Small enterprises can significantly benefit from using a free salary receipt template. This simple tool streamlines payroll processes, ensuring clear communication between employers and employees. Templates are easy to use and customizable, allowing small business owners to provide consistent and accurate salary details with minimal effort.

Time-Saving and Cost-Effective

By opting for a free salary receipt template, small business owners save both time and money. Templates eliminate the need for manual calculations or complex software, making payroll management faster and more straightforward. This is particularly helpful for businesses that don’t have the budget for expensive payroll systems or accounting software.

Professional and Transparent Records

Using a salary receipt template ensures that all essential payment details, such as salary, deductions, bonuses, and tax information, are clearly presented. This transparency builds trust with employees and can serve as a useful reference during audits or for resolving any payroll disputes. The uniformity of a template also presents a more professional image for the business.

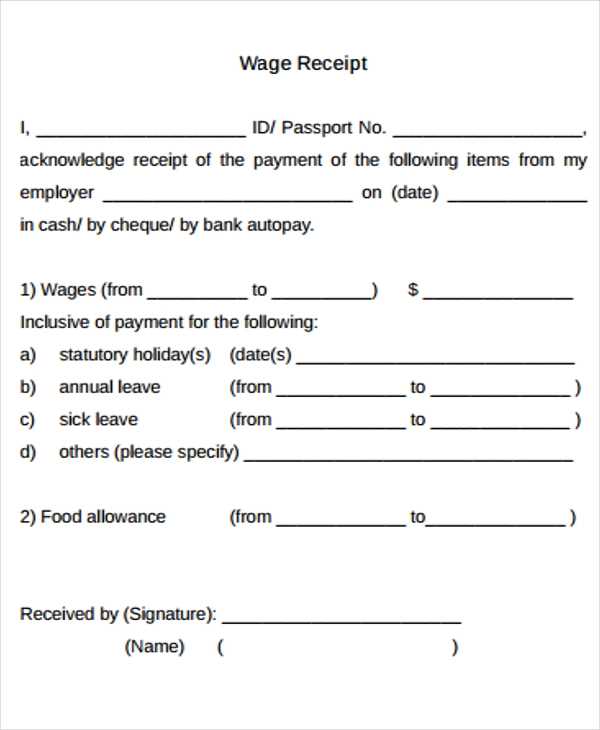

To customize a salary receipt template, focus on the specific needs of each employment category. For salaried employees, include fixed salary, allowances, deductions, and the net amount. For hourly workers, emphasize the number of hours worked, hourly rate, overtime pay, and deductions. For freelance contractors, add project-based payments, invoiced amounts, and relevant tax deductions.

Adjust the template’s structure to suit the frequency of payments. For weekly workers, include the start and end date of the pay period. Monthly employees should have the total salary for the month and any bonuses or commissions listed separately.

Consider adding fields for company-specific benefits, such as health insurance or retirement contributions, where applicable. Tax information, including gross earnings and tax deductions, should also be included for all categories, ensuring compliance with tax regulations.

| Employment Category | Key Information to Include |

|---|---|

| Salaried | Fixed salary, allowances, deductions, net salary |

| Hourly | Hours worked, hourly rate, overtime, deductions |

| Freelance | Project payments, invoiced amounts, tax deductions |

Tailor the template’s design to make these categories clearly identifiable, ensuring transparency for both employer and employee. Keep the layout clean and simple, avoiding unnecessary complexity to enhance readability.

Ensure that your salary receipt includes the essential details to maintain clarity and professionalism. This includes the employee’s name, job title, salary breakdown, tax deductions, and the payment period. A clear format with labeled sections makes it easier for employees to understand their pay and any applicable deductions.

Provide a section for net salary after all deductions are made, along with a detailed list of the deductions themselves. Taxes, benefits, and other withholdings should be listed separately to avoid confusion. Each deduction should include a brief description to clarify its purpose.

Consider using a template that offers a simple, straightforward design. A clean layout with enough space between sections enhances readability. Avoid clutter and unnecessary details that could make the document harder to follow. Focus on the core information that employees need to verify their pay.

Finally, ensure that the template is customizable. Different companies may have specific requirements for salary receipts, such as additional benefits or special deductions. A flexible template allows easy updates for any future changes in payroll structure.